|

市场调查报告书

商品编码

1437340

视讯编码器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Video Encoder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

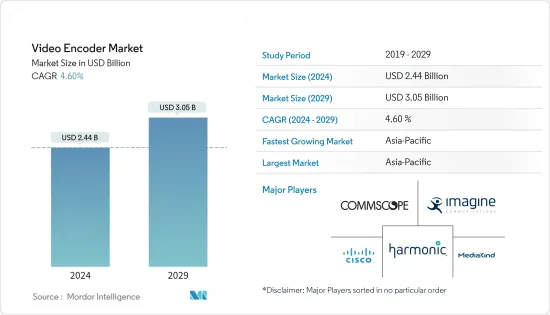

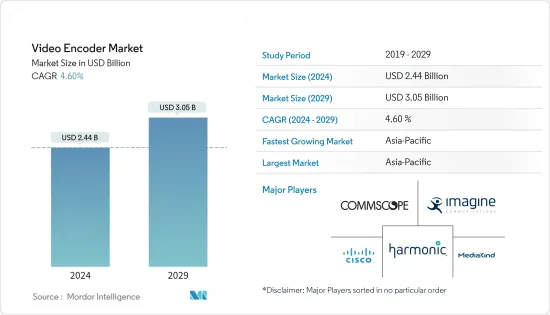

视讯编码器市场规模预计到 2024 年为 24.4 亿美元,预计到 2029 年将达到 30.5 亿美元,预测期内(2024-2029 年)复合年增长率为 4.60%。

随着内容创作者数量的增加,对影片编码器的需求保持一致。由于病毒的传播,IPTV产业正在快速成长。此外,自疫情以来,视讯编码器市场持续成长。 COVID-19感染疾病导致影片消费量显着增加,尤其是 VOD 内容。

主要亮点

- 视讯编码器将类比或数位视讯转换为另一种数位视讯格式并将其传送到解码器。视讯编码器将 SDI 作为未压缩的数位视讯讯号输入到 H.264 或 HEVC 进行电视广播。这些编码器专为 ISR 和 IPTV 设计,通常接受模拟复合视讯、SDI 或乙太网路以及特定于应用程式的元资料,透过无线或基于 IP 的网路传输到各种显示或储存设备。储存设备。

- 对视讯进行编码的目的是创建将透过网路传输的数位副本。广播公司可以根据其串流媒体目标和预算在硬体和软体编码器之间进行选择。大多数专业广播公司都使用硬体编码器,但由于价格较高,大多数入门级到中级广播公司都使用直播编码器软体。

- 此外,美乐威于 2021 年 1 月推出了全新的 Ultra Encode 系列通用直播媒体编码器,支援广泛的专业应用、直播、基于 IP 的製作以及对 AV-over-IP 的远端贡献。

- 硬体编码器和软体编码器的工作原理类似,获取原始视讯檔案并将其转换为数位檔案。硬体编码设备仅用于编码,而软体编码器与电脑的作业系统配合使用。所以编码不是主要功能。软体编码器具有图形介面,可让您管理转换过程并控制位元率和流品质等元素。

- 串流传输是一种透过网路传送资料的方法,无需最终用户完全下载资料。直播是另一个透过网路即时传输的串流,无需录製或储存。

- 近年来,视讯串流平台经历了快速增长,尤其是在疫情期间。随着人们花在网路上的时间越来越多,这种成长幅度甚至更大。例如,根据电讯(ITU) 的数据,在新型冠状病毒肺炎 (COVID-19) 大流行期间,网路用户数量从 2019 年的 41 亿增加到 2021 年的 49 亿。

视讯编码器市场趋势

视讯串流平台的日益普及预计将推动市场成长

- 串流传输是一种透过网路传送资料的方法,无需最终用户完全下载资料。即时串流媒体是另一种类型,其中串流透过互联网即时传输,而无需先录製和储存。

- 近年来,视讯串流平台经历了快速增长,尤其是在疫情期间。随着人们花在网路上的时间越来越多,这种成长幅度甚至更大。例如,根据电讯(ITU) 的数据,在新型冠状病毒肺炎 (COVID-19) 大流行期间,网路用户数量从 2019 年的 41 亿增加到 2021 年的 49 亿。

