|

市场调查报告书

商品编码

1435903

应用程式发布自动化:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Application Release Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

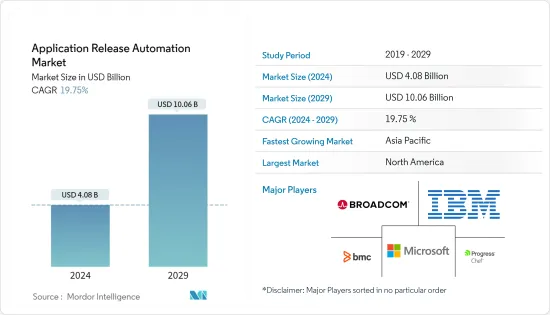

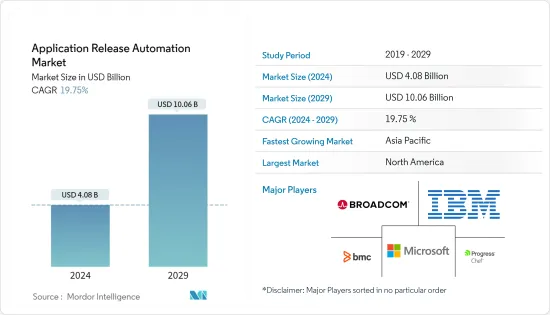

应用程式发布自动化市场规模预计到2024年为40.8亿美元,预计到2029年将达到100.6亿美元,在预测期内(2024-2029年)增长19.75%,并以复合年增长率增长。

随着业务的变化,数位基础设施在世界各地发生显着发展,而现代化是成功的关键。此外,随着 COVID-19感染疾病的出现,应用程式可见性和控制变得更加重要,因为我们迅速改变环境,使员工在家或在办公室工作,无论他们身在何处,都可以维持员工的工作效率。看到了。预计这将进一步推动预测期内的市场成长。此外,随着 COVID-19 封锁的实施以及向远端工作环境的切换,前所未有的数量的人开始使用行动应用程式进行工作和其他活动,这些应用程式的无缝安全至关重要。 。

主要亮点

- 大多数企业越来越多地采用数位转型,以及对人工智慧、巨量资料和认知自动化等先进技术的投资,这些可以增加企业的收益,是推动应用程式发布自动化市场的关键因素之一。 。

- 数位转型的进步促使大多数企业采用应用程式和工具来回应市场回馈,并比以往更快地为最终用户提供新体验。组织正在转向应用程式发布自动化软体,以在这些新的市场条件下保持竞争力并加快交付速度。透过利用应用程式发布自动化,组织可以轻鬆处理快速软体交付和更新,减少人为错误、遗漏步骤和潜在的操作问题。

- 此外,推动市场发展的关键因素是在生产环境中向软体应用程式快速部署新功能,以确保 100% 的执行时间,或几乎没有停机时间的安全性修补程式。IT 部门应用的压力越来越大此外,COVID-19 迫使世界各地前所未有的人数将职场从办公室改为家庭,这给通讯服务供应商带来了巨大压力,要求他们以完美的数位通讯能力支持社会的正常运作。

- 2023 年 2 月,能源管理和自动化数位转型领导者Schneider Electric在佛罗里达州奥兰多举行的第 27 届年度 ARC 产业领导力论坛上推出了新的工业数位化转型服务。这项专业化的全球服务旨在帮助工业企业为未来做好准备,实现创新、永续和有效的端到端数位转型。

应用程式发布自动化市场趋势

云端预计将占据重要的市场占有率

- 随着世界各地的企业迅速将其应用程式迁移到云端中,全球市场对云端基础云端的应用程式的需求正在激增。此外,根据 Apps Run The World 进行的一项研究,微软在 2021 年以 13% 的云端应用市场占有率成为最大供应商。 Salesforce 和 Oracle 紧随其后,市场占有率分别为 11% 和 7%。

- 云端基础的应用程式和 Web 伺服器不仅使客户能够从世界任何地方灵活地存取应用程序,还可以降低使用旧有系统时因业务停机而产生的成本。

- 传统的应用程式发布自动化用于对应用程式伺服器进行负载平衡,以管理流量和应用程式部署。多年来,已经整合了 SSL 卸载、可见性、应用程式分析、多重云端支援、TCP 优化、速率调整和网路应用程式防火墙等新功能。

- 2022 年 6 月,持续配置(CD) 公司 Armory 宣布推出 Armory Continuous Deployment-as-a-Service,该服务使开发团队能够轻鬆、可靠、安全、持续地部署任意规模的软体。该产品提供跨多种环境的声明式配置,支援先进的渐进策略,使开发人员能够专注于建置良好的程式码而不是配置,从而改善客户体验并避免中断。

- 此外,2023年1月,阿里云宣布推出飞天开发者社区,这是一个新的中心,旨在透过增强提供的各种开发者工具和资源来支援全球开发者。它旨在支持开发团体的持续成长,同时促进跨市场数位经济的进一步发展。

