|

市场调查报告书

商品编码

1438373

安全资讯与事件管理 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Security Information and Event Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

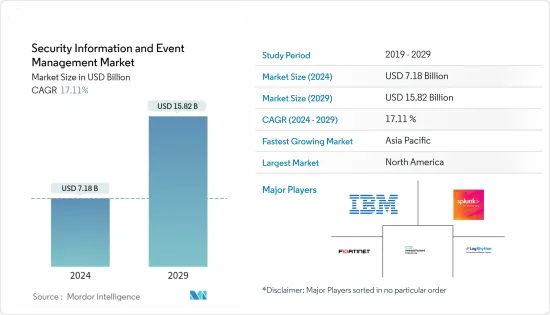

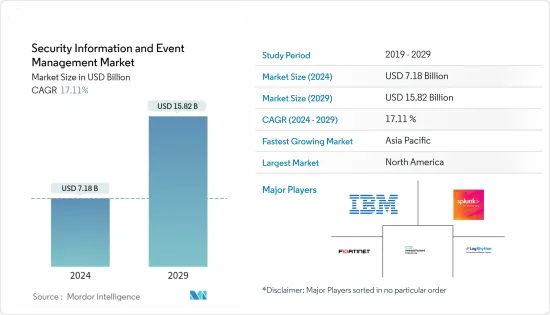

安全资讯和事件管理市场规模预计到 2024 年为 71.8 亿美元,预计到 2029 年将达到 158.2 亿美元,在预测期内(2024-2029 年)CAGR为 17.11%。

安全资讯和事件管理是基于对组织 IT 网路应用程式和基础架构中产生的安全警报的即时分析。

主要亮点

- 预计未来几年,各行业的网路攻击和安全漏洞风险将不断增加,银行和医疗保健公司的关键资讯被盗取的可能性很高。主要公司正在采用安全资讯和事件管理解决方案来应对这些挑战。由于政府组织可以存取其国家的金融资料,由于多项监管合规性而导致的安全问题增加等因素也有助于市场的成长。

- 与需要软硬体整合的本地部署相比,基于云端的 SIEM 解决方案可以节省大量前期成本和 IT 支出,从而导致 IT 支出增加。基于云端的解决方案占据了很大的市场份额,并且正在推动全球市场的发展。

- 随着威胁情势的复杂性增加和使用网路的人数增加,市场预计将在动态变化的环境中快速成长。 BYOD 的日益普及、网路犯罪的持续威胁、SIEM 解决方案的复杂性以及高昂的拥有成本也是市场成长的原因。

- 缺乏对安全措施的认识对市场的成长构成了挑战。然而,政府在资料安全领域的措施预计将缓解未来的挑战。安全资讯和事件管理软体的高部署成本和可扩展性等重要因素预计将阻碍预测期内市场的成长。

- 由于 COVID-19 的爆发,针对快速部署的新型远端存取和远端办公基础设施的攻击在各个地区有所增加。世界各地的组织积极应对网路威胁,网路威胁在疫情期间激增。因此,网路弹性,指的是一个部门或组织准备、回应和从网路攻击中恢復的能力,在当前情况下已成为绝对必要性,而不仅仅是一种选择,这正在逐渐推动疫情后的市场。

安全资讯和事件管理市场趋势

BFSI 预计将出现显着成长

- SIEM 解决方案用于保护银行免受因安全漏洞造成的诈欺。它们为 ATM 网路提供了宝贵的可视性。银行和金融服务是内部和外部诈欺活动最关键的行业,与其他行业相比,打破了所有违规记录。註册诈欺审查员协会 (ACFE) 在其报告中审查了来自 125 个国家的 2,504 起内部诈欺案件,这些案件造成了 36 亿美元的损失。 ACFE 评估的大多数内部诈欺案件(占总数的 15.4%)发生在银行和金融服务部门。 BFSI 领域日益增长的诈欺趋势正在推动市场发展,因为组织正在其流程中实施 SIEM 软体来检测安全漏洞。

- 例如,俄罗斯重要的金融机构乌拉尔FD银行与Jet Infosystems合作,建立了基于HP ArcSight的安全资讯和事件管理系统。该银行获得了可靠、便捷的工具来及时识别和调查资讯安全漏洞。这将事件回应和调查的周转时间缩短了 80%。

- 根据 IBM 安全情报部落格上的一篇文章,SIEM 工具从 ATM 端点接收日誌、控製网路伺服器并采用关联规则来帮助安全分析师监控事物,例如网路条目、软体完整性和防毒来源。这有助于随时提供 ATM 网路安全状况的全面概览。

- 由于金融机构在全球营运中优先考虑安全合规性,因此对安全资讯和事件管理 (SIEM) 的需求更大。例如,在美国,银行实施了 SIEM 平台以实现 FFIEC 合规性,以保护组织免受漏洞、骇客、网路犯罪和其他网路安全风险的影响。

- 公司正在为 BFSI 开发专门设计的解决方案,并与他们合作提供解决方案。 Adlumin Inc.推出了专门针对金融机构的SIEM解决方案。 Alumni 是美国银行家协会的会员,一直致力于改善金融机构保护敏感资料和智慧财产权的方式,同时实现合规目标。

