|

市场调查报告书

商品编码

1437934

石膏板:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Gypsum Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

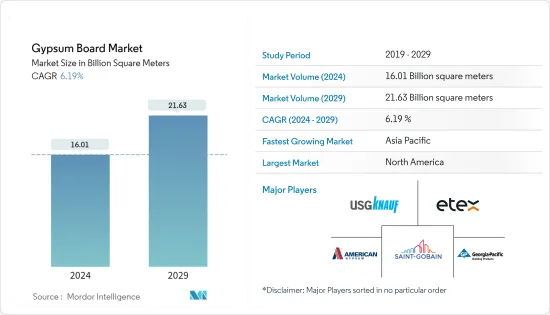

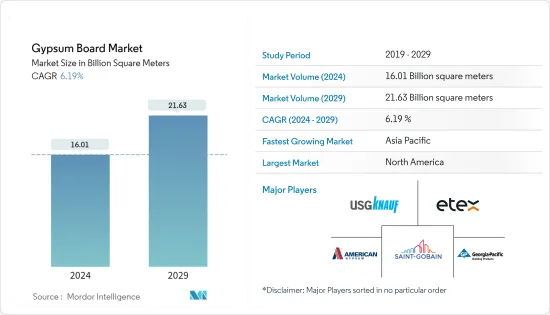

石膏板市场规模预计到2024年为160.1亿平方公尺,预计到2029年将达到216.3亿平方公尺,预测期内(2024-2029年)复合年增长率为6.19%。

2020年,新型冠状病毒感染疾病(COVID-19)对市场产生了负面影响。然而,由于住宅、商业和其他领域等各种最终用户应用的消费增加,市场在 2021 年显着復苏。

主要亮点

- 短期内,推动市场成长的主要因素包括对住宅建筑产品的需求增加以及全球范围内维修活动的增加。

- 然而,干墙具有吸湿性,因此容易受到水损坏。它很容易吸收和保留水分。此外,垃圾掩埋场可能会造成环境问题,例如有毒化学物质渗入地下水并释放甲烷气体。这些因素阻碍了所研究市场的成长。

- 儘管如此,未来的建筑投资预计将为预测期内在全球石膏板市场运营的主要企业创造利润丰厚的成长机会。

石膏板市场趋势

住宅产品需求增加

- 石膏板广泛用作住宅内墙和天花板的覆盖材料。它们用作石膏板、石膏干墙板和装饰灰泥。它们是石膏板的重要组成部分,用于墙壁、天花板、屋顶和地板的隔间和衬里。同样,石膏干墙板也可以用于相同的目的,并且具有隔音、抗衝击和防潮的优点。

- 全球住宅计划需求的成长预计将在预测期内推动全球石膏板市场。全球范围内,满足住宅需求的供应严重短缺。这为投资者和开发商提供了巨大的机会,可以采用替代的施工方法和新的合作伙伴关係来推动发展。

- 中国、印度、巴西、阿根廷和其他地区的主要经济体城市正在扩张,需要额外的住宅来容纳从该国不同地区搬迁的人们。

- 根据牛津经济研究院预测,2022年中国住宅建筑产量预计将比2021年增加4.5%。

- 在印度,由于都市化的加速和家庭收入的增加,对住宅的需求正在迅速增加。据印度投资资讯和信用评级局(ICRA)称,预计到 2022 年,印度企业将在基础设施和房地产(包括住宅基础设施)方面投资超过 3.5 兆卢比(即 480 亿美元)。

