|

市场调查报告书

商品编码

1435839

电磁场模拟软体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Electromagnetic Simulation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

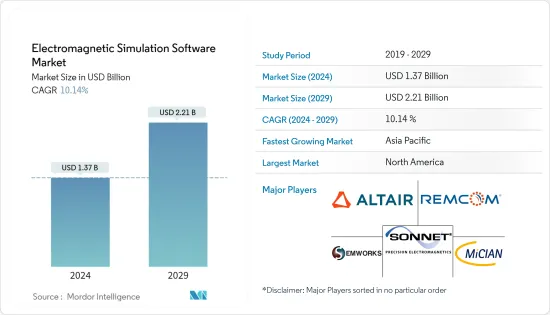

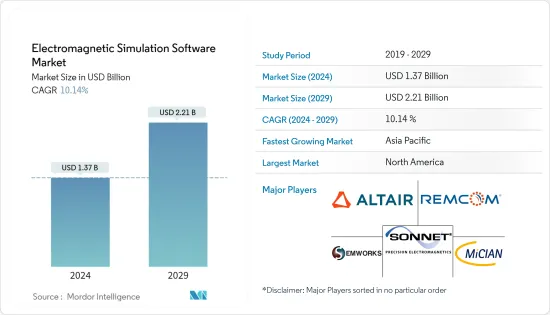

电磁场模拟软体市场规模预计到 2024 年为 13.7 亿美元,预计到 2029 年将达到 22.1 亿美元,在预测期内(2024-2029 年)增长 10.14%。复合年增长率为

主导驱动的产品开发方法主要为多种挑战提供有效的解决方案。模拟使工程团队能够在组件和系统层级的各种操作条件下快速评估设计的性能。该软体还可以快速分析数十种初步设计方案,并对选定的少数产品进行上市前所需的严格测试。

主要亮点

- 技术进步和对自动化的日益依赖预计将迅速增加对耐用消费品、电子产品和高端技术产品的需求,从而推动市场。随着互联网在全球变得越来越普及,供应商寻求提高速度和连接性,从而促进了 5G 的发展。过去几年,工业、商业、汽车和通讯系统对低成本、精确电磁场模拟软体的需求也迅速成长。

- 此外,电网基础设施正变得越来越数位化和互联,确保关键数位通讯的可靠和安全。因此,智慧电网基础设施至关重要,无论是变电站还是住宅环境。智慧电錶和系统控制可实现监控设备运作状况、电网拥塞和稳定性所需的即时测量,是智慧电网不可或缺的一部分。电磁场模拟软体主要用于分析智慧电錶主要部件的工频磁场干扰。随着智慧电錶的大规模引入,预计会有进一步的需求。

- 根据美国能源局预测,到2024年,美国对先进计量基础设施(AMI)等智慧电网设备或系统的投资预计将达到64亿美元。随着一些国家大力投资智慧电网,全球市场预计在未来十年将继续成长。

- 多输入多输出(MIMO)技术是天线的最新迭代。由于该技术具有广泛的优势,包括扩展通讯和 3D 波束成形,因此采用率预计将快速成长,特别是在北美和欧洲等先进通讯市场。

- 持续的 COVID-19感染疾病迫使所有行业的组织要么完全关闭製造业,要么允许所有员工在家工作。这导致多种目的使用网路的显着增加,例如查看线上媒体内容、对其他任务的呼叫增加以及对现有网路造成压力的几个因素。因此,通讯业参与者寻找像 MIMO 这样为消费者提供不间断服务的解决方案已变得至关重要。

电磁场模拟软体市场趋势

通讯业预计将推动市场成长

- 随着LTE的不断引入以及无线连接技术领域的进步,例如通用封包服务(GPRS)、Wi-Fi和微波接入全球互通性(WiMax)在各个领域的应用,随着使用的设备数量不断增加,电磁模拟软体用于执行高保真 3-D EM 模拟、分析几何尺度变化、执行热机械应力分析以及优化天线设计,这导致了其增长。

- 由于频谱可用性以及部署下一代行动网路所需的大量时间和成本,成熟市场中的大多数行动网路营运商计划在未来几年内升级到 5G。领先的公司与技术供应商合作,加快流程并提高其在通讯市场的竞争力。

- 例如,2020 年 2 月,三星电子与美国 Cellular 合作开发 5G 和 4G LTE 网路解决方案。该协议允许为美国数百万客户提供行动服务的领先提供商美国 Cellular 购买三星商业性验证的网路解决方案,包括5G 新无线电(NR) 技术,并将突破性的4G LTE 和5G 技术扩展到您的服务中。消费者和商业应用程式的客户群正在不断增长。

