|

市场调查报告书

商品编码

1435966

单件拣选机器人 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Piece Picking Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

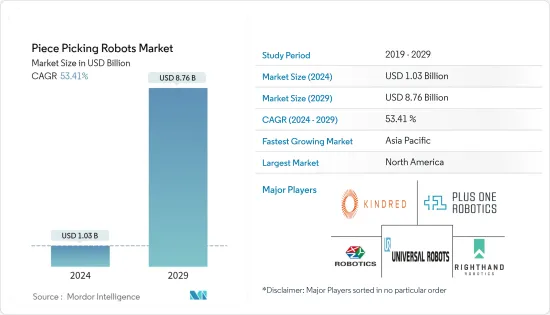

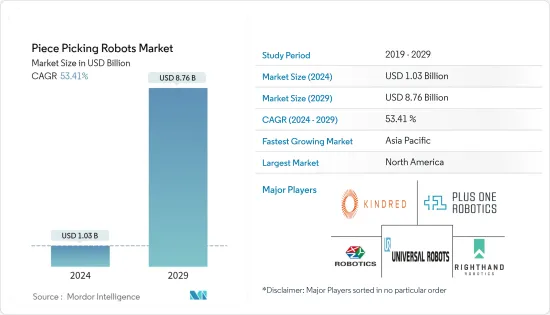

预计2024年单件拣选机器人市场规模为10.3亿美元,预计到2029年将达到87.6亿美元,在预测期内(2024-2029年)CAGR为53.41%。

COVID-19 显着增加了自动化解决方案的销售以及物流需求。儘管供应链因封锁而中断,但该行业却取得了显着成长。仓库订单取货被认为是供应链中最耗时的部分,而拣货机器人可望缩短这一时间。因此,移动工件拣货机可以取代工人在仓库内移动所花费的时间。

主要亮点

- 据inVia Robotics Inc.称,工人在整个仓库中从一个地点走到另一个地点所花费的时间约占总拣货时间的50%,占所有营运成本的50%以上。此外,在当今紧张的劳动力市场中寻找和留住员工具有挑战性,通常会导致僱用和培训临时工的重复且昂贵的循环。所有这些决定因素累积起来都在推动市场成长。

- 如今,全球安装了数千台机器人,而五年前,这一领域还不存在。消费者行为正在推动公司满足产品和交付个人化的需求。越来越多的公司意识到机器人技术为其业务带来的众多优势。此清单范围从更快、更准确的拣选到最小化的劳动力需求。劳动力短缺和对在传统仓库环境中工作缺乏兴趣都发挥了分类机器人的价值。

- 值得注意的是,在製造领域,协作机器人和移动机器人满足了灵活物料搬运的需求、机器人能够在大型结构上操作的需求以及快速重新配置工作区域的需求。此外,两个路线图提供了对未来移动机器人系统的预测。例如,物料搬运研究所期望自主控制、人工智慧和机器人技术以及运动和手势敏感技术方面的新能力,这些技术可能会导致物料搬运系统中人、机器和电脑完全自由、有效地互动。新方法。该研究所进一步预测,预计到 2025 年,纸箱和托盘层面都将实现经济、高速的卡车装卸自动化。

- 其次,对于製造业中使用的工件拾取移动机器人,美国机器人技术的最新路线图预测,到2030 年,自动驾驶汽车将能够在人类可以驾驶的任何环境中行驶,而且比人类驾驶员更安全、更可预测.车辆将能够自行学习如何在以前未见过的场景中驾驶。

- 在劳动力资源不断萎缩的背景下,製造和物流公司越来越需要满足消费者对更多选择和更快交付的需求,这促使企业寻找透过使用分类机器人来实现营运自动化的新方法。随着公司寻找更有效地部署现有劳动力并最大限度地提高营运生产力和效率的方法,它们在工业应用中得到越来越多的采用。例如,2022 年 4 月,FedEx、iHerb 和许多其他公司转向分类机器人系统来解决其履行挑战。

- 据美国银行称,到 2025 年,45% 的製造业将由机器人技术完成。顺应这一趋势,雷蒙德有限公司(印度纺织巨头)和富士康科技(三星等大型科技製造商的中国供应商)等大公司已分别更换(或计划更换)10,000 名和 60,000 名工人。将自动化技术融入他们的工厂。因此,增加对自动化的投资将推动市场的发展。

