|

市场调查报告书

商品编码

1435863

工单管理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Work Order Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

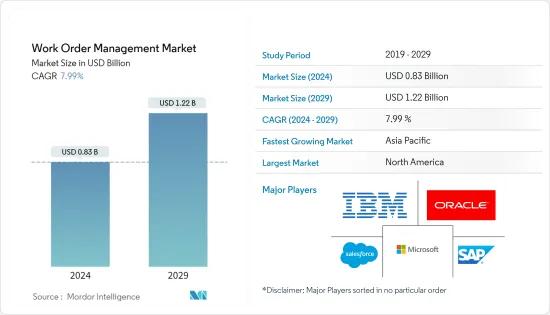

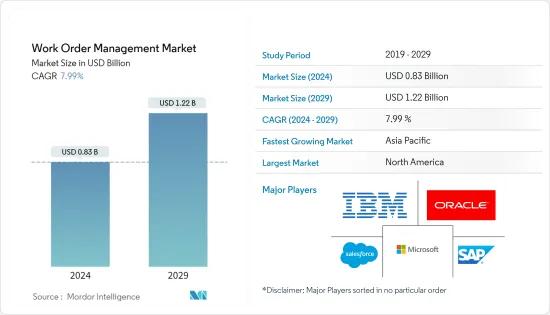

工单管理市场规模预计到 2024 年为 8.3 亿美元,预计到 2029 年将达到 12.2 亿美元,在预测期内(2024-2029 年)将成长 7.99%,复合年增长率成长。

世界各地的企业越来越多地走向数位转型,并采用各种解决方案来监控维护和管理。

主要亮点

- 客户对智慧工厂的兴趣与日俱增,根据思科预测,到年终,支援物联网应用的机器对机器 (M2M) 连接将占全球 285 亿连接设备的一半以上。

- 工单管理是对公司维护、安装和维修任务的工单进行排程、规划、追踪和管理。降低成本、减少设备停机时间和优化营运正在推动世界各地设施的数位化。工作订单管理系统为公司提供了预防性保养的选择,从而更容易提出服务请求和接收即时更新。

- 随着中小型企业越来越多地采用云端基础的管理解决方案,我们预计小型供应商将越来越注重为此类企业提供区域性服务。较小的供应商预计将在某些客户中拥有优势,而较大的供应商则越来越多地参与併购活动以获得区域市场占有率。

- 例如,2022 年 5 月,Verisk 宣布收购 Pruvan,后者为财产保护和建筑专业人士提供现场到办公室的管理解决方案。此次收购将帮助客户节省时间并降低营运成本。预计未来几年此类发展将会增加并再形成市场。

- COVID-19 透过增加对远距工作和协作工具的需求而影响了所研究的市场。许多组织已转向远距工作,这使得管理工单变得更加困难。因此,对可从任何地方存取的工作订单管理解决方案的需求不断增加。

工单管理市场趋势

预计在製造业中广泛采用

- 工业 4.0 正在将产业从旧有系统转变为智慧组件和机器,以促进数位工厂以及互联工厂和企业生态系统的发展。工业 4.0 促使OEM在其业务中采用物联网。

- 物联网在製造业中带来的好处将推动采用率,例如提高机器运转率、预测性维护和生产、资料分析、监控、自动化和成本效益。

- 随着製造业对自动化的需求不断增加,各公司纷纷建立策略伙伴关係,以利用这种不断增长的需求。

- 例如,2022年3月,全球首个针对现代商业的3D机器人供应链系统Attabotics与物流自动化公司SYNUS Tech宣布建立独家合作伙伴关係,为韩国市场提供综合物流技术仓库解决方案。在 Attabotics 等合作伙伴的帮助下,SYNUS Tech 开发了智慧工厂整体解决方案,并且是韩国第一家将人工智慧融入仓库的公司。

- 此外,2022年11月,中国工业和资讯化部核准新设三个国家製造业研发中心。他也表示,这些中心将专注于重要非专利技术,推动这些产业的技术研发。

- 此外,工信部表示,将指导新建製造业研发中心增强技术创新能力,为製造业重点领域高品质发展提供重要支撑。

预计北美将主导市场

- 由于 IBM、Microsoft、Oracle 和 Salesforce 等该地区的多家解决方案供应商以及该地区的技术采用优势,预计北美将主导工作订单管理市场。

