|

市场调查报告书

商品编码

1444859

模拟软体 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Simulation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

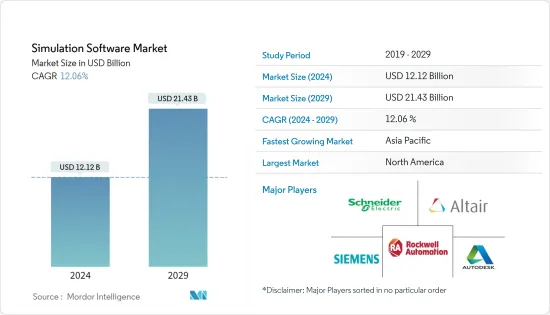

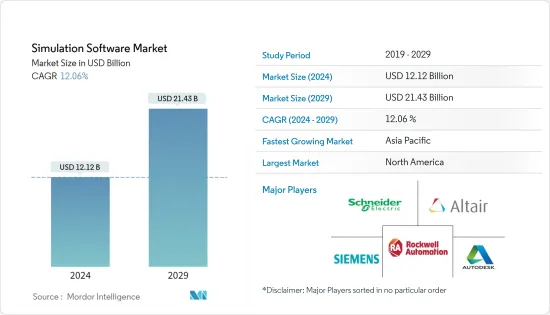

模拟软体市场规模预计到 2024 年为 121.2 亿美元,预计到 2029 年将达到 214.3 亿美元,在预测期内(2024-2029 年)CAGR为 12.06%。

主要亮点

- 最初,仿真软体仅用于调整生产线。然而,在当前的市场情况下,它被用来测试新概念、加速产品开发并证明合规性。

- 通常,当对生产线进行更改存在不确定性或建造新生产线过于昂贵时,製造商会投资模拟软体。这主要是因为如果客户订单延迟,停机时间会影响营运效率,製造商的声誉也会受到影响。然而,新的用例证明製造商可以透过投资模拟软体提前识别和解决问题。模拟软体还可以模拟组件如何协同工作来创建新产品并影响製程流程以证明合规性。

- 模拟软体的一些用例包括西门子对伊莱克斯工厂进行建模,以识别营运效率,以及帮助 General Dynamic (NASSCO) 改进其造船厂中数千个零件的处理的 anylogic。达梭系统正在协助 Global Trailers 加快将新拖车推向市场的流程。同样,福陆工程和建筑公司 aspentech 开发了一种解决方案,以证明其硫追踪技术有助于天然气工厂满足环境要求。

- 值得注意的是,由于其优越的特性,它被广泛应用于教育和研究领域,这可能会推动预测期内的产业成长。此外,创建即时模拟场景可以节省大量资金并减少执行时间,从而鼓励和增强核心业务能力。因此,预计这将对市场成长产生积极影响。

- 此外,具有机器学习功能的设计工具集的即将到来的趋势极大地促进了市场的成长。此外,还进行了大量投资,使设计人员能够减少错误数量,从而节省大量时间,并预计在未来产生结果。

- 由于对复杂设计的先进製造的需求不断增长,以及在提高汽车性能的同时减小尺寸的需求,汽车製造商应增加研发投资并采用模拟软体。

- COVID-19 的爆发促使组织迅速采取行动,保护员工、应对重大挑战并协助对抗疫情,将损失降至最低。仿真建模可以帮助组织制定快速、安全、有效的回应策略。例如,根据Ansys Inc.的说法,模拟可用于设计适用于各种环境的紫外线处理系统,并确保提供足够剂量的紫外线来灭活病毒,从而引发市场成长。

仿真软体市场趋势

汽车领域预计将以更快的速度成长。

- 汽车产业正在见证其价值链中采用多种技术的典范转移。自动驾驶汽车的发展以及更有效率和电动车的发展等宏观趋势影响着汽车产业对模拟需求的成长。相比之下,车辆模拟的传统需求持续获得普遍接受。

- 高性能电脑 (HPC) 模拟曾经被汽车製造商用于车辆设计中的有限用例,使用电脑辅助工程 (CAE) 应用程序,在改进和优化产品开发的各个方面(包括製造过程)方面取得了长足的进步。

- 现在,最高效和最具成本效益的製造流程由车辆设计流程中使用的相同 CAE 模拟工具决定。随着铝和塑胶等新材料的引入,模拟变得异常有价值,并使製造商能够避免采用传统的试误方法来建立新车的生产流程,从而避免成本高、效率低下的问题。