- 此外,工业领域机器人数量的增加将推动所研究的市场成长。据IFR称,预计2021年全球将出货约4,35,000台工业机器人。其中亚洲/澳洲的安装量最多,预计2021年将达到3,06,000台。亚洲/澳洲的工业机器人安装量预计将达到370,000台到 2024 年。

单件拣选机器人市场趋势

协作机器人推动市场

- 协作移动机器人增强了人类的工作能力,提高了准确性,并引导仓库员工纠正拣选位置并利用 UPC 扫描,进一步减少人为错误。根据HMC Investment Securities预测,预计到2025年,全球协作机器人市场规模将达到128亿美元左右,单件拣货机器人市场可望获得提振。

- 虽然协作机器人市场相对较新,但它有望在未来十年内大幅成长。协作机器人是能够与人类工人一起安全工作并在工厂内外变得更加复杂和有用的机器人。协作机器人的功能不断进步,同时变得更便宜且更广泛使用。这两个决定因素是未来市场爆炸性成长的重要因素。

- 透过协作式单件拣选机器人,我们有机会将自动化引入当前的拣选环境,而无需中断或重新安排设置,并见证生产力的显着提高。例如,2022年5月,现代汽车计画在2025年在美国投资50亿美元,进一步开发自动驾驶、机器人和人工智慧等领域的行动技术

- 推动市场的主要因素是先进机器人的引入,这些机器人能够在智慧零件组装和电子元件生产和组装等领域与人类合作,从而刺激了对协作机器人的需求。根据 FMI 分析,在协作机器人市场中,2022 年上半年观察到 BPS 值之间的变化 - 2022 年上半年的展望反映了 99 个单位的增长,与 2021 年上半年相比,市场预计将飙升- 2022 年上半年成长81 个基点。

- 此外,2022年8月,Smart Robotics推出了最新的协作机器人系统,名为Smart Fashion Picker。智慧时尚挑选器的名字来自于它的功能——协作机器人可以直接从购物车或垃圾箱中挑选各种各样的时尚物品,这些物品被放置在保护性包装中。智慧时装挑选器解决了仓库自动化转型的痛点。

- 根据HMC Investment Securities预测,全球协作机器人(co-bot)销售量在美国将达到134,400台左右,而中国预计到2025年销售量最大,达到2,43,600台,这将进一步推动市场成长。

- 部署协作机器人的应用有很多:包装、品质测试、物料搬运、机器维护、组装、焊接等。其中,预计物料搬运领域的协作机器人安装量将出现最显着的成长。

- 根据机器人工业协会的说法,促使协作机器人越来越多地采用的主要因素之一是它们不断降低的价格标籤。许多协作机器人的价格低于 4.5 万美元,它们在工厂环境之外也变得可行。无论环境如何,低廉的价格都使自动化投资更容易取得,也更容易证明其合理性。

北美将占据重要份额

- 在仓库和电子商务履行设施中将协作机器人和移动机器人结合的单件拣选机器人使北美地区受益。美国的机器人大部分是从日本和欧洲进口的(资料来源:IFR)。儘管有许多重要的机器人系统整合商。

- 该地区的 3PL 公司越来越多地关注不同的客户资料,以从他们的角度了解最佳应用程式。此外,还观察到多种趋势,例如投资、鼓励黑客马拉松、趋势社群和新创实验室。例如,2022 年 10 月,印度的 V-Trans 宣布计划在未来三年内在印度前 40 个城市将其仓库组合扩大五倍,面积超过 500 万平方英尺,预计将大幅推动业务源于政府最近公布的国家物流政策。

- 人们也认为,即使在 COVID-19 引发劳动力短缺问题之前,相关产业也需要进一步自动化。根据 Salary.com 的数据,截至 2023 年 5 月 1 日,美国仓库工人的平均时薪为 17 美元,但范围通常在 15 美元至 18 美元之间。

- 具体来说,在农业领域,美国农民每年在劳动力上的支出超过 340 亿美元(根据美国农业部的数据),H2B 签证的稀缺和工人人口的老化导致了向自动化的转变。儘管采用单件拾取机器人有些牵强,但我们已经考虑了积极的发展。

