|

市场调查报告书

商品编码

1435805

电动轻型商用车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Electric LCV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

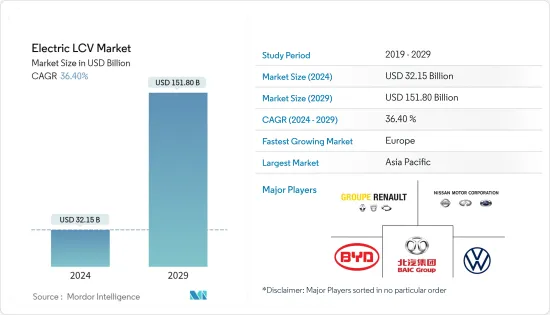

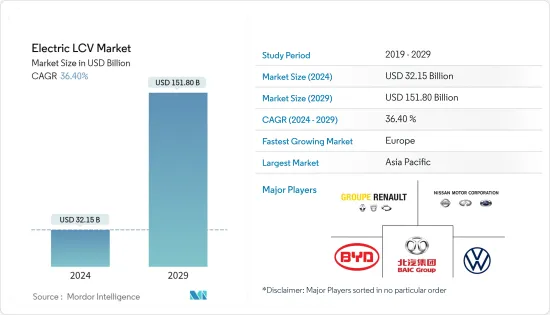

电动轻型商用车市场规模预计到 2024 年为 321.5 亿美元,预计到 2029 年将达到 1,518 亿美元,在预测期内(2024-2029 年)复合年增长率为 36.40%。

主要亮点

- 快速的都市化、严格的排放法规和电池技术的进步预计将在预测期内增加对电动轻型商用车的需求。已开发市场已经开始采用电动小客车,轻型商用车市场的新兴企业和大型企业计划在未来几年推出新的电动车款。

- 城市透过设立超低排放气体区来限制柴油车的使用。此外,政府津贴、降低的运作和维护成本以及进入超低排放区可能会使电动商用车成为未来企业有吸引力的选择。

- 电动车电池阵容正在迅速扩大。目前,新车型正在上市,续航里程可达600英里。卡车和货车比小客车更大,因此可以携带更多电池并行驶远距。大型马达可以根据牵引和牵引能力产生巨大的扭力。例如,Nikola 的 Badger 皮卡凭藉燃料电池技术和电池,续航力可达 600 英里。

电动轻型商用车市场趋势

电动货车引领电动轻型商用车市场

随着都市区的快速增长,世界各国政府都计划禁止柴油汽车和货车。例如,

- 英国计划在2040年禁止销售所有类型的汽油和柴油引擎汽车。印度计划在 2030 年禁止所有类型的柴油引擎车辆上路。

- 挪威处于领先地位,计划到 2025 年使所有新车实现零排放。

随着电动车需求的不断增长,企业主开始用电动车取代现有车辆,市场相关人员也纷纷公布新电动车车型的发布时间表。 2019 年,福特宣布计划于 2021 年将大众市场商用货车的电动版本 Transit EV 推向欧洲市场。货车占欧洲轻型商用车总销量的 80%。

货车用于广泛的商业活动,包括建筑、邮政和宅配服务、救护车服务、警察和救援行动、流动车间和客运。

亚太地区可望引领电动轻型商用车市场

亚太地区原料廉价、人事费用低、产业相关人员多、人口多、政府参与度高,是电动车产业的中心。例如,中国政府已花费约600亿美元支持电动车产业,包括研发资金、免税和电池充电站贷款。

在国内市场表现出色后,中国企业正在寻求扩大在其他国家的市场份额。例如,2019年,中国最大的电动车製造商比亚迪集团在印度推出了两款纯电动商用车,分别是T3纯电动商务物流小型货车和T3纯电动搭乘用MPV。

电动货车在欧洲越来越受到市场关注,市场主要参与者在该地区推出了新型电动货车。例如,

2019年,雷诺集团推出两款氢电动商用车:MASTER ZE Hydrogen和KANGOO ZE Hydrogen。该公司还将车辆的续航里程从 120 公里增加到 350 公里。

电动轻型商用车产业概况

电动轻型商用车市场有适度整合,活跃参与者数量有限。市场正在见证新兴企业和老牌企业推出各种新的电动车型。该市场的主要企业包括比亚迪集团、日产汽车、雷诺集团和大众汽车公司。两家公司都透过与市场上的其他参与者建立策略联盟并推出新型电动轻型商用车来扩大其影响力。例如,

- 2020年,电动货车製造商Arrival获得联合包裹服务公司(UPS)价值4.28亿美元的1万辆订单。 UPS 还计划购买这家新兴企业的股份。 Arrival 已获得现代汽车和起亚汽车超过 1 亿美元的融资。

- 2019年,Rivian Automotive共获得多方融资13亿美元。该新兴企业还宣布计划于 2019 年 9 月与亚马逊合作开发电动送货车,总合向亚马逊订购了 10 万辆电动送货车,预计将于 2021 年开始交付。

- 2019年,特斯拉在加州洛杉矶推出了首款电动皮卡车,名为Cybertruck。 Cybertruck 提供三种型号,最大续航里程分别为 200 英里、300 英里和 500 英里,预计将于 2021 年首次交付。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依推进类型

- BEV

- HEV

- FCEV

- 按车型分类

- 货车

- 皮卡车

- 按产量

- 小于100千瓦

- 100~250 kW

- 250度以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 墨西哥

- 阿拉伯聯合大公国

- 其他的

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- BYD Group

- Nissan Motor Co.

