|

市场调查报告书

商品编码

1435780

矾土:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Bauxite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

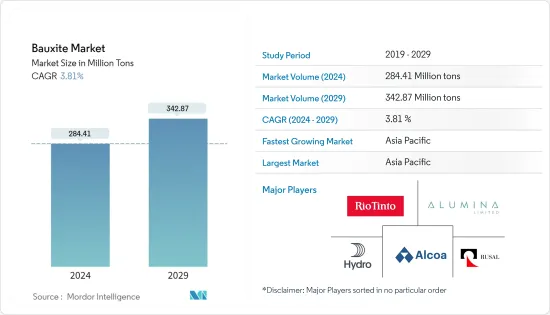

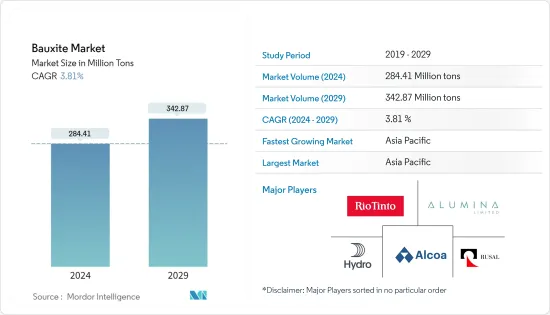

预计2024年矾土市场规模为28,441万吨,预估至2029年将达3,4,287万吨,预测期(2024-2029年)复合年增长率为3.81%。

主要亮点

- 2020年,市场受到冠状病毒感染疾病(COVID-19)爆发的负面影响,导致世界各地国家封锁,扰乱製造活动和供应链,并导致生产停顿。然而,到了2021年,情况开始好转,市场恢復了成长轨迹。

- 从中期来看,推动所研究市场的主要因素是其在水泥行业中的使用加速以及氧化铝在工业应用中的持续使用。

- 与矾土开采相关的环境问题预计将阻碍未来几年的市场成长。

- 来自中国的耐火材料和磨料以及扁平矾土生产等商业应用的需求不断增加,预计将为所研究的市场带来机会。

- 亚太地区主导全球矾土市场,预计未来几年将实现最快的成长。

矾土市场趋势

冶金应用中对氧化铝的需求不断增加

- 矾土是一种含有大量铝的沉积岩。它是铝和镓的主要来源,主要由三水铝石、水铝石和水铝石等铝矿物组成。

- 由于其氧化铝含量高,矾土是氧化铝生产的主要来源,然后加工成最终产品和氧化铝生产。因此,增加氧化铝产量正在推动所研究的市场。

- 氧化铝因其密度低、无毒、导热率高、耐腐蚀好、易于铸造、机械加工和成型等各种优异性能而受到广泛需求。氧化铝产量的增加预计将在未来几年推动矾土市场。

- 氧化铝用于主要工业用途。除了製造铝外,它还用于製造火星塞绝缘体和金属涂料,以及作为固体火箭助推器的燃料成分。

- 此外,氧化铝也用于製造量子干涉装置、电子电晶体等超导性元件。氧化铝或氧化铝也用作辐射防护的剂量计。

- 根据美国地质调查局估计,全球矾土资源量估计为550亿至750亿吨,足以满足世界未来对金属的需求。

- 根据美国人口普查局的数据,2022 年采矿和采石业收益总计 143.9 亿美元,而 2021 年为 136.8 亿美元。预计 2023 年该产业收益将达到 152.5 亿美元。

- 美国地质调查局公布的资料显示,矾土和氧化铝产量从 27.9 亿吨大幅增加。

- 采矿和冶金是该国的主要工业。加拿大向世界各国供应 60 多种金属和矿物。采矿业正在投资创新和新技术,这些技术正在迅速再形成该行业。采矿业也出现了整合,引发了对该行业未来几年成长前景的猜测。

- 因此,由于上述所有因素,冶金用氧化铝需求的增加预计将在预测期内推动调查市场的需求。

亚太地区主导市场

- 预计亚太地区将在预测期内主导矾土市场。中国、澳洲和印度等国家的快速工业化以及铝在建筑、建筑、铝箔和包装等各个行业的使用不断增加,继续增加了该地区对矾土的需求。