- 除了娱乐之外,远距教育、远距工作、远距医疗服务也是使用者数量快速成长的重点领域。远距工作文化预计未来将以某种形式继续存在,对视讯串流平台的需求预计将持续下去。例如,根据 Upwork 的未来劳动力脉动报告,到 2025 年,将有 3,620 万美国人进行远距工作,比疫情前的水准增加 87%。

- 同样,根据 CNNIC 的数据,截至 2021 年 12 月,中国约有 4.69 亿员工使用线上服务在家工作,约占中国网路用户群的 45.4%。随着视讯串流平台的用户群达到新的高度,对视讯编码器的需求预计将会上升。例如,Netflix 表示,2021 年最后三个月其用户数量增加了 830 万人,年度用户总合成长至 1,820 万人。

- 此外,考虑到视讯串流平台的用户群不断增长,视讯编码市场的供应商越来越注重开发满足视讯串流平台供应商的各种要求的创新解决方案。例如,2022年6月,Skywire Broadcast与Kiloview合作推出专业高阶编码P系列视讯编码器设备。根据该公司介绍,新推出的编码器采用了 KiloLink 技术,这是 KiloView 专为解决连接不良问题而设计的专利演算法,非常适合音乐会、实况活动、现场转播等场景的户外使用,据说非常适合现场直播。串流媒体和传输。

预计亚太地区将占据最大的市场占有率

- 中国数位地面电视广播的出现改善了现有服务并为新应用铺平了道路。 DTT 广播标准可实现高画质电视和多个标准画质电视节目的广域固定接收。新服务还包括行动、穿戴式和高速应用程式。

- 中国政府也致力于改善人们的观看体验,并鼓励主要城市开始提供免费的地面电波高清电视广播内容。这将有助于推动地面电波市场和整个高清电视行业的成长,包括高清平板、晶片组、发射机、软体和内容製作。

- 根据 IBEF 2020 年 10 月的数据,印度预计到 2024 年将成为全球第六大 OTT 市场。该市场预计未来四年将以 28.6% 的复合年增长率成长,收益达到 29 亿美元。 Netflix、亚马逊和 Disney+Hotstar 等 OTT 服务对原创和收购内容的投资,推动订阅视讯点播占 OTT 总收益的 93%,2018 年增幅高达 30.7%。 2024年将达27亿美元。喀拉拉邦将推出 CSPACE,这是首批国有 OTT 平台之一。喀拉拉邦政府将于2022年11月设立Over-the-TopOTT平台,为电影爱好者提供各种短片和纪录片。

- 2021年6月,印度线上影片消费快速成长,占消费者网路流量的80%。然而,使用者体验因资料使用情况和网路速度而异。 MX Player 是第一批将视讯编码和压缩技术升级至 H.266(通用视讯编码)的 OTT 平台之一,可将串流视讯资料使用量减少一半以上。 H.266 允许 MX 播放器用户以更少的资料流传输内容,需要一半(或更少)的资料,从而带来更快的网路频宽和视讯串流加载,缓衝量也会减少。

- 该韩国组织开发视讯编码器解决方案以促进广播和串流媒体市场。例如,KT公司由于其在DTH领域的垄断地位以及在IPTV领域的强势地位(在IPTV领域占有最大份额),在订阅和监控方面领先于韩国付费电视服务行业。

- 近年来,由于技术的进步,能够录製和显示比高清电视(HDTV)分辨率更高的4K影片的相机、显示器和平板电脑等设备迅速普及。随着这些设备普及越来越普遍,人们对下一代视讯编码的期望越来越高,以便为日本的广播和网路分发提供高清视讯。 4K电视在家庭中越来越普及,各大电视製造商都推出了许多型号。

