|

市场调查报告书

商品编码

1435975

智慧清洁与卫生:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Smart Cleaning And Hygiene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

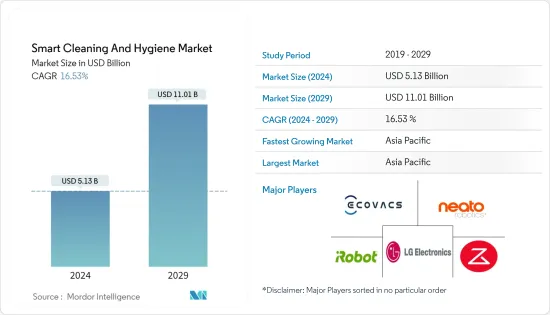

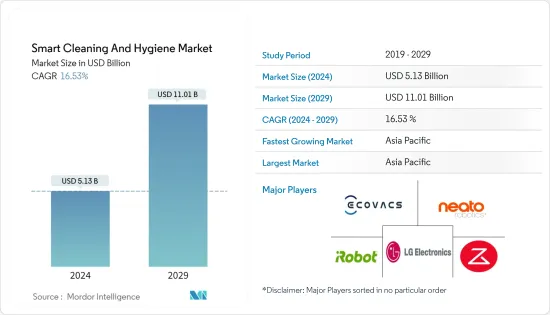

智慧清洁和卫生市场规模预计到 2024 年为 51.3 亿美元,预计到 2029 年将达到 110.1 亿美元,在预测期内(2024-2029 年)增长 16.53%,复合年增长率为

保持清洁在任何地方都至关重要,尤其是在医院。大约 50% 至 70% 的医院获得性感染 (HAI) 是透过受污染的手传播的。智慧清洁可协助您识别医院内的常见接触点,并找到消除所有细菌的正确解决方案。医疗保健领域的智慧清洁对于减少疾病和改善医院卫生至关重要。

主要亮点

- 酒店业越来越多地利用机器人技术来改善业务并增强宾客体验。例如,纽约花园城酒店采用了 Whiz,该系统由Softbank Robotics的人工智慧 (AI) 平台提供支援。酒店工作人员声称这很方便,因为他们可以将宴会厅家具放在一侧,并安装 Whiz 来清洁地毯。

- 2023 年 1 月,Mero Technologies Inc 透过就业成长基金获得加拿大政府 150 万美元的资金。 Mero 为商业建筑提供智慧清洁解决方案,测量建筑入住率和清洁度,帮助租户安全返回工作岗位。这笔资金将帮助 Mero 将其智慧清洁平台业务扩展到加拿大西部和美国。

- 过去两年,清洁行业发生了重大变化,感染疾病 ( COVID-19) 大流行加速了这一转变。智慧清洁趋势已成为一种必然,因为它提供了让员工重返办公室的强大动力。资料驱动的智慧清洁使供应商能够比以往更有效地提供高品质的服务,使客户满意。与人工智慧整合的智慧清洁解决方案现在可以更有效地清洁会议室和工作空间。

- 资料安全和保护是智慧清洁公司面临的关键问题。同样重要的是能够智慧地清理感测器收集的资料并保护这些资料免受损害活动。例如,骇客可以存取清洁机器人的摄影机并获取有关建筑物内部楼层平面图的知识。

智慧清洁和卫生市场趋势

机器人吸尘器占据主要市场占有率

- 预计2027年机器人市场将达到1,000亿美元。人工智慧整合使机器人能够在环境中导航。 ICE 开发了一款使用测绘和雷射技术来清洁复杂环境的机器人。人员配备可能很困难,因为昂贵的夜班和不合群的工作时间消耗了大量低效率的管理时间。引入机器人技术进行清洁可以节省金钱并改善时间管理。儘管初始成本可能很高,但使用机器人是具有成本效益的。

- 扫地机器人是世界上生产和销售最广泛的家用机器人。清洁专家 Roomba 专门用于吸尘,具有地板类型之间的内置自动调节功能以及去除宠物毛髮的重要清洁功能。

- 2022年6月,Anker旗下Eufy推出了Robovac G20。它与 UltraPak 灰尘压缩技术配合使用,提供四种抽吸模式,增加气流,在家中安静运行。有效利用随附的垃圾箱并检测何时需要额外的真空动力。

- 2022年5月,海尔在印度半岛推出干湿拖二合一机器人吸尘器。该公司表示,该机器人可以强制清洁所有类型的地板,避开障碍物,并防止损坏和刮伤。

亚太地区将经历最高的成长

- 亚太地区(APAC)是全球成长最快的人工智慧(AI)市场。到2023年,亚太地区对人工智慧等新技术的投资预计将占资讯和通讯技术(ICT)总投资的40%。人工智慧和机器学习正在造成重大破坏,并改变几乎每个行业领域的技术形势。清洁业正在逐渐赶上这项变化。

