|

市场调查报告书

商品编码

1435767

无菌医疗包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sterile Medical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

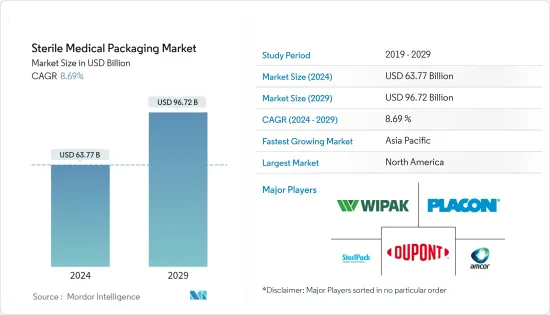

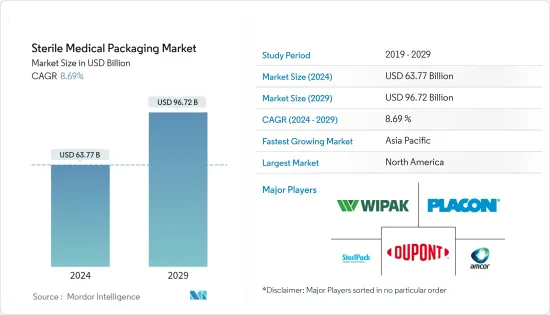

无菌医疗包装市场规模预计2024年为637.7亿美元,预计到2029年将达到967.2亿美元,在预测期(2024-2029年)将成长8.69%,复合年增长率成长。

主要亮点

- 流行病和大流行病构成的威胁日益明显,成为一项持续的普遍挑战,现已被认为是全球卫生议程中行动的重中之重。各种组织针对感染预防和控制(IPC)制定了严格的规定,预计将增加对无菌医疗包装、无污染医疗产品和预防疾病传播的需求。由于这些规定,Jubilant HollisterStie 等公司正在投资扩大产能。 2022 年 5 月,Jubilant HollisterStier 投资 2.85 亿美元,将其华盛顿州斯波坎工厂的无菌注射剂填充和精加工产能提高了一倍。这项投资是该公司合作协议的一部分,美国政府将为其提供 1.496 亿美元,以扩大其在美国的关键疫苗生产能力。

- 此外,该供应商正在不断扩大其业务,以扩大产品系列。例如,通过 ISO 9001:2015 认证的 Dordan Manufacturing Inc. 启动了无尘室计划,以增强其在医疗包装方面的现有专业知识。该公司为多个行业设计、製造和销售客自订热成型包装。

- 医用无菌包装对于医疗保健和感染疾病控制至关重要。无菌医疗包装不断创新,并投资于一次性选择和生物分解性塑胶,且无污染风险。这些包装可保护患者、医务人员和临床医生免受潜在的微生物感染。它还有助于确保医疗产品在运输、储存和使用过程中无菌且不受污染。

- 近年来,聚碳酸酯、聚丙烯和聚乙烯等许多聚合物作为材料被广泛应用于医疗包装产业。然而,高性能塑料和工程聚合物的进步日益渗透到该行业,取代了传统金属和现有的一般塑胶,这主要是由于刺激性强的消毒剂的出现。 2022 年 9 月,英国科学家开发出一种塑胶薄膜,仅使用室内光即可杀死附着在表面的 SARS-CoV-2 病毒颗粒。这种自消毒薄膜由英国贝尔法斯特女王大学的一个团队开发,製造成本低廉且易于规模化。用于桌布、医院窗帘、一次性围裙等。该薄膜涂有一层薄薄的颗粒,可吸收紫外线 (UV) 并产生活性氧 (ROS),预计将取代医疗保健行业使用的一次性塑胶薄膜。

- 然而,在欧洲国家,欧盟法规要求各药品生产商在供应欧盟产品时必须遵守欧盟良好生产规范(GMP)。此外,製造商和进口商必须获得许可证并向成员国主管机关机关註册。製造商和进口商定期接受欧盟主管机关或其他认可机构的检查,以确保符合欧盟的 GMP。无论製造商位于何处,此过程均适用。如果产品是从其他公司进口的,则进口商有责任遵守 GMP。