- 此外,铝的耐腐蚀、高延展性、高强度和轻重量等优越性能正在增加铝在轻型汽车零件製造中的采用,推动该地区矾土市场的发展。

- 此外,矾土熔点高,用作耐火材料产品的原料,使其在该地区的需求量很大。耐火级矾土用于製造电弧钢炉和高炉炉顶的砖。

- 矾土还可以透过与石灰石混合来製造水泥。生产的水泥氧化铝含量高,以其快速沉降时间和强度而闻名,导致该地区对矾土的需求增加。

- 电动车的成长趋势可能会进一步增加对铝合金的需求。中国政府预计,到2025年,电动车产量的普及将达到20%。这反映在该国的电动车销售趋势上,2022年电动车销量创下历史新高。根据中国小客车协会统计,中国电动车销量创历史新高。 2022 年,电动车和插电式汽车销量将达到 567 万辆,几乎是 2021 年销量的两倍。

- 由于100%外商直接投资(FDI)、无需工业许可证、以及从手动生产流程到自动化生产流程的技术改造等政府优惠政策,国内电子製造业正稳步扩张。印度针对国内电子产品製造推出了修改奖励特别配套计画 (M-SIPS) 和电子发展基金 (EDF) 等新奖励,预算为 1.14 亿美元。

- 市场上一些因亚太企业发展而受到调查的主要製造商包括氧化铝有限公司、澳洲铝土矿有限公司和力拓集团。

- 因此,上述因素可能会增加预测期内该地区矾土的需求。

矾土业概况

矾土市场本质上是部分一体化的,主要企业占据了全球市场的重要份额。市场主要企业包括(排名不分先后)力拓、俄罗斯铝业、美国铝业公司、氧化铝有限公司、挪威海德鲁公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 继续使用工业应用中的氧化铝

- 水泥业加速使用

- 其他司机

- 抑制因素

- 与矾土开采相关的环境问题

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 生产分析

第五章市场区隔(市场规模:基于数量)

- 目的

- 冶金用氧化铝

- 水泥

- 耐火材料

- 研磨材料

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Alcoa Corporation

- Alumina Limited

- Aluminum Corporation of China Limited

- Australian Bauxite Limited

- Compagnie des Bauxites de Guinee(CBG)

- GRAFIT MADENCILIK SAN. TIC. AS

- Iranian Aluminium Co.

- LKAB Minerals

- Norsk Hydro ASA

- Possehl Erzkontor GmbH & Co. KG

- Queensland Alumina Limited

- Rio Tinto

- RusAL

- Vimetco NV

- YunXiang Develop Co.,Limited

第七章 市场机会及未来趋势

简介目录

Product Code: 69277

The Bauxite Market size is estimated at 284.41 Million tons in 2024, and is expected to reach 342.87 Million tons by 2029, growing at a CAGR of 3.81% during the forecast period (2024-2029).

Key Highlights

- The market experienced negative impacts in 2020 due to the COVID-19 outbreak, which led to nationwide lockdowns worldwide, disruptions in manufacturing activities and supply chains, and production halts. However, in 2021, the conditions began to recover, restoring the growth trajectory of the market.

- In the medium term, the major factors driving the market studied are accelerating usage in the cement industries and continuous usage of alumina from industrial applications.

- Environmental concerns related to bauxite mining are expected to hinder market growth in the coming years.

- Increasing demand from commercial applications such as refractories and abrasives and leveling off of bauxite production from China is expected to act as an opportunity for the market studied.

- Asia-Pacific dominated the global bauxite market and is also expected to register the fastest growth in the years to come.

Bauxite Market Trends

Increasing Demand of Alumina for Metallurgical Purposes

- Bauxite is a sedimentary rock having a high content of aluminum. It is the main source of aluminum & gallium and consists mostly of aluminum minerals, namely gibbsite, boehmite, and diaspore.

- Because of its high alumina content, bauxite is a primary source for alumina production, which is then processed to produce finished products and alumina production. Thus rising alumina production is driving the market studied.

- The demand for alumina is increasing owing to its various superior properties such as low density, non-toxic nature, high thermal conductivity, excellent corrosion resistivity, and its ability to be easily cast, machined, and formed. Rising alumina production is expected to drive the market for bauxite through the upcoming years.

- Alumina is used for key industrial purposes. Other than producing aluminum, it is used for the production of spark plug insulators and metallic paints, and it is used as a fuel component for solid rocket boosters.

