|

市场调查报告书

商品编码

1438253

加工油:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Process Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

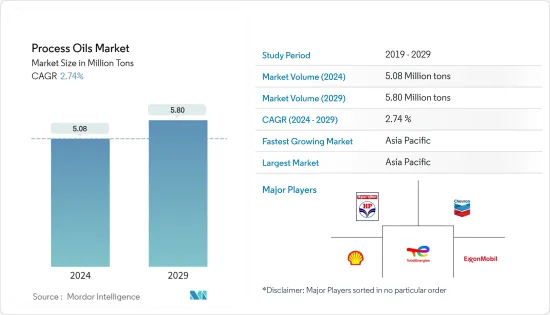

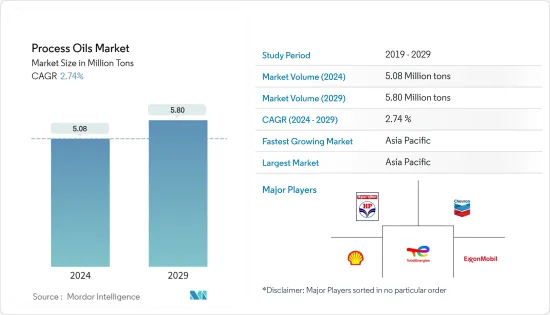

预计2024年加工油市场规模为508万吨,预计2029年将达到580万吨,在预测期(2024-2029年)复合年增长率为2.74%。

冠状病毒感染疾病(COVID-19)大流行对 2020 年市场产生了负面影响。然而,市场已达到疫情前的水平,预计未来几年将稳定成长。

主要亮点

- 短期内,推动市场成长的主要因素是聚合物生产需求的增加。橡胶油用量的快速增加也可能增加未来几年对加工处理油的需求。

- 然而,由于严格的法规,PAHs 和 DAEs 的使用量减少可能会阻碍研究期间的市场成长。

- 儘管如此,生物基橡胶加工油的探索和电动汽车加工油需求的加速可能很快就会成为全球市场成长机会的因素。

- 预计亚太地区将主导市场,并且在预测期内也可能呈现最高的复合年增长率。

加工油市场趋势

橡胶应用主导市场

- 橡胶加工处理油是使用高挥发性汽油生产的,并使用蒸馏过程分离煤油馏分。

- 天然和合成加工油加工油都在商业性用于製造多种橡胶产品,例如橡皮筋、玩具和轮胎。

- 它们也用于橡胶混合物的混合过程中,以增加填料的分散性并增强混合物的流动性能。

- 全球橡胶工业的扩张正在推动橡胶加工油在各种应用产业的使用。典型的橡胶应用包括轮胎、建筑材料、白色家电、生物医学和纺织品。

- 中国是世界上最大的轮胎生产国。根据中国国家统计局数据,2021年中国轮胎产量为90,246万条,较2020年增加约9,500万条。

- 根据马来西亚橡胶理事会的数据,2022年上半年全球橡胶产量约1,390万吨,比去年同期的约1,410万吨下降1.5%。

- 基于以上因素,橡胶油作为加工油的应用预计将占据市场主导地位。

亚太地区主导市场

- 由于印度和中国等国家对纺织品和个人保健产品的广泛需求,亚太地区是一个潜力巨大的地区。

- 自1994年以来,中国一直是全球最大的纺织品服装出口国,以OEM製造加工为主,主导全球中价格分布市场。同时,欧盟继续主导世界奢侈品市场和高品质纺织产品。

- 根据OICA统计,2021年中国汽车产量为2,608万辆,比2020年的2,522万辆成长3%。预计这将对预测期内的加工油市场产生正面影响。

- 目前,与已开发国家和其他新兴经济体相比,印度个人保健产品的普及相对较低。

- 然而,随着经济环境的改善和印度公民购买力的增强,个人保健产品在该国的采用预计将会增加。

- 据NIPFA India称,印度美容和个人护理行业目前价值268亿美元,预计未来三年将成长至372亿美元。预计印度市场的成长将在研究期间推动加工油市场的发展。

- 根据OICA统计,2021年印度汽车工业成长30%,产量约439万辆。汽车产业的快速成长将对所研究的市场产生正面影响。

- 由于上述因素,亚太地区加工油市场预计将在预测期内主导全球市场。

加工油业概况

加工油市场本质上是部分一体化的。市场上主要企业包括雪佛龙公司、埃克森美孚、惠普润滑油公司、加拿大皇家壳牌公司和道达尔公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 聚合物产量增加

- 抑制因素

- 汽车业下滑

- 更严格的法规减少 PAH 和 DAE 的使用

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 芳香

- 石蜡基

- 环烷烃

- 目的

- 橡皮

- 聚合物

- 个人护理

- 纤维

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Chevron Corporation

- Ergon Inc.

