|

市场调查报告书

商品编码

1438286

机器人流程自动化:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Robotic Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

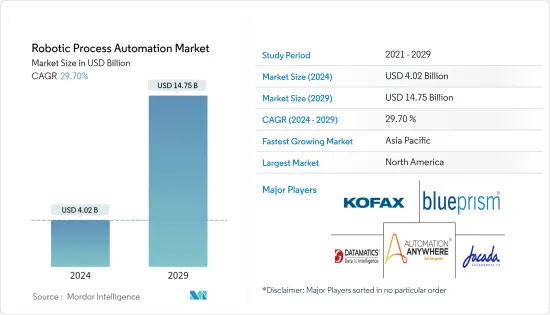

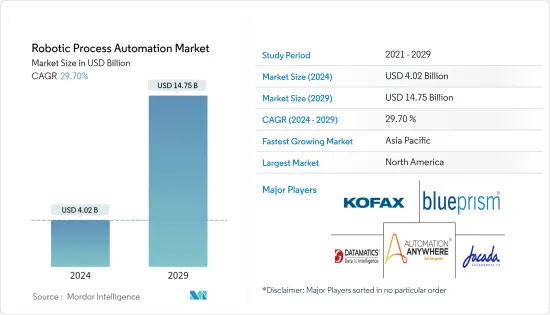

机器人流程自动化(RPA)市场规模预计到 2024 年为 40.2 亿美元,预计到 2029 年将达到 147.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 29.70%。

各种规模的组织越来越多地采用 RPA 来产生更大的投资收益(ROI) 并提高生产力。主要市场参与者正在推出基于人工智慧、机器学习和云端模型的新型机器人流程自动化 (RPA) 解决方案,以满足不断增长的需求。

主要亮点

- 机器人流程自动化(RPA),也称为智慧自动化或智慧自动化,是一种尖端技术,可以透过程式设计来执行以前需要人工干预的各种任务,例如操纵资料和启动反应。学期。 ,与其他流程和系统建立必要的通讯。除了新的资料API 之外,市场上的供应商还透过整合自动化生命週期管理、工作负载管理、基于 SLA 的自动化、凭证管理和 Citrix 自动化等新功能来改进其产品。这些改进吸引了需要更多操作和安全功能的新行业领域。

- 人工智慧、机器学习和云端等尖端技术的利用不断增加,主要推动了机器人流程自动化市场的成长。越来越多的公司正在实施 RPA 来自动化业务流程并处理日益复杂的资料。企业正在开发和部署基于云端和人工智慧的 RPA 解决方案,以自动优化业务流程和工作流程。中小企业越来越多地采用人工智慧和云端基础的解决方案来提高内部效率,正在推动市场成长。据伟事达称,在利用人工智慧的 13.6% 中小企业中,很大一部分使用人工智慧来改善业务,其次是提高客户参与。

- SaaS、IaaS 和 PaaS 服务在客户关係管理、云端运算、企业资源管理、开放原始码资源、协作机器人学习、网路连接和其他金融应用中的越来越多的使用也正在推动 RPA 解决方案市场的发展。 RPA 在 IT、通讯、BFSI、医疗保健和零售等各个最终用户行业中的功能优势正在推动市场扩张。基于云端基础方案的不断增长趋势以及基于机器人的解决方案在各个最终用户行业的成长预计将为全球建立机器人流程自动化开闢新的可能性。

- RPA 在提高产量和收益的同时,也面临可能损失数百万美元的风险。与机器人流程自动化相关的两个重大安全威胁是资料遗失和窃盗。如果没有采取适当的安全措施,RPA 机器人密码和 RPA 处理的消费者资料等敏感资料可能会暴露给攻击者,从而可能导致市场窒息。

- COVID-19 对机器人流程自动化市场产生了负面影响,由于自动化流程自动化解决方案的使用增加和社交距离规范的收紧,该市场出现了显着增长,而且这种趋势可能很快就会持续下去。此外,各行业公司之间的人才短缺预计将在未来两年进一步影响 RPA 的采用,从而增加对此类解决方案供应商的需求。随着软体机器人被用来管理临时工和季节性工人执行的常规业务,以及管理由于监管高峰、新产品发布和新业务而导致的尖峰时段,该行业不断扩大。