北美将占据最大市场份额

- 北美地区预计将占据重要的市场份额,这主要是由于先进技术的广泛采用。该地区的最终用户行业对先进安全系统的需求不断增加,这积极推动了市场的成长。

- 技术的发展导致该地区复杂的威胁和网路攻击的发展。组织对其专用网路的安全漏洞也变得非常谨慎,这可能会导致巨大的损失。这种安全性问题增加了 SIEM 解决方案的部署,以有效应对持续的安全漏洞。

- 支付卡产业资料安全标准 (PCI DSS) 合规性最初推动了 SIEM 在大型企业中的采用。与支付和银行业相关的资料外洩在美国非常突出,这反过来又会增加 SIEM 等先进安全服务的采用。此外,随着区块链技术的日益普及,许多组织正在采用 SIEM 解决方案,特别是在 BFSI 领域。这一因素正在推动该国市场的成长。许多公司正在开发基于区块链的 SIEM 解决方案。

- SIEM 使组织能够最大限度地减少安全预算。该地区的组织始终需要创新和先进的技术。 SIEM 不仅帮助他们侦测和管理即时威胁和违规行为,还使他们能够快速分析大量资讯。由于技术的发展,该地区的 SIEM 供应商正在开发先进的超现代解决方案。

- 根据 Deccan Herald 报导,IT 科技巨头 Wipro 已投资美国网路安全公司 Vectra Networks 和诈欺防制公司 Emailage Corporation,建立网路防御平台。 Wipro也向应用程式安全公司Denim Group投资了883万美元。

安全资讯和事件管理产业概述

安全资讯和事件管理市场整合。它由市场上的主要参与者主导。一些主要的市场参与者包括 IBM Corporation、Splunk Inc.、Fortinet Inc.、Hewlett Packard Enterprise Company 和 LogRhythm, Inc.。各种正在进行的收购和创新正在推动市场的成长。此外,SIEM 供应商正在与不同的最终用户公司建立合作伙伴关係并开发客製化解决方案以增加其市场份额。

2022 年 10 月,Exabeam 提供了全球网路安全解决方案,并开发了用于进阶安全营运的 New-Scale SIEM。 Exabeam 宣布日本三菱日联银行 (MUFG Bank of Japan) 已在其全国金融集团站点和办事处实施了 Exabeam Fusion SIEM。为了提供整个 IT 基础架构中典型活动的基线并立即识别可能是网路安全威胁或攻击迹象的异常情况,MUFG 银行选择了 Exabeam Fusion SIEM。

2022 年 10 月,LogRhythm 推出了名为 Axon 的新云端原生安全营运平台,该平台是 LogRhythm SIEM、NDR 和 UEBA 的升级版本。在 Axon 的帮助下,安全团队可以轻鬆直观地获得跨云端和本地日誌来源的无缝可见性,为其安全程序奠定基础。

2022 年 7 月,下一代 SIEM 开发商 Securonix Inc. 与 Redington 在中东和非洲的託管安全服务品牌 DigiGlass 宣布签署战略託管安全服务提供者 (MSSP) 协议。根据合约条件,DigiGlass 已获准使用 Securonix 下一代 SIEM 平台为该地区的客户提供託管服务。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究成果和假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场动态

- 市场驱动因素

- 安全问题日益严重

- BYOD 的采用率不断提高

- 市场限制

- 部署和可扩充性成本高

第 6 章:市场细分

- 按部署

- 本地部署

- 云

- 按组织类型

- 中小企业 (SME)

- 大型企业

- 按最终用户产业

- 零售

- BFSI

- 製造业

- 政府

- 卫生保健

- 其他最终用户产业

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 亚太其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- IBM Corporation

- Splunk Inc.

- Fortinet Inc.

- LogRhythm Inc.

- McAfee LLC

- Micro Focus International PLC

- RSA Security LLC (Dell Technologies)

- Rapid7 Inc.

- Exabeam Inc.

- Securonix Inc.

- AlienVault Inc.

- Hewlett Packard Enterprise Company

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Security Information and Event Management Market size is estimated at USD 7.18 billion in 2024, and is expected to reach USD 15.82 billion by 2029, growing at a CAGR of 17.11% during the forecast period (2024-2029).

Security information and event management are based on real-time analysis of security alerts, which are generated in organizations' IT network applications and infrastructure.

Key Highlights

- Increasing risks of cyber-attacks and security breaches across various industries and high chances of critical information being extracted from banks and healthcare companies are anticipated in the coming years. Major companies are adopting security information and event management solutions to deal with these challenges. Factors such as the rise in security concerns due to several regulatory compliances, as government organizations have access to their country's financial data, are also aiding the market's growth.

- The cloud-based SIEM solutions save a lot of upfront costs and IT expenses compared to on-premise deployments that require hardware and software integration, leading to an increase in IT spending. The cloud-based solutions account for a significant share of the market, and it is driving the market around the world.

- With the growth in complexity of the threat landscape and an increase in the number of people using the internet, the market is expected to grow rapidly in a dynamically changing environment. The growing adoption of BYOD, the constant threat of cybercrime, the complexity of SIEM solutions, and the high cost of ownership are also responsible for the market's growth.