视讯编码器产业概况

视讯编码器市场竞争激烈且分散。这要归功于 Harmonic Inc.、CommScope Holding Company Inc. 和 MediaKind 等重要参与者。市场参与者正在采取产品创新、併购和策略合作伙伴关係等关键策略,以扩大产品系列扩大其地理覆盖范围。

- 2022 年 5 月 - Lutech SpA 和 Imagine Communications 计划推出新的 IP 视讯和音讯发布和配送网路「IP Matrix」。该计划可以受益于完全 IP、基于软体的网路所提供的弹性。它采用编码器,并且能够利用 Imagine 广泛部署的基于标准的 Selenio 网路处理器的功能。全新的贡献基础设施 Rai Way 专为视讯和音讯网路而设计,建立在 SNP 等尖端技术之上,结合了传统 SDI 和尖端 IP 领域的优点。

- 2022 年 3 月 - Globecast 和 Ateme 联手提供额外的安全选项。 Globecast 将采用 Ateme 开发的强大加密技术,以尽可能安全的方式保护上传到卫星的内容。透过采用 Ateme 编码器,服务供应商可以以最低的位元率和延迟提供最高的视讯质量,同时确保广播安全。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 视讯转码器及其演变分析

- VVC核准成立的公司名单

- 为 VVC 标准做出贡献的公司名单

- COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场动态

- 市场驱动因素

- 视讯串流平台日益普及

- 轻鬆整合硬体编码器和摄影机

- 云端视讯编码技术拉动需求

- 市场挑战

- 硬体视讯编码器初始成本高

第六章市场区隔

- 按用途

- 付费电视

- 有线视讯编码器

- 卫星视讯编码器

- IPTV视讯编码器

- 广播与数位地面电视 (DTT)

- 贡献视讯编码器

- 回程传输和分配视讯编码器

- DTT 视讯编码器

- 安全和监视

- 付费电视

- 按地区

- 美洲

- 美国

- 加拿大

- 巴西

- 墨西哥

- 其他美洲

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 中东和非洲

- 土耳其

- 以色列

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 美洲

第七章 竞争形势

- 公司简介

- Harmonic Inc.

- Commscope Holding Company Inc.

- MediaKind

- Cisco Systems Inc.

- Imagine Communications

- Z3 Technology

- ATEME

- Adtec Digital

- Telairity(VITEC)

- Axis Communications AB(Canon Inc.)

第八章投资分析

第9章市场的未来

The Video Encoder Market size is estimated at USD 2.44 billion in 2024, and is expected to reach USD 3.05 billion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

The demand for the video encoder is consistent, owing to the increasing number of content creators. As a result of the viral spread, the IPTV industry is growing rapidly. Furthermore, the market for video encoders has constantly been rising since the pandemic. The COVID-19 pandemic resulted in a large increase in video consumption, particularly VOD content.

Key Highlights

- Video encoders convert analog or digital video to another digital video format for delivery to a decoder. Video encoders input SDI as an uncompressed digital video signal into H.264 or HEVC for television broadcasting. These encoders are designed for ISR, and IPTV typically accepts analog composite video, SDI, or Ethernet, along with application-specific metadata, for transporting to different viewing or storage devices over a wireless or IP-based network for viewing via computer monitors or for being captured by storage devices.

- The purpose of encoding a video is to create a digital copy transmitted over the internet. Broadcasters can choose between a hardware or software encoder, depending on the purpose of the stream and the budget. Most professional broadcasters use hardware encoder, but due to the high price point, most beginner-level to mid-experienced broadcasters go with live streaming encoder software.

- In addition, in January 2021, Magewell launched its new Ultra Encode family of universal live media encoders, providing H.264, H.265, and NDI|HX encoding with multi-protocol support for a wide range of professional applications, live streaming, remote contribution to IP-based production, and AV-over-IP.