亚太地区预计将占据重要市场占有率

- 预计亚太地区在预测期内将呈现最高成长率。该地区云端运算的快速成长预计将成为云端基础的应用传输控制器的关键驱动力。

- 此外,由于中小企业的投资,该地区预计将实现成长。中小型企业正在云端基础云端基础且技术先进的解决方案。中国和印度等国家为该地区提供了巨大的成长机会。

- 例如,根据中小企业部最新资料,印度拥有 5,000 万家中小微型企业,使其成为全球最大的中小微型企业市场之一。鑑于政府和微企业依赖可扩展的 IT 系统和解决方案,他们可能会将流程以及敏感资讯转移到云端,这是可以理解的。因此,应用程式发布自动化市场获得了更大的吸引力。

- 在最近的冠状病毒感染疾病(COVID-19)爆发后,亚太地区出现了采用云端基础的解决方案的重大转变,应用程式发布自动化行业在各技术提供商的支持下反弹并显示出实力。印度作为客服中心外包目的地发挥重要作用,当地企业需要额外的远端操作技术力,需要远端连线的协助。因此,各个供应商正在提供创新的解决方案来吸引客户。

- 例如,新加坡被认为是亚太地区的医疗保健中心,并提供该地区最好的医疗保健系统。国际联合委员会 (JCI) 对新加坡超过 23 家医院和医疗机构进行了认证。每年有超过 35 万名患者前往新加坡接受优质的医疗保健服务。这种可能性将增加云端应用程式的使用并推动预测期内的市场成长。

应用程式发布自动化产业概况

全球应用程式发布自动化市场竞争激烈,有多家领先企业。从市场占有率来看,目前很少大公司占据市场主导地位。这些拥有显着市场份额的领先公司正致力于扩大海外客户群。这些公司利用策略合作倡议来提高市场占有率和盈利。

- 2023 年 3 月 - Applitools 宣布推出 Centra 抢先体验计划,这是一款旨在连接整个产品交付生命週期团队的新工具。目前免费提供。 Centra 将整个产品交付生命週期的团队连接起来,在从设计到实施的流程的每个阶段追踪、检验和协作使用者介面。

- 2023 年 2 月 - 软体智慧公司 Dynatrace 宣布推出AutomationEngine。这种新的 Dynatrace 平台技术具有直觉的介面以及无程式码和低程式码工具集,利用 Davis 因果 AI 使团队能够在无限的 BizDevSecOps 工作流程中扩展答案驱动的主导。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 满足日益增长的需求,更快地交付软体,同时降低营运风险

- 企业快速采用,以提供差异化的客户体验并实现客户维繫

- 市场限制因素

- 产品高成本、软体或应用部署失败、配置复杂

第六章市场区隔

- 按成分

- 工具

- 服务

- 按配置

- 云

- 本地

- 按最终用户产业

- BFSI

- 资讯科技和通讯

- 零售与电子商务

- 媒体和娱乐

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Broadcom Inc.

- IBM Corporation

- Microsoft Corporation

- BMC Software, Inc.

- Chef Software, Inc.

- CloudBees, Inc.

- Micro Focus International Plc

- ARCAD Software

- Attunity Ltd.

- Flexagon LLC

- Datical, Inc.

- Electric Cloud, Inc.

- CollabNet, Inc.

第八章投资分析

第九章市场机会与未来趋势

The Application Release Automation Market size is estimated at USD 4.08 billion in 2024, and is expected to reach USD 10.06 billion by 2029, growing at a CAGR of 19.75% during the forecast period (2024-2029).

Digital infrastructure has been significantly evolving globally along with business change, thereby making modernization the key to success. Moreover, with the emergence of the COVID-19 pandemic, application visibility and management gained even more prominence as employees working from their homes and businesses rapidly transformed their environments to keep their staff productive from any location. This was anticipated to further boost the market's growth over the forecast period. Moreover, due to the COVID-19 lockdowns that were put in place along with the switch to remote working environments, an unprecedented number of people started using mobile applications for work and other activities, creating the need for seamless security access to these applications.

Key Highlights

- Increasing adoption of digital transformation in most enterprises and investment in advanced technologies such as artificial intelligence, big data, and cognitive automation that can boost the company's revenue are some of the primary factors boosting the application release automation market.

- The growing digital transformation has pushed most businesses to adopt applications and tools to respond to market feedback and deliver new experiences to end users faster than ever. Organizations have turned to application release automation software to stay competitive in these new market conditions and speed up delivery. By leveraging application release automation, organizations can easily handle fast software delivery and updates and decrease human error, missed steps, and potential production issues.

- Additionally, the primary factor driving the market is increasing pressure on the IT sector to roll out new features to software applications quickly in production or apply security patches with little to no downtime to guarantee 100% uptime. Moreover, COVID-19 forced an unprecedented number of people worldwide to change their workplace from office to home, creating immense pressure on communications service providers to support a functioning society with flawless digital communication capabilities.

