|

市场调查报告书

商品编码

1690707

橡胶加工油:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Rubber Process Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

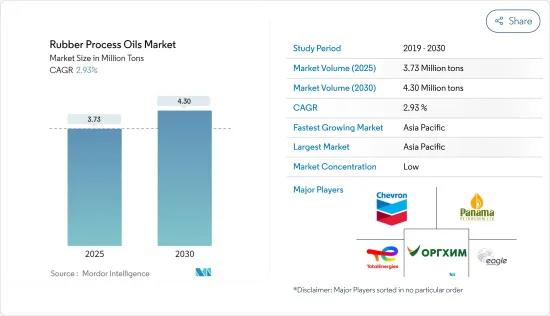

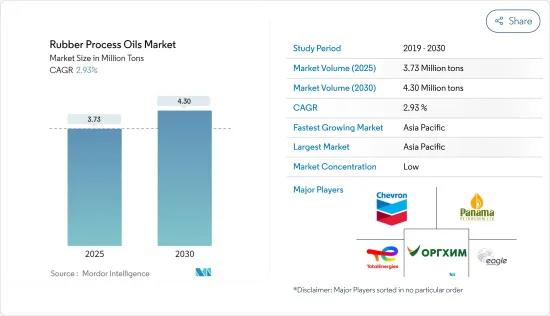

2025 年橡胶加工油市场规模预计为 373 万吨,预计到 2030 年将达到 430 万吨,预测期内(2025-2030 年)的复合年增长率为 2.93%。

新冠肺炎疫情为市场带来了负面影响。这是因为製造设施和工厂由于封锁和限製而关闭。供应链和运输中断进一步扰乱了市场。不过,2021年,产业復苏,市场需求回归。

主要亮点

- 短期内,汽车产业对轮胎和汽车零件的需求增加是推动市场成长的主要因素之一。

- 另一方面,原材料价格的波动预计会阻碍市场成长。

- 然而,预计预测期内对生物基橡胶加工油的需求不断增加将为市场成长提供各种机会。

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费量不断增加,预计将在预测期内成为成长最快的市场。

橡胶加工油市场趋势

轮胎和汽车零件对橡胶加工油的需求不断增加

- 橡胶加工油用于混合橡胶化合物。这些产品提高了填料的分散性和化合物的流动性。因此,它被认为是橡胶工业最重要的组成部分。

- 橡胶加工油用于轮胎和其他汽车零件,因为它们可以改善机械性能。此外,该产品的煞车效率和燃油经济性提高将进一步有利于其在轮胎和汽车零件中的应用。

- 橡胶加工油可以改善用于製造轮胎的橡胶的性能。人口成长带来的生活水准提高和消费能力增强正在推动全球对汽车的需求。例如,根据 OICA 的数据,2022 年全球整体乘用车产量将达到 6,159 万辆,比 2021 年增长 8%,比 2020 年增长 10%。因此,预计乘用车产量的增加将在预测期内创造对橡胶加工油市场的需求上升。

- 此外,德国汽车产业也因半导体短缺和原材料供应有限而受到阻碍。同样,其他因素,例如新的全球统一轻型车辆测试程序(WLTP)的实施、美国和中国之间的贸易紧张局势导致国际汽车需求减少,以及欧盟28国的新排放气体标准要求汽车製造商确保新售出的汽车平均二氧化碳排放为每公里95克,也对乘用车生产产生了不利影响。

- 不过,2022年,汽车生产逐渐从半导体短缺中恢復。例如,根据 OICA 的数据,2022 年德国生产了约 3,480,357 辆乘用车,比 2021 年成长 12%。因此,预计乘用车领域产量的增加将推动橡胶加工油市场的需求上升。

- 此外,美国是世界第二大汽车销售和生产市场。例如,根据 OICA 的数据,2022 年美国汽车产量将达到 10,063,339 辆,比 2021 年增加 10%。因此,预计汽车产量的增加将导致橡胶加工油市场的需求增加。

