|

市场调查报告书

商品编码

1435197

量子密码学:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Quantum Cryptography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

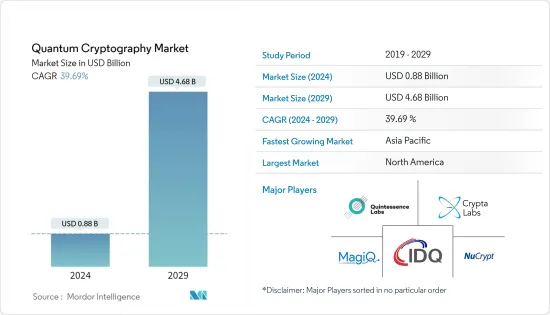

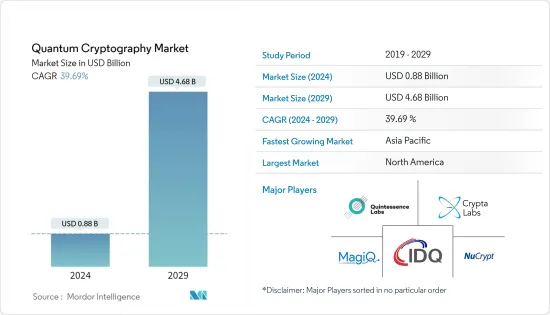

量子密码学市场规模预计在2024年为8.8亿美元,预计到2029年将达到46.8亿美元,在预测期内(2024-2029年)复合年增长率为39.69%。

主要亮点

- 世界各地的组织越来越多地部署量子加密解决方案,以增强其网路和应用程式的安全性。政府和 BFSI 行业越来越多地采用这些解决方案,预计将为市场创造新的机会。行业相关人员正在关注先进的解决方案,以提高安全性并实现安全交易。

- 由于数位化加速、网路安全相关资金增加、对下一代云端和物联网技术安全解决方案的需求不断增加以及下一代无线网路技术的发展而导致的网路攻击增加,将推动全球量子密码市场的成长。据预测。

- 无线网路技术的进步促进了量子密码学的发展和采用。 Wi-Fi、蓝牙和行动电话网路等无线网路在现代社会中普及。它们的使用增加了无线传输的资料量。

- 高实施和安装成本是限制量子密码技术采用的因素之一。量子密码学是一项相对较新的技术,需要专门的硬体和软体。该硬体可能很昂贵,而且安装和维护成本也可能很高。此外,该技术仍处于发展的早期阶段,因此包含量子加密技术的解决方案和服务的可用性目前有限。

- 这场流行病加速了向远端工作的过渡,并增加了数位技术在通讯和协作方面的使用。这增加了对安全通讯技术的需求,例如量子加密技术,它比传统加密方法提供更高等级的安全性。

- 在后疫情时代,物联网(IoT)、自动驾驶汽车和智慧城市等新兴技术可能会增加对量子密码学的需求。这些技术产生和交换大量敏感资料,需要强大的安全措施来防止网路攻击。

量子密码学市场趋势

网路攻击的增加预计将推动市场成长

- 网路攻击的增加正在推动量子密码学的发展和部署。量子密码学是一种利用动态原理来保护通讯通道安全的技术。它提供了传统加密方法无法妥协的高等级安全性。

- 网路攻击的频繁性和复杂性使得传统加密方法容易受到攻击。例如,传统的加密方法依赖数学演算法,它可以击败更快的运算能力和先进的演算法。另一方面,量子密码学则依靠动态原理来确保通讯通道的安全。

- 与传统密码方法相比,量子密码学具有多种优势。例如,它提供高保密性。这意味着即使拥有无限的运算能力,窃听者也无法读取加密的讯息。任何窃听量子加密讯息的尝试都会中断通讯并提醒相关合法方。

- 因此,量子密码学越来越多地被政府、军事组织、金融机构和其他需要高水准安全通讯管道的组织所采用。然而,这项技术仍处于起步阶段,在广泛采用之前还需要解决一些挑战。这些挑战包括高昂的实施成本、对专用硬体的需求以及量子加密通讯的传输距离有限。

- 组织必须保持警惕并持续评估其通讯通道的安全性,包括使用量子加密技术保护的通讯通道。我们还需要投资持续的研究和开发,以识别和解决量子密码学中的漏洞,并确保我们领先于新出现的威胁。儘管网路攻击数量不断增加,但透过主动的安全方法,组织可以最大限度地降低资料外洩的风险和成本。 IBM 的资料显示,2020 年 5 月至 2022 年 3 月期间,全球资料外洩的平均成本为 435 万美元。

预计北美将占据重要市场占有率

- 由于网路攻击不断增加、最终用户对网路安全的日益关注以及资料隐私投资的增加等因素,北美在全球量子密码市场中占据了重要份额。此外,北美主要量子密码市场供应商的大量存在正在推动该地区的市场成长。