- Hardware and software encoders function similarly, taking RAW video files and converting them into digital files. Hardware encoding devices have the sole purpose of encoding, while software encoders work with a computer's operating system; thus, encoding is not the primary function. Software encoders have graphic interfaces to manage the conversion process and allow control over elements, such as bitrate and stream quality.

- Streaming is a method of delivering data over the internet without making end users fully download the data. Live streaming is another stream that is sent over the internet in real-time without being recorded and stored.

- In recent years, video streaming platforms have witnessed rapid growth, especially during the pandemic. The growth was even higher as people spent extended time on the internet. For instance, according to the International Telecommunication Union (ITU), during the COVID-19 pandemic, internet user rank increased to 4.9 billion in 2021, from 4.1 billion in 2019.

Video Encoder Market Trends

Increasing Popularity of Video Streaming Platforms is Expected to Drive the Market Growth

- Streaming is a method of delivering data over the internet without making end users fully download the data. Live streaming is another type wherein the stream is sent over the internet in real-time, without first being recorded and stored.

- In recent years, video streaming platforms have witnessed rapid growth, especially during the pandemic. The growth was even higher as people spent extended time on the internet. For instance, according to the International Telecommunication Union (ITU), during the COVID-19 pandemic, internet user rank increased to 4.9 billion in 2021, from 4.1 billion in 2019.

- In addition to entertainment, remote education, remote work, and remote health services were some of the major areas that witnessed a rapid growth in user count. With the remote working culture expected to continue in some form or other, video streaming platforms are expected to stay in demand. For instance, according to Upwork's 'Future of Workforce Pulse Report, by 2025, 36.2 million Americans will be working remotely, an 87% increase from pre-pandemic levels.

- Similarly, according to CNNIC, to work from home, around 469 million employees in China use online services, accounting for around 45.4% of the Chinese internet user base as of December 2021. With the subscriber base of video streaming platforms reaching new heights, the demand for video encoders is expected to witness an upward trend. For instance, according to Netflix, its subscriber base increased by 8.3 million in the last three months of 2021, with total subscriber growth for the year reaching 18.2 million.

- Furthermore, considering the growing user base of video streaming platforms, the vendors operating in the video encoding market are increasingly focusing on developing innovative solutions to fulfill various requirements of video streaming platform providers. For instance, in June 2022, Skywire Broadcast collaborated with Kiloview to launch a professional high-end encoding P series video encoder device. According to the company, the newly launched encoder adopts Kilo Link as a patented algorithm of Kiloview that is designed to solve the poor connectivity problems making it highly suitable for outdoor live streaming and transmission in scenarios such as concerts, live events, field broadcasts, etc.

Asia-Pacific is Expected to Hold the Largest Market Share

- The advent of terrestrial digital television broadcasting in China has improved existing services and paved the way for new applications. The DTT broadcast standard enables wide-area fixed reception on HDTV and multiple SDTV programs. New services also include mobile, wearable, and high-speed applications.

- The Chinese government is also working to improve people's viewing experience, and China encouraged major cities to start offering free terrestrial HDTV broadcast content. This helps drive growth in the digital terrestrial market and the HDTV industry as a whole, including high-definition flat panels, chipsets, transmitters, software, and content creation.

- According to the IBEF, in October 2020, India will emerge as the world's sixth-largest OTT market by 2024. The market is expected to grow at a CAGR of 28.6% over the next four years, amounting to a revenue of USD 2.9 billion. The investments made by OTT services like Netflix, Amazon, Disney+ Hotstar, and others in originals, as well as acquired content, will enable subscription video-on-demand to make up 93% of the total OTT revenue, increasing up to 30.7% by 2024, amounting to USD 2.7 billion. Kerala is expected to launch one of the first state-owned OTT platforms, CSPACE. The Kerala State Government will establish a state-owned over-the-top (OTT) platform in November 2022 to offer film enthusiasts various short films and documentaries.