- 石膏市场成长的主要因素是住宅的上升趋势、主要经济体人口向城市的快速迁移、政府在住宅的房地产市场支出的增加以及豪华住宅需求的增加。

- 此外,石膏市场受到房地产成本上涨的推动,尤其是新兴国家单户住宅和高层公寓的开发。由于城市人口的快速增长和住宅需求的增加,市场正在扩大。

- 预计这种趋势将在预测期内加强住宅领域并有利于石膏板市场需求。

亚太地区主导市场

- 快速都市化和家庭收入增加推动的建设产业的成长预计将为本地区的石膏板带来强劲需求。

- 根据中国2022年1月公布的五年计划,预计2022年中国建筑业将成长6%左右。中国计划增加组装式建筑的建设,以减少与建筑相关的污染和废弃物。地点。

- 住宅需求的成长可能会刺激公共和私营部门的住宅建设。高层建筑和酒店建设的不断增加正在推动市场研究。

- 同样,未来六到七年印度的住宅投资预计将达到约 1.3 兆美元。此外,该国可能会建造 6,000 万套新住宅,这将成为所研究市场的主要驱动力。

- 未来几年,该国经济适用住宅的供应量预计将增加 70% 左右。由于政府在基础设施发展和经济适用住宅(例如全民住宅和智慧城市计划)方面的倡议,印度预计今年将为建设产业贡献约 6,400 亿美元。

- 在 2022-23 年联邦预算中,印度政府拨款 100 万卢比(约 1,305.7 亿美元)用于加强基础设施部门,大力推动基础设施部门发展。

- 在日本,东京地区的多家建设公司将于 2022 年开始建造 258 栋高层建筑和 103,100 套公寓。日本基础设施部专家委员会表示,该部正在向国内企业增加最多5.1兆日圆(454.8亿美元)的建筑订单,这将增加国内对石膏板的需求,这是有可能的。

- 此外,韩国正在加强其作为高层建筑之国的地位,大量高层建筑正在建设中和处于提案阶段,这可能会增加所研究市场的需求。

- 所有这些正在进行和即将进行的建设和维修活动,加上政府对基础设施领域的重新关注,预计将在预测期内显着增加该地区对石膏板的需求。

石膏板产业概况

全球石膏板市场由圣戈班、USGKnauf、EtexGroup等领导企业进行顶级整合。这些参与者占据了超过 50% 的市场。该市场有许多参与者,例如 Georgia-Pacific LLC、American Gypsum Company LLC 以及在该区域市场运营的其他公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 住宅建设需求增加

- 维修活动呈上升趋势

- 抑制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 墙板

- 天花板

- 装饰板

- 目的

- 住宅部门

- 引擎部

- 工业部门

- 商业部门

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- American Gypsum Company LLC

- Beijing New Building Material Public Limited Company(BNBM Group)

- Etex Group

- Everest Industries Limited

- Georgia-Pacific LLC

- Global Gypsum Board Co. LLC(Gypcore)

- Holcim Ltd

- Jason Plasterboard(Jiaxing)Co. Ltd

- National Gypsum Services Company

- Osman Group

- PABCO Building Products LLC

- Saint-Gobain

- USGKnauf

- VANS Gypsum

- VOLMA

第七章市场机会与未来趋势

- 建筑业的未来投资

The Gypsum Board Market size is estimated at 16.01 Billion square meters in 2024, and is expected to reach 21.63 Billion square meters by 2029, growing at a CAGR of 6.19% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. However, the market recovered significantly in 2021, owing to rising consumption from various end-user applications, including residential, commercial, and other sectors.

Key Highlights

- Over the short term, key factors driving the market's growth include increasing product demand for residential construction and rising repair activities across the world.

- However, gypsum boards are prone to water damage owing to their hygroscopic properties. They easily tend to absorb and retain water. In addition, dumping gypsum boards in landfills may result in environmental issues such as leaching toxic chemicals into the groundwater and releasing methane gas. Such factors are hindering the growth of the market studied.

- Nevertheless, future construction investments are expected to create lucrative growth opportunities for the major players operating in the global gypsum board market over the forecast period.

Gypsum Board Market Trends

Increasing Product Demand from Residential Construction

- Gypsum boards are widely used as covering material for interior walls and ceilings in residential buildings. They are used as plasterboards, gypsum drywall boards, and decorative plasters. They are important components of plasterboards used for the partitions and the linings of walls, ceilings, roofs, and floors. Similarly, gypsum drywall boards can be used for the same applications while offering the advantages of being soundproof and resistant to shocks and humidity.

- The increasing demand for residential projects across the world is expected to drive the global gypsum board market over the forecast period. Globally, there has been a significant undersupply to meet the demand for housing. This presented a major opportunity for investors and developers to embrace alternative construction methods and new partnerships to bring forward development.