- 物联网技术正在克服製造业的劳动力短缺问题,尤其是在美国等已开发国家。美国联邦政府和私营部门组织正在投资工业 4.0 物联网技术,以扩大美国的工业基础。

- 人工智慧、物联网、智慧型装置和 3D 列印等多项技术已经在改善美国主要工厂的绩效指标。该地区各国政府也采取措施支持机器人市场新兴技术的发展,以促进机器人的采用。

- 例如,美国联邦政府启动了国家机器人倡议(NRI)计划,以加强美国国内机器人建立能力并推动该领域的研究活动。工单管理透过全面检查进出物流,降低供应链风险,确保运输途中产品的品质和可靠性。

- 此外,根据美国劳工统计局的数据,截至 2023 年 2 月,美国建筑业僱用了约 800 万人,高于 2021 年的 729 万人。对建筑劳动力的需求不断增长,也增加了现场对穿戴式装置的需求。增加更多工人并加速市场成长。

工单管理产业概述

由于全球存在 Salesforce、IBM、Microsoft、SAP SE、Oracle 等解决方案供应商,工单管理市场的竞争形势较为分散。市场相关人员正在进行重大的产品开发和创新,以增强其在市场中的地位。

2022年3月,亚马逊宣布收购多通路订单管理软体公司Veeqo。此次收购将有助于亚马逊将增强的销售工具整合到其多通路履约计画中。

2022 年 1 月,房地产软体供应商 MRI Software 宣布收购 Angus Systems,这是一家总部位于多伦多的为商业房地产业主和营运商提供企业级建筑营运管理软体供应商。 Angus Systems 扩展了 MRI 的能力,帮助客户在疫情期间实现数位转型并管理不断变化的工作环境。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 现场工作人员采用行动和穿戴式设备

- 公司倾向于优化工作以更好地执行计划

- 市场限制因素

- 现场工作人员缺乏专业知识

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按成分

- 解决方案

- 服务

- 依部署方式

- 本地

- 云

- 按最终用户产业

- 製造业

- 运输和物流

- 能源和公共

- 卫生保健

- BFSI

- 通讯和资讯技术

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Salesforce.com, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- IFS AB

- Infor Inc.

- Hippo CMMS

- ServiceMax, Inc.

- Innovapptive Inc.

- eMaint Enterprises, LLC

第七章 投资分析

第八章市场机会及未来趋势

The Work Order Management Market size is estimated at USD 0.83 billion in 2024, and is expected to reach USD 1.22 billion by 2029, growing at a CAGR of 7.99% during the forecast period (2024-2029).

Enterprises worldwide are increasingly moving towards digital transformation, adopting various solutions to oversee maintenance and management.

Key Highlights

- According to Cisco, customers are becoming more interested in smart factories, and by the end of 2022, machine-to-machine (M2M) connections that support IoT applications are predicted to account for more than half of the 28.5 billion connected devices worldwide.

- Work order management is scheduling, planning, tracking, and managing work orders for a business's maintenance, installation, and repair tasks. Reducing costs, equipment downtime, and optimizing operations are augmenting the digitalization of facilities across the globe. Adopting a work order management system allows enterprises to opt for preventive maintenance, making it easy to place service requests and gain real-time updates.

- Due to SMEs' growing inclination towards adopting cloud-based management solutions, smaller vendors are expected to increase their focus on catering to such enterprises regionally. Smaller vendors are expected to command dominance in several clients, and large vendors are increasingly engaging in M&A activities to gain regional market share.

- For instance, In May 2022, Verisk announced the acquisition of Pruvan, a provider of field-to-office management solutions for property preservation and construction professionals. The acquisition would help clients in saving time and reduce operating costs. Such developments are expected to increase over the coming years and reshape the market.

- COVID-19 impacted the studied market through the increased need for remote work and collaboration tools. Many organizations shifted to remote work, making managing work orders more challenging. As a result, there was an increased demand for work order management solutions accessible from anywhere.