机器人流程自动化市场趋势

零售业在 RPA 市场中占据主要份额

- 退货处理、工作流程管理、客户支援管理、会计和财务、ERP 管理和行销、消费行为分析等都是零售领域的一些应用,RPA 在其中发挥着重要作用。据估计,透过实现近一半的人工任务自动化,可以为全球劳动力节省超过 2 兆美元,特别是在零售等新兴产业。

- 疫情导致的在家工作趋势带来的业务营运调整加大,是零售业机器人自动化市场扩张的关键驱动力之一。该行业也受益于认知技术的使用和跨组织内部业务流程的变化。

- 电子商务产业的快速成长是推动RPA市场成长的关键因素。预计到 2023 年,美国的线上销售额将翻一番,约占零售业总额的 20-25%。根据美国商务部人口普查局的数据,2022 年第三季美国零售电子商务销售额经季节调整后估计值为 2,517 亿美元。在英国(UK),零售业在塑造经济方面发挥关键作用,僱用了近 300 万人。

- 零售业参与者正在采用创新技术来吸引和吸引更多客户,并利用零售自动化新技术来平滑流程并应对各种挑战,我们获得了成长动力。随着仓库数量的增加,零售业越来越多地使用机器人流程自动化来更有效率、更有效地执行任务。 Zebra Technologies 的一项零售业趋势研究显示,预计到 2023 年,约 75% 的零售商将在所有关键功能中自动化。

预计美国将占重要市场占有率

- 在采用机器人技术的主要创新者和先驱者中,美国是最大的市场之一。该地区机器人的使用持续成长,帮助美国公司提高竞争力并创造新的就业机会。此外,根据机器人工业协会 (RIA) 的数据,今年迄今为止工业机器人成长的最重要推动因素是汽车原始OEM购买的用于流程自动化的机器人数量增加了 83%。

- 根据自动化促进协会统计,自 2010 年以来,美国各公司已部署了超过 18 万台机器人,期间创造了超过 120 万个新的製造业就业机会。据麻省理工学院称,汽车製造业占美国工业机器人需求的很大一部分,其次是电子、塑胶和化学製造业。预计这将推动机器人流程自动化(RPA)的成长。

- 政府和监管机构加大力度加速 RPA 在各行业的采用预计将在预测期内推动市场成长。据 UiPath 称,该地区有 30 多个政府机构使用其 RPA 来消除合规问题、提高吞吐量并减少积压。

- 一些政府机构和私人公司正在投资创建会话式 RPA 聊天机器人以实现流程自动化。例如,美国科学基金会 (NSF) 组织创建了一个 RPA 机器人来帮助自动化讯息并通知人们即将举行的公开会议。由于 NSF 组织每年举办数千次会议,RPA 机器人可以帮助管理人员节省超过 25,000 小时的时间。

机器人流程自动化产业概述

机器人流程自动化市场的整合程度较低,仅有 Automation Anywhere Inc、Jafada 和 Kofax 等少数几家厂商参与,预计大型公司的各种收购和联盟很快就会发生。该市场的一些主要发展包括:

- 2022 年 11 月,零售履约自动化公司 Fabric 与新通讯管道和数位媒体专家 Reply 达成策略合作伙伴关係,为品牌和零售商提供仓库管理系统和自动化单点解决方案,提供无缝整合。与机器人相处的成就感。

- 2022 年 10 月,机器人流程自动化供应商 Automation Anywhere 宣布推出 Automation Success Platform,其中包含流程发现和文件处理的新机器人流程自动化工具。这个成功的平台使企业能够自动化业务运营的各个方面。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间敌对的强度

- 替代品的威胁

- 新型冠状病毒感染疾病(COVID-19)对产业的影响

- 市场驱动因素

- 零售业在 RPA 市场中占据主要份额

- 部署人工智慧和云端基础的解决方案以提高中小型企业的内部效率

- 市场限制因素

- 资料安全问题

第五章市场区隔

- 按发展

- 本地

- 云

- 按解决方案

- 软体

- 服务

- 按公司规模

- 中小企业

- 大公司

- 按最终用户产业

- 资讯科技和电信

- BFSI

- 卫生保健

- 零售

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Automation Anywhere Inc.

