|

市场调查报告书

商品编码

1438482

清洁机器人:全球市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Cleaning Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

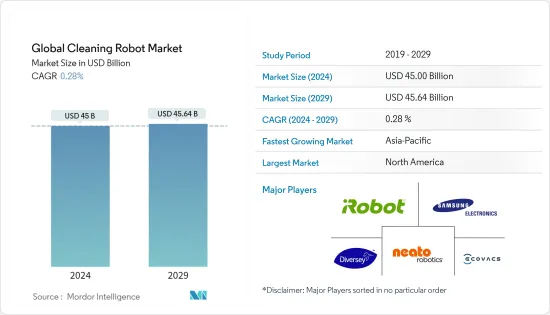

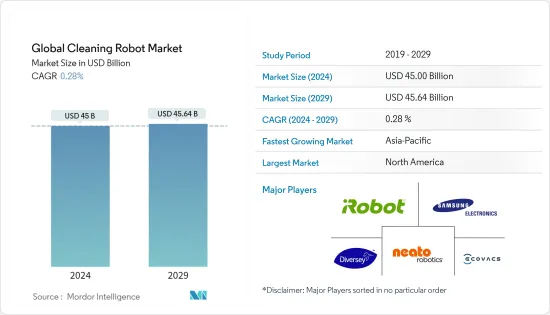

预计2024年全球清洁机器人市场规模为450亿美元,预计2029年将达456.4亿美元,预测期间(2024-2029年)复合年增长率为0.28%。

推动机器人扩展到多种应用的主要因素是电子、技术的进步和人类生活方式的变化。智慧家电的日益普及导致了家用和工业清洁机器人的扩展。

主要亮点

- 推动所研究市场发展的主要因素包括家庭消费机器人的需求不断增长以及个人服务机器人研发投资的增加以支持各种家庭应用,我可以列出来。

- 此外,人事费用上升和安全问题正在加速市场扩张。清洁机器人有多种用途,包括清洁窗户、地板和游泳池。机器人清洁减少了人力,节省了金钱、时间和电力。

- 受疫情影响,自主清洁消毒机器人在医院广泛使用。他们使用的紫外线可以消灭细菌。当医护人员评估患者是否患有晚期感染疾病时,配备机械臂的 AMR 可以进行简单的诊断,例如测量患者的体温,从而最大限度地减少接触。

- 然而,对大多数人来说,市场扩张的主要障碍是实施清洁机器人的成本。预计吸尘机器人将取代传统吸尘器,因为它们可以自动化人类任务并节省电力。与吸尘器相比,清洁机器人的成本较高,预计其推广将受到阻碍。

- 由于 COVID-19 第一阶段期间全球范围内的封锁和众多製造设施的关闭,该行业的供应链经历了研究中断。然而,由于COVID-19的影响,市场需求和生产已开始復苏。研究的市场反映了半导体产业的发展方向。为了因应封锁带来的工作时间减少,汽车、国防、航太、工业和电气等最终用户产业已经开始使用自主机器人。

清洁机器人市场趋势

泳池清洁机器人在商业和住宅领域的使用预计将大幅成长。

- 由于家庭和国内行业对泳池清洁自动化的需求,预计泳池清洁机器人市场在预测期内将大幅扩张。人们不断变化的城市生活方式是推动市场扩张的关键因素。人们有更多的钱可以花,需要一个住宅泳池来维持他们的奢华。然而,保持你的收藏清洁和维护可能会很痛苦。因此,人们正在寻找这些问题的自动化解决方案。

- 泳池清洁机器人可以擦洗表面以去除污垢和碎片。还有自动化功能。手动清洁泳池需要大量的精力和时间。随着泳池清洁机器人的发明,清洁过程变得更容易。

- 泳池清洁机器人是传统泳池清洁工具的更现代、更有效、更实惠的替代品。它们在几乎没有人类帮助的情况下从水池中收集垃圾和淤泥。因此,这些机器人所提供的优势可望推动国内清洁机器人市场的扩大。

