|

市场调查报告书

商品编码

1436005

货柜运输:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Container Shipping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

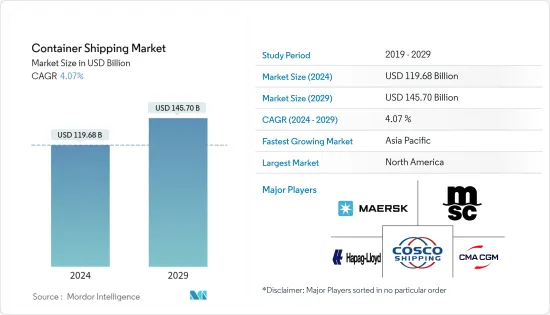

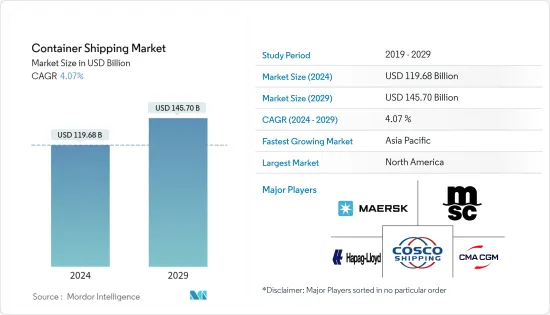

预计2024年货柜运输市场规模为1,196.8亿美元,预计2029年将达到1,457亿美元,在预测期内(2024-2029年)复合年增长率为4.07%。

主要亮点

- 在货运量萎缩对市场结构性失衡带来进一步挑战的同时,货柜运输业变得更加自律,增加运力并降低成本以维持盈利。根据全球最大的两家货柜运输公司穆勒-马士基和达飞轮船报道,全球货柜运输正从疫情中强劲復苏。

- 流量增加的原因是,随着各种封锁措施的放鬆,全球经济活动復苏,支持计画刺激了一些地区的商品消费势头,以及库存重建导致电子商务强劲增长。 ,以及商业活动的正常季节性波动。

- 船舶货物运输需求的增加和贸易相关协议的激增等因素正在补充货柜市场的成长。此外,运输和库存成本的波动也阻碍了货柜市场的成长。然而,海上运输自动化的预期趋势和海上安全标准的提高等因素预计将为预测期内的货柜市场提供成长机会。

- 铁路货运和卡车运输业的货柜运输也存在巨大潜力。但受部分国家贸易保护主义政策、货柜运输运费上涨等因素影响,成长可能会受到一定程度的限制。此外,有关使用水性涂料的环境法规可能会导致额外的成本。

货柜运输市场趋势

海上贸易增加

- 在海上货物贸易中,由于货物安全和成本效益等因素,对水路货物运输的需求正在迅速增加。货船运输货物比公路或航空运输便宜。船舶可以在更短的时间内将更多的货物从一个地方运送到另一个地方。

- 船舶运输了全球 80% 以上的贸易,因此港口和航线的中断可能会导致食品、能源、药品和其他必需品无法到达有需要的人手中。企业面临供应短缺。生产者和消费者的价格将会上涨。

- 消费者支出(尤其是网路订购的商品)激增,加上供应链中断和物流限制,导致 2021 年货柜运费比大流行前高出五倍。货柜运输成本飙升,在2022年初达到顶峰,目前大幅上涨。许多商品的消费者价格。

- 所有发展中地区均出现成长。非洲预计成长5.63%,拉丁美洲和加勒比海地区成长3.2%,亚洲成长3.1%,2021年,其装载量占42.4%,卸货量占64.5%,仍然是世界领先的海上货物装卸中心。

- 此外,世界各国货柜船数量的增加和港口容量的增加也增加了市场对新货柜运输的需求。

亚太地区主导市场

- 2021年,亚洲仍是全球领先的海运货物处理中心,占出口量的42%和进口量的64%。

- 2021年,约40%的货柜贸易总量发生在亚洲、欧洲和美国之间的主要东西航线上。当地以外的东西航线,如南亚-地中海,占12.9%。

- 货柜航线的整体表现也取决于贸易方向(头程或回程传输)。跨太平洋航线流量成长15%,其中东亚至北美尖峰时段成长20%。同时,回程传输贸易量下降了 1.6%。受东亚至欧洲贸易量成长(14.7%)的推动,亚欧航线贸易量增加了10%。