- 此外,在全球冠状病毒感染疾病(COVID-19)大流行期间,供应链中断导致无菌包装製造业下滑。相较之下,消费者对病毒接触各种物质的担忧不断增加,将推动产业成长。疫情期间,快速生产也成为医疗包装专业人士的关键因素。越来越多的医疗保健公司需要更快、更永续的包装,自感染疾病-19 以来,包装公司正在竭尽全力满足这项需求。

无菌医疗包装市场趋势

管瓶和安瓿预计将占据很大份额

- 无菌医疗包装主要包括管瓶和安瓿。它们广泛应用于製药业,用于填充和储存各种药品和药品。所有化学不稳定物质、药物和化学物质都可以储存在这些物品中。这些有助于防止篡改存放在那里的药物和其他物品。任何含有药物或药物的样本都可以长期保存在管瓶中。

- 过去几年,与 COVID-19感染疾病相关的药品和疫苗的需求增加了对管瓶和安瓿的需求。药品包装製造商显着提高了产能。製造商满载运作,每月生产数百万管瓶和安瓿。

- 该行业的领先公司致力于透过投资和合作伙伴关係进行扩张。例如,2022年8月,德国药品包装供应商Gerresheimer宣布投资高达9,400万美元,以加强其在美国的管瓶製造、出货和分销能力。该公司计划在其北卡罗来纳州工厂增加管瓶成型生产线,以进行扩建计划。其中包括尺寸控制、退火、目视检查和包装线。

- 玻璃是常用于製造管瓶和安瓿的材料之一。除了医疗保健成本上升之外,药品销售的增加以及包括医院和製药公司在内的各种最终用户的成长趋势,导致对化学惰性和药物稳定性以及管瓶和安瓿包装的需求增加。渗透性将促进玻璃瓶和安瓿瓶的使用。这些项目。液体和冻干药物。此外,根据Astra Zeneca,美国药品销售额与前一年同期比较增约 8%,从 2020 年的 5,160 亿美元增至 2022 年的 6,050 亿美元。

- 此外,在人口稠密的国家,对管瓶和安瓿的需求正在增加。这些国家药品生产的增加进一步增加了需求。根据成分和药物含量等参数,应包装在非反应性容器中。生物製药、疫苗和胰岛素的消费量不断增加,特别是在亚太地区、拉丁美洲和东欧国家,预计在预测期内推动安瓿使用量的成长。

预计北美将出现显着成长。

- 该地区的已开发国家,如美国和加拿大,拥有繁荣的经济、人口老化和先进的医疗保健服务系统。美国拥有发达的基层医疗社区、广泛的医疗和生命科学研究活动、较高的医疗保健支出集中、丰富的药品和医疗用品及医疗设备产业,是全球最大的无菌医疗包装产品生产国,已成为世界上最大的无菌医疗包装产品生产国。市场。这是我们主要的地理市场之一。

- 医疗技术的高昂医疗成本正在推动对美国无菌医疗包装市场的需求。医学技术的进步使医生能够以以前难以治疗的方式诊断和治疗疾病。医疗技术方面医疗保健支出的增加可能会将新的医疗设备和产品推向市场。随着设备和产品的可用性、数量和种类的增加,对无菌医疗包装的需求也增加。

- 国际公司正在向该地区扩张。 2023 年 3 月,Granules India 透过其位于美国维吉尼亚的 Granules Consumer Health (GCH) 子公司推出了一家包装工厂。该工厂占地超过 79,000 平方英尺,包括包装线和无尘室,用于包装和出货处方笺和非处方产品到整个美国市场。该设施以 483 个零观测值获得美国FDA核准。

- 製药业对无菌医疗包装产品的需求不断增长,预计将在预测期内进一步推动所研究市场的成长。据StatCan称,预计2024年製药和药品製造业的收益将达到99.4亿美元。