- Exxon Mobil Corporation

- HollyFrontier Refining &Marketing LLC

- HP Lubricants

- Idemitsu Kosan Co. Ltd

- LUKOIL

- Nynas AB

- ORGKHIM Biochemical Holding

- Panama Petrochem Ltd

- PetroChina

- PETRONAS Lubricants International

- Phillips 66 Company

- Repsol

- Royal Dutch Shell PLC

- ENEOS Corporation

第七章市场机会与未来趋势

The Process Oils Market size is estimated at 5.08 Million tons in 2024, and is expected to reach 5.80 Million tons by 2029, growing at a CAGR of 2.74% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. However, the market reached pre-pandemic levels and is expected to grow steadily in the coming years.

Key Highlights

- Over the short term, the primary factor driving the market's growth is the increasing demand for polymer production. The surge in the use of rubber oils is also likely to augment the demand for process oils in the coming years.

- However, declining usage of PAH and DAE due to stringent regulations is likely to hinder the market's growth during the studied period.

- Nevertheless, research in bio-based rubber process oils and the accelerating demand for process oils in electric vehicles can soon be the factors behind growth opportunities for the global market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Process Oils Market Trends

Rubber Applications to Dominate the Market

- Rubber process oil is manufactured using petroleum after the more volatile petrol, and heating oil fractions are separated using the distillation process.

- Both natural and synthetic process oils are commercially used in producing several rubber products, including rubber bands, toys, and tires.

- They are also used in the mixing process for rubber compounds as they increase the dispersion of fillers and enhance the flow characteristics of the mixture.

- The expansion of the global rubber industry is promoting the use of rubber process oils across various application industries. Some typical rubber applications include tires, construction materials, white goods, biomedical, and textiles.

- China is the largest tire-producing country in the world. According to the National Bureau of Statistics of China, tire production in China in 2021 was 902.46 million units, an increase of around 95 million units compared to 2020.

- According to Malaysian Rubber Council, the global rubber production in the first half of 2022 was around 13.9 million metric tons, with a decline of 1.5% from the corresponding period of the previous year, where about 14.1 million metric tons were produced.

- Based on the factors above, the rubber oil application for process oils is expected to dominate the market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is an area of immense potential due to the extensive demand for textiles and personal care products in countries such as India and China.

- China continued to be the biggest textile and apparel exporter in the world since 1994. The country dominates the global low-to-medium-end market by mainly engaging in OEM manufacturing and processing. At the same time, the European Union continues to dominate the global upmarket and high-quality textiles.

- According to OICA, automotive production in China in 2021 was at 26.08 million units, with a 3% growth from 25.22 million units in 2020. It is anticipated to positively impact the process oil market during the forecast period.

- Presently, the penetration of personal care products in India is comparatively low compared to developed and other developing economies.

- However, the improving economic environment and the increasing purchasing power of the Indian population are expected to increase the adoption of personal care products in the country.

- According to NIPFA India, the Indian beauty and personal care industry is currently worth USD 26.8 billion and is anticipated to grow to USD 37.2 billion over the next three years. The growth of the Indian market is expected to boost the development of the process oil market during the studied period.

- According to OICA, the automotive industry in India observed a growth of 30% in 2021 and produced around 4.39 million units. Rapid growth in the Automotive sector would positively impact the studied market.

- Due to the factors above, the market for process oils in the Asia-Pacific region is expected to dominate the global market during the forecast period.

Process Oils Industry Overview

The process oils market is partially consolidated in nature. Some of the major players in the market are Chevron Corporation, ExxonMobil Corporation, HP Lubricants, Royal Dutch Shell Plc, and Total.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Polymer Production

- 4.2 Restraints

- 4.2.1 Declining Automotive Sector

- 4.2.2 Declining Usage of PAH and DAE due to Stringent Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Aromatic

- 5.1.2 Paraffinic

- 5.1.3 Naphthenic

- 5.2 Application

- 5.2.1 Rubber

- 5.2.2 Polymers

- 5.2.3 Personal Care

- 5.2.4 Textile

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Corporation

- 6.4.2 Ergon Inc.

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 HollyFrontier Refining & Marketing LLC

- 6.4.5 HP Lubricants

- 6.4.6 Idemitsu Kosan Co. Ltd

- 6.4.7 LUKOIL

- 6.4.8 Nynas AB

- 6.4.9 ORGKHIM Biochemical Holding

- 6.4.10 Panama Petrochem Ltd

- 6.4.11 PetroChina

- 6.4.12 PETRONAS Lubricants International

- 6.4.13 Phillips 66 Company

- 6.4.14 Repsol

- 6.4.15 Royal Dutch Shell PLC

- 6.4.16 ENEOS Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research in Bio-based Rubber Process Oils

- 7.2 Rising Demand for Process Oils in Electric Vehicles