- 包括美国、欧洲国家、印度和中国在内的世界各国的国内住宅建设业务持续復苏。由于可支配收入的增加以及住宅和居民区对大型泳池设施的需求,全球范围内对泳池清洁机器人的需求正在增加。

- 预计住宅和商业环境中泳池清洁机器人的使用将会增加。由于豪华酒店行业的扩张以及用于培训的泳池数量的增加,预计泳池清洁机器人的市场使用量将会增加。

预计亚太地区的采用率将达到最高

- 预计在预测期内,亚太地区清洁机器人的采用率最高。消费者可支配收入的逐步增加和生活方式的快速变化是该地区市场扩张的主要驱动力。

- 技术进步、永续性问题和有吸引力的经济状况推动了清洁机器人在中国的快速扩张。此外,客户越来越愿意为清洁机器人改进的某些产品功能支付更多费用。中国经济的快速成长和生活水准的提高增加了对所研究产业的需求。

- 此外,主要企业正在扩大其在新国家的足迹,以获取尽可能大的市场占有率。例如,2021年12月,创建和製造家用机器人吸尘器的中国新兴企业Uoni发布了其最新型号V980 plus+,该型号可以长时间吸尘和拖地,无需人工干预。

- 为了增加市场占有率和覆盖范围,该地区的公司正在引进最新的技术先进的清洁机器人。该地区清洁机器人的采用仍处于早期阶段,因此供应商应该有一些潜力。

- 中国扫地机器人製造商正专注于海外扩张,以应对不断增长的全球需求。例如,北京石头科技2021年上半年出口收益年增124%至12.6亿元。此收入来源约占公司总收益的一半。

- 此外,2021年3月,小米旗下的扫地机器人企业石头扫地宣布推出全新T7S系列,包括三款吸尘器:T7S、T7S Plus和带自动集尘和充电底座的T7S。石头扫地机器人T7S采用RR Mason演算法,对Zigzag演算法进行了改进,减少了重复次数,提高了效率。诸如此类的产品设计进步将增加清洁机器人产业的需求,并使其获得该领域的市场占有率。

清洁机器人产业概况

清洁机器人市场的竞争格局非常明显,业界不仅有许多厂商,还有新的竞争对手带着新产品和解决方案进入市场并获得市场占有率。儘管清洁机器人仍处于开发阶段,但一些老牌公司和新兴企业已经开始研究并与各种电子元件供应商合作,提供整合所有关键技术的有效清洁设备。

- 2022年8月-智慧家庭机器人公司、地宝吸拖一体机器人製造商科沃斯推出地宝OZMO T8,这是机器人T8系列的最新成员。地宝 T8 继三月推出 T8 AIVI 后加入 T8 系列,是采用先进物体侦测技术的 ECOVACS 家用清洁机器人系列的最新成员。

- 2021年3月,小米在印尼推出了一款「机器人」吸尘器。该设备配备了一个连接到MI Home应用程式的智慧型控制。用户可以使用应用程式直接从智慧型手机控制产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代产品的威胁

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 增加在专业环境中维持高卫生标准的奖励

- 医疗保健专业服务的高需求

- 市场挑战

- 与传统手动设备相比,拥有成本较高,效率较低

第六章市场区隔

- 按用途

- 家用/家用机器人

- 地板吸尘器

- 泳池清洁

- 其他清洁

- 专业机器人

- 清洁地板

- 清洗储槽、管道和管道

- 其他用途

- 家用/家用机器人

- 按地区

- 美洲

- 欧洲、中东/非洲

- 亚太地区

第七章 竞争形势

- 公司简介

- Domestic Robot Cleaners

- Ecovacs Robotics Co. Ltd

- Roborock Technology Co. Ltd

- LG Electronics Inc.

- iRobot Corporation

- Cecotec Innovaciones SL

- Neato Robotics Inc.

- Electrolux AB

- SharkNinja Operating LLC

- Panasonic Corporation

- Haier Group Corporation

- Hitachi Ltd

- Samsung Electronics Co. Ltd

- Xiaomi Group

- Professional Robot Cleaners

- AzioBot BV

- Softbank Robotics

- Karcher

- Avidbots Corp.