- 此外,加拿大对注射药物的需求不断增长正在推动玻璃瓶的成长。对肿瘤学和其他强效药物(例如需要快速起效的类固醇、静脉静脉注射和抗体偶联物)的需求预计将成为主要的成长动力。此外,Hikma Pharmaceuticals PLC 等跨国公司正致力于在该地区推出无菌注射药物。 2023年3月,跨国药厂Hikma Pharmaceuticals PLC(Hikma)宣布在加拿大推出四种新的无菌注射药物。这扩大了该公司在加拿大市场的影响力,并为患者和医疗保健提供者提供了新的治疗选择。

无菌医疗包装产业概况

由于国内和国际市场上的大大小小的参与者,无菌医疗包装市场竞争非常激烈。市场参与者正在采取产品创新、併购和策略合作伙伴关係等关键策略,以扩大产品系列扩大其地理覆盖范围。市场参与者包括 Amcor PLC、Steripack Ltd、Wipak Group 和 Placon Corporation。

2022 年 5 月,这家美国包装公司的子公司无尘室 Film and Bags (CFB) 开设了一家生产无菌无尘室包装的工厂。该设施拥有 ISO 认证的无尘室,并使用太阳能。

2022 年 4 月,Amcor 扩建了位于爱尔兰斯莱戈的医疗保健包装工厂,以巩固其在无菌包装行业的地位。作为计划的一部分,Amcor 将增加 VII 级无尘室製造环境和先进的热成型操作,该操作已通过 ISO 13485 认证,以满足监管要求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对无菌医疗包装市场的影响

第五章市场动态

- 市场驱动因素

- 严格的感染控制法规预计将推动对无菌产品的需求

- 最近产能增加

- 塑胶领域材料的进展

- 市场挑战

- 法规的动态性质使得製造商很难遵守与材料可用性相关的区域因素

第六章市场区隔

- 依材料类型

- 塑胶

- 聚丙烯

- 聚酯纤维

- PS

- PVC、HDPE 等

- 纸板

- 玻璃

- 其他的

- 塑胶

- 依产品类型

- 热成型托盘

- 无菌瓶/容器

- 袋子和袋子

- 泡壳包装

- 管瓶和安瓿

- 预填充式注射器

- 裹

- 按用途

- 药品

- 手术和医疗器械

- 体外诊断药物

- 其他用途

- 按灭菌类型

- 化学灭菌

- 放射线杀菌

- 压力/温度灭菌

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Amcor PLC

- Dupont De Nemours Inc.

- Steripack Ltd

- Wipak Group

- Placon Corporation

- Riverside Medical Packaging Company Ltd

- Tekni-Plex Inc.

- BillerudKorsnas AB

- Sonoco Products Co

- Wheaton Industries

- Technipaq Inc.

- 3M Co(3M Packaging)

- Nelipak Healthcare

第八章市场展望

The Sterile Medical Packaging Market size is estimated at USD 63.77 billion in 2024, and is expected to reach USD 96.72 billion by 2029, growing at a CAGR of 8.69% during the forecast period (2024-2029).

Key Highlights

- The threats posed by epidemics and pandemics have become increasingly evident as ongoing universal challenges, and they are now recognized as a top priority for action on the global health agenda. Various organizations have put up strict regulations toward infection prevention and control (IPC), which is expected to drive the demand for sterile-based medical packaging, contamination-free medical products, and preventing disease transmission. Owing to such regulation, a player such as Jubilant HollisterStie is investing in expanding capacity. In May 2022, Jubilant HollisterStier invested USD 285 million to double its capacity to fill and finish sterile injectables at its Spokane, Washington facility. The investment is part of the company's cooperative agreement providing USD 149.6 million from the US Government to expand its critical vaccine manufacturing capacity in the US.

- Additionally, vendors are continuously expanding their operations to widen their product portfolio. For instance, Dordan Manufacturing Inc. (an ISO 9001:2015 certified company) initiated its cleanroom project to enhance its existing expertise in medical packaging. The company designs, manufactures and distributes custom thermoformed packaging for multiple industries.

- Sterile medical packaging is integral to healthcare and infectious disease control. Sterile medical packaging continues to innovate and invest in single-use options and biodegradable plastics without the risk of contamination. These packagings protect patients, medical staff, and clinicians from potential microbial infections. It also helps ensure that medical products are sterile and uncontaminated during transportation, storage, and use.