- 此外,电子公司正专注于新产品开发,例如 5G MIMO 微带天线,并正在考虑各种结构,以满足不同应用经常相互衝突的需求。例如,2020 年 2 月,Fractus Antennas 推出了一款只有米粒大小的新型多频段 5G 和蜂巢式物联网天线增强器。它提供全球连接并解决通用的尺寸挑战,因为其尺寸仅为 7.0 毫米 x 3.0 毫米 x 1.0 毫米。单天线可覆盖824 MHz至5 GHz的2G、3G、4G和5G频宽。天线设计的进一步进步将大大推动模拟软体市场的发展。

北美占有很大的市场占有率

- 北美被认为是全球行动通讯和 MIMO 技术最先进的市场之一。根据 GSMA 的数据,2019 年美国独立行动用户数量为 2.81 亿,预计到 2025 年将成长至 2.97 亿。

- 在美国,AT&T、Verizon、T-Mobile 和 Sprint 等主要营运商占据了所有订阅量的近 95%。随着大多数公司大力投资 5G 技术,预计 MIMO 在预测期内该地区的采用率将大幅上升,从而推动市场发展。

- 有了这样的发展,多输入多输出技术预计在预计的时期内将在北美地区显示出突出的地位。 Baylin Technologies 的子公司 Galtronics USA 为北美一家主要通讯业者推出了 6 英尺、12 埠基地台(宏)天线。基地台天线支援所有北美中频频率,具有八个端口,并在现有 Cellular 850频宽、LTE 700频宽和新的 600 MHz频宽上实现真正的 4x4 MIMO。

- 智慧型手机、平板电脑和人工智慧辅助电子产品在该地区正在经历高速成长。预计这将影响该地区的市场成长。根据消费者科技协会(CTA)进行的美国消费者技术销售和预测研究,2018年和2019年智慧型手机产生的收益分别为791亿美元和775亿美元。加拿大也是世界上最大的消费性电器产品生产国之一。

- 该地区的汽车产业预计将为市场带来重大机会。随着产业动态的变化,汽车製造商正在转向电动车,以满足下一代消费者的需求。

- 然而,由于 COVID-19感染疾病,美国汽车製造商面临越来越大的关闭工厂的压力。自从联邦、州和地方政府开始鼓励人们尽可能待在家里以来。这导致了各个行业的供应链中断。

电磁场模拟软体产业概况

电磁模拟软体市场由 Remcom Inc.、Altair Engineering Inc.、Mician GmbH、Sonnet Software, Inc. 和 ElectroMagneticWorks, Inc. 等几家大型企业集中并主导。拥有重要市场份额的主要参与者正在专注于扩大海外客户群。这些公司正在利用策略合作倡议来提高市场占有率和盈利。然而,随着技术进步和产品创新,中小企业正在透过赢得新合约和开拓新市场来增加其市场份额。市场的一些主要发展是:

- 2023 年 1 月 - Remcom 宣布发布 XFdtd 3D 电磁模拟软体。这为XFdtd的原理图编辑器添加了分析工具,让使用者可以轻鬆调整元件值以满足设计目标并了解电路行为,进一步扩展了软体的工具集。实现综合匹配网路设计。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估感染疾病-19 对电磁场模拟软体市场的影响

第五章市场动态

- 市场驱动因素

- 提高求解器工具的使用率来处理大量组件形状和尺寸

- 射频模组、MMIC、RFIC 设计的应用不断增加

- 市场限制因素

- 模拟器所需的计算密集型处理的复杂性

第6章 电磁仿真方法

- 积分或微分方程求解器

- 矩量法 (MOM)

- 多层次快速多极子方法(MLFMM)

- 时域有限差分 (FDTD)

- 有限元素法(FEM)

- 渐近法

- 物理光学(PO)

- 几何光学 (GO)

- 均匀衍射理论(UTD)

- 其他数值方法

第 7 章. 相关用例与案例研究

第八章 主要应用领域

- 天线设计与分析

- 行动装置

- 汽车雷达

- 生物医学科学

- 无线电传播

- 其他用途

第九章市场区隔

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第10章竞争形势

- 公司简介

- Remcom Inc.

- EMPIRE(IMST GmbH)

- Altair Engineering Inc.

- WIPL-D doo

- Mician GmbH

- Sonnet Software Inc.

- ElectroMagneticWorks Inc.

- COMSOL Inc.

- Keysight Technologies

- ANSYS Inc.