- 此外,政府对资料安全的监管支持,尤其是在美国,使北美成为量子密码市场的关键部分。

- 例如,2022 年 7 月,美国商务部国家标准与技术研究院 (NIST) 宣布推出首批四种加密工具,旨在抵御未来利用量子运算的网路攻击。选定的四种加密演算法将成为 NIST 后量子密码标准的一部分,预计将在两年内完成。

- 资料外洩和网路入侵在该地区非常常见。智慧型设备的引入和数位技术的广泛使用导致网路攻击数量增加。量子密码学可以保护资料免受这些不断变化的威胁。

- 该地区正在建立多种伙伴关係和协作来促进和开发学徒计划,以提高员工的密码学技能。此类计划预计将透过提供必要的技能并鼓励更多公司采用这些技术来帮助市场的整体成长。

量子密码行业概况

量子密码学市场较为分散,主要参与者包括 QuintessenceLabs、Crypta Labs、ID Quantique、MagiQ Technologies, Inc. 和 NuCrypt。市场参与者正在采取合作伙伴关係、创新和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 2 月 - 在 MWC23 上,ID Quantique、KCS 和 SK Telecom 宣布推出新的量子增强型加密硬体。 IDQ 的量子随机数产生器 (QRNG) 技术和 KCS 的通讯半导体技术整合到一个安全晶片组中。下一代安全晶片可为物联网和连结设备提供骇客的保护和至关重要的安全性。

- 2022 年 11 月 - 量子网路安全产业的领导者之一 QuintessenceLabs 今天在量子世界大会上宣布,其 qOptica量子金钥分发(QKD) 解决方案将使客户能够「立即收穫,稍后解密」(HNDL) 威胁,其中独特的资料现在被盗,以便稍后使用量子技术对其进行解密。 qOptica QKD 的第二个版本增强了安全性,同时安全地提供了能够抵抗经典或量子电脑的暴力和演算法攻击的金钥材料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 网路攻击增加

- 对云端和物联网技术的下一代安全解决方案的需求不断增长

- 无线网路技术的演变

- 市场挑战

- 引进和安装成本高

- 缺乏熟练的专业人员和技术挑战

第六章市场区隔

- 按成分

- 解决方案

- 按服务

- 按申请

- 网路安全

- 应用程式安全

- 资料库安全

- 按最终用户

- 资讯科技/通讯

- BFSI

- 政府/国防

- 卫生保健

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- QuintessenceLabs

- Crypta Labs

- ID Quantique

- MagiQ Technologies, Inc.

- NuCrypt

- PQ Solutions Limited

- ISARA Corporation

- QuantumCTek Co., Ltd.

- Quantum XC

- QuNu Labs Pvt Ltd

- qutools GmbH

- AUREA Technology

- Infineon Technologies AG

- Toshiba Corporation

- Mitsubishi Electric Corporation

- IBM Corporation

- NEC Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Quantum Cryptography Market size is estimated at USD 0.88 billion in 2024, and is expected to reach USD 4.68 billion by 2029, growing at a CAGR of 39.69% during the forecast period (2024-2029).

Key Highlights

- Organizations across the globe increasingly implement quantum cryptography solutions to boost network and application security. The market is expected to witness new opportunities owing to the increasing uptake of these solutions in the government and BFSI verticals. The industry players focus on advanced solutions to improve security and secure transactions.

- The rising incidents of cyber-attacks with acceleration in digitalization, growing cybersecurity funding, increasing demand for next-generation security resolutions for cloud and IoT technologies, and the development of next-generation wireless network technologies are anticipated to propel the growth of the global quantum cryptography market.

- The evolution of wireless network technologies has driven the development and adoption of quantum cryptography. Wireless networks like Wi-Fi, Bluetooth, and cellular networks have become ubiquitous in modern society. Their use has led to an increase in the amount of data being transmitted wirelessly.

- The high implementation and installation costs are one of the factors that restrain the adoption of quantum cryptography. Quantum cryptography is a relatively new technology requiring specialized hardware and software. This hardware can be expensive, and the cost of installation and maintenance can also be high. Additionally, the technology is still in the early stages of development, so the availability of sollutions and services incorporating quantum cryptography is currently limited.

- The pandemic has accelerated the shift towards remote work and increased the use of digital technologies for communication and collaboration. This has led to an increased demand for secure communication technologies, including quantum cryptography, which offers a higher security level than traditional cryptographic methods.

- The post-pandemic era would likely increase demand for quantum cryptography from emerging technologies such as the Internet of Things (IoT), autonomous vehicles, and smart cities. These technologies generate and exchange massive amounts of sensitive data, which requires robust security measures to protect against cyber-attacks.

Quantum Cryptography Market Trends

Rising Number of Cyber Attacks is Expected to Drive the Market Growth

- The rising number of cyber attacks has driven the development and adoption of quantum cryptography. Quantum cryptography is a technology that uses the principles of quantum mechanics to secure communication channels. It offers a high level of security that traditional cryptographic methods cannot compromise.

