|

市场调查报告书

商品编码

1435801

塑胶回收再利用:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Engineering Plastic Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

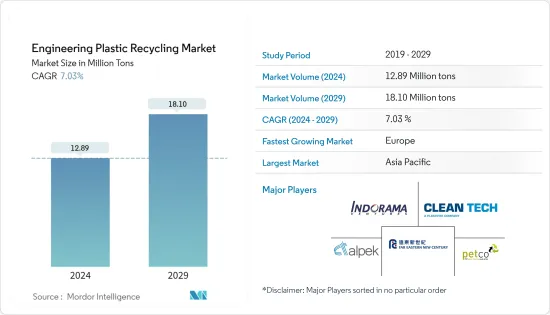

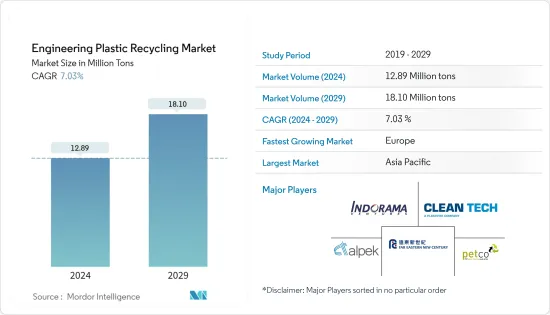

预计2024年塑胶回收再利用市场规模为1,289万吨,预计2029年将达1,810万吨,在预测期内(2024-2029年)复合年增长率为7.03%。

COVID-19感染疾病对工程塑胶塑胶回收再利用行业造成了沉重打击。由于全球封锁和各国政府实施的严格监管,大多数生产基地被关闭,造成毁灭性打击。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

主要亮点

- 推动所研究市场成长的关键因素是消费者和包装产品对永续性的日益重视以及再生聚酯的使用增加。

- 另一方面,收集和分离混合塑胶的困难预计将阻碍市场成长。

- 塑胶自动加工和分离的回收技术创新预计将为全球工程塑胶塑胶回收再利用市场提供充足的机会。

- 亚太地区占最大份额。然而,预计欧洲在预测期内仍将维持最高的复合年增长率。

塑胶回收再利用市场趋势

包装产业主导市场

- PET 是包装应用中使用最广泛的塑胶之一。除了食品安全之外,PET 还坚固、轻质、透明且防碎。此外,PET 具有有效阻挡二氧化碳的特性,使其成为饮料和硬质食品包装的无可比拟的选择。

- 英国塑胶联合会 (BPF) 表示,目前几乎 70% 的无酒精饮品(碳酸气泡式饮料、气泡式饮料、果汁和瓶装水)均采用 PET 塑胶瓶包装。

- 此外,BP plc 指出,PET 通常用于硬质食品包装,全球每年约有 2700 万吨 PET 用于这些应用,其中大部分(约 2300 万吨)被装入瓶子。再生 PET 可以取代新包装产品中全部或部分原生 PET 聚合物。

- 随着许多主要包装公司计划解决废弃物管理问题,回收越来越受到关注。许多公司从家庭废弃物管理中收集宝特瓶,并将其加工成塑胶薄片,以进一步用于包装应用。

- 全球许多知名品牌都致力于使用再生 PET 来减少其饮料产品的碳排放。其中包括可口可乐、雀巢饮用水、百事可乐、达能以及其他无酒精饮品和瓶装水公司,它们已承诺在 2030 年停止使用一次性塑胶。

- 根据软包装协会(FPA)预测,到2022年,美国软包装产业价值将达到1,850亿美元,约占整个市场的20%。 2022年软包装与前一年同期比较成长12.1%。

- 因此,包装行业预计将主导市场,并有望为工程塑胶塑胶回收再利用市场的参与者提供大量成长机会。

亚太地区主导市场

- 由于中国、日本和印度的塑胶回收再利用需求,亚太地区主导了塑胶回收再利用市场。

- 中国是全球最大的聚聚对苯二甲酸乙二酯(PET)消费国之一。近年来,丰富的原料供应和低廉的生产成本支撑了该国PET等工程塑胶产量的成长。

- 根据中国国家统计局数据,2022年上半年中国塑胶製品产量约3,821万吨,2021年约8,004万吨。

- 根据印度品牌股权基金会(IBEF)统计,2022年4月至2023年2月印度塑胶出口额达109亿美元。此外,根据PET包装和清洁环境协会(PACE)和国家化学实验室(NCL)的数据,印度的再生PET塑胶产业估计约为400-5.5亿美元。因此,由于塑胶出口和回收活动的增加,工程塑胶回收市场正在扩大。

- 此外,包装、汽车、电气和电子等许多最终用途行业对再生塑胶的巨大需求进一步推动了市场成长。

- 例如,根据OICA的数据,2022年亚太地区汽车总产量为50,020,793辆,比2021年的46,768,800辆成长7%。

- 因此,塑胶产量的增加、回收活动的显着增长以及多个最终用户行业的巨大需求正在推动工程塑胶塑胶回收再利用市场的成长。

塑胶回收再利用产业概况

由于区域市场参与者的高度主导地位,工程塑胶塑胶回收再利用市场高度分散。市场主要企业包括(排名不分先后)Indorama Ventures Public Company Limited、Clean Tech UK Ltd、Far Eastern New Century Corporation (Phoenix Technologies)、Alpek SAB de CV 和 Petco。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 越来越重视消费品和包装产品的永续性

- 增加再生聚酯的使用

- 其他司机

- 抑制因素

- 收集和分离混合塑胶的困难

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 塑胶类型

- 聚碳酸酯

- 聚对苯二甲酸乙二酯(PET)

- 苯乙烯共聚物(ABS、SAN)

