|

市场调查报告书

商品编码

1438358

拖拉机:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

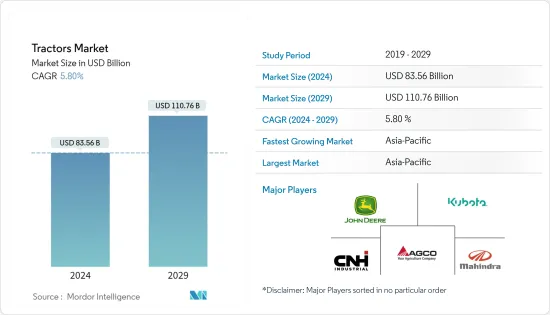

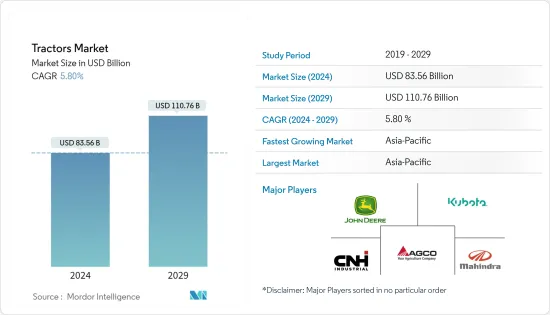

拖拉机市场规模预计2024年为835.6亿美元,预计到2029年将达到1107.6亿美元,在预测期内(2024-2029年)复合年增长率为5.80%增长。

拖拉机市场受到 2020 年第二季新型 COVID-19感染疾病爆发的负面影响,因为世界各地的封锁扰乱了供应链并影响了全球拖拉机的生产和销售。然而,随着经济活动的恢復,随着新产品的开发和推出,市场正在迅速復苏。拖拉机需求的增加也促进了市场的成长。

从长远来看,推动全球拖拉机销售成长的主要因素将是农业机械化率的提高(特别是在开发中国家)、农业劳动力成本上升、季节性劳动力短缺以及拖拉机更换週期缩短。然而,该行业的一些知名企业正专注于市场上的併购和新产品开发。

主要亮点

- 2022 年 10 月,在 Kubota Connect 上,製造商向经销商展示了新产品。 M7 系列 第四代久保田 M7 是该公司针对牲畜和饲料生产商的最大拖拉机。

- 2021 年 9 月,TAFE 为印度西孟加拉邦和奥里萨邦推出了新的麦赛福格森 244 和 246 Dynatruck 版本拖拉机。这些拖拉机具有实用性高、技术先进、功率大的特性。

新兴市场国家政府也鼓励农民,以低利率向他们提供补贴和农业设备。农业设备和拖拉机的需求预计将稳定成长。

主要亮点

- 根据美国农业部2021年预算,拨款33亿美元支持提高美国农业竞争力和促进粮食安全的研究。该预算还将透过提供营运成本融资以及收购农场或维护现有农场的机会来帮助估计 35,000 名农民和牧场主。

随着印度、中国和日本等主要新兴经济体透过提供农业设备补贴和降低信贷利率来鼓励农民,以普及,亚太地区将继续增长。预计未来五年将出现显着增长年。这些发展可能会增加这些地区对拖拉机的需求。

拖拉机市场趋势

未来五年,40马力以下拖拉机产业的成长预计将进一步加速

由于大马力拖拉机在困难地形中的卓越性能以及农场和非农业应用的多功能性,大马力拖拉机的行业趋势在世界范围内持续增长。印度和中国等主要拖拉机市场近年来在 40 马力以下细分市场中取得了积极成长。

小于 40 马力的拖拉机通常是紧凑型拖拉机的代名词。这些拖拉机的引擎排气量小于1,500 cc,占用空间小,放置非常灵活。它们主要用于割草,但也可以执行其他基本农业任务,例如处理肥料。

然而,由于COVID-19感染疾病导致全球市场发生重大变化,2020年第一季紧凑型拖拉机的需求大幅下降。一些地区的封锁限制了人员流动并导致零售商店关闭。结果是市场滞后,销售量大幅下降。