Work Order Management Market Trends

Manufacturing Expected to Exhibit Significant Adoption

- Industry 4.0 is transforming industries, from legacy systems to smart components and machines, to promote digital factories and the development of an ecosystem of connected plants and enterprises. Industry 4.0 has persuaded OEMs to adopt IoT across their operations.

- The benefits offered by IoT in the manufacturing industry drive the adoption rates, such as increased machine utilization, predictive maintenance and production, data analytics, monitoring, automation, and cost benefits.

- With the growing demand for automation in manufacturing, companies are entering into strategic partnerships to leverage the growing demand.

- For instance, in March 2022, Attabotics, the world's first 3D robotics supply chain system for modern commerce, and SYNUS Tech, a logistics automation company, announced an exclusive partnership to provide integrated logistics technique warehouse solutions to South Korean markets. SYNUS Tech is developing smart factory total solutions and integrating AI into warehouses for the first time in Korea with the help of partners such as Attabotics.

- Moreover, in November 2022, China's Ministry of Industry and Information Technology approved three new national manufacturing innovation centers. They also stated that these centers would focus on vital generic technologies and boost technological research and development in these industries.

- In addition, the ministry stated that it would guide the new manufacturing innovation centers in strengthening their capabilities to seek technological innovation to provide critical support for the high-quality development of primary fields in manufacturing.

North America Expected to Dominate the Market

- North America is expected to dominate the Work Order Management Market owing to several solution providers in the region, such as IBM, Microsoft, Oracle, and Salesforce, amongst others, coupled with the region's dominance in technology adoption.

- IoT technologies are overcoming the labor shortage in the manufacturing sector, especially in developed countries such as the United States. The Federal Government and private sector organizations in the United States are investing in Industry 4.0 IoT technologies to expand the American industrial base.

- Several technologies like AI, IoT, smart devices, and 3D printing are already growing the performance metrics of major US-based factories. The government in the region is also promoting the adoption of robotics by taking initiatives to support the growth of modern technologies in the robotics market.

- For instance, the US federal government has initiated the National Robotics Initiative (NRI) program to strengthen the capabilities of building domestic robots in the country and boost research activities in the field. Work order management decreases supply-chain risk and ensures the quality and authenticity of in-transit products with a full survey of inbound and outbound logistics.

- Moreover, according to the Bureau of Labor Statistics, the construction sector employed around eight million people in the United States as of February 2023, which increased from 7.29 million in 2021. Such rising demand for construction labor has propelled the demand for wearable devices among field workers, thus accelerating market growth.

Work Order Management Industry Overview

The competitive landscape of the Work Order Management Market is moderately fragmented owing to the presence of several solution providers, such as Salesforce, IBM, Microsoft, SAP SE, and Oracle, amongst others, across the world. The market players are making significant product developments and innovations to enhance their market presence.

In March 2022, Amazon announced the acquisition of Veeqo, a multichannel order management software company. The acquisition would support Amazon in integrating enhanced seller tools into its Multichannel Fulfillment program.

In January 2022, MRI Software, a real estate software provider, announced the acquisition of Angus Systems, a Toronto-based enterprise-class building operations management software provider for commercial real estate owners and operators. Angus Systems expanded MRI's ability to help its clients embrace attaining digital transformation and manage the changing work environments amid the pandemic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Mobile and Wearable Devices Among Field Workers

- 4.2.2 Enterprise Propensity Towards Optimizing Work for Better Execution of Projects

- 4.3 Market Restraints

- 4.3.1 Lack of Expertise Among Field Workers

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-user Industry

- 5.3.1 Manufacturing

- 5.3.2 Transportation and Logistics

- 5.3.3 Energy & Utilities

- 5.3.4 Healthcare

- 5.3.5 BFSI

- 5.3.6 Telecom and IT

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Salesforce.com, Inc.

- 6.1.2 IBM Corporation

- 6.1.3 Microsoft Corporation

- 6.1.4 Oracle Corporation

- 6.1.5 SAP SE

- 6.1.6 IFS AB

- 6.1.7 Infor Inc.

- 6.1.8 Hippo CMMS

- 6.1.9 ServiceMax, Inc.

- 6.1.10 Innovapptive Inc.

- 6.1.11 eMaint Enterprises, LLC