|

市场调查报告书

商品编码

1435851

叫车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Ride-Hailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

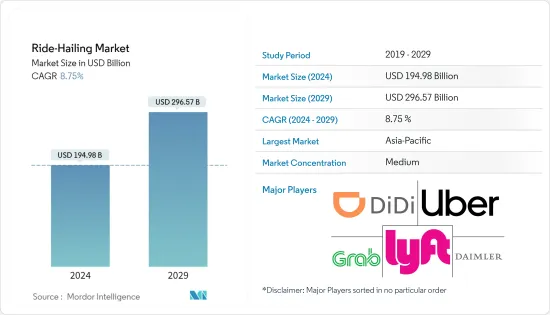

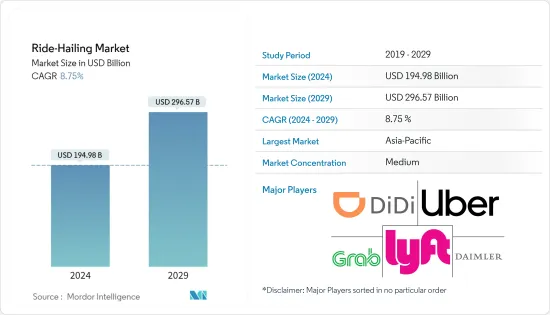

预计2024年叫车市场规模为1,949.8亿美元,预估至2029年将达2,965.7亿美元,预测期间(2024-2029年)复合年增长率为8.75%,预计将会成长。

在冠状病毒感染疾病(COVID-19)大流行期间,世界各地为遏制病毒传播而实施的封锁对市场造成了沉重打击。然而,随着经济逐步重新开放,需求正在回归市场。

近年来,由于美国、中国、美国等发展中国家的乘客对叫车服务的偏好增加。这促使公司增强在行动应用程式中提供的选项并扩展业务,以便在竞争激烈的市场中保持各自的市场占有率。

叫车公司正在努力透过从汽油动力汽车转向电动车来消除废气排放,并减少全球车队整体碳排放。机队改装带来了各种直接的环境效益以及其他市场的间接效益。它可以支援公共充电基础设施并增加私人消费者对电动车的接触。

叫车市场趋势

叫车服务需求不断成长

预计在预测期内,叫车服务将取代传统计程车。一些研究显示,每天总合1,500万次叫车出行,预计到2030年这数字将大幅增加并达到1亿次。

2020 年 12 月,欧盟最高法院裁定,让乘客和计程车驾驶人直接联繫且不提供交通服务重要组成部分的叫车应用程式属于线上平台。欧盟法院的这项裁决代表了叫车应用程式优步的胜利,该应用程式此前一直作为计程车公司受到监管。一旦您能够证明自己是一个平台,您就有机会寻求进一步不受欧盟监管的自由。

一些叫车公司正在从投资者那里筹集资金,旨在改进技术并为客户提供更好的服务。例如,

- 2020 年 12 月,爱沙尼亚叫车公司 Bolt 在 D1 Capital 主导领投的一轮资金筹措中筹集了 1.5 亿欧元(1.82 亿美元)。该公司表示,将利用这笔资金开发 Facilitator脸部认证,并利用机器学习来防止潜在的事故。该公司的应用程式目前在欧洲和非洲 40 多个国家拥有超过 5,000 万用户。

- 2020 年 11 月,Meru Taxi 宣布计划从私募股权基金筹集 5,425 万美元(40 亿印度卢比)。这项资金筹措计划推出之际,该公司正专注于为企业提供计程车并扩大其在印度的电动车基地。

亚太地区将成为2020年最大市场

2020年,亚太地区占全球叫车市场份额43.83%,占市场主要份额。与其他交通途径相比,交通拥堵加剧和计程车费用降低是推动叫车服务成长的主要因素。亚太地区的摩托车/自行车叫车服务。

由于全球60%的人口居住在该地区,该地区的叫车市场规模最大且成长速度很快。

印度是世界第二人口大国,其公民大部分属于中产阶级,使用计程车和机动三轮车(农村三轮计程车)进行短途通勤。

2020年11月,印度政府发布了新的指导方针,将Ola和Uber等计程车聚合商纳入法律规范。根据《2020 年汽车聚合指南》,新规范规定了价格上涨突波,并禁止叫车公司申请超过基本票价 1.5 倍的费用。新规定还允许公司提供自己的共乘服务,但限制为每天四次城市旅行和每週两次城际旅行。

在中国营运的叫车市场参与者正在向司机提供补贴,以避免日常预订受到干扰。例如,2020年9月,由于国庆节日恰逢中秋节,因此滴滴出行的许多驱动因素都选择了叫车服务。早点离开。为鼓励更多服务商订单,平台与计程车服务业快速的新计程车、新经济共乘服务花小猪合作,向司机发放1亿元补助。

叫车产业概况

该市场本质上是适度分散的,因为与全部区域相比,每个地区的参与者都拥有较高的市场占有率。虽然UBER和Lyft在北美市场占有率突出,但滴滴出行技术在中国也贡献了较高的市场占有率。此外,总体而言,滴滴、Uber、Lyft、Grab在全球市场占有率突出。市场的最新发展包括:

- 2020年4月,首汽约车携手阿里云,发挥创新优势,打造5G车联网产业新生态。首汽约车与阿里云合作启动先导计画,探索5G、边缘运算等行动叫车服务。透过开启智慧交通新时代,该计划将共同探索5G下缘运算在交通领域的应用和拓展,共同推动大众交通工具产业的发展与升级。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概览(评估 COVID-19感染疾病的影响)

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 车辆类型

- 摩托车

- 车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Didi Chuxing Technology Co.