- Minuteman International

- Diversey Holdings

- Tennant Company

- Nilfisk A/S

- ICE Cobotics

- Domestic Robot Cleaners

第八章投资分析

第9章 未来趋势

The Global Cleaning Robot Market size is estimated at USD 45 billion in 2024, and is expected to reach USD 45.64 billion by 2029, growing at a CAGR of 0.28% during the forecast period (2024-2029).

The key forces driving the expansion of robots for diverse applications are electronic progress, technology, and changing human lifestyles. Cleaning robotics for household and industrial usage is expanding because of the increased adoption of smart home appliances.

Key Highlights

- Some key factors propelling the development of the market under study include the rising demand for domestic consumer robots and the increasing investment in R&D of personal service robots for assistance in various home applications.

- Additionally, rising labor costs and safety concerns have accelerated the market expansion. Cleaning robots have several uses, including cleaning windows, floors, and swimming pools. Robotic cleaning reduces the amount of labor required from humans and saves money, time, and electricity.

- Hospitals used autonomous cleaning and disinfection robots extensively due to the pandemic. The UV light they use can eradicate bacteria. While the medical personnel evaluates whether a patient has a highly infectious disease, simple diagnostics like taking a patient's temperature are carried out by AMRs with robotic arms to minimize touch.

- However, for most people, a big barrier to the market's expansion is the expense of deploying cleaning robots. Since cleaning robots automate human labor and save electricity, they are predicted to displace the conventional vacuum cleaner. The adoption of cleaning robots is anticipated to be hampered by the higher costs incurred compared to a vacuum cleaner.

- Due to lockdowns and the closing of numerous manufacturing facilities worldwide during the first phase of COVID-19, the supply chain in the industry experienced study interruption. However, during COVID-19, the market began to experience a recovery in demand and output; the market under study reflected the direction of the semiconductor industry. To address the reduced working hours brought on by the lockdowns, end-user sectors such as automotive, defense and aerospace, industrial, and electrical started using autonomous robots.

Cleaning Robot Market Trends

Use of Pool Cleaning Robot in Commercial and Domestic Sectors Expected to Grow Significantly

- Due to the demand for automation in pool cleaning across the home and domestic sectors, the pool cleaning robot market is anticipated to expand significantly during the forecast period. People's evolving urban lifestyles are a key factor fueling the market's expansion. People have more money to spend, and maintaining luxury requires residential pools. However, keeping a collection clean and maintained is laborious; thus, people are searching for an automated solution to these problems.

- Robotic cleaners for pools can scour the surface and remove dirt and debris. They also have automated features. Pool cleaning by hand is labor-intensive and time-consuming. The invention of pool cleaning robots has made the cleaning procedure simpler.

- Pool cleaning robots are a more modern, effective, and affordable alternative to conventional pool cleaning tools. They do so with little human assistance, collecting debris and silt from pools. Therefore, it is anticipated that the advantages provided by these robots would fuel the expansion of the cleaning robot market in domestic sectors.

- The Domestic residential construction business has continued to recover in the United States, European nations, India, China, and others worldwide. The need for pool cleaning robots is rising globally due to increasing disposable income and the desire for large facilities in residential and domestic areas with swimming pools.

- Robotic pool cleaner usage is anticipated to rise in residential and commercial settings. The market usage of pool cleaning robots is expected to increase due to the expansion of the upscale hotel sector and the rise in the number of swimming pools used for training.

Asia-Pacific Expected to Exhibit Maximum Adoption

- Cleaning robot adoption is anticipated to be highest in the Asia-Pacific region over the projected period. The progressive increase in customers' disposable income and the quick shift in their lifestyles are the main drivers of market expansion in the area.

- China's rapid expansion of cleaning robots was fueled by technological progress, concerns about sustainability, and alluring economics. Additionally, customers are increasingly willing to pay more for specific product features that cleaning robots have improved. China's rapid economic growth and rising standard of living have increased demand for the industry under study.