- In the past few years, many polymers, such as polycarbonates, polypropylene, and polyethene, have been widely adopted as a material of choice by the medical packaging industry. However, high-performance advancements in plastic and engineering polymers have seen growing penetration in the industry, replacing conventional metals and existing commodity plastics primarily because of the advent of stringent and robust sanitizing agents. In September 2022, Scientists in the UK developed a plastic film that can kill SARS-CoV-2 virus particles attached to its surface with just room light. Developed by a team at Queen's University Belfast in the UK, the self-sterilizing film is cheap to manufacture and easy to scale. It is used in tablecloths, curtains in hospitals, and disposable aprons. The film is coated with a thin layer of particles that absorb ultraviolet (UV) light and generate reactive oxygen species - ROS and is expected to replace disposable plastic films used in the healthcare industry.

- However, In European countries, EU regulations require that various pharmaceutical manufacturers comply with EU Good Manufacturing Practices (GMP) when supplying products to the EU. In addition, manufacturers and importers must be licensed and registered by the competent authorities of Member States. Manufacturers and importers are regularly inspected by their EU authorities in the jurisdiction or other recognized authorities to confirm compliance with their GMPs in the EU. This process applies regardless of the manufacturer's location. If the product is imported from another company, the importer is responsible for GMP compliance.

- Furthermore, disruptions in the supply chain contributed to a downfall in manufacturing sterile packaging amid the global COVID-19 pandemic. In contrast, rising consumer concerns associated with viral exposure to various materials favour the industry's growth. Also, rapid production has become a key factor for medical packaging professionals during the pandemic. More medical companies are demanding faster and more sustainable packaging, and packaging companies are overdriving to meet that demand post-COVID-19.

Sterile Medical Packaging Market Trends

Vials and Ampoules is Expected to Hold a Significant Share

- Sterile medical packaging mainly includes vials and ampoules. They are widely used in the pharmaceutical business to fill and store a variety of medications and pharmaceuticals. Chemically unstable materials, drugs, and chemicals can all be stored in these items. These aid in preventing tampering with medicines and other things kept there. Every sample, including medications and drugs, can be kept longer in vials.

- The demand for vials and ampoules has grown due to the medications and vaccination demand related to the COVID-19 pandemic in the past few years. Manufacturers of pharmaceutical packaging have significantly boosted their production capacity. Millions of vials and ampoules are produced monthly by manufacturers operating at full capacity.

- Major companies operating in the industry are focused on expansions through investments and collaborations. For instance, in August 2022, German pharmaceutical packaging supplier Gerresheimer announced an investment of up to USD 94 million to strengthen its glass vial manufacturing, shipping, and distribution capabilities in the United States. The company will add a vial forming line to its North Carolina facility for the expansion project. These include dimensional control, annealing, visual inspection, and packaging lines.

- Glass is one of the materials that is frequently used to make vials and ampoules. The increasing healthcare expenditures, along with growing pharmaceutical sales and the expanding propensity of various end-users, including hospitals and pharmaceutical businesses, would propel the use of the items due to their chemical inertness and impermeability to drug stability, glass vials, and ampoules package liquid and lyophilized medications. Further, according to AstraZeneca, pharmaceutical sales in the United States are growing by ~8% year-on-year and have reached USD 605 billion in 2022 from USD 516 billion in 2020.

- Further, there is an increasing demand for vials and ampoules in nations with dense populations. The rising pharmaceutical manufacturing in these nations is further fueling the need. Depending on parameters, such as the ingredients and medication content, they must be packaged in a nonreactive container. Increased consumption of biopharmaceuticals, vaccines, and insulin, particularly in nations in the Asia-Pacific, Latin America, and Eastern Europe, is projected to encourage a rise in the usage of ampoules during the forecast period.

North America is Expected to Witness a Significant Growth.

- The developed countries in the region, such as the United States and Canada, have prosperous economies, ageing populations, and advanced medical delivery systems. With its advanced primary care community, extensive medical and life sciences research activities, high healthcare spending intensity, and ample pharmaceutical and medical supplies and medical device industries, the United States is the world's largest market for sterile medical packaging products. It is one of our important geographical markets.