- BAIC Group

- Rivian Automotive

- Renault Group

- Tesla Inc.

- Volkswagen AG

- Groupe PSA

- Arrival Ltd

- Mahindra and Mahindra Ltd

- Tata Motors Limited

第七章 市场机会及未来趋势

The Electric LCV Market size is estimated at USD 32.15 billion in 2024, and is expected to reach USD 151.80 billion by 2029, growing at a CAGR of 36.40% during the forecast period (2024-2029).

Key Highlights

- The rapid urbanization, stringent emission regulations, and advancements in battery technology are expected to fuel the demand for electric LCVs during the forecast period. The market is already witnessing the adaptation of electric passenger vehicles in developed countries, and the start-ups and major players in the LCV market are planning to introduce their new electric models in the coming years.

- Cities are restricting the access of diesel vehicles through the implementation of ultra-low emissions zones. Additionally, government grants, lower running and servicing costs, and access to ultra-low emissions zones can make electric commercial vehicles an attractive choice for business in the future.

- The EV battery range is growing rapidly. Presently, new models are being launched in the market witha range of up to 600 miles. Trucks and vans' body sizes are bigger compared to passenger cars, thus, they can accommodate more batteries for a longer range. Big electric motors can create enormous amounts of torque for towing and hauling capacities. For instance, Nikola's Badger pickup truck has a range of 600 miles, owing to its fuel cell technology and batteries.

Electric LCV Market Trends

Electric Van is Leading the Electric LCV Market

The population in urban areas is growing rapidly, owing to which, governments across the world are planning to ban diesel cars and vans. For instance,

- The United Kingdom is planning to ban sales of all types of gasoline and diesel engine cars by 2040. India is planning to ban all types of diesel-engine cars on the roads by 2030.

- Norway is way ahead of the curve, and it plans to make every new car a zero-emission car by 2025.

With the growing demand for electric vehicles, business owners have started replacing their existing fleets to electric vehicles, and market players are announcing the expected launch of their new electric models. In 2019, Ford announced its plans to launch its mass-selling Transit commercial van in an electric variant, named as Transit EV, in the European market by 2021. Vans contribute 80% of the total light commercial vehicle sales in Europe.

Vans are used for a wide range of commercial activities, such as construction, postal and courier services, ambulance services, policing and rescue operations, mobile workshops, and passenger transportation.

Asia-Pacific is Expected to Lead the Electric LCV Market

Asia-Pacific is the hub of the electric vehicle industry, owing to the availability of cheap raw materials, low labor cost, presence of numerous industry players, large population, and government participation. For instance, the Chinese government spent around USD 60 billion to support the electric-vehicle industry, including R&D funding, tax exemptions, and financing for battery-charging stations.

Chinese players, after performing well in their local markets, are trying to expand their market presence in other countries. For instance, in 2019, BYD Group, China's largest electric vehicle manufacturer, introduced its two pure electric commercial vehicles in India, namely, T3 pure electric commercial logistics minivan and T3 pure electric passenger MPV.

Europe is gaining traction in the market with the help of electric vans, and major players in the market are launching new electric vans in the region. For instance,

In 2019, Renault Group launched two hydrogen-electric commercial vehicles, namely, MASTER Z.E. Hydrogen and KANGOO Z.E. Hydrogen. The company is also increasing its range of vehicles from 120 km to up to 350 km.

Electric LCV Industry Overview

The electric LCV market is moderately consolidated, and it has a limited number of active players. The market is witnessing the launch of various new electric models by start-ups and established players. Some of the major players in the market are BYD Group, Nissan Motor Co., Renault Group, and Volkswagen AG, among others. The companies are expanding their presence by forming strategic alliances with other players in the market and launching new electric LCVs. For instance,

- In 2020, Arrival, an electric van manufacturer, won a USD 428 million order from United Parcel Service (UPS) for 10,000 vehicles. UPS is also planning to buy an equity stake in the start-up. Arrival already received over USD 100 million in funding from Hyundai and KIA.

- In 2019, Rivian Automotive received a total of USD 1.3 billion in funding from different sources. Also, in September 2019, this start-up announced its plans to collaborate with Amazon for an electric delivery van, and a total of 100,000 of these electric vans have been ordered by Amazon, with deliveries expected to start by 2021.

- In 2019, Tesla launched its first electric pickup truck named Cybertruck, in Los Angeles, California. Cybertruck comes in three variants with a maximum range of 200 miles, 300 miles, and 500 miles, with the first delivery expected by 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Propulsion Type

- 5.1.1 BEV

- 5.1.2 HEV

- 5.1.3 FCEV

- 5.2 By Vehicle Type

- 5.2.1 Van

- 5.2.2 Pick-up Truck

- 5.3 By Power Output

- 5.3.1 Less Than 100 kW

- 5.3.2 100 -250 kW

- 5.3.3 More Than 250 kW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BYD Group

- 6.2.2 Nissan Motor Co.

- 6.2.3 BAIC Group

- 6.2.4 Rivian Automotive

- 6.2.5 Renault Group

- 6.2.6 Tesla Inc.

- 6.2.7 Volkswagen AG

- 6.2.8 Groupe PSA

- 6.2.9 Arrival Ltd

- 6.2.10 Mahindra and Mahindra Ltd

- 6.2.11 Tata Motors Limited