- 中国和日本是最大的工业机器人供应商,正在推动人工智慧研究领域的商业化。中国正在投资并推动「中国製造2025」、「促进巨量资料发展行动指南」、「下一代人工智慧发展规划」等计划。

- 印度也在 NITI Aayog 政策下启动了国家人工智慧策略,以指导新兴人工智慧技术的研发。印度不断发展的Start-Ups文化影响了该国人工智慧的发展。

- 根据最近的智慧职场清洁度调查,75%的新加坡工人认为机器人是清洁工的理想补充,可确保工作场所清洁。

- Softbank Robotics与 InfoGrid 合作推出清洁机器人「Whiz」。 Whiz 的智慧 AI 清洁功能使用 Infogrid 感测器及其分析仪表板提供室内空气品质的即时资料,消除了办公室中空气传播病毒传播的威胁。

智慧清洁卫生产业概况

智慧清洁和卫生市场有适度竞争。许多设施管理平台和基于技术的清洁服务供应商都是清洁和消毒方面的专家,并且透过新产品发布、合作和收购获得了发展势头。服务该领域的主要企业包括 Neato Robotics、iRobot Corporation、Ecovacs Robotics、LG Electronics 等。

- 2023 年 3 月,德国清洗解决方案公司 Karcher 开始在印度製造消费清洗机,产能翻倍。凯驰为客户提供既能清洗又能节省能源和资源的机器。凯驰印度公司在印度各地拥有 13 家分店和 19 个服务点,并拥有训练有素的销售和服务人员。

- 2023年2月,智慧清洁解决方案供应商Obode推出智慧吸尘机器人系列,扩大在北美的足迹。吸尘机器人自动清洗拖把垫片,防止发霉和产生异味。这些产品与雷射雷达技术集成,可识别不同的表面类型,并根据需要应用适当的吸尘、拖地、边缘清洁和完整的测绘功能。它在房间内无缝移动,并在扫地和拖地之间智慧切换,以实现安全有效的地板清洁。

- 2022年10月, Softbank Robotics America(SBRA)与领先的自主清洁和服务机器人解决方案提供商Gausium合作,向美国市场销售室内自主机器人解决方案。此次合作旨在帮助客户在其组织内部署、整合和扩展机器人解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 分销通路分析(线上与线下)

- 市场驱动因素

- 随着单价下降,消费者偏好和社会经济因素发生变化

- 市场限制因素

- 安全担忧和广泛的流行病扰乱了供应链活动

- 评估 COVID-19感染疾病对市场的影响

第五章市场区隔

- 产品

- 机器人吸尘器

- 泳池清洁机器人

- 窗户清洁机器人

- 其他卫生相关产品

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Ecovacs Robotics Co. Ltd

- Roborock Technology Co. Ltd

- LG Electronics Inc.

- iRobot Corporation

- Cecotec Innovaciones SL

- Neato Robotics Inc.

- Electrolux AB

- SharkNinja Operating LLC

- Panasonic Corporation

- Haier Group Corporation

- Hitachi Ltd

- Samsung Electronics Co. Ltd

第七章 投资分析

第八章市场机会及未来趋势

The Smart Cleaning And Hygiene Market size is estimated at USD 5.13 billion in 2024, and is expected to reach USD 11.01 billion by 2029, growing at a CAGR of 16.53% during the forecast period (2024-2029).

Maintaining cleanliness is essential in all places, especially in hospitals. Around 50% to 70% of hospital-acquired infections (HAI) are spread through contaminated hands. Smart cleaning can help identify common touchpoints in hospitals and find the right solutions to eradicate all germs. Smart cleaning in the healthcare sector is essential to reduce diseases and improve the hospital's hygiene.

Key Highlights

- The hospitality industry increasingly utilizes robotic technology to improve operations and enhance the guest experience. For instance, the Garden City Hotel in New York adopted Whiz by SoftBank Robotics' artificial intelligence (AI)-driven platform. The hotel staff claims it is convenient to use as they can keep the banquet hall furniture on one side and deploy Whiz to clean the carpets.

- In January 2023, Mero Technologies Inc received a fund of USD 1.5 million from the Canadian Government through the Jobs and Growth Fund. Mero offers smart cleaning solutions for commercial buildings to help measure building occupancy and cleanliness, helping tenants return to work safely. The funding will help Mero to expand its smart cleaning platform efforts into Western Canada and the US.

- The past two years saw a significant upheaval in the cleaning sector as the COVID-19 pandemic accelerated this transformation. The trend of smart cleaning became a necessity as it was a powerful incentive to get workers back into the office. Data-driven smart cleaning made it more efficient than ever for providers to offer a high-quality service that satisfies their customers. AI-integrated smart cleaning solutions enabled more efficient cleaning of meeting rooms and workspaces.

- Data security and protection will be a significant challenge for smart cleaning companies. Smart cleaning functions on data collected by sensors and protecting this data from breaching activities are equally important. For instance, a hacker can access the cameras of a cleaning robot and, in this way, gain knowledge of the internal floor plans of a building.