- 2021年,亚洲货柜出口国排名前五,几乎占出货量的一半,包括中国、越南、韩国和日本。

- 铁矿石贸易高度依赖中国发展,2021年贸易额仅成长1%。中国约占全球铁矿石进口量的73%,比例高于疫情前的水准。根据运输情报报告,亚太地区仍然是合约物流成长最快的地区,预计市场价值将从 2021 年的 950 亿欧元增长到 2026 年的 1,350 亿欧元。亚太地区合约物流市场占有率预计将从2021年的39.8%增加到2026年的44.8%,而欧洲和北美的市场占有率预计将下降。

- 预计货柜运输市场的大部分贡献将来自中国和印度的零售业,并得到线上市场、中国汽车工业和印度製药业的支持。同时,高科技电子产品出口商可能会利用外部需求来推动成长。

货柜运输业概况

货柜运输市场本质上高度分散,市场上有许多国际公司。该领域的主要企业包括马士基、MSC、CMA、COSCO 和 Hapag Lloyd。由于汽车价格高和规模经济不断成长,进入障碍高,影响了产业竞争。

行业结构也受到严格的国际政府法规和需求週期性的影响。航运公司正在明智地投资新资产,以确保客户的可靠性和效率,并获得良好的投资收益。

由于 COVID-19 造成的运输感染疾病,快递公司意识到整合在节省成本和永续性方面的好处。预计海上运输的自动化趋势和不断提高的海上安全标准也有望在未来几年为市场相关人员创造机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析调查方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 国际贸易量增加

- 国家间贸易协定的兴起

- 抑制因素

- 燃料成本上涨影响市场

- 贸易紧张局势加剧

- 机会

- 市场技术进步

- 世界贸易的扩大

- 促进因素

- 价值链/供应链分析

- 行业政策法规

- 物流领域技术发展

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对市场的影响

- 市场最终用户洞察

第五章市场区隔

- 按尺寸

- 小容器

- 大货柜

- 高立方容器

- 按类型

- 一般货柜运输

- 冷藏货柜运输

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 印度

- 新加坡

- 马来西亚

- 印尼

- 泰国

- 其他亚太地区

- 中东和非洲

- 埃及

- 卡达

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 南美洲

- 巴西

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 市场集中度概况

- 公司简介

- AP Moller-Maersk AS

- MSC Mediterranean Shipping Company SA

- CMA CGM

- China COSCO Holdings Company Limited

- Hapag-Lloyd

- ONE(Ocean Network Express)

- Evergreen Line

- Wan Hai Lines

- Zim

- SITC

- Zhonggu Logistics Corp.

- Antong Holdings(QASC)*

第七章 市场的未来

第8章附录

The Container Shipping Market size is estimated at USD 119.68 billion in 2024, and is expected to reach USD 145.70 billion by 2029, growing at a CAGR of 4.07% during the forecast period (2024-2029).

Key Highlights

- While the contraction of cargo volumes brought an additional challenge to structural market imbalance, the container shipping industry adopted more discipline, capacity, and reduced costs to maintain profitability. Global container shipping is showing a strong recovery, leaving behind the pandemic, as reported by AP Moller-Maersk and CMA-CGM (the world's two largest container shipping lines).

- The increase in volumes transported was due to the pick-up in global economic activity following the easing of various lockdown measures, the strong momentum in terms of the consumption of goods encouraged in some locations by support packages, strong e-commerce growth with inventory rebuilding, and the usual seasonal variation in business activity.

- Factors such as the increase in demand for cargo transportation through ships and the surge in trade-related agreements supplement the growth of the shipping container market. Moreover, fluctuations in transportation and inventory costs hamper the growth of the shipping containers market. However, factors such as the anticipated trend of automation in marine transportation and an increase in marine safety norms are expected to provide opportunities for the growth of the shipping containers market during the forecast period.

- There also exists a huge potential for shipping containers in the rail freight and trucking industry. However, factors such as protectionist measures by some nations and high freight rates in the transportation of containerized goods are likely to restrain the growth up to some extent. In addition, the environmental regulations on using water-based coatings are also likely to incur some extra costs.

Container Shipping Market Trends

Increasing Seaborne Trade

- The seaborne cargo trade is experiencing an upsurge in demand for cargo transportation through waterways backed by factors like cargo safety and cost-effectiveness. Cargo ships are less expensive for shipping goods than road and air transits. Ships can carry more cargo from one place to another within a short period.

- Ships deliver over 80% of world trade, so disruptions in ports and shipping lanes mean food, energy, medicine, and other essential items don't reach those in need. Businesses are left without supplies. And prices for producers and consumers soar.

- A surge in consumer spending - especially for goods ordered online - combined with supply chain disruptions and logistics constraints pushed container freight rates to five times their pre-pandemic levels in 2021. The surge in container shipping costs, which peaked in early 2022, sharply increased consumer prices for many goods.