- 因此,预计预测期内该地区所有这些有利趋势和投资都将推动橡胶加工油市场的需求。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导橡胶加工油市场。中国、日本和印度等新兴国家轮胎和汽车零件对橡胶加工油的需求不断增长,预计将推动该地区对橡胶加工油的需求。

- 最大的橡胶加工油生产商位于亚太地区。橡胶加工油生产的主要企业包括道达尔、雪佛龙知识产权有限责任公司、巴拿马石油化工有限公司、ORGKHIM生化控股和Eagle Petrochem。

- 随着消费者对电动车的偏好日益增长,中国汽车产业正经历动态转变。中国汽车工业的扩张预计将使橡胶加工油市场受益。根据国际汽车工业组织(OICA)的数据,中国是世界上最大的汽车生产国,占全球产量的近34%。 2022年汽车产量为27,020,615辆,较2021年的26,121,712辆成长24%。因此,汽车产量的增加预计将带来橡胶加工油市场需求的上升。

- 在印度,更严格的汽车排放标准、车辆安全性的提高、汽车高级驾驶辅助系统 (ADAS) 的引入以及零售和电子商务领域物流的快速增长都在推动对新型和先进轻型商用车 (LCV) 的需求。例如,根据OICA的数据,印度2022年轻型商用车产量将达到617,398辆,较2021年成长27%,较2020年恢復60%。

- 此外,印度汽车产业的投资不断增加和进步预计将增加橡胶加工油市场的消费量。例如,塔塔汽车在2022年4月宣布,计划在未来五年内向其乘用车业务投资30.8亿美元。预计此次扩建将对该国的橡胶加工油市场产生正面影响。

- 在工业和建筑活动中,人们越来越意识到要保护工人免受触电、坠落物体、有害化学物质和石油洩漏、移动机械等造成的伤害,这可能会对橡胶鞋的需求产生积极影响。橡胶鞋生产中橡胶加工油的使用量正在增加。因此,对橡胶鞋的需求不断增长将进一步推动橡胶加工油市场的发展。

- 由于上述因素,预计研究期间亚太地区的橡胶製加工油市场将大幅成长。

橡胶加工油产业概况

橡胶加工油市场比较分散。该市场的主要企业(不分先后顺序)包括道达尔能源、雪佛龙公司、巴拿马石油化工有限公司、ORGKHIM Biochemical Holding、EaglePetrochem 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 轮胎和汽车零件需求增加

- 鞋类需求增加

- 其他的

- 限制因素

- 原物料价格波动

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 产品类型

- 芳香

- 石蜡基

- 环烷酸

- 应用

- 轮胎和汽车零件

- 鞋类

- 消费品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- APAR Industries

- Chevron Corporation

- CPC Corporation

- EaglePetrochem

- Exxon Mobil Corporation

- HF Sinclair Corporation

- LODHA Petro

- ORGKHIM Biochemical Holding

- Panama Petrochem Ltd

- Repsol

- Sterlite Lubricants

- TotalEnergies

- Witmans Industries Pvt. Ltd

第七章 市场机会与未来趋势

- 生物基橡胶加工油的需求不断增加

- 其他机会

The Rubber Process Oils Market size is estimated at 3.73 million tons in 2025, and is expected to reach 4.30 million tons by 2030, at a CAGR of 2.93% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand for tire and automotive components from the automobile industry is one of the major factors driving the growth of the market studied.

- On the flip side, volatility in raw material prices is expected to hinder the growth of the market.

- However, the increasing demand for bio-based rubber process oil is forecasted to offer various opportunities for the growth of the market over the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Rubber Process Oil Market Trends

Growing Demand of Rubber Process Oil from Tire and Automobile Components

- Rubber process oils are used while mixing the rubber compounds. These products improve the dispersion of fillers and the flow property of the compound. Hence, it is considered to be the most important ingredient for the rubber-based industry.