单件拣选机器人产业概述

单件拣选机器人市场竞争适中,由几个主要参与者组成。目前,这些参与者中很少有人在市场份额方面占据主导地位。这些厂商提供灵活、经济高效且高效的移动单件拣选机器人,可实现码垛和卸垛、储存和检索、运输和包装等多种仓库服务的自动化。主要参与者都专注于产品开发,并在现有产品线中引入先进技术,以获得竞争优势。市场上的知名企业包括 Plus One Robotics Inc.、Kindred Systems Inc.、Universal Robots A/S、XYZ Robotics Inc. 和 Righthand Robotics Inc. 等。

- 2023 年 4 月 - OSARO 宣布建立合作伙伴关係,将其拾取机器人与突破性的 Geek+ 仓库自动化系统整合。新联盟为企业提供仓库履行营运的一站式解决方案以及提高自主移动机器人系统(AMR)和自动储存和检索系统(ASRS)投资回报率的策略。

- 2022 年 11 月 - 亚马逊推出了其仓库机器人系列的最新产品,名为 Meet Sparrow,这是一种机械臂,能够在包装前挑选单个产品。亚马逊的 Robin 和 Cardinal 机器人负责挑选和整理要寄送的包裹,而 Sparrow 则可以处理单一产品。此外,亚马逊还宣布了其机器人团队正在开发的另一种机器人:用于移动超大物品的自主移动机器人。该机器人的目标是从亚马逊商店订购的 10% 的商品,这些商品太长、太宽或太笨重,无法放入公司的吊舱或传送带上。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 产业价值链分析

- COVID-19 对自动化产业影响的评估

- 工件拣选机器人软体技术与发展

第 5 章:市场动态

- 市场驱动因素

- 从整箱或託盘拣选到单件流的转变以及改进的技术投资

- 增加自动化投资

- 市场挑战

- 速度较慢、夹具无法处理不寻常的物品以及可靠性问题

第 6 章:市场细分

- 按机器人类型

- 协作性

- 移动及其他

- 按最终用户应用程式

- 製药

- 零售/仓储/配送中心/物流中心

- 其他最终用户应用程式

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第 7 章:竞争格局

- 公司简介

- Plus One Robotics Inc.

- Kindred Systems Inc.

- Universal Robots A/S

- XYZ Robotics Inc.

- Righthand Robotics Inc.

- Berkshire Grey Inc.

- Robomotive BV

- Lyro Robotics Pty Ltd.

- Knapp AG

- Grey Orange Pte. Ltd.

- Handplus Robotics

- Dematic Group (KION Group AG)

- Nomagic Inc.

- Fizyr BV

- Mujin Inc.

- Nimble Robotics Inc.

- Swisslog Holding AG

- Karakuri Ltd

- Osaro Inc.

- Covariant

- SSI Schaefer Group

第 8 章:投资分析

第 9 章:市场的未来

The Piece Picking Robots Market size is estimated at USD 1.03 billion in 2024, and is expected to reach USD 8.76 billion by 2029, growing at a CAGR of 53.41% during the forecast period (2024-2029).

COVID-19 significantly increased the sales of automated solutions, as well as the logistics requirements. Though the supply chain has been disrupted due to the lockdown, the industry has grown significantly. Warehouse order pickups are considered the most time-consuming part of the supply chain, with picking robots promising to shorten it. Mobile piece pickers, thus, can replace the number of hours that workers spend moving around the warehouse.

Key Highlights

- According to inVia Robotics Inc., the time workers spend walking from location to location throughout the warehouse accounts for about 50% of the total pick time and represents more than 50% of all operational costs. Additionally, finding and retaining staff in today's tight labor market is challenging, often resulting in a repetitive and expensive cycle of hiring and training temporary workers. All these determinants, on a cumulative basis, are fuelling market growth.

- There are thousands of robots installed worldwide today that did not exist in this segment just five years ago. Consumer behavior is driving companies to address the demand for the personalization of both products and delivery. More and more companies are realizing the numerous advantages robotics provides their businesses. That list ranges from faster, more accurate picking to minimized labor requirements. Both the labor shortage and a lack of interest in working in traditional warehouse settings play to the value of piece-picking robots.

- Notably, in the manufacturing sector, collaborative as well as mobile robots address the demand for flexible material handling, the need for robots to be able to operate on large structures, and the requirement for rapid reconfiguration of work areas. Moreover, two roadmaps provide predictions for future mobile robot systems. For instance, the material handling institute expects new capabilities in autonomous control, artificial intelligence, and robotics, along with motion- and gesture-sensitive technologies that could lead to material handling systems in which humans, machines, and computers interact freely and effectively in completely new ways. The institute further predicts that it is expected that economical, high-speed automation for loading and unloading trucks should be available, both at the carton and pallet level, by 2025.