- Major cities in economies, including China, India, Brazil, Argentina, and other regions, are expanding and require additional housing to accommodate people migrating from various regions of the country.

- According to Oxford Economics, China's residential building construction output is expected to grow by 4.5% in 2022 compared to 2021.

- In India, demand for residential properties has rapidly increased due to growing urbanization and rising household income. According to the Investment Information and Credit Rating Agency of India Limited (ICRA), Indian companies are expected to invest more than INR 3.5 trillion or USD 48 billion in infrastructure and real estate in 2022, including residential infrastructure.

- The primary drivers of the growth of the gypsum market are the rising home construction trend, rapid urban migration in major economies, increased government spending in the real estate market for residential construction, and the growing demand for high-class residential homes.

- In addition, the gypsum market is driven by rising real estate costs, particularly in developing single-family homes and multistory apartments in emerging economies. The market is expanding due to the rapidly expanding urban population and the rise in housing demand.

- Such trends are projected to augment the residential sector, benefiting the demand for the gypsum board market over the forecast period.

Asia-Pacific Region to Dominate the Market

- The growing construction industry fueled by rapid urbanization and growing household income is expected to generate strong demand for gypsum boards in the region.

- According to China's five-year plan, unveiled in January 2022, the construction industry in the country is estimated to register a growth rate of approximately 6% in 2022. China is planning to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites.

- The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors. The increase in the construction of tall buildings and hotels is driving the market studied.

- Likewise, India is likely to witness around USD 1.3 trillion of investment in housing over the next six to seven years. It is also likely to witness the construction of 60 million new houses in the country, which is a major boosting factor for the market studied.

- The availability of affordable housing in the country is expected to rise by around 70% in the next few years. By this year, India is expected to contribute about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as Housing for All and the Smart City Scheme.

- In the Union Budget of 2022-23, the Indian government gave a massive push to the infrastructure sector by allocating INR 10 lakh crore (or USD 130.57 billion) to enhance the infrastructure sector.

- In Japan, the construction of 258 high-rise buildings with 103,100 apartments commenced in 2022 by various construction companies in the Tokyo region. As per an expert panel of Japan's infrastructure ministry, the country's ministry padded up the construction orders made to domestic firms by up to JPY 5.1 trillion (USD 45.48 billion), which, in turn, may increase the demand for gypsum boards in the country.

- In addition, South Korea is strengthening its position as the home for high-rise buildings, and there are many tall buildings under construction and in proposal phases, which may enhance the demand for the market studied.

- All such ongoing and upcoming construction and renovation activities, coupled with the government's refocus on the infrastructure sector, are expected to increase the demand for gypsum boards in the region at a noteworthy rate over the forecast period.

Gypsum Board Industry Overview

The global gypsum board market is consolidated at the top level with major players, such as Saint-Gobain, USGKnauf, and EtexGroup. These players occupy a significant share of more than 50% of the market. The market exhibits the presence of many players, such as Georgia-Pacific LLC, American Gypsum Company LLC, and other companies operating in the regional market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From Residential Construction

- 4.1.2 Rising Repair Activities

- 4.2 Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Wall Board

- 5.1.2 Ceiling Board

- 5.1.3 Pre-decorated Board

- 5.2 Application

- 5.2.1 Residential Sector

- 5.2.2 Institutional Sector

- 5.2.3 Industrial Sector

- 5.2.4 Commercial Sector

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Gypsum Company LLC

- 6.4.2 Beijing New Building Material Public Limited Company (BNBM Group)

- 6.4.3 Etex Group

- 6.4.4 Everest Industries Limited

- 6.4.5 Georgia-Pacific LLC

- 6.4.6 Global Gypsum Board Co. LLC (Gypcore)

- 6.4.7 Holcim Ltd

- 6.4.8 Jason Plasterboard (Jiaxing) Co. Ltd

- 6.4.9 National Gypsum Services Company

- 6.4.10 Osman Group

- 6.4.11 PABCO Building Products LLC

- 6.4.12 Saint-Gobain

- 6.4.13 USGKnauf

- 6.4.14 VANS Gypsum

- 6.4.15 VOLMA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Investments in the Construction Sector