- High medical spending on medical technology drives the demand for the sterile medical packaging market in the United States. Technological advancements in medicine have enabled doctors to diagnose and treat diseases in previously difficult ways. Increased medical spending on medical technology may bring new medical devices and products to market. As the availability, number, and variety of devices and products increase, so does the demand for sterile medical packaging.

- International companies are expanding their business into the region. In March 2023, Granules India launched its packaging facility through its Granules Consumer Health (GCH) step-down subsidiary, which is located in Virginia, US. The facility is over 79,000 square feet and is equipped with packaging lines and clean rooms to package and ship prescription and over-the-counter products across the U.S. market. The facility received US FDA approval with zero 483 observations.

- The increasing demand for sterile medical packaging products from pharmaceutical industries would further drive the growth of the studied market during the projected timeframe. According to StatCan, in 2024, pharmaceutical and medicine manufacturing industry revenue is expected to account for USD 9.94 billion.

- Moreover, the increasing demand for injectable pharmaceuticals in Canada is driving the growth of glass bottles. The need for oncology and other high-potency drugs (such as steroids, IV fluids, and antibody conjugates that require quick onset of action) is anticipated to be the key growth driver. In addition, global players, such as Hikma Pharmaceuticals PLC, are focusing on launching sterile injectable medicines in the region. In March 2023, Hikma Pharmaceuticals PLC (Hikma), a multinational pharmaceutical company, announced the launch of four new sterile injectable drugs in Canada, providing new treatment options for patients and healthcare service providers alongside building on the company's growing presence in the Canadian market.

Sterile Medical Packaging Industry Overview

The Sterile Medical Packaging Market is highly competitive, owing to several small and large players operating in domestic and international markets. The players in the market are adopting major strategies, like product innovations, mergers and acquisitions, and strategic partnerships, to widen their product portfolio and expand their geographical reach. Some of the players in the market are Amcor PLC, Steripack Ltd, Wipak Group, and Placon Corporation, among others.

In May 2022, Cleanroom Film and Bags (CFB), a division of a US-based packaging company, opened a facility to manufacture sterile cleanroom packaging. The facility features ISO-certified cleanrooms and will use solar-powered energy.

In April 2022, Amcor expanded its healthcare packaging facility in Sligo, Ireland, to strengthen its position in the sterile packaging industry. As part of the project, Amcor will add Class VII cleanroom manufacturing environments and ISO 13485-certified advanced thermoforming operations that meet regulatory requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Sterile Medical Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent regulations towards infection control expected to aid demand for sterile-based products

- 5.1.2 Recent increase in utilization capacity

- 5.1.3 Material advancements in the field of Plastics

- 5.2 Market Challenges

- 5.2.1 Dynamic nature of regulations makes it challenging for manufacturers to comply with local factors with issues related to material availability

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 PP

- 6.1.1.2 Polyester

- 6.1.1.3 PS

- 6.1.1.4 PVC, HDPE, etc.

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Others

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Thermoform Trays

- 6.2.2 Sterile Bottles and Containers

- 6.2.3 Pouches and Bags

- 6.2.4 Blisters Packs

- 6.2.5 Vials and Ampoules

- 6.2.6 Pre-Filled Syringes

- 6.2.7 Wraps

- 6.3 By Application Type

- 6.3.1 Pharmaceutical

- 6.3.2 Surgical and Medical Appliances

- 6.3.3 IVD

- 6.3.4 Other Applications

- 6.4 By Sterilization Type

- 6.4.1 Chemical Sterilization

- 6.4.2 Radiation Sterilization

- 6.4.3 Pressure/Temperature Sterilization

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Dupont De Nemours Inc.

- 7.1.3 Steripack Ltd

- 7.1.4 Wipak Group

- 7.1.5 Placon Corporation

- 7.1.6 Riverside Medical Packaging Company Ltd

- 7.1.7 Tekni-Plex Inc.

- 7.1.8 BillerudKorsnas AB

- 7.1.9 Sonoco Products Co

- 7.1.10 Wheaton Industries

- 7.1.11 Technipaq Inc.

- 7.1.12 3M Co (3M Packaging)

- 7.1.13 Nelipak Healthcare