- The increasing frequency and sophistication of cyber-attacks have made traditional cryptographic methods vulnerable to attacks. For example, conventional encryption methods rely on mathematical algorithms, which can break faster computing power or advanced algorithms. Quantum cryptography, on the other hand, depends on the principles of quantum mechanics to ensure the security of communication channels.

- Quantum cryptography offers several advantages over traditional cryptographic methods. For example, it provides high secrecy, meaning an eavesdropper cannot read the encrypted message, even with unlimited computing power. Any attempt to eavesdrop on a quantum-encrypted message will also disrupt communication, alerting the legitimate parties involved.

- As a result, quantum cryptography is being increasingly adopted by governments, military organizations, financial institutions, and other entities that require high levels of security for their communication channels. However, the technology is still in its early stages, and some challenges need to be addressed before it can be widely adopted. These challenges include the high cost of implementation, the need for specialized hardware, and the limited distance over which quantum-encrypted communication can be transmitted.

- Organizations must remain vigilant and continuously assess the security of their communication channels, including those secured with quantum cryptography. They should also invest in ongoing research and development to identify and address quantum cryptography vulnerabilities and ensure they stay ahead of emerging threats. By taking a proactive approach to security, organizations can minimize the risk and cost of a data breach, even in the face of a rising number of cyber-attacks. According to IBM, the global average data breach cost from May 2020 to March 2022 was USD 4.35 Million.

North America is Expected to Hold Significant Market Share

- North America accounts for a significant share of the global quantum cryptography market owing to the factors such as the rising number of cyber-attacks, increasing focus on cyber security by end-users, and growing investments in data privacy. Furthermore, the significant presence of major quantum cryptography market vendors in North America boosts the market growth in the region.

- Furthermore, supportive government regulations for data security, especially in the United States, make North America a leading segment in the quantum cryptography market.

- For instance, in July 2022, the US Department of Commerce's National Institute of Standards and Technology (NIST) revealed the first four encryption tools designed to withstand future cyber attacks powered by quantum computing. The four selected encryption algorithms would become part of NIST's post-quantum cryptographic standard, which is expected to be finalized in two years.

- Data breaches and network intrusions are very recurrent in the region. The adoption of smart devices and extensive use of digital technologies have increased the number of cyber-attacks. Quantum cryptography technology can defend data against these evolving threats.

- The region is seeing multiple partnerships and collaborations to promote and develop apprenticeship programs to enhance the workforce's skills in cryptography. Such programs are expected to help the collective growth of the market by providing the necessary skills and encouraging more companies to adopt these technologies.

Quantum Cryptography Industry Overview

Quantum Cryptography Market is fragmented, with the presence of major players like QuintessenceLabs, Crypta Labs, ID Quantique, MagiQ Technologies, Inc., and NuCrypt. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2023 - At MWC23, ID Quantique, KCS, and SK Telecom launched new quantum-enhanced cryptography hardware. IDQ's quantum random number generator (QRNG) technology and KCS' cryptographic communication semiconductor technology are combined into a single security chipset. The next-generation security chip offers protection against hackers and the most significant security for IoT and linked devices.

- November 2022 - QuintessenceLabs, one of the quantum cybersecurity industry leaders, announced today at Quantum World Congress that its qOptica Quantum Key Distribution (QKD) solution provides enhanced key enabling technology to assist in improving security against harmful cyber-attacks such as "harvest now, decrypt later" (HNDL) threats, in which proprietary data is stolen now with the intent of decrypting it later with quantum technology. The second version of qOptica QKD offers greater security while safely providing key material resistant to brute force and algorithmic assaults by conventional or quantum computers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Number of Cyber Attacks

- 5.1.2 Growing Need for Next Generation Security Solutions for Cloud and IoT Technologies

- 5.1.3 Evolution of Wireless Network Technologies

- 5.2 Market Challenges

- 5.2.1 High Implementation and Installation Costs

- 5.2.2 Absence of Skilled Expertise and Technological Challenges

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Network Security

- 6.2.2 Application Security

- 6.2.3 Database Security

- 6.3 By End-users

- 6.3.1 IT and Telecommunication

- 6.3.2 BFSI

- 6.3.3 Government and Defence

- 6.3.4 Healthcare

- 6.3.5 Other End-users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 South America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 QuintessenceLabs

- 7.1.2 Crypta Labs

- 7.1.3 ID Quantique

- 7.1.4 MagiQ Technologies, Inc.

- 7.1.5 NuCrypt

- 7.1.6 PQ Solutions Limited

- 7.1.7 ISARA Corporation

- 7.1.8 QuantumCTek Co., Ltd.

- 7.1.9 Quantum XC

- 7.1.10 QuNu Labs Pvt Ltd

- 7.1.11 qutools GmbH

- 7.1.12 AUREA Technology

- 7.1.13 Infineon Technologies AG

- 7.1.14 Toshiba Corporation

- 7.1.15 Mitsubishi Electric Corporation

- 7.1.16 IBM Corporation

- 7.1.17 NEC Corporation