- Furthermore, alumina is used for the fabrication of superconducting devices, such as quantum interference devices and electron transistors. Aluminum oxide or alumina is also used as a dosimeter for radiation protection.

- According to a US Geological survey, global resources of bauxite are estimated to be between 55 billion and 75 billion tons and are sufficient to meet world demand for metal well into the future.

- As per the United States Census Bureau, revenue in mining and quarrying amounted to USD 14.39 billion in 2022, as compared to USD 13.68 billion in 2021. The revenue from this sector is projected to amount to USD 15.25 billion in 2023.

- As per data published by the United States Geological Survey, the bauxite and alumina increased significantly from 2790 million metric tons.

- Mining and metallurgy are key industries in the country. Canada supplies over 60 metals and minerals to different countries worldwide. The mining industry invests in innovation and new technologies, which rapidly reshapes the sector. The mining industry also witnessed consolidations, which led to speculations regarding the growth prospects for the industry in the coming years.

- Therefore, owing to all the above-mentioned factors, increasing demand for alumina for metallurgical purposes is expected to boost the demand for the market studied over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for bauxite during the forecast period. In countries such as China, Australia, and India, owing to rapid industrialization and an increase in the usage of aluminum in various industries, such as building and construction, foil, and packaging, the demand for bauxite continues to increase in the region.

- Furthermore, superior properties of aluminum, like corrosion resistance, high ductility, high strength, and lightweight, have led to an increase in the adoption of aluminum for producing light vehicle parts, which is propelling the bauxite market in the region.

- Additionally, demand for bauxite is rising in the region due to its usage as a raw material in making refractory products since it has a high melting point. Refractory grade bauxite is used to manufacture bricks to line the roof of electric arc steel-making furnaces and blast furnaces.

- Bauxite is also used for manufacturing cement by mixing it with limestone. The cement produced has high alumina content and is known for its rapid settling time and strength, leading to an increasing demand for bauxite in the region.

- The increasing trend of electric vehicles may further propel the demand for aluminum alloys. The government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went record-breaking high in 2022. As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, touching almost double the sales figures achieved in 2021.

- The domestic electronics manufacturing sector has been expanding at a steady rate, owing to favorable government policies, such as 100% Foreign Direct Investment (FDI), no requirement for an industrial license, and the technological transformation from manual to automatic production processes. New incentives, such as the Modified Incentive Special Package Scheme (M-SIPS) and Electronics Development Fund (EDF), have been started in the country with a budget of USD 114 million for the domestic manufacturing of electronics in India.

- Some of the major manufacturers of the market studied operating in Asia-Pacific include Alumina Limited, Australian Bauxite Limited, and Rio Tinto.

- Therefore, the aforementioned factors are likely to boost the demand for bauxite in the region during the forecast period.

Bauxite Industry Overview

The bauxite market is partially consolidated in nature, with top players accounting for a significant share of the global market. Some of the major companies in the market include Rio Tinto, RusAL, Alcoa Corporation, Alumina Limited, and Norsk Hydro ASA, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Continuous Usage of Alumina from Industrial Applications

- 4.1.2 Accelerating Usage in the Cement Industries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Concern Related to Bauxite Mining

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Alumina for Metallurgical Purposes

- 5.1.2 Cement

- 5.1.3 Refractories

- 5.1.4 Abrasives

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Australia and New Zealand

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Alumina Limited

- 6.4.3 Aluminum Corporation of China Limited

- 6.4.4 Australian Bauxite Limited

- 6.4.5 Compagnie des Bauxites de Guinee (CBG)

- 6.4.6 GRAFIT MADENCILIK SAN. TIC. A.S.

- 6.4.7 Iranian Aluminium Co.

- 6.4.8 LKAB Minerals

- 6.4.9 Norsk Hydro ASA

- 6.4.10 Possehl Erzkontor GmbH & Co. KG

- 6.4.11 Queensland Alumina Limited

- 6.4.12 Rio Tinto

- 6.4.13 RusAL

- 6.4.14 Vimetco NV

- 6.4.15 YunXiang Develop Co.,Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Commercial Applications such as Refractories and Abrasives

- 7.2 Levelling Off of Bauxite Production from China

02-2729-4219

+886-2-2729-4219