|

市场调查报告书

商品编码

1437968

NAND快闪记忆体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)NAND Flash Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

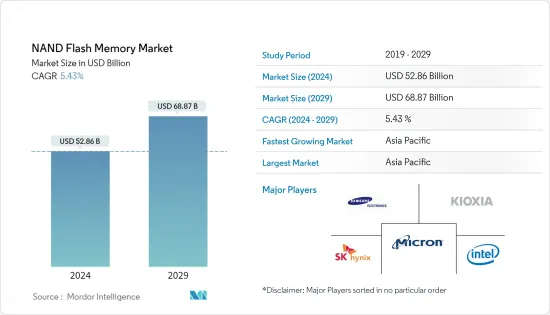

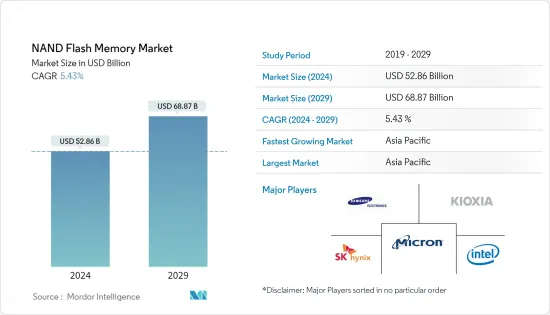

NAND快闪记忆体市场规模预计到2024年为528.6亿美元,预计到2029年将达到688.7亿美元,在预测期内(2024-2029年)增长5.43%,复合年增长率为

主要亮点

- 随着个人电脑和智慧型手机的兴起, NAND快闪记忆体消费量急剧增加,其中很大一部分原因是智慧型手机平均容量的增加。预计这将增加NAND快闪记忆体封装的需求,并影响记忆体封装的需求。

- 据美光称,智慧型手机平均配备 43 GB NAND快闪记忆体闪存,预计未来四年将大幅增加。该公司预计,到 2021 年,普通行动电话将拥有 142 GB 的NAND快闪记忆体闪存,旗舰设备将拥有 1 Terabyte的快闪记忆体。

- 其他消费性产品(例如平板电脑和相机)以及工业设备和感测器、汽车系统和医疗设备都与处理器集成,并依靠快闪记忆体来储存资料和可执行程式码。随着人工智慧和机器学习应用程式对大规模资料处理的需求的增加,基于快闪记忆体的储存趋势将继续发展。

- 中国的NAND快闪记忆体供应商的生产并未受到新的COVID-19感染疾病的严重影响。这是因为工厂自动化程度较高,人力需求相对较低,经营者也在农历新年前囤积原料。由于半导体製造工厂持有特殊的国家许可证,晶圆代工厂产品交货给中国的客户。这使得该公司能够将产品运送到中国各地,甚至是被隔离的城市。

- 由于中国是原料和最终产品的主要供应国之一,预计电子业将受到COVID-19感染疾病的严重影响。该行业面临产量减少、供应链中断和价格波动的问题。在此期间,知名电子公司的销售受到影响。人员和产品的旅行限制在短期内阻碍了市场成长。

NAND快闪记忆体主要市场趋势

智慧型手机领域预计将显着成长

- 快闪记忆体已成为智慧型手机的重要组成部分。 NAND快闪记忆体需求快速成长,主要得益于智慧型手机平均容量的增加。

- 智慧型手机中的 NAND 快闪记忆体可以显着提高网页浏览、电子邮件阅读、游戏甚至 Facebook 等社群网站的效能。随着智慧型手机变得越来越普及,该公司正在添加额外的功能和应用程序,以将其产品与其他製造商区分开来。

- 例如,製造商正在将手势控制、指纹扫描器和 GPS 等功能整合到他们的设备中。这增加了对 NAND 快闪记忆体的需求,NAND 快闪存在智慧型手机中用作代码储存媒体。

- 随着5G无线通讯的到来,智慧型手机的使用量将增加许多倍,从而增加了对不断提高标准的最新型号的需求。例如,根据爱立信移动的一份报告,在北美地区,到年终,5G合约预计将占行动合约的55%。

亚太地区获得主要市场占有率

- 亚太地区是全球最大的 NAND 快闪记忆体市场之一。该地区几乎所有最终用户应用程式的需求都非常高,这主要是由该地区多个新兴国家(例如中国、印度和印尼)对智慧型手机的需求所推动的。