- In June 2021, online video consumption in India was growing exponentially, accounting for 80% of consumers' internet traffic. However, the user experience depends on data usage and network speed. MX Player is one of the first OTT platforms with video encoding and compression technology upgraded to H.266 (versatile video coding), reducing streaming video data usage by more than half. With H.266, MX Player users will be able to stream content with less data, and network bandwidth and video streams will load faster and buffer less since they require only half (or less) the data they may need otherwise.

- South Korean organizations are developing video encoder solutions to drive the broadcasting and streaming market. For example, KT Corp is driving the pay TV services industry in South Korea regarding subscriptions and supervision, owing to its monopoly in the DTH segment and strong position in the IPTV segment, where it has the greatest share.

- In recent years, technological advances have led to the rapid spread of devices such as cameras, displays, and tablets that can record and display 4K video in higher resolution than high-definition televisions (HDTVs). With the proliferation of these devices, expectations are rising for next-generation video encoding for delivering HD video over broadcast and network delivery in Japan. 4K TVs are becoming increasingly popular in the home, and many models are available from major TV manufacturers.

Video Encoder Industry Overview

The video encoder market is highly competitive and fragmented. This is due to significant players such as Harmonic Inc., CommScope Holding Company Inc., MediaKind, etc. The players in the market are adopting major strategies, like product innovations, mergers and acquisitions, and strategic partnerships, to widen their product portfolio and expand their geographical reach.

- May 2022 - Lutech SpA and Imagine Communications are to launch their new IP video and audio contribution and distribution network, "IP Matrix." The project could benefit from the flexibility provided by a full IP, software-based network. It could take advantage of the capabilities of Imagine's extensively deployed, standards-based Selenio Network Processor, which employs encoders. The fully new contribution infrastructure Rai Way, designed for its video and audio networks and built on cutting-edge technologies like the SNP, could combine the best of both traditional SDI and state-of-the-art IP worlds.

- March 2022 - Globecast and Ateme collaborated to provide additional security options. Globecast would employ strong encryption techniques developed by Ateme to protect satellite uplinked content in the most secure manner possible. The service provider could give the highest video quality at the lowest bitrates and latency while keeping broadcasts safe by employing Ateme encoders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Video Codecs and their Evolution

- 4.3 List of VVC approved and incorporated Companies

- 4.4 List of Companies Contributing to the VVC Standard

- 4.5 Impact of COVID-19 on the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of Video Streaming Platforms

- 5.1.2 Easy Integration of Hardware Encoders with Video Cameras

- 5.1.3 Cloud Video Encoding Technology to Drive the Demand

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Hardware Video Encoder

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Pay TV

- 6.1.1.1 Cable Video Encoder

- 6.1.1.2 Satellite Video Encoder

- 6.1.1.3 IPTV Video Encoder

- 6.1.2 Broadcast and Digital Terrestrial Television (DTT)

- 6.1.2.1 Contribution Video Encoder

- 6.1.2.2 Backhaul and Distribution Video Encoder

- 6.1.2.3 DTT Video Encoder

- 6.1.3 Security and Surveillance

- 6.1.1 Pay TV

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Brazil

- 6.2.1.4 Mexico

- 6.2.1.5 Rest of the Americas

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Russia

- 6.2.2.5 Poland

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 South Korea

- 6.2.3.4 Japan

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Middle-East and Africa

- 6.2.4.1 Turkey

- 6.2.4.2 Israel

- 6.2.4.3 United Arab Emirates

- 6.2.4.4 Saudi Arabia

- 6.2.4.5 South Africa

- 6.2.4.6 Rest of Middle-East and Africa

- 6.2.1 Americas

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Harmonic Inc.

- 7.1.2 Commscope Holding Company Inc.

- 7.1.3 MediaKind

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Imagine Communications

- 7.1.6 Z3 Technology

- 7.1.7 ATEME

- 7.1.8 Adtec Digital

- 7.1.9 Telairity (VITEC)

- 7.1.10 Axis Communications AB (Canon Inc.)