- 在模拟软体的帮助下,甚至在汽车原型出现之前,就可以透过巨大的努力来模拟所有可能的驾驶情况下的多种车辆变体。目前,宝马正在其慕尼黑总部建造一个用于此类模拟的大型设施。

- 随着预计全面投入使用的新系统,宝马打算加强其在自动驾驶方面的开发专业知识。工程师希望透过对真实驾驶情况的高度动态模拟,对未来的 HMI 概念、显示器、驾驶员辅助和驾驶自动化系统进行虚拟测试。

北美占最大市场份额

- 随着该地区中小企业数量的不断增加以及北美对研发活动的日益关注,预计该市场将在预测期内显着增长。

- 此外,北美地区政府不断注重创新和投资,以创造更绿色的工作环境。该地区与环保工作环境相关的法规变得越来越严格,因此,该公司正在采用模拟器在製造之前测试产品的可行性。

- 此外,该地区政府采取的创新城市措施也对模拟和分析技术的采用趋势产生了积极影响,以加强监测和改进监控。

模拟软体产业概况

模拟软体市场竞争激烈,国内外参与者多。市场主要参与者采取的关键策略是产品创新、併购、收购和合作。

2023 年 11 月,全球工程模拟软体厂商 Ansys 与全球 3D 列印软体和服务解决方案厂商 Materialise 联手提供整合数位解决方案,以协助克服增材製造业的工作流程挑战。此次合作将把 Ansys Additive Suite 无缝整合到 Materialise 的资料和建置准备工具 Magics 中。初步解决方案将于 2023 年 Formnext 上预览并于 2024 年第二季度推出,将为管理跨行业(包括医疗和航空航天领域)的增材製造工业项目提供一流的工作流程。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场的影响

- 市场驱动因素

- 不断成长的汽车产业

- 市场限制

第 5 章:市场细分

- 部署类型

- 本地部署

- 云

- 最终用户产业

- 汽车

- 资讯科技和电信

- 航太和国防

- 能源和采矿业

- 教育与研究

- 电气和电子

- 其他最终用户产业

- 地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Altair Engineering Inc.

- The MathWorks Inc.

- Autodesk Inc.

- Cybernet Systems Corp.

- Bentley Systems Incorporated

- PTC Inc.

- CPFD Software LLC

- Design Simulation Technologies Inc.

- Synopsys Inc.

- Siemens AG

- Ansys Inc.

- Dassault Systemes SE

- Simio LLC

- Lanner Group Ltd

- SIMUL8 Corporation

- CONSELF Srl

- SolidWorks Corporation

- Rockwell Automation Inc.

- The COMSOL Group

- Schneider Electric SE

第 7 章:市场投资分析

第 8 章:市场机会与未来趋势

The Simulation Software Market size is estimated at USD 12.12 billion in 2024, and is expected to reach USD 21.43 billion by 2029, growing at a CAGR of 12.06% during the forecast period (2024-2029).

Key Highlights

- Initially, simulation software was only used to tweak production lines. However, in the current market scenario, it is being used to test new concepts, accelerate product developments, and demonstrate regulatory compliance.

- Often, manufacturers invest in simulation software when there is uncertainty about making changes to a production line or when building a new line is too expensive. This is mainly due to the high cost of downtime in terms of operational efficiencies and a manufacturer's reputation on the line if customer orders are delayed. However, new use cases have proven that manufacturers can identify and solve issues in advance by investing in simulation software. Simulation software can also simulate how components work together to create new products and affect process flows to demonstrate compliance.

- A few use cases for simulation software include Siemens modeling Electrolux's factories to identify operational efficiencies and anylogic helping General Dynamic (NASSCO) improve its handling of the thousands of parts flowing through their shipyards. Dassault Systemes is assisting Global Trailers in fastening the processes for bringing new trailers to the market. Similarly, Fluor, an engineering and construction firm, aspentech, developed a solution to demonstrate that its sulfur tracking technologies help gas plants meet environmental requirements.

- Notably, owing to its superior characteristics, it is widely used in education and the research segment, which may propel the industry growth over the forecast period. Moreover, creating real-time simulation scenarios saves a lot of money and poses less time to execute, which encourages and enhances the core business competencies. Therefore, this is expected to have a positive impact on market growth.