- Dassault Systmes SE

- Cadence Design Systems Inc.

- ESI Group

第十一章比较分析

第十二章投资分析

第十三章市场的未来

The Electromagnetic Simulation Software Market size is estimated at USD 1.37 billion in 2024, and is expected to reach USD 2.21 billion by 2029, growing at a CAGR of 10.14% during the forecast period (2024-2029).

A simulation-driven approach toward product development primarily offers an effective solution to multiple challenges. The usage of simulation enables the engineering teams to quickly assess the performance of their designs under a wide range of operating conditions, at both the component and systems levels. This software can also rapidly analyze dozens of preliminary design choices and then subject a chosen few to the rigorous testing that must precede any market launch.

Key Highlights

- The rapidly rising demand for consumer durables, electronics goods, and high-end technology products owing to technological advancement and increased dependency on automation is expected to drive the market. The increasing penetration of the internet across the world has encouraged vendors to improve their speed and connectivity, which has led to the development of 5G. The demand for low-cost, accurate, electromagnetic simulation software has also grown rapidly during the past few years in the industrial, commercial, automotive, and communications systems.

- Moreover, the power grid infrastructure is increasingly becoming digitized and connected, ensuring the reliable and secure flow of critical digital communications. Thus, smart grid infrastructure, whether in a power substation or residential setting, is vital. Smart meters enabling the real-time measurements needed to monitor equipment health, grid congestion, and stability, and system control form an integral part of smart grids. The electromagnetic simulation software is primarily being used to analyze the interference of the power-frequency magnetic field from the key parts of these smart meters. It is expected to witness further demand owing to the large-scale deployment of these smart meters.

- According to the US Department of Energy, investment on smart grid devices or systems, such as advanced metering infrastructure (AMI), was expected to reach USD 6.4 billion by 2024 in the United States. As several countries have made substantial investments in smart grids, the global market is expected to continue to grow throughout the decade.

- The multiple-input and multiple-output (MIMO) technology is the most recent iteration of antennas. With a wide range of advantages, such as increased range and 3D beamforming, it is expected that this technology will rapidly expand the adoption rates of this technology, especially in the advanced telecommunication markets, like North America and Europe.

- The ongoing pandemic of COVID-19 has propelled the organizations in all the sectors to either stop their manufacturing completely or grant work from homes to all of their employees. This has significantly increased internet usage for multiple purposes, such as browsing online media content, increased calling among other works, and some of the factors that are putting a burden on the existing networks. Therefore, it has become imperative for the telecom industry players to look for solutions like MIMO to provide uninterrupted services to its consumers.

Electromagnetic Simulation Software Market Trends

Telecommunication Sector is Expected to Drive the Market Growth

- The ongoing deployment of LTE and advancements in the field of wireless connectivity technologies, such as general packet radio service (GPRS), Wi-Fi, and worldwide interoperability for microwave access (WiMax) in various fields have boosted the number of connected devices and has led to the growth of electromagnetic simulation software, as they are used to conduct high-fidelity 3-D EM simulations, analyze geometric-scale variations, perform thermomechanical stress analysis, and optimize antenna design.

- The majority of mobile network operators in mature markets are planning to upgrade into 5G in the next few years due to spectrum availability and the sheer time and costs involved in rolling out the next generation of mobile networks. Major players partner with the technology provider to speed up the process and be competitive in the telecom market.

- For instance, in February 2020, Samsung Electronics Co. Ltd collaborated with US Cellular for 5G and 4G LTE network solutions. Through the agreement US Cellular, a key provider of mobile services to millions of customers across the United States, can purchase Samsung's commercially-proven network solutions, including 5G New Radio (NR) technology, and will extend groundbreaking 4G LTE and 5G technology to its customers base, expanding in consumer and business applications.

- Moreover, electronic companies are focusing on new product development, such as 5G MIMO microstrip antenna, to consider a wide variety of structures to meet the often-conflicting needs for different applications. For instance, in February 2020, Fractus Antennas launched a new multi-band 5G and cellular IoT antenna booster as tiny as a rice grain. It provides global connectivity and solves the common challenge of size as it is of only 7.0 mm x 3.0 mm x 1.0 mm in size. A single antenna can cover 2G, 3G, 4G, and 5G frequency bands from 824 MHz to 5 GHz. More advancement in the antenna design will propel the simulation software market significantly.

North America to Hold a Significant Market Share

- North America is considered to be one of the most advanced markets for mobile communications and MIMO technology in the world. According to the GSMA, the number of unique mobile subscribers in the United States was 281 million in 2019 and is expected to increase by up to 297 million by 2025.

