|

市场调查报告书

商品编码

1435789

汽车泡沫:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

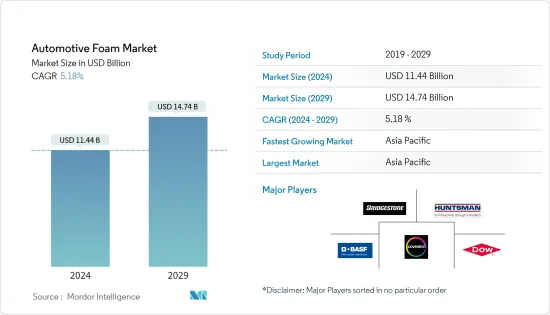

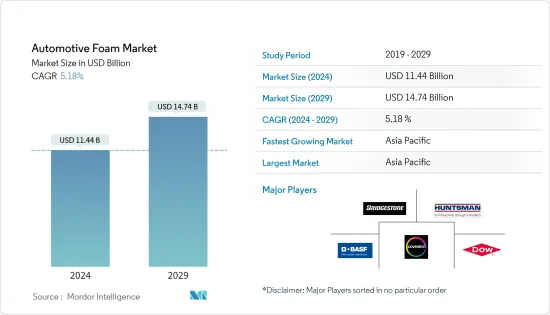

预计2024年汽车泡棉市场规模为114.4亿美元,预计到2029年将达到147.4亿美元,在预测期内(2024-2029年)成长5.18%,复合年增长率成长。

2020年,冠状病毒感染疾病(COVID-19)的传播和封锁对汽车产业产生了负面影响,导致销售和产量下降。然而,随着封锁的放鬆和经济的成长势头,该行业能够在 2021-2022 年恢復成长势头。

主要亮点

- 日益重视汽车泡棉的永续生产和日益增长的汽车减重需求等因素预计将在预测期内推动市场发展。

- 然而,环境友善生物泡沫的供应和欧洲主要经济体汽车产量的下降预计将阻碍预测期内的市场成长。

- 电动车需求的成长和其他因素预计将在预测期内为市场带来机会。

- 亚太地区主导了市场,印度和中国等国家的需求不断增长。

汽车泡棉市场趋势

室内应用主导市场

- 在汽车内装应用中,汽车泡棉主要用于仪表板、底盘零件、电缆覆盖层、头枕、方向盘、排挡轮圈、座椅、保险桿、门饰等。

- 对于这些应用,聚氨酯泡棉在世界各地最常使用。这种泡棉具有隔热性能、缓衝性能、窗户密封性能和隔音性能等优点。

- 由于这些泡棉重量轻,因此可以帮助减轻车辆的整体重量、提高燃油效率并减少排放气体。这些泡棉具有隔音性能,可降低车内噪音水平,使驾驶更加舒适。因此,聚氨酯泡棉在内燃机和电动车的各种内装应用中越来越受到製造商的欢迎。

- 根据国际工业组织(OICA)的数据,2022年全球汽车产量与前一年同期比较成长6%,总合生产85.01辆汽车。因此,这种趋势可能会增加对泡沫的需求,以减轻车辆重量并提高效率。

- 根据EV Volumes的数据,2022年全球纯电动车(BEV)和插电式混合(PHEV)总合销量总计1,050万辆,与前一年同期比较去年同期成长60%。

- 根据国际能源总署(IEA)预测,在新的政策情境下,预计2030年全球电动车销售将达到1.25亿辆(不包括两轮/三轮车)。

- 因此,汽车产业的这种趋势可能会增加预测期内对内装应用泡棉的需求。

亚太地区主导市场

- 由于中国、印度和东南亚国协等国家聚氨酯消费量的增加,亚太地区在全球汽车泡沫市场中占据主导地位。

- 根据中国工业协会预测,2022年中国汽车企业产量为2702万辆,与前一年同期比较2021年的2609万辆年增长3.4%,销量增长2.1%。% 至 2,686 台,达到 10,000 台。

- 此外,中国还是全球最大的电动车市场。根据中国工业协会统计,2023年2月纯电动和插电式混合动力车产量为55.2万辆,较1月的42.5万辆成长30%,市占率可望带动成长。

- 印度也是一些世界上最大的汽车製造商的所在地。印度品牌股权基金会(IBEF)预计,到2027年,印度小客车市场规模预计将达到548.4亿美元,2022年至2027年复合年增长率将超过9%。

- 根据OICA统计,2022年国内汽车总产量为545万辆,但2021年则上升至439万辆,与前一年同期比较增加24%。

- 因此,该地区汽车行业的这种趋势预计将在预测期内推动汽车泡棉市场。

汽车泡棉产业概况

汽车泡沫市场已部分整合,主要企业占据了相当大的市场份额。主要企业包括(排名不分先后) BASF SE、Dow、Huntsman International LLC.、Covestro AG 和 Bridgestone Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 越来越关注汽车泡棉的永续生产

- 减肥需求日益增加

- 其他司机

- 抑制因素

- 欧洲主要国家汽车产量下降

- 环境友善生物形态的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 聚氨酯泡棉(PUF)

- 软质聚氨酯泡棉

- 硬质聚氨酯泡棉

- 发泡聚丙烯

- 聚酯泡沫

- 其他的

- 聚氨酯泡棉(PUF)

- 目的

- 内部的

- 外部的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)分析/市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Bridgestone Corporation

- Covestro AG

- Dow

- Huntsman Corporation

- Recticel

- Rogers Corporation

- Saint-Gobain

- Vita(Holdings)Limited

- Woodbridge Foam Corporation

第七章 市场机会及未来趋势

The Automotive Foam Market size is estimated at USD 11.44 billion in 2024, and is expected to reach USD 14.74 billion by 2029, growing at a CAGR of 5.18% during the forecast period (2024-2029).