- Due to enhanced mechanical properties, rubber process oils are used in the tire and other automotive components. In addition, improved braking efficiency and fuel consumption of the product are likely to further benefit its usage in the tire and automotive components.

- The rubber process oils enhance the rubber properties used in the production of tires. Rising population improved living standards and increased spending power are factors likely to boost the demand for automobiles globally. For instance, according to OICA, in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021 and 10% compared to 2020. Therefore, an increase in the production of passenger cars is expected to create an upside demand for the rubber process oil market in the forecast period.

- Moreover, in Germany, the automotive industry has been hampered by the shortage of semiconductors and a limited supply of raw materials. Similarly, other factors such as the implementation of the new Worldwide Harmonized Light-Duty Vehicles Test Procedure (WLTP) and US-China trade conflicts which decreased the international automotive demand, EU-28's new emission standard which mandates carmakers to achieve average CO2 emissions of 95 grams per kilometre across newly sold vehicles had negatively affected the production of passenger cars.

- However, in 2022 the automobile production in the country recovered gradually from semiconductor shortages. For instance, according to OICA, around 34,80,357 passenger cars were produced in Germany in 2022, which shows an increase of 12% compared to 2021. Therefore, increase in the production of passeger car segment is expected to create an upside demand for the rubber process oils market.

- Furthermore, the United States is the second-largest market for vehicle sales and production globally. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create an upside demand for rubber process oils market.

- Therefore, all such favorable trends and investments in the region are expected to drive the demand for rubber process oils market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for rubber process oil during the forecast period. The rising demand for rubber process oil from tire and automobile components in developing countries like China, Japan, and India is expected to drive the demand for rubber process oil in this region.

- The largest producers of rubber process oil are located in the Asia-Pacific region. Some of the leading companies in the production of rubber process oil are Total, Chevron Intellectual Property LLC, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, and Eagle Petrochem among others.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit the rubber process oil market. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing in the production of automobiles is expected to create an upside demand for the rubber process oil market.

- In India, increasing regulations on vehicle emissions, advancement in vehicle safety, the introduction of driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors, have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, accroding to OICA, in 2022, light commercial vehicle production in India amounted to 6,17,398 units, which showen an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Furthermore, increased investments and advancements in the automobile industry in India is expected to increase the consumption of rubber process oil market. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This expansion is expected to have a positive impact on the rubber process oils market in the country.

- Rising awareness about the worker's safety from injuries due to electrical contacts, falling objects, spilling of harmful chemicals and oils, moving machinery, and others during industrial or construction work is likely to benefit the demand for rubber footwear. Rubber process oil is increasingly used in manufacturing footwear using rubber. Hence, the rising demand for rubber footwear further fuels the rubber process oils market.

- Owing to the above-mentioned factors, the market for rubber process oil in the Asia-Pacific region is projected to grow significantly during the study period.

Rubber Process Oil Industry Overview

The Rubber Process Oil Market is fragmented in nature. The major players in this market (not in a particular order) include TotalEnergies, Chevron Corporation, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, and EaglePetrochem, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Tire and Automotive Components

- 4.1.2 Growing Demand for Footwear

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Price

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Aromatic

- 5.1.2 Paraffinic

- 5.1.3 Naphthenic

- 5.2 Application

- 5.2.1 Tire and Automobile Components

- 5.2.2 Footwear

- 5.2.3 Consumer Goods

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 APAR Industries

- 6.4.2 Chevron Corporation

- 6.4.3 CPC Corporation

- 6.4.4 EaglePetrochem

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 HF Sinclair Corporation

- 6.4.7 LODHA Petro

- 6.4.8 ORGKHIM Biochemical Holding

- 6.4.9 Panama Petrochem Ltd

- 6.4.10 Repsol

- 6.4.11 Sterlite Lubricants

- 6.4.12 TotalEnergies

- 6.4.13 Witmans Industries Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand of Bio Based Rubber Processing Oil

- 7.2 Other Opportunities