- 中国、韩国和新加坡等国家的半导体製造设施也都很活跃。多家跨国记忆体製造商正在将巨额资金投入中国市场,特别是在中国政府「中国製造2025」等措施的推动下。中国的宏伟目标是到 2030 年半导体产量达到 3,050 亿美元,并于 2025 年实现。它占国内半导体需求的至少80%,预计在预测期内该国的投资将进一步增加。

- 预计多家中国新兴企业将在该地区进行重大投资,包括长江储存、福建金华、华力和合肥长鑫记忆体。这些公司的资本支出预计也将增加一倍。

- 多个国家的这些发展导致该地区的各个竞争对手加强了扩张。例如,截至2019年2月,全球最大的记忆体晶片製造商之一SK海力士计划巨额投资1,060亿美元,主要用于在韩国建立四座新的半导体製造工厂,并宣布正在这样做。 2021年4月,该公司在韩国京畿道利川市总部举行了新製造工厂M16的完工仪式。

NAND快闪竞争形势

NAND快闪记忆体市场由英特尔、美光科技、三星电子、SanDisk、SK海力士和东芝等主要供应商主导。市场进入障碍较高,新进者举步维艰。市场上的现有供应商正在大力投资新产品和创新产品的研发。

2021年12月,SK海力士宣布将投资90亿美元收购英特尔NAND部门。该公司的目标是在 2025 年之前完成新的整合流程。因此,此类发展正在推动市场。

2021 年 11 月,Mercury Systems Inc. 宣布推出NAND快闪记忆体记忆体非挥发性储存设备。这款新元件采用塑胶球栅阵列 (BGA) 封装,符合 NASA 的 EEE-INST-002 航太级应用指南,适用于太空等高辐射环境中的超密集记忆体储存应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 对资料中心的需求增加

- 5G 和物联网设备的普及提高

- 市场限制因素

- 可靠性问题

第五章市场区隔

- 类型

- SLC(每单元 1 位元)

- MLC(每个单元 2 位元)

- TLC(每个单元 3 位元)

- QLC(四级单元)

- 结构

- 2D结构

- 3D结构

- 目的

- 智慧型手机

- SSD

- 记忆卡

- 药片

- 其他用途

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Samsung Electronics Co. Ltd

- KIOXIA Corporation

- Micron Technology Inc.

- SK Hynix Inc.

- Intel Corporation

- Yangtze Memory Technologies

- SanDisk Corp.(Western Digital Technologies Inc.)

- Powerchip Technology Corporation

- Cypress Semiconductor Corporation

第七章 厂商市场定位

第八章投资分析

The NAND Flash Memory Market size is estimated at USD 52.86 billion in 2024, and is expected to reach USD 68.87 billion by 2029, growing at a CAGR of 5.43% during the forecast period (2024-2029).

Key Highlights

- With the rise of PCs and smartphones, NAND flash consumption is dramatically increasing, much of which is attributed to the growth of the average capacity of smartphones. This is expected to drive the demand for NAND flash packaging, thus influencing the demand for memory packaging.

- According to Micron, an average smartphone contains 43 GB of NAND flash storage, and it is expected to grow substantially over the next four years. The company estimated that, by 2021, an average phone would have 142 GB of NAND flash storage, with flagship devices having one terabyte of flash storage.

- Other consumer products such as tablets and cameras, along with industrial equipment and sensors, automotive systems, and medical devices, rely upon flash memory, which is integrated alongside their processors, and stores both data and the code they execute. As demand for massive data processing for artificial intelligence and machine learning applications grows, the trend for flash-based storage will continue to evolve.

- Production of China-based NAND flash vendors was not severely affected by the outbreak of novel COVID-19. This is because the plants are highly automated, have relatively low demands for manpower, and operators are also stocked up with raw materials before the Chinese Lunar New Year. Foundry output was delivered to customers in China because semiconductor fabrication plants hold national special licenses. These allow them to ship their products throughout domestic China, even with cities under quarantine.

- The electronics device sector was anticipated to be impacted significantly by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The industry faced a reduction in production, disruption in the supply chain, and price fluctuations. The sales of prominent electronic companies were affected during the period. The travel restriction on both people and products hampered the market's growth in the short run.