在大多数农业活动规模较大的国家中,亚太和非洲地区对40马力以下拖拉机的需求量大,主要用于农业活动。这是因为这些拖拉机的低廉价格提高了广大人口和人口中负担得起的拖拉机的购买率。农场规模。研究市场中的多个参与者正在推出他们的最新产品以占领市场占有率。

此外,尺寸紧凑、易于自订以及即将推出的功率范围内拖拉机价格上涨近 50% 等因素预计将推动对这些拖拉机的需求。在这个功率范围内,有来自不同製造商的多种选择和替代品,与高功率拖拉机相比,为消费者提供了更多的议价能力。由于上述趋势和发展,40 马力以下拖拉机市场预计将在未来几年实现健康成长。

预计亚太地区将在预测期内引领市场

预计拖拉机市场将由亚太地区主导,预计该地区在未来几年发展最快。对农业机械化的兴趣日益浓厚以及政府资助政策的增加预计将推动未来几年的市场成长。

- 2021年10月,印度政府宣布将为总理基桑拖拉机计划下购买拖拉机提供高达50%的补贴。根据该计划购买拖拉机的农民可以支付一半的价格享受优惠。

中国农业机械化协会等一些地区监管机构正在透过对合作社和个体农民进行有关在大型农场使用大马力拖拉机的好处的教育来促进农业机械化。向电动车的过渡也得到了政府的支持,政府支持企业开发永续产品。

- Monarch Tractor 是业界全电动自动拖拉机製造商。 2021年11月,该公司及其农业电气化联盟合作伙伴获得加州能源委员会(CEC)价值300万美元的资金,用于加速包括拖拉机在内的农业机械的电气化,并展示农用设备电池的津贴。在野火造成停电期间保持关键电力负载运作。联盟包括 Monarch Tractor、Gridtractor、Rhombus Energy Solutions、Current Ways 和 Polaris Energy Services。

农业规模化生产者和从事农业的新农村群体数量的扩大,促进了稳定市场需求的趋势。在印度,农机领域大型客製化就业服务公司的引进,加速了农业机械化的进程。随后向自动化技术的转变预计将推动全部区域对拖拉机的需求。所有上述因素预计将推动市场成长。

拖拉机产业概况

拖拉机市场适度整合,多个全球和地区参与者积极参与。 Mahindra & Mahindra、Tractor、Kubota Corporation、Farm Equipment Limited 和 HMT Limited 等领先公司已将合约和产品发布作为关键发展策略,以改善产品系列。

- 在 2022 年 11 月的 SIMA 2022 上,New Holland 首次推出了 T8 拖拉机以及无人谷物车收割应用程式 Raven Autonomy。它采用了OMNiDRIVE,这是世界上第一个用于粮车收割的无人农业技术。尖端技术堆迭使农民能够从收割机驾驶室监控、同步和操作无人驾驶拖拉机。

- 2021 年 10 月,马恆达推出了三款新型 YuvoTech+ 拖拉机,配备了具有最高扭力和燃油效率的新时代先进技术。该拖拉机有三种型号:Yuvo Tech+275(27.6 kW-37 HP)、Yuvo Tech+405(29.1kW 39 HP)和Yuvo Tech+415(31.33 kW-42 HP)。

- 2021 年 8 月,约翰迪尔推出了新型 6155MH 拖拉机,该拖拉机为犁耕机、犁耕机和牵引式收割机拖车提供所有经过现场验证的性能和可靠性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔(市场规模)

- 按马力

- 小于40HP

- 40HP~100HP

- 100HP以上

- 按下驱动器类型

- 两轮驱动

- 四轮驱动/全轮驱动

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Deere and Company

- CNH Global NV(includes New Holland and Case IH)

- AGCO Corporation(includes Massey Ferguson, Valtra, Fendt, and Challenger)

- CLAAS KGaA mbH

- Mahindra and Mahindra Corporation

- Kubota Corporation

- Escorts Limited

- Tractors and Farm Equipment Limited(TAFE)

- Kuhn Group(Subsidiary of Bucher Industries)

- Yanmar Company Limited

- Deutz-Fahr

The Tractors Market size is estimated at USD 83.56 billion in 2024, and is expected to reach USD 110.76 billion by 2029, growing at a CAGR of 5.80% during the forecast period (2024-2029).