- Furthermore, the upcoming trend of designing toolsets with machine learning capabilities significantly contributes to the market's growth. Also, significant investments were made to empower designers to reduce the number of errors, thereby saving considerable time, which is expected to produce future results.

- Due to the growing demand for advanced manufacturing with intricate designs and the need to reduce the size while improving the performance of automotive compels, automotive manufacturers should increase their R&D investments and adopt simulation software.

- The outbreak of COVID-19 pushed organizations to act quickly to protect employees, address critical challenges, and help fight to minimize losses. Simulation modeling can help organizations to develop strategies to respond quickly, safely, and effectively. For instance, according to Ansys Inc., simulation can be used to design UV light treatment systems for various environments and ensure that sufficient doses of UV light are delivered to deactivate viruses, triggering market growth.

Simulation Software Market Trends

Automotive Segment is expected grow at a faster pace.

- The automotive industry is witnessing a paradigm shift in adopting multiple technologies in its value chain. Macro trends, such as the development of autonomous vehicles and the drive toward more efficient and electric vehicles, influence the increased demand for simulation in the automotive sector. In contrast, traditional demand in vehicle simulation continues to gain general acceptance.

- Once used by automakers for limited use cases in vehicle design, high-performance computer (HPC) simulation, using computer-aided engineering (CAE) applications, has come a long way in improving and optimizing all aspects of product development, including the manufacturing process.

- The most efficient and cost-effective manufacturing processes are now determined by the same CAE simulation tools used in the vehicle design process. Simulation has become exceptionally valuable as new materials, such as aluminum and plastics, are introduced and enables manufacturers to avoid expensive inefficiencies of the traditional trial-and-error approach to establishing the production process of a new vehicle.

- With the aid of simulation software, multiple vehicle variants in all possible driving situations are played through with immense effort, even before the car's prototype. Presently, BMW is building a massive facility for such simulations in its Munich headquarters.

- With the new system, which is expected to be fully operational, BMW intends to strengthen its development expertise in autonomous driving. Using highly dynamic simulations of real driving situations, the engineers want to carry out virtual tests of future HMI concepts, displays, driver assistance, and driving automation systems.

North America Occupies the Largest Market Share

- With the growing number of SME units in the region and the increasing focus on research and development activities in North America, the market is expected to witness significant growth over the forecast period.

- In addition, the governments in the North American region are constantly focusing on innovation and investment for a greener work environment. The regulations associated with the eco-friendly work environment are becoming stringent in the region, and as a result, companies are adopting simulators to test product viability before manufacturing it.

- Also, the innovative city initiatives taken by the government in this region have positively impacted the adoption trend of simulation and analysis technology to enhance monitoring and improve surveillance.

Simulation Software Industry Overview

The simulation software market is highly competitive, with many domestic and international players. The key strategies adopted by the major players in the market are product innovation, mergers, acquisitions, and partnerships.

In November 2023, Ansys, the global player in engineering simulation software, and Materialise, a global player in 3D printing software and service solutions, are joining forces to deliver integrated digital solutions to help overcome workflow challenges in the AM industry. The partnership will seamlessly integrate Ansys Additive Suite into Materialise's data and build preparation tool, Magics. An initial solution, to be previewed at Formnext 2023 and arriving in Q2 2024, will provide a best-in-class workflow for managing AM industrial projects across industries, including the medical and aerospace sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Growing Automotive Sector

- 4.5 Market Restraints

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 IT and Telecommunication

- 5.2.3 Aerospace and Defense

- 5.2.4 Energy and Mining

- 5.2.5 Education and Research

- 5.2.6 Electrical and Electronics

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Altair Engineering Inc.

- 6.2.2 The MathWorks Inc.

- 6.2.3 Autodesk Inc.

- 6.2.4 Cybernet Systems Corp.

- 6.2.5 Bentley Systems Incorporated

- 6.2.6 PTC Inc.

- 6.2.7 CPFD Software LLC

- 6.2.8 Design Simulation Technologies Inc.

- 6.2.9 Synopsys Inc.

- 6.2.10 Siemens AG

- 6.2.11 Ansys Inc.

- 6.2.12 Dassault Systemes SE

- 6.2.13 Simio LLC

- 6.2.14 Lanner Group Ltd

- 6.2.15 SIMUL8 Corporation

- 6.2.16 CONSELF Srl

- 6.2.17 SolidWorks Corporation

- 6.2.18 Rockwell Automation Inc.

- 6.2.19 The COMSOL Group

- 6.2.20 Schneider Electric SE