- Secondly, for piece-picking mobile robots used in manufacturing, a recent roadmap for US robotics predicts that autonomous vehicles will be capable of driving in any environment in which humans can drive and, furthermore, be safer and more predictable than a human driver by 2030. Vehicles will be able to learn on their own how to drive in previously unseen scenarios.

- The rising need for manufacturing and logistics companies to meet consumer demands for greater choice and faster delivery, against a backdrop of a shrinking labor pool, is leading businesses to look for new ways of automating their operations through the use of piece-picking robots. They are being adopted in increasing numbers in industrial applications as companies look for ways both to deploy their existing workforces more effectively and maximize the productivity and efficiency of their operations. For instance, in April 2022, FedEx, iHerb, and many other companies turned to piece-picking robotic systems to solve their fulfillment challenges.

- According to the Bank of America, by 2025, 45% of all manufacturing will be performed by robotic technology. Following this trend, large firms, such as Raymond Limited (an Indian textile major) and Foxconn Technology (a China-based supplier for large technology manufacturers like Samsung), have replaced (or plan to replace) 10,000 and 60,000 workers, respectively, by incorporating automated technology into their factories. Hence increasing investment in automation drives the market.

- Moreover, the rise in the number of robots in industrial areas will drive the studied market growth. According to IFR, approximately 4,35,000 industrial robots were expected to be shipped worldwide in 2021. Asia/Australia had the most units installed, with an estimated 3,06,000 in 2021. Industrial robot installations in Asia/Australia are expected to reach 370,000 units by 2024.

Piece Picking Robots Market Trends

Collaborative Robots to Drive the Market

- Collaborative mobile robots augment humans' work to improve accuracy and lead warehouse associates to correct pick locations and utilize UPC scanning, further reducing human error. According to HMC Investment Securities, it is expected that, by 2025, the global co-bot market size will reach around USD 12.8 billion, and the Piece Picking Robots Market is envisioned to get a boost.

- While the collaborative robot market is relatively new, it's poised for massive growth over the next ten years. Collaborative robots are robots capable of safely working alongside human workers and becoming more sophisticated and useful inside and outside factory settings. Collaborative robots are advancing in capability while simultaneously becoming cheaper and more widely available. These two determinants are vital contributors to the explosive market growth ahead.

- With collaborative piece-picking robots, there is an opportunity to introduce automation into the current pick environment, not disrupt or rearrange the setup, and witness significant productivity gains. For instance, in May 2022, Hyundai plans USD 5 billion investment in the United States by 2025 to further develop mobility technologies in areas like autonomous driving, robotics, and A.I.

- The primary factor driving the market is the Introduction of advanced robots, capable of working with humans in areas like smart parts assembly and electronics component production and assembly, fueling the demand for collaborative robots. According to FMI analysis, in the Collaborative Robots market, the variation between the BPS values has been observed in H1, 2022 - Outlook over H1, 2022 Projected reflects a gain of 99 units, compared to H1, 2021, the market is expected to spike by 81 BPS in H1 -2022.

- Furthermore, in August 2022, Smart Robotics launched its latest collaborative robotic system named the Smart Fashion Picker. The Smart Fashion Picker's name is derived from its function - the cobot can pick a large variety of fashion items, which are placed in protective wrapping, straight from a cart or bin. The Smart Fashion Picker addresses the pain point of transformation within warehouse automation.

- According to HMC Investment Securities, global collaborative robots (co-bot) sales will reach around 134,400 units in the United States, and china is expected to sell the largest units accounting for 2,43,600 by 2025, which will further drive the market growth.

- There are quite a few applications where collaborative robots are deployed: packing, quality testing, material handling, machine tending, assembly, welding, and others. Among these, the material handling segment is expected to experience the most significant growth in collaborative robot installments.

- According to the Robotic Industries Association, one of the main factors contributing to the increasing adoption of collaborative robots is their constantly lowering price tag. With many collaborative robots available for under USD 45K, they are becoming viable outside the factory setting. No matter the setting, the low price tag makes automation investment more accessible and more comfortable to justify.