In the year 2020, the breakdown of Covid-19 and the imposition of lockdowns negatively affected the automotive industry causing a decline in sales and production. However, the easing of lockdowns and economies gaining momentum helped the industry to gain back momentum in the years 2021 and 2022.

Key Highlights

- Factors such as growing emphasis on the sustainable production of automotive foams and the growing need for weight reduction in vehicles are expected to drive the market over the forecast period.

- However, the availability of eco-friendly bio-foams and the decline in automotive production in major economies of Europe is expected to hinder the market growth over the forecast period.

- The growing demand from electric vehicles and other factors are expected to act as an opportunity for the market over the forecast period.

- Asia-Pacific dominated the market with an increased demand from countries like India, China, and others.

Automotive Foam Market Trends

Interior Applications to Dominate the Market

- In interior applications, automotive foams are mainly used for dashboards, chassis components, cable sheathing, headrests, steering wheels, gear knobs, seats, bumpers and door trims, and others.

- For these applications, polyurethane foam is the most used foam worldwide. This foam provides benefits like insulation properties, cushioning, window encapsulation, and acoustical properties.

- As these foams are lightweight, they help in reducing the total weight of the car, which can improve fuel efficiency and reduce emissions. By providing acoustical insulation properties, these foams help in reducing noise levels inside the car, making the car more pleasurable to drive. Hence, polyurethane foams have gained popularity amongst manufacturers for various interior applications in ICEs and EVs.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in the year 2022, the production of vehicles increased globally by 6% with a total of 85.01 units manufactured as compared to the previois year. Hence, such trends are likely to increase the demand for foams to reduce the weight of vehicles and increase efficiency.

- According to EV Volumes, in the year 2022, the total sales of Battery Electric Vehicles (BEVs) and plug-in Hybrid Electric Vehicles (PHEVs) were 10.5 million worldwide, registering a growth of 60% as compared with the previous year.

- According to the International Energy Agency (IEA), global electric vehicle sales are expected to reach 125 million in 2030, as per the New Policies Scenario (excluding two/three-wheelers).

- Hence, such trends in the automotive industry are likely to increase the demand for foams used in interior applications over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region dominates the global market for automotive foams owing to the growing polyurethane consumption in countries such as China, India, and ASEAN Countries.

- According to the China Association of Automobile Manufacturers (CAAM), Chinese carmakers produced 27.02 million units in 2022, up by 3.4% Y-o-Y compared to 26.09 million units in 2021, while sales rose by 2.1% to 26.86 million units.

- Further, China is the biggest market for electric vehicles in the world. According to the China Association of Automobile Manufacturers (CAAM), in February 2023, the production of BEVs and PHEVs was 552 thousand while in the month of January, it was 425 thousand registering a growth of 30% which is likely to drive the market growth for automotive foams.

- India is also home to some of the world's largest automakers. According to the Indian Brand Equity Foundation (IBEF), the Indian passenger car market is expected to reach USD 54.84 billion by 2027 while registering a CAGR of over 9% between 2022-27.

- According to OICA, the total production of vehicles in the country in the year 2022 was 5.45 million units while in the year 2021, it was 4.39 million units registering a growth of 24% year-on-year.

- Hence, such trends in the automotive industry in the region is expected to drive the market for automotive foams during the forecast period.

Automotive Foam Industry Overview

The automotive foam market is partially consolidated, with top players accounting for a considerable share of the market. Some of the major companies include (not in any particular order) BASF SE, Dow, Huntsman International LLC., Covestro AG, and Bridgestone Corporation among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Emphasis on the Sustainable Production of Automotive Foams

- 4.1.2 Growing Need for Weight Reduction

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Declining Automotive Production in Major Economies of Europe

- 4.2.2 Availability of Eco-Friendly Bio-Foams

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyurethane Foams(PUFs)

- 5.1.1.1 Flexible Polyurethane Foam

- 5.1.1.2 Rigid Polyurethane Foam

- 5.1.2 Expanded Polypropylene Foam

- 5.1.3 PET Foam

- 5.1.4 Other Types

- 5.1.1 Polyurethane Foams(PUFs)

- 5.2 Application

- 5.2.1 Interior

- 5.2.2 Exterior

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bridgestone Corporation

- 6.4.3 Covestro AG

- 6.4.4 Dow

- 6.4.5 Huntsman Corporation

- 6.4.6 Recticel

- 6.4.7 Rogers Corporation

- 6.4.8 Saint-Gobain

- 6.4.9 Vita (Holdings) Limited

- 6.4.10 Woodbridge Foam Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from Electric Vehicles

- 7.2 Other Opportunities