- Uber Technologies Inc.

- Lyft Inc.

- Grab Holdings Inc.

- Free now(Daimler)

- BlaBla Car

- ANI Technologies Pvt. Ltd

- FastGo Vietnam JSC

- ZuumViet

- Be Group JSC

- Yandex.Taxi LLC

第七章市场机会与未来趋势

The Ride-Hailing Market size is estimated at USD 194.98 billion in 2024, and is expected to reach USD 296.57 billion by 2029, growing at a CAGR of 8.75% during the forecast period (2024-2029).

During the outbreak of pandemic COVID-19, the market was hit badly because of the imposed lockdowns around the world to curb the spread of virus. Yet, with gradual reopening of economies demand is returning to the market.

In recent years, passenger preferences for utilizing ride-hailing services across the developing countries, such as India, China, Vietnam, etc., have increased, along with increasing demand in the developed regions, such as the United States and Europe. This has led the companies to enhance the options and expand their operations to be provided in mobile applications, to retain their respective market shares in a highly competitive market.

Ride-hailing companies are working to eliminate tailpipe emissions and reduce the overall vehicle carbon emissions globally, by converting gasoline vehicles to electric. Fleet conversion has various direct environmental benefits and indirect benefits for other markets. It can support the public charging infrastructure and increase individual consumer exposure to EVs.

Ride Hailing Market Trends

Rising Demand for Ride-Hailing Services

Ride-hailing is anticipated to takeover the conventionall taxi over the forecast period. According to some surveys, a total of 15 million ride-hailing trips happen each day, which is expected to gigantically increase and hit a 100 million mark, by 2030.

In December 2020, EU's top court ruled that ride-hailing apps that put passengers directly in touch with taxi drivers and do not provide a crucial part of the transport service are online platforms. The ruling from the Court of Justice of the European Union amounts to a victory for ride-hailing apps, namely Uber, which have so far been regulated as taxi companies. It opens an opportunity for them to seek greater freedom from regulation in the EU, if they can prove they are platforms.

Several ride hailing companies are raising funds from investors with an aim to improve their technology and provide better services to its customers. For instance,

- In December 2020, Estonian ride-hailing firm Bolt raised EUR 150 million (USD 182 million) in a funding round led by D1 Capital Partners. The company said it will use the money to develop driver face verification and use machine learning to prevent potential incidents. The firm's app now counts more than 50 million users in over 40 countries across Europe and Africa.

- In November 2020, Meru cabs announced that they are planning to raise USD 54.25 million (INR 400 Crore) from private equity funds. The fundraising plan comes at a time when the company is sharpening focus on providing cabs to corporates and expanding its base of electric vehicles in India.

Asia-Pacific is the Largest Market in 2020

Asia-Pacific captured a major share of the market, accounting for 43.83% of the global ride hailing market, in 2020. Increasing traffic congestion and low taxi fare, when compared to other modes of transportation, are the major factors driving the growth of the motorcycle/bike ride hailing service in the Asia-Pacific region.

Owing to the fact that 60% of world population is resident in the region, the ride hailing market in the region is bigget and is growing with high rate.

India is the second-most populous country in the world, and most of the people fall under the middle-class category who utilize cabs and auto-rickshaws (local three-wheeler taxis) for commuting short distances.

In November 2020, the Government of India issued fresh guidelines for cab aggregators, like Ola and Uber, to bring them under regulatory framework. The new norms, as per the Motor Vehicle Aggregator Guidelines 2020, mandated a cap on surge price, preventing ride-hailing companies from charging more than 1.5 times of the base fare. The new rules also allow companies to offer pooling services on private vehicles, but with a daily limit of four intra-city rides and two inter-city rides per week.

Ride-hailing Marketcompanies active in China are providing subsidies to their drivers so that there is no disruption in daily bookings, For instance, in September 2020, as the National Day Holiday overlaps with the Mid-Autumn Festival, many Didi Chuxing drivers opted for an early leave. In order to encourage more drivers to take orders, the platform partnered with taxi service unit, Kuaidi New Taxi, and the new economy ride-sharing service, Huaxiaozhu, to issue a driver subsidy worth CNY 100 million.

Ride Hailing Industry Overview

The market is moderately fragmented in nature as the players in the respective region have their high market share comparing to the overall region. UBER and Lyft have a prominent share in the North America region, whereas, in China, Didi Chuxing Technology Co. contributes to the high market share. Moreover, overall Didi, Uber, Lyft, and Grab have prominent market share globally. Recent developments in the market are -

- April 2020 - Shouqi Limousine and Chauffeur cooperated with Alibaba Cloud, leveraging innovation advantages to build a new industry ecosystem of 5G Internet of Vehicle. A pilot project between Shouqi Limousine and Chauffeur and Alibaba Cloud has been initiated for exploring 5G, edge computing for online ride-hailing mobile services. By leading the new era of intelligent transportation, the project will jointly explore the application and expansion of edge computing in transportation under 5G and together promote the development and upgrade of the public transport industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview (Assesment of Covid-19 Impact)

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Motorcycle

- 5.1.2 Cars

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Didi Chuxing Technology Co.

- 6.2.2 Uber Technologies Inc.

- 6.2.3 Lyft Inc.

- 6.2.4 Grab Holdings Inc.

- 6.2.5 Free now (Daimler)

- 6.2.6 BlaBla Car

- 6.2.7 ANI Technologies Pvt. Ltd

- 6.2.8 FastGo Vietnam JSC

- 6.2.9 ZuumViet

- 6.2.10 Be Group JSC

- 6.2.11 Yandex.Taxi LLC