North America to Hold Significant Share

- The piece picking robots to combine cobots and mobile robots in warehouses and e-commerce fulfillment facilities has benefitted the North American region. Most of the USA robots are imported from Japan and Europe (source: IFR). Although the presence of numerous important robot system integrators.

- The 3PL companies in the region are increasingly looking at different customer profiles to understand the best applications from their perspectives. Also, multiple trends, such as making investments, encouraging hackathons, trend communities, and startup labs, are being observed. For instance, in October 2022, V-Trans from India announced a five-fold expansion plan in its warehouse portfolio to more than 5 million square feet in the top 40 cities of India over the next three years, as it expects a major boost to business from the government's recently announced National Logistics Policy.

- It is also believed the allied industry needed further automation even before COVID-19 casts the issue of labor tenuousness. According to Salary.com, the average hourly wage for a Warehouse Worker in the United States is USD 17 as of May 01, 2023, but the range typically falls between USD 15 and USD 18.

- Specifically, in the agriculture sector, where farmers have spent over USD 34 billion a year on labor in the United States (according to the USDA), the scarcity of H2B visas and an aging worker population has led to a shift to automation. Though it is farfetched on adopting piece pick robots, active developments have been considered.

Piece Picking Robots Industry Overview

The Piece Picking Robots Market is moderately competitive and consists of several major players. Few of these players currently dominate the market in terms of market share. These players offer flexible, cost-effective, and efficient mobile Piece Picking Robots, which can automate multiple warehouse services such as palletizing & depalletizing, storage & retrieval, transportation, and packaging. Major players are concentrating on product development and introducing advanced technologies in the existing product lines to gain a competitive advantage. Prominent players in the market include Plus One Robotics Inc., Kindred Systems Inc, Universal Robots A/S, XYZ Robotics Inc., and Righthand Robotics Inc., among others.

- April 2023 - OSARO announced a partnership that integrates its pick-and-place robots with groundbreaking Geek+ warehouse automation systems. The new alliance facilitates businesses with a one-stop solution for their warehouse fulfillment operations as well as a strategy to boost the ROI of their autonomous mobile robot systems (AMRs) and automated storage and retrieval systems (ASRS).

- November 2022 - Amazon unveiled the latest addition to its collection of warehouse robots named the Meet Sparrow, which is a robotic arm capable of picking individual products before they get packaged. Unlike Amazon's Robin and Cardinal robots, which pick and organize packages to be sent out for delivery, Sparrow can handle individual products. Further, Amazon announced another robot that is being developed by its robotics team: an autonomous mobile robot for moving oversized items. This robot targets the 10% of items ordered from the Amazon Store that are too long, wide or unwieldy to fit in the company's pods or on its conveyor belts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Automation Industry

- 4.5 Piece-picking Robot Software Technology and Evolution

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 A Shift from Full-case or Pallet Picking to Piece Flow and Improved Technology Investments

- 5.1.2 Increasing Investments in Automation

- 5.2 Market Challenges

- 5.2.1 Slower Speeds, Inability of the Grippers to Deal with Unusual Items, and Reliability Issues

6 MARKET SEGMENTATION

- 6.1 By Type of Robot

- 6.1.1 Collaborative

- 6.1.2 Mobile and others

- 6.2 By End User Application

- 6.2.1 Pharmaceutical

- 6.2.2 Retail/Warehousing/Distribution Centers/Logistics Centers

- 6.2.3 Other End User Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Plus One Robotics Inc.

- 7.1.2 Kindred Systems Inc.

- 7.1.3 Universal Robots A/S

- 7.1.4 XYZ Robotics Inc.

- 7.1.5 Righthand Robotics Inc.

- 7.1.6 Berkshire Grey Inc.

- 7.1.7 Robomotive BV

- 7.1.8 Lyro Robotics Pty Ltd.

- 7.1.9 Knapp AG

- 7.1.10 Grey Orange Pte. Ltd.

- 7.1.11 Handplus Robotics

- 7.1.12 Dematic Group (KION Group AG)

- 7.1.13 Nomagic Inc.

- 7.1.14 Fizyr B.V.

- 7.1.15 Mujin Inc.

- 7.1.16 Nimble Robotics Inc.

- 7.1.17 Swisslog Holding AG

- 7.1.18 Karakuri Ltd

- 7.1.19 Osaro Inc.

- 7.1.20 Covariant

- 7.1.21 SSI Schaefer Group