- 聚酰胺

- 其他的

- 最终用户产业

- 包装

- 工业丝

- 电力/电子

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)/排名分析

- 主要企业策略

- 公司简介

- Alpek SAB de CV

- Clean Tech UK Ltd

- Euresi Plastics SL

- EF Plastics UK Ltd

- Far Eastern New Century Corporation(Phoenix Technologies)

- Indorama Ventures Public Company Limited

- JFC Group

- Krones AG

- Petco

- Placon

- PolyClean Technologies

- Reliance Industries Limited

- REPRO-PET

- TEIJIN LIMITED

- UltrePET LLC

第七章 市场机会及未来趋势

The Engineering Plastic Recycling Market size is estimated at 12.89 Million tons in 2024, and is expected to reach 18.10 Million tons by 2029, growing at a CAGR of 7.03% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the engineering plastic recycling sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factor driving the growth of the market studied is the growing emphasis on sustainability among consumers and packaging products and the increasing use of recycled polyester.

- On the flip side, difficulty in collecting and sorting mixed plastic is expected to hinder the market's growth.

- Innovations in recycling technologies for the automatic processing and sorting of plastics are expected to provide ample opportunities in the global engineering plastic recycling market.

- The Asia-Pacific region accounted for the largest share; however, Europe is expected to register the highest CAGR during the forecast period.

Plastic Recycling Market Trends

Packaging Industry to Dominate the Market

- PET is one of the most widely used plastics for packaging applications. Apart from being food-safe, PET is also strong, lightweight, transparent, and shatter-resistant. Moreover, the characteristics of PET, as an effective barrier to carbon dioxide, make it an unrivaled choice for beverage and rigid food packaging.

- British Plastics Federation (BPF) stated that, at present, nearly 70% of soft drinks (carbonated drinks, still and dilatable drinks, fruit juices, and bottled water) are packaged in PET plastic bottles.

- Further, BP p.l.c. stated that PET is usually used in rigid food packaging, and per year, nearly 27 million metric tons of PET are used in these applications globally, with the majority, around 23 million tons, used in bottles. Recycled PET can replace all or a proportion of virgin PET polymer in new packaging products.

- Recycling has been gaining traction as many major packaging companies are planning initiatives for waste management. Many companies are collecting PET bottles from domestic waste management and then processed into plastic flakes to further use in packaging applications.

- Numerous major brands worldwide are committed to using recycled PET to reduce the carbon footprint of their drink products. Some of these include Coca-Cola, Nestle Waters, PepsiCo, and Danone, others that sell soft drinks and bottled water, have committed to stop using single-use plastics by 2030.

- According to Flexible Packaging Association (FPA), the United States packaging industry was valued at USD 185 billion in 2022 in flexible packaging, accounting for around 20% of the total market share. The year-on-year growth of flexible packaging in 2022 was up 12.1%.

- Hence, the packaging industry is expected to dominate the market and expect to provide numerous growth opportunities to the players operating in the engineering plastic recycling market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the engineering plastic recycling market owing to the demand for plastic recycling from China, Japan, and India.

- China is one of the largest global polyethylene terephthalate (PET) consumers. The abundant availability of raw materials and the low cost of production have supported the production growth of engineering plastics, such as PET, in the country for the past few years.

- According to the National Bureau of Statistics of China, in H1 2022, China produced plastic products to nearly 38.21 million metric tons, around 80.04 million metric tons in 2021.

- According to the Indian Brand Equity Foundation (IBEF), India's plastic export from April-2022 to February 2023 stood at USD 10.9 billion. Further, according to PET Packaging Association for Clean Environment (PACE) and National Chemical Laboratory (NCL), the Indian recycled PET plastic industry was estimated to be around USD 400-550 million. Thus, increasing plastic export and recycling activities is boosting the engineering plastic recycling market.

- Further, the significant demand for recycled plastic in numerous end-use industries, such as packaging, automotive, electrical, and electronics, is further propelling the market growth.

- For instance, according to OICA, in 2022, the total production of motor vehicles in Asia-Pacific amounted to 50,020,793 units which was increased by 7% compared to 2021, which accounted for 46,768,800 units.

- Thus, the rise in plastic production, remarkable growth in recycling activities, and significant demand for several end-user industries is propelling the growth of the engineering plastic recycling market.

Plastic Recycling Industry Overview

The engineering plastic recycling market is highly fragmented as the dominance of regional market players is extremely high. Some of the major players in the market (in no particular order) include Indorama Ventures Public Company Limited, Clean Tech U.K. Ltd, Far Eastern New Century Corporation (Phoenix Technologies), Alpek S.A.B. de C.V., and Petco.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Emphasis on Sustainability among Consumer and Packaging Products

- 4.1.2 Increasing Use of Recycled Polyester

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Difficulty in Collecting and Sorting Mixed Plastic

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Plastic Type

- 5.1.1 Polycarbonate

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Styrene Copolymers (ABS and SAN)

- 5.1.4 Polyamide

- 5.1.5 Other Engineering Plastics

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Industrial Yarn

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpek S.A.B. de C.V.

- 6.4.2 Clean Tech UK Ltd

- 6.4.3 Euresi Plastics SL

- 6.4.4 EF Plastics UK Ltd

- 6.4.5 Far Eastern New Century Corporation (Phoenix Technologies)

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 JFC Group

- 6.4.8 Krones AG

- 6.4.9 Petco

- 6.4.10 Placon

- 6.4.11 PolyClean Technologies

- 6.4.12 Reliance Industries Limited

- 6.4.13 REPRO-PET

- 6.4.14 TEIJIN LIMITED

- 6.4.15 UltrePET LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Recycling Technologies for Automatic Processing and Sorting of Plastics

- 7.2 Other Opportunities