- Growth was recorded in all developing regions. It increased by an estimated 5.63 % in Africa, 3.2 % in Latin America and the Caribbean, and 3.1 %in Asia, which remained the world's leading maritime cargo handling center, accounting for 42.4 % of goods loaded and 64.5 % of those unloaded in 2021.

- Additionally, the growing number of container ships and an increase in the port capacity in countries throughout the world are propelling the demand for new container shipping in the market.

Asia-Pacific is dominating the Market

- Asia remained the world's leading maritime cargo handling center in 2021, accounting for 42% of exports and 64% of imports.

- In 2021, around 40% of total containerized trade was between Asia, Europe, and the United States on the main East-West routes. Non-mainland East-West routes such as South Asia-Mediterranean accounted for 12.9%.

- Performance across container shipping lanes also varied depending on the direction of trade - head haul or backhaul. Volumes on the Transpacific route increased by 15%, reflecting a 20% growth on the peak East Asia to North America. Meanwhile, trade on the backhaul journey fell by 1.6%. Trade on the Asia-Europe route increased by 10%, supported by growing volumes from East Asia to Europe (14.7%).

- In 2021, Asian container exporters were among the top five, accounting for almost half the traffic, and included China, Vietnam, the Republic of Korea, and Japan.

- Trade in iron ore depends heavily on developments in China, and in 2021, it grew only marginally by 1%. China accounted for about 73% of world iron ore imports - a share above the pre-pandemic level. Asia-Pacific is expected to remain the fastest-growing region for contract logistics, growing from a market worth EUR 95 Billion in 2021 to EUR 135 Billion in 2026, according to a report by Transport Intelligence. Asia Pacific's share of the contract logistics market is expected to grow from 39.8% in 2021 to 44.8% in 2026, while Europe and North America are expected to see a contraction in market share.

- Most of the container shipping market contribution is expected to come from retail in China and India, supported by online marketplaces, automotive in China, and pharma in India. At the same time, exporters of high-tech electronics will take advantage of external demand to push forward growth.

Container Shipping Industry Overview

The container shipping market is fairly fragmented in nature, with the presence of many international companies in the market. The top players in the segment include Maersk, MSC, CMA, COSCO, and Hapag Lloyd. High barriers to entry due to the high cost of vehicles and increasing economies of scale affect competition in the industry.

The industry structure is also affected by strict international government regulations and demand cyclicality. Shipping firms are making judicious investments in new assets to guarantee reliability and efficiency to their customers and earn superior returns on their investments.

Due to shipping congestions during COVID-19, the shipping companies realized the benefits of consolidation in ways of cost reduction and sustainability. The anticipated trend of automation in marine transportation and the rise in marine safety norms are also expected to create opportunities for market players in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing volume of International Trade

- 4.2.1.2 The rise of trade agreements between nations

- 4.2.2 Restraints

- 4.2.2.1 Surge in fuel costs affecting the market

- 4.2.2.2 Increasing trade tension

- 4.2.3 Opportunities

- 4.2.3.1 Technological advancements in the market

- 4.2.3.2 Expanding global trade

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Industry Policies and Regulations

- 4.5 Technological Developments in the Logistics Sector

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

- 4.8 Insights into End Users in the Market

5 MARKET SEGMENTATION

- 5.1 By Size

- 5.1.1 Small Containers

- 5.1.2 Large Containers

- 5.1.3 High Cube Containers

- 5.2 By Type

- 5.2.1 General Container Shipping

- 5.2.2 Reefer Container Shipping

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 India

- 5.3.3.5 Singapore

- 5.3.3.6 Malaysia

- 5.3.3.7 Indonesia

- 5.3.3.8 Thailand

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Egypt

- 5.3.4.2 Qatar

- 5.3.4.3 Saudi Arabia

- 5.3.4.4 United Arab Emirates

- 5.3.4.5 South Africa

- 5.3.4.6 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Colombia

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 A. P. Moller-Maersk AS

- 6.2.2 MSC Mediterranean Shipping Company SA

- 6.2.3 CMA CGM

- 6.2.4 China COSCO Holdings Company Limited

- 6.2.5 Hapag-Lloyd

- 6.2.6 ONE (Ocean Network Express)

- 6.2.7 Evergreen Line

- 6.2.8 Wan Hai Lines

- 6.2.9 Zim

- 6.2.10 SITC

- 6.2.11 Zhonggu Logistics Corp.

- 6.2.12 Antong Holdings (QASC)*