- In the United States, major players, such as AT&T, Verizon, T-Mobile, and Sprint, account for nearly 95% of all subscriptions. With most of the firms making significant investments in 5G technology, MIMO's usage is expected to witness a surged rate of adoption in this region during the forecast period, thereby driving the market.

- Owing to such developments, the multiple input multiple output technologies in the North American region are expected to showcase a prominent position in the foreseen period. Adding to the scenario, Galtronics USA, a subsidiary of Baylin Technologies, has introduced a six-foot, 12-Port base station (macro) antenna for major North American carriers. The base station antenna supports all of the North American mid-band frequencies on eight of its ports and true 4x4 MIMO on the existing Cellular 850 band, LTE 700 band, and the new 600 MHz band.

- Smartphones, tablets, and AI-assisted electronics are experiencing high growth in the region. This is expected to influence the growth of the market in the region. According to the US Consumer Technology Sales and Forecast study conducted by the Consumer Technology Association (CTA), the revenue generated by smartphones was valued at USD 79.1 billion and USD 77.5 billion in 2018 and 2019, respectively. Canada is also one of the largest producers of consumer electronics in the world.

- The region's automotive sector is expected to offer significant opportunities to the market. With changing dynamics in the industry, automotive manufacturers are moving toward electric vehicles to meet next-generation consumers' needs.

- However, automakers in the United States have faced increased pressure to shut down their factories owing to the COVID-19 pandemic. After the federal, state, and local governments started recommending people stay in their homes as much as possible. This has caused supply chain disruptions across various industries.

Electromagnetic Simulation Software Industry Overview

The electromagnetic simulation software market is concentrated and dominated by a few major players, like Remcom Inc., Altair Engineering Inc., Mician GmbH, Sonnet Software, Inc., and ElectroMagneticWorks, Inc. The major players, with a prominent share of the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies increase their market presence by securing new contracts and tapping new markets. Some of the key developments in the market are:

- January 2023 - Remcom announced the release of XFdtd 3D electromagnetic simulation software, which enables users to easily adjust component values in order to meet design objectives and understand circuit behavior, when adding an analysis tool into the schematic editor of XFdtd, further expands this software's toolset for comprehensive matching network designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Electromagnetic Simulation Software Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Utilization of Solver Tools to Handle a Multitude of Component Shapes and Sizes

- 5.1.2 Increasing Applications in RF Module, MMIC, and RFIC Design

- 5.2 Market Restraints

- 5.2.1 Complexity Regarding Computationally-Intensive Processing Required by Simulators

6 METHODS OF ELECTROMAGNETIC SIMULATION

- 6.1 Integral or Differential Equation Solvers

- 6.1.1 Methods of Moments (MOM)

- 6.1.2 Multilevel Fast Multipole Method (MLFMM)

- 6.1.3 Finite Difference Time Domain (FDTD)

- 6.1.4 Finite Element Method (FEM)

- 6.2 Asymptotic Techniques

- 6.2.1 Physical Optics (PO)

- 6.2.2 Geometric Optics (GO)

- 6.2.3 Uniform Theory of Diffraction (UTD)

- 6.3 Other Numerical Methods

7 RELEVANT USE-CASES AND CASE STUDIES (Major use-cases and case studies, such as Surrogate Models for Antenna Placement on Large Platforms and Development of Wireless Sensors to Detect Lightning, will be discussed)

8 KEY APPLICATION AREAS (Qualitative Analysis pertaining to major applications such as 5G MIMO, Circuit co-simulation, among others, will be provided)

- 8.1 Antenna Design and Analysis

- 8.2 Mobile Device

- 8.3 Automotive Radar

- 8.4 Biomedical

- 8.5 Wireless Propagation

- 8.6 Other Applications

9 MARKET SEGMENTATION

- 9.1 Geography

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia-Pacific

- 9.1.4 Rest of the World

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Remcom Inc.

- 10.1.2 EMPIRE (IMST GmbH)

- 10.1.3 Altair Engineering Inc.

- 10.1.4 WIPL-D d.o.o.

- 10.1.5 Mician GmbH

- 10.1.6 Sonnet Software Inc.

- 10.1.7 ElectroMagneticWorks Inc.

- 10.1.8 COMSOL Inc.

- 10.1.9 Keysight Technologies

- 10.1.10 ANSYS Inc.

- 10.1.11 Dassault Systmes SE

- 10.1.12 Cadence Design Systems Inc.

- 10.1.13 ESI Group