NAND Flash Memory Key Market Trends

The Smartphone Segment is Expected to Witness Significant Growth

- Flash memory storage has become an essential component of smartphones. The NAND flash demand has been growing exponentially, primarily driven by the growth of the average capacity of smartphones.

- NAND flash memory in smartphones can significantly enhance the performance of web browsing, email loading, games, and even social network sites such as Facebook. With the increasing adoption of smartphones, companies are adding extra features and applications to differentiate their products from other manufacturers.

- For instance, manufacturers are integrating features such as gesture control, fingerprint scanners, and GPS into the devices. This is boosting the demand for NAND flash memory, which is used as code storage media for smartphones.

- With 5G wireless communication on its way, the use of smartphones would increase multifold, increasing the need for the latest models to raise the bar continuously. For instance, according to the Ericsson Mobility report, in the North American region, 5G subscriptions are expected to account for 55% of mobile subscriptions by the end of 2024.

Asia-Pacific to Hold a Significant Market Share

- Asia-Pacific is one of the biggest markets for NAND flash memories across the world. The region has a very high demand from almost all end-user applications, primarily led by the demand for smartphones in multiple developing countries in the region, such as China, India, and Indonesia.

- Also, there is high activity from the semiconductor fabrication facilities in countries like China, Korea, and Singapore. An immense amount of capital is directed into the Chinese market by several multinational memory manufacturers, especially boosted by the country's government initiatives, such as Made in China 2025. The country's ambitious goal is to reach USD 305 billion in semiconductor output by 2030 and meet at least 80% of the domestic demand for semiconductors, which is expected to draw more investments into the country over the forecast period.

- Multiple new companies in China, such as Yangtze River Storage Technology, Fujian Jin Hua, Hua Li, and Hefei Chang Xin Memory, are expected to invest heavily in the region. These companies are also expected to double their equipment investments.

- Owing to such development in multiple countries, various competitors in the region are intensifying their efforts for expansion. For instance, as of February 2019, SK Hynix, one of the world's largest memory-chip makers, announced that it was planning to invest a huge sum of USD 106 billion, primarily to establish four new semiconductor fabrication plants in South Korea. In April 2021, the company held a completion ceremony for its new fabrication plant M16 at headquarters located in Icheon, Gyeonggi-do, South Korea.

NAND Flash Memory Competitive Landscape

The NAND flash memory market is dominated by major vendors, such as Intel, Micron Technology, Samsung Electronics, SanDisk, SK Hynix, and Toshiba. As the entry barriers in the market are high, the entry of new players is difficult. The existing vendors in the market are investing heavily in the R&D of new and innovative products.

In December 2021, SK Hynix announced the acquisition of Intel's NAND unit for an investment of USD 9 billion. The company aims to focus on completing another integration process by 2025. Thus, such developments are driving the market.

In November 2021, Mercury Systems Inc. announced the launch of the NAND flash non-volatile memory device. The new device features a plastic ball-grid array (BGA) package to meet NASA's EEE-INST-002 space-grade application guidelines for ultra-high-density memory storage applications in high-radiation environments like space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Market Drivers

- 4.5.1 Increasing Demand for Data Centers

- 4.5.2 Increasing Proliferation of 5G and IOT Devices

- 4.6 Market Restraints

- 4.6.1 Reliability Issues

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 SLC (One-Bit Per Cell)

- 5.1.2 MLC (Two-Bit Per Cell)

- 5.1.3 TLC (Three-Bit Per Cell)

- 5.1.4 QLC (Quad Level Cell)

- 5.2 Structure

- 5.2.1 2D Structure

- 5.2.2 3D Structure

- 5.3 Application

- 5.3.1 Smartphone

- 5.3.2 SSD

- 5.3.3 Memory Card

- 5.3.4 Tablet

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics Co. Ltd

- 6.1.2 KIOXIA Corporation

- 6.1.3 Micron Technology Inc.

- 6.1.4 SK Hynix Inc.

- 6.1.5 Intel Corporation

- 6.1.6 Yangtze Memory Technologies

- 6.1.7 SanDisk Corp. (Western Digital Technologies Inc.)

- 6.1.8 Powerchip Technology Corporation

- 6.1.9 Cypress Semiconductor Corporation