The tractor market was impacted negatively by the outbreak of COVID-19, as the lockdowns in various parts of the world disrupted the supply chain during the second quarter of 2020, which impacted the production and sales of tractors globally. However, as the economies reopened, the market is recovering at a high rate, along with new product developments and launches. The increasing demand for tractors is also contributing to the growth of the market.

Over the long term, the key factors contributing to the increase in worldwide tractor sales are increasing farm mechanization rates, especially in developing nations, rising farm labor costs, seasonal labor shortages, and shorter tractor replacement cycles. However, some of the prominent players in the industry are focusing on mergers and acquisitions and new product development in the market. For instance,

Key Highlights

- In October 2022, At Kubota Connect, the manufacturer gave dealers a sneak peek at the new products. Series M7 Generation 4 The Kubota M7s are the company's largest tractors, aimed at livestock and forage producers.

- In September 2021, TAFE launched the new Massey Ferguson 244 and 246 Dynatrack versions of tractors specifically for West Bengal and Odisha states of India. These tractors are characterized by high utility, advanced technology, and high power.

Governments in emerging markets are also encouraging farmers in their countries and providing farm equipment at subsidized rates and low-interest rates. The demand for farm equipment and tractors is expected to grow at a healthy rate. For instance,

Key Highlights

- According to USDA 2021 Budget, USD 3.3 billion is allocated to support research to advance the competitiveness of US agriculture and promote food security. The budget also supports an estimated 35,000 farmers and ranchers by financing operating expenses and providing opportunities to acquire a farm or keep an existing one.

Asia-Pacific region is expected to witness significant growth in the next five years as emerging key economies like India, China, and Japan are encouraging farmers in their countries by offering subsidized farm equipment and low credit rates to encourage tractor adoption. Such developments are likely to drive the demand for tractors in these regions.

Tractor Market Trends

Below 40 HP Tractors Segment's Growth Expected to be Bolstered over the Next Five years

The industry trend toward bigger horsepower tractors continues to grow worldwide, owing to greater performance in difficult terrain and versatility in farm and non-farm applications. The major tractor markets like India and China are recording positive growth across less than 40 HP segments in recent years.

Less than 40 HP tractors are often synonymous with the term compact tractors. With an engine displacement of not more than 1,500 ccs, these tractors occupy less space and can be aligned with great flexibility. They are primarily used for mowing but can handle other basic farming tasks, like manure handling.

However, due to the significant volatility that caused the world market during the COVID-19 pandemic, demand for compact tractors fell dramatically in the first quarter of 2020. The imposition of lockdowns in several regions limited mobility and resulted in the closure of retail outlets. This resulted in a market delay, which, in turn, significantly reduced sales.

With the majority of countries that have huge agricultural activity, Asia-Pacific and African regions are witnessing high demand for less than 40 HP tractors, primarily for agricultural activities, as the low cost of these tractors increased the affordability rate among the highly populated small-scale farmers. Several players in the market studied are launching the latest products to gain market share. For instance,

- In August 2021, Kubota introduced its new LX Series, a range of multi-purpose compact tractors under 40 HP with two different models, namely the 35HP LX-351 Rear ROPS and LX-351 Cab. The new LX tractor features a Stage V engine with CRS, EGR, and DPF and is available in four different models. The LX-351 Rear ROPS and LX-351 Cab, with 35 hp and an HST 3-range transmission, and the LX-401 Rear ROPS and LX-401 Cab, featuring 40 hp and a 3-range HST transmission.

Further factors such as compact size, ease of customization, and nearly 50% more price for the next power range of tractors, are expected to enhance the demand for these tractors. In this power band, the bargaining power of consumers is high, compared to high-powered tractors, given the wide range of options and substitutes from different manufacturers. With the aforementioned trends and developments, it is expected that the Below 40HP tractors segment is likely to have healthy growth over the coming years.