- In February 2023, Schneider Electric, the leader in the digital transformation of energy management and automation, launched its new Industrial Digital Transformation Services during the 27th Annual ARC Industry Leadership Forum in Orlando, Florida. The specialized global service is designed to help industrial enterprises achieve future-ready, innovative, sustainable, and effective end-to-end digital transformation.

Application Release Automation Market Trends

Cloud is Expected to Hold Significant Market Share

- As enterprises across the globe are migrating applications to the cloud at a rapid pace, there is a spike in demand for cloud-based applications in the global market. Moreover, according to a survey conducted by Apps Run The World, in 2021, Microsoft led as the top vendor in the cloud applications market share with 13%. Salesforce and Oracle were close behind, having 11% and 7% of the market share, respectively.

- Cloud-based applications and web servers not only help clients to access the applications with agility from anywhere across the globe, but it reduces the cost incurred due to downtime of businesses while using legacy systems.

- Traditional application release automation was used for load-balancing application servers to manage traffic and application deployment. Over the years, new functions have been integrated, including SSL offloading, visibility, application analytics, multi-cloud support, TCP optimizations, rate shaping, and web application firewalls.

- In June 2022, Armory, the continuous deployment (CD) company empowering development teams to easily, reliably, safely, and continuously deploy software at any scale, announced the general availability of Armory Continuous Deployment-as-a-Service. The product delivers declarative deployments across multiple environments that support advanced progressive strategies, allowing developers to focus on building great code rather than deploying it, enhancing their customers' experience, and avoiding outages.

- Further, in January 2023, Alibaba Cloud announced the launch of the Apsara Developer Community, a new hub created to support global developers through an enhanced provision of various developer tools and resources. It aims to support the developer community's continuous growth while facilitating the digital economy's further progress across markets.

Asia Pacific is Expected to Hold Significant Market Share

- Asia-Pacific is expected to witness the highest growth rate over the forecast period. The rapid increase in cloud computing in this region is expected to be a significant driver for cloud-based application delivery controllers.

- Additionally, the region is expected to witness growth, owing to the investments of small and medium organizations. SMEs are investing in cost-effective cloud-based and technologically advanced solutions for cloud-based applications. Countries such as China and India provide significant growth opportunities in the region.

- For instance, according to recent data from the Ministry of Micro, Small, and Medium Enterprises, India has 50 million MSMEs, which makes it among the world's largest MSME markets. Given that the government and MSMEs rely on scalable IT systems and solutions, it is understandable that they may shift their processes, along with sensitive information, to the cloud. This has further given significant traction to the application release automation market.

- In the wake of the recent outbreak of COVID-19, Asia-pacific is witnessing a significant shift toward adopting cloud-based solutions, and the application release automation industry is showing resiliency with support from various technology providers. India, a vital contact center outsourcing destination, needs help with remote connections, as regional enterprises need more technological capabilities for remote operations. Due to such reasons, various vendors offer innovative solutions to attract customers.

- For instance, Singapore is considered the Asia-Pacific's medical and healthcare hub and offers the region's best healthcare system. The Joint Commission International (JCI) has accredited over 23 hospitals and healthcare facilities in Singapore. Over 350,000 patients visit Singapore to provide high-quality healthcare services each year. Such potential would increase the use of cloud applications and drive market growth during the forecast period.

Application Release Automation Industry Overview

The global application release automation market is highly competitive and has several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- March 2023 - Applitools announced the launch of an Early Access Program for Centra, a new tool designed to connect teams across the product delivery lifecycle. It is now available for free access; Centra connects teams across the product delivery lifecycle to track, validate, and collaborate on user interfaces at every process stage, from design to implementation.

- February 2023 - Software intelligence company Dynatrace announced the launch of the AutomationEngine. This new Dynatrace platform technology features an intuitive interface and no-code and low-code toolset and leverages Davis causal AI to empower teams to extend answer-driven automation across boundless BizDevSecOps workflows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 On Increasing Demand of Faster Delivery of Software with Reduced Operational Risk

- 5.1.2 Rapid Adoption by Enterprise to Deliver Differentiated Customer Experiences and to Retain

- 5.2 Market Restraints

- 5.2.1 High Cost of Product and Failed Deployment of Software or Applications and Complexity in Configurations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Tool

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-Premises

- 6.3 By End-User Industries

- 6.3.1 BFSI

- 6.3.2 IT & Telecommunications

- 6.3.3 Retail & E-commerce

- 6.3.4 Media & Entertainment

- 6.3.5 Others End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 BMC Software, Inc.

- 7.1.5 Chef Software, Inc.

- 7.1.6 CloudBees, Inc.

- 7.1.7 Micro Focus International Plc

- 7.1.8 ARCAD Software

- 7.1.9 Attunity Ltd.

- 7.1.10 Flexagon LLC

- 7.1.11 Datical, Inc.

- 7.1.12 Electric Cloud, Inc.

- 7.1.13 CollabNet, Inc.