- Additionally, the top players are increasing their footprint in new nations to capture the largest possible market share. For example, in December 2021, Uoni, a Chinese start-up that creates and produces robotic vacuum cleaners for homes, unveiled its most recent model, the V980 plus+, which can sweep and mop for lengthy periods without requiring human intervention.

- To increase their market share and reach, businesses in the area are introducing brand-new, technologically advanced cleaning robots. The adoption of cleaning robots in the region is still in its early stages, so vendors should have access to several possible chances.

- Chinese producers of robotic vacuum cleaners are making an effort to go abroad in response to rising worldwide demand. For instance, Beijing Roborock Technology Co. Ltd.'s export revenue climbed by 124% yearly to CNY 1.26 billion in the first half of 2021. This source accounts for around half of the company's total revenue.

- Additionally, in March 2021, the robotic vacuum cleaner business Roborock, which Xiaomi owns, announced its new T7S lineup, which consists of three vacuum cleaners: the T7S, T7S Plus, and T7S with Automatic Dust Collection and Charging Dock. The Roborock T7S uses the RR Mason algorithm, which improves the zigzag algorithm by cutting down on repetition and increasing efficiency. Such advancements in product design will boost demand for the cleaning robots industry and allow them to gain market share in the area.

Cleaning Robot Industry Overview

Due to the existence of various vendors in the industry, as well as new competitors entering the market with new products and solutions and gaining market share, the competitive environment of the cleaning robot market is significant. Even though the cleaning robot is still in development, some established businesses and start-ups have started doing research and teaming up with different suppliers of electronic components to offer effective cleaning equipment that is integrated with all the key technologies.

- August 2022 - Smart home robotics company and makers of the DEEBOT vacuuming and mopping in-one-go robots, ECOVACS, has launched the newest member of their T8 series of robots - the DEEBOT OZMO T8. The DEEBOT T8 joins the T8 family following the launch of the T8 AIVI in March and is the latest in ECOVACS home cleaning robotics to leverage advanced technology for object detection. I

- March 2021 - Xiaomi introduced the 'Robot' Vacuum Cleaner in Indonesia. The device comes with a smart control that connects to the MI Home app. Users might control the product directly from their smartphones using the app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Incentive to Maintain High Hygiene Standards in Professional Environments

- 5.1.2 High Demand from Professional Services in Healthcare

- 5.2 Market Challenges

- 5.2.1 High Cost of Ownership Paired with a Lower Efficiency Compared to Traditional Manual Equipment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Domestic/Household Robots

- 6.1.1.1 Vacuum Floor Cleaner

- 6.1.1.2 Pool Cleaning

- 6.1.1.3 Other Cleaning

- 6.1.2 Professional Robots

- 6.1.2.1 Floor Cleaning

- 6.1.2.2 Tank, Tube, and Pipe Cleaning

- 6.1.2.3 Other Applications

- 6.1.1 Domestic/Household Robots

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East & Africa

- 6.2.3 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Domestic Robot Cleaners

- 7.1.1.1 Ecovacs Robotics Co. Ltd

- 7.1.1.2 Roborock Technology Co. Ltd

- 7.1.1.3 LG Electronics Inc.

- 7.1.1.4 iRobot Corporation

- 7.1.1.5 Cecotec Innovaciones SL

- 7.1.1.6 Neato Robotics Inc.

- 7.1.1.7 Electrolux AB

- 7.1.1.8 SharkNinja Operating LLC

- 7.1.1.9 Panasonic Corporation

- 7.1.1.10 Haier Group Corporation

- 7.1.1.11 Hitachi Ltd

- 7.1.1.12 Samsung Electronics Co. Ltd

- 7.1.1.13 Xiaomi Group

- 7.1.2 Professional Robot Cleaners

- 7.1.2.1 AzioBot BV

- 7.1.2.2 Softbank Robotics

- 7.1.2.3 Karcher

- 7.1.2.4 Avidbots Corp.

- 7.1.2.5 Minuteman International

- 7.1.2.6 Diversey Holdings

- 7.1.2.7 Tennant Company

- 7.1.2.8 Nilfisk A/S

- 7.1.2.9 ICE Cobotics

- 7.1.1 Domestic Robot Cleaners