- Blue Prism Group PLC

- Jacada Inc.

- Pegasystems Inc.

- UIPath Inc.

- Kofax Inc.(Thoma Bravo LLC)

- Be Informed BV(Hoogenberg Beheer BV)

- Datamatics Global Services Limited

- AutomationEdge Technologies Inc.

- Jidoka

- HelpSystems LLC(HGGC)

- Nice Robotic Automation Ltd

- CGI Inc.

第七章 投资分析

第八章市场机会及未来趋势

The Robotic Process Automation Market size is estimated at USD 4.02 billion in 2024, and is expected to reach USD 14.75 billion by 2029, growing at a CAGR of 29.70% during the forecast period (2024-2029).

RPA adoption is increasing across organizations of all sizes to generate greater Return on Investment (ROI) and boost productivity. Major market players are launching new Robotic Process Automation (RPA) solutions based on AI, machine learning, and cloud models to help meet the increasing demand.

Key Highlights

- Robotic process automation (RPA), also known as intelligent automation or smart automation, is a general term for cutting-edge technologies that can be programmed to carry out a variety of tasks that previously required human intervention, such as data manipulation, setting off reactions, and establishing necessary communication with other processes and systems. Vendors in the market are also improving their products by including new capabilities like automation lifecycle management, workload management, SLA-based automation, credential management, and Citrix automation, in addition to new data APIs. These improvements are drawing in new sectors of industry that require more operational and security capabilities.

- The rising use of cutting-edge technologies like AI, machine learning, and the cloud will primarily fuel the robotic process automation market growth. More and more businesses are adopting RPA to automate business processes and handle increasingly complex data. Companies are developing and deploying cloud and AI-based RPA solutions to automatically optimize business processes and workflow. The increase in the adoption of Artificial Intelligence and cloud-based solutions for internal efficiency among SMEs is thriving the market growth. According to Vistage, among the 13.6% of SMBs leveraging AI, a significant share is using it to improve business operations, followed by customer engagement.

- The expanding use of SaaS, IaaS, and PaaS services for customer relationship management, cloud computing, enterprise resource management, open source resources, cooperative robot learning, network connectivity, and other financial applications is also creating a market for RPA solutions. RPA's functional advantages in various end-user industries, including IT and telecom, BFSI, healthcare, and retail, fuel the market's expansion. It is anticipated that the growing trend toward cloud-based solutions and the growth of robot-based solutions across a range of end-user industries will open up new potential for the construction of robotic process automation worldwide.

- RPA boosts output and revenue but also confronts risks that could cost millions. Two significant security threats associated with robotic process automation are data loss and theft. If the proper security measures are not in place, sensitive data, such as RPA bot passwords or consumer data handled by RPA, may be exposed to attackers, which could stifle the market.

- COVID-19 has negatively impacted the robotic process automation market and witnessed significant growth, owing to an increased usage of automated process automation solutions and increased social distancing norms, which will continue soon. Also, the human resource crunch observed by enterprises in industries is expected to further influence the adoption of RPA during the next two years, thus, driving the demand for such solution vendors. The industry continues to expand as software robots are used to manage regular tasks performed by temporary or seasonal workers and for staff peaks caused by regulatory spikes, new product launches, or new operations.

Robotic Process Automation Market Trends

Retail Sector to hold major share in RPA Market

- Returns processing, workflow management, customer support management, accounting and finance, ERP management and marketing, and consumer behavior analysis are some of the applications in the retail sector, with RPA playing an important role. It has been estimated that more than USD 2 trillion can be saved in a global workforce by automating almost half of human tasks, especially in an emerging industry like retail.

- The rise in business operational adjustments brought on by the pandemic-induced work-from-home trend is one of the major drivers of the robotic automation market expansion in the retail industry. The industry also benefits from using cognitive technologies and modifying internal business procedures across organizations.