Asia-Pacific Region Anticipated to Lead the Market During the Forecast Period

The tractor market is expected to be dominated by Asia-Pacific, and the region is predicted to develop at the highest rate over the coming years. The growing preference for farm mechanization and an increase in the number of government-funded policies are anticipated to promote the growth of the market in the next few years. For instance,

- In October 2021, the Indian government announced up to 50% subsidy on buying tractors under the PM Kisan Tractor Scheme. Farmers buying a tractor under the scheme can avail of the benefits and pay half the amount.

Several regional regulatory bodies, such as the China Agricultural Industry Mechanization Association, promote farm mechanization by educating co-operatives and individual farmers about the benefits of using high-horsepower tractors in larger farm areas. A shift toward EVs is also backed by the government, which is helping companies to develop sustainable products. For instance,

- Monarch Tractor is the manufacturer of the industry's fully electric autonomous tractor. In November 2021, the company and its Farm Electrification Consortium partners received a grant worth USD 3 million from the California Energy Commission (CEC) to accelerate the electrification of agricultural equipment, including tractors, and to demonstrate the ability of batteries in on-farm equipment to keep critical electrical loads running during power outages caused by wildfires. Monarch Tractor, Gridtractor, Rhombus Energy Solutions, Current Ways, and Polaris Energy Services make up the consortium.

The expansion in the number of large agricultural producers and new rural groups engaged in farming contributed to this tendency to stabilize the demand in the market. The introduction of large-scale bespoke hiring service enterprises in agricultural machinery in India fueled the rise in farm mechanization. The subsequent move to automated technologies is envisioned to drive the demand for tractors across the Asia-pacific region. All these aforementioned factors are expected to drive the growth of the market.

Tractor Industry Overview

The tractor market is moderately consolidated as it witnesses active engagement from several global and regional players. Major players such as Mahindra & Mahindra, Tractor, Kubota Corporation, Farm Equipment Limited, and HMT Limited are adopting agreements and product launches as key developmental strategies to improve the product portfolio of tractor products. For instance,

- In November 2022, At SIMA 2022, New Holland debuted the T8 tractor with Raven Autonomy, a driverless grain cart harvest application. It incorporates OMNiDRIVE, the world's first driverless agriculture technology for grain cart harvesting. The cutting-edge technology stack allows the farmer to monitor, synchronize, and operate a driverless tractor from the harvester's cab.

- In October 2021, Mahindra launched three new YuvoTech+ tractors that come equipped with the new-age advanced technology with the highest torque and fuel efficiency. The tractors are available in three models, namely Yuvo Tech+ 275 (27.6 kW-37 HP), Yuvo Tech+ 405 (29.1kW 39 HP), and Yuvo Tech+ 415 (31.33 kW-42 HP).

- In August 2021, John Deere introduced the new 6155MH Tractor that delivers all field-proven performance and reliability effective for cultivating, harrowing, or pulling harvester trailers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Challenges

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD billion)

- 5.1 By Horsepower

- 5.1.1 Below 40 HP

- 5.1.2 40 HP - 100 HP

- 5.1.3 Above 100 HP

- 5.2 By Drive Type

- 5.2.1 Two-wheel Drive

- 5.2.2 Four-wheel Drive/All-wheel Drive

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Deere and Company

- 6.2.2 CNH Global NV (includes New Holland and Case IH)

- 6.2.3 AGCO Corporation (includes Massey Ferguson, Valtra, Fendt, and Challenger)

- 6.2.4 CLAAS KGaA mbH

- 6.2.5 Mahindra and Mahindra Corporation

- 6.2.6 Kubota Corporation

- 6.2.7 Escorts Limited

- 6.2.8 Tractors and Farm Equipment Limited (TAFE)

- 6.2.9 Kuhn Group (Subsidiary of Bucher Industries)

- 6.2.10 Yanmar Company Limited

- 6.2.11 Deutz-Fahr