Smart Cleaning And Hygiene Market Trends

Robotic Vacuum Cleaner Holds Significant Market Share

- The robotics market is expected to reach USD 100 billion by 2027. The integration of AI allows robots to navigate their environment. ICE developed robots that use mapping and laser technology to clean complex environments. Staffing may be challenging due to expensive night shifts and unsociable hours, which consume a lot of ineffective management time. Adopting robotic techniques for cleaning can save expenses and improve time management. Start-up costs may be high, but they are cost-effective once the robots are used.

- Robot vacuum cleaners are the world's most widely produced and sold robots for domestic tasks. The cleaning expert Roomba specializes in vacuum cleaning, featuring a great built-in automatic adjustment between floor types and vital cleaning functions to pick up pet hair.

- In June 2022, Eufy by Anker launched the Robovac G20, which runs on ultra-pack dust compression technology and offers four suction modes, increased airflow, and quiet operation around the house. It efficiently utilizes the attached dust box and can detect when extra vacuuming power is needed.

- In May 2022, Haier launched the 2-in-1 dry & wet mop Robot Vacuum Cleaner in the Indian subcontinent. The company claims the robot can forcefully clean all floor types, avoiding obstructions and preventing damage and scratches.

Asia-Pacific to Witness Highest Growth

- The Asia-Pacific (APAC) region is the fastest-growing artificial intelligence (AI) market globally. By 2023, APAC's investments in new technologies, including AI, are anticipated to account for 40% of its total information communication technology (ICT) investments. AI and ML are causing significant disruptions and transforming the technological landscape in almost every industry domain. The cleaning industry is gradually catching up to adopt this change.

- China and Japan are among the largest suppliers of industrial robots, and they are commercializing research domains for AI. China is investing and promoting projects such as 'Made in China 2025,' 'Action Outline for Promoting the Development of Big Data,' and 'Next Generation Artificial Intelligence Development Plan.'

- India also initiated a National AI Strategy under its NITI Aayog policy to guide the research and development of emerging AI technologies. The growing startup culture in India influenced the growth of AI in the country.

- According to a recent Workplace Smart Cleanliness Study, 75% of workers in Singapore believe that robots are an ideal complement to janitorial staff in ensuring the cleanliness of their workspace.

- SoftBank Robotics partnered with Infogrid to launch the Whiz cleaning robot. Whiz's smart AI cleaning with real-time data on indoor air quality using Infogrid sensors and its analytical dashboard can eliminate the fear of transmission of airborne viruses in the office.

Smart Cleaning And Hygiene Industry Overview

There is moderate competition in the smart cleaning and hygiene market. Many facility management platforms and tech-based cleaning service providers are experts in cleaning and disinfecting and are gaining momentum with new product launches, partnerships, and acquisitions. Some significant players offering services in this sector include Neato Robotics, iRobot Corporation, Ecovacs Robotics Co. Ltd, LG Electronics, and more.

- In March 2023, the German cleaning solutions company Karcher began manufacturing more consumer cleaning machines in India to double its production capacity. Karcher offers customers machines that can clean while saving energy and conserving resources. Karcher India includes 13 branches and owns 19 service points throughout India with trained sales and service staff.

- In February 2023, Obode, the smart cleaning solution provider, extended its footprint in North America by launching its smart vacuum robot series. The vacuum robot can self-clean its mop pads, warding off mold and bad smells. The products are integrated with LiDAR technology that identifies different surface types and then applies proper vacuuming, mopping, edge cleaning, and complete mapping functions as needed. It moves seamlessly across rooms and can intelligently switch between sweeping and mopping for safe and effective floor cleaning.

- In October 2022, Softbank Robotics America (SBRA) collaborated with Gausium, a leading autonomous cleaning and service robot solution provider, to distribute indoor automated robotic solutions to the US market. The partnership aims to help clients adopt, integrate, and scale robotic solutions within their organizations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Distribution Channel Analysis (Online vs Offline)

- 4.4 Market Drivers

- 4.4.1 Changing Consumer Preferences and Socio-economic Factors Along with Reduced Unit Prices

- 4.5 Market Restraints

- 4.5.1 Security Concern and Prevailing Pandemic Disrupt Supply Chain Activities

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Robotic Vacuum Cleaner

- 5.1.2 Pool Cleaning Robot

- 5.1.3 Window Cleaning Robot

- 5.1.4 Other Hygiene-based Products

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ecovacs Robotics Co. Ltd

- 6.1.2 Roborock Technology Co. Ltd

- 6.1.3 LG Electronics Inc.

- 6.1.4 iRobot Corporation

- 6.1.5 Cecotec Innovaciones SL

- 6.1.6 Neato Robotics Inc.

- 6.1.7 Electrolux AB

- 6.1.8 SharkNinja Operating LLC

- 6.1.9 Panasonic Corporation

- 6.1.10 Haier Group Corporation

- 6.1.11 Hitachi Ltd

- 6.1.12 Samsung Electronics Co. Ltd