- Rapid growth in the e-commerce industry is an essential factor adding to the growth of the RPA market. Online sales in the United States are expected to double, by 2023, reaching approximately 20 to 25% of the overall retail sector. According to The Census Bureau of the Department of Commerce, the estimate of US retail e-commerce sales for the third quarter of 2022, adjusted for seasonal variation, was USD 251.7 billion. Within the United Kingdom (UK), retail plays a vital role in shaping the economy and employs nearly 3 million people.

- Along with adopting innovative practices to attract and engage more customers, the players in the retail industry have been using newer technologies for retail automation to smoothen their processes and gaining a growth momentum to counter various challenges. The growing number of warehouses is making the retail sector use robotic process automation to do tasks more efficiently and effectively. A study by Zebra Technologies on the trends in the retail industry revealed that around 75% of retailers are expected to adopt automation across all critical functions by 2023.

United States Expected to Hold Significant Market Share

- Among the leading innovators and pioneers in adopting robotics, The United States is one of the largest markets. Robot use in the region continues to grow, helping make US companies more competitive and leading to new job growth. Further, according to the Robotic Industries Association (RIA), the most significant driver of the year-to-date growth of industrial robots was an 83% increase in units purchased by automotive OEMs for process automation.

- According to the Association for Advancing Automation, over 180,000 robots have been dispatched to various American companies since 2010, and more than 1.2 million new manufacturing jobs have been created during this time. According to MIT, automotive manufacturing accounted for a significant portion of the demand for industrial robots in the United States, followed by electronic, plastics, and chemical manufacturing. It is anticipated to augment robotic process automation (RPA) growth.

- The increasing initiatives by the government and regulated authorities to boost the adoption of RPA across various industries are expected to fuel market growth over the forecast period. According to UiPath, more than 30 agencies in the region are using its RPA to eliminate compliance issues, improve throughput, and reduce their backlogs.

- Several government organizations and private companies are investing in creating conversational RPA chatbots for automating their processes. For instance, the National Science Foundation (NSF) Organization has created an RPA bot that automates messages and helps to remind people about upcoming public meetings. Since the NSF organization holds several thousand meetings annually, and the RPA bot helps save over 25,000 hours for the administrative staff.

Robotic Process Automation Industry Overview

The robotic process automation market is low consolidated with a few players such as Automation Anywhere Inc, Jafada, Kofax, etc., as various acquisitions and collaborations of large companies are expected to occur shortly. Some of the Key developments in this market are:

- In November 2022, Fabric, a retail fulfillment automation company, and Reply, which specializes in new communications channels and digital media, entered into a strategic partnership to offer brands and retailers seamless integration to a single-point solution for a warehouse management system and automated robotic fulfillment.

- In October 2022, Automation Anywhere, a robotic process automation vendor, unveiled its Automation Success Platform with new robotic process automation tools for process discovery and document processing. This successful platform lets enterprises automate all aspects of their business operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the industry

- 4.4 Market Drivers

- 4.4.1 Retail Sector to hold major share in RPA Market

- 4.4.2 Adoption of AI- and Cloud-based Solutions for Internal Efficiency among SMEs

- 4.5 Market Restraints

- 4.5.1 Data Security Concerns

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 Solution

- 5.2.1 Software

- 5.2.2 Service

- 5.3 Size of Enterprise

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 End User Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Retail

- 5.4.5 Manufacturing

- 5.4.6 Other End User Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Automation Anywhere Inc.

- 6.1.2 Blue Prism Group PLC

- 6.1.3 Jacada Inc.

- 6.1.4 Pegasystems Inc.

- 6.1.5 UIPath Inc.

- 6.1.6 Kofax Inc. (Thoma Bravo LLC)

- 6.1.7 Be Informed BV (Hoogenberg Beheer BV)

- 6.1.8 Datamatics Global Services Limited

- 6.1.9 AutomationEdge Technologies Inc.

- 6.1.10 Jidoka

- 6.1.11 HelpSystems LLC (HGGC)

- 6.1.12 Nice Robotic Automation Ltd

- 6.1.13 CGI Inc.