- The lack of awareness about security measures challenges the market's growth. However, government initiatives in the data security space are expected to mitigate the challenge in the future. Significant factors, such as the high cost of deployment and scalability of security information and event management software, are expected to hinder the market's growth over the forecast period.

- Due to the outbreak of COVID-19, attacks against the new and rapidly deployed remote access and teleworking infrastructure increased across various regions. Organizations around the world responded proactively toward cyber threats, which witnessed a spike during the pandemic. Hence, cyber resilience, which refers to a sector or organization's ability to prepare for, respond to, and recover from cyberattacks, has become an absolute necessity rather than a mere option in the current scenario, and this is driving the market gradually after the pandemic.

Security Information and Event Management Market Trends

BFSI Expected to Witness Significant Growth

- SIEM solutions are used to protect banks against fraud due to security breaches. They offer invaluable visibility into ATM networks. Banking and financial services are the most critical sectors for internal and external fraudulent activities, breaking all the breach records compared to other industries. The Association of Certified Fraud Examiners (ACFE) examined 2,504 instances of internal fraud from 125 countries that resulted in losses of USD 3.6 billion in its report. The majority of internal fraud instances evaluated by the ACFE, 15.4% of the total, were in the banking and financial services sector. This increasing trend of fraud in the BFSI sector is driving the market because organizations are implementing SIEM software in their processes to detect security breaches.

- For instance, an important financial institution in Russia, Ural FD Bank, along with Jet Infosystems, established a security information and event management system based on HP ArcSight. The bank acquired a reliable and convenient instrument to identify and investigate information security breaches promptly. This reduced the turnaround time for incident response and investigation by 80%.

- According to a post on IBM's Security Intelligence Blog, SIEM tools receive logs from ATM endpoints, control network servers, and employ correlation rules to help security analysts monitor things, such as entries into the network, software integrity, and antivirus feeds. This helps to deliver a comprehensive overview of the ATM network security posture at any moment.

- Security Information and Event Management (SIEM) is in greater demand because financial institutions prioritize security compliance in their operations around the world. For instance, in the United States, banks implemented SIEM platforms for FFIEC compliance to protect organizations from vulnerabilities, hackers, cybercriminals, and other cybersecurity risks.

- Companies are developing specifically designed solutions for BFSIs and partnering with them to provide the solutions. Adlumin Inc. introduced SIEM solutions specifically for financial institutions. Alumni, a member affiliate of the American Bankers Association, has been working to improve the way financial institutions protect sensitive data and intellectual property while accomplishing their compliance goals.

North America to Hold the Largest Market Share

- The North American region is expected to hold a significant market share, primarily due to the high adoption of advanced technologies. There is an increasing need for advanced security systems among the end-user industries in the region, which positively boosts the market's growth.

- The technological evolution has led to the evolution of sophisticated threats and cyber-attacks in this region. Organizations are also becoming very cautious regarding security breaches in their private networks, which may lead to huge losses. This security concern has increased the deployment of SIEM solutions for efficiently dealing with constant security breaches.

- Payment Card Industry Data Security Standard (PCI DSS) compliance originally drove SIEM adoption in large enterprises. Data breaches related to payment and the banking sector have been prominent in the United States, which, in turn, is set to increase the adoption of advanced security services, such as SIEM. Additionally, many organizations are adopting SIEM solutions with the increasing adoption of blockchain technology, especially in the BFSI sector. This factor is fuelling the market's growth in the country. Many companies are developing blockchain-based SIEM solutions.

- SIEM enables organizations to minimize their security budget. Organizations in the region always demand innovative and advanced technologies. SIEM not only helps them to detect and manage real-time threats and breaches but also enables them to analyze a large amount of information quickly. SIEM providers in this region are developing advanced and ultramodern solutions due to technological growth.

- According to Deccan Herald, IT Technological giant Wipro, has invested in US-based cybersecurity company Vectra Networks and fraud prevention firm Emailage Corporation to establish a cyber defense platform. Wipro also invested USD 8.83 million in application security company Denim Group.

Security Information and Event Management Industry Overview

The security information and event management market is consolidated. It is dominated by the major players present in the market. Some major market players are IBM Corporation, Splunk Inc., Fortinet Inc., Hewlett Packard Enterprise Company, and LogRhythm, Inc. The various ongoing acquisitions and innovations are leading to the market's growth. In addition, SIEM providers are forming partnerships with different end-user companies and developing customized solutions to increase their market share.

In October 2022, Exabeam offered worldwide cybersecurity solutions and developed the New-Scale SIEM for advanced security operations. Exabeam announced that MUFG Bank of Japan had implemented Exabeam Fusion SIEM throughout its nationwide financial group sites and offices. To provide a baseline of typical activity throughout its IT infrastructure and immediately identify anomalies that could be signs of a cybersecurity threat or attack, MUFG Bank selected Exabeam Fusion SIEM.

In October 2022, LogRhythm launched a new Cloud-Native Security Operations Platform called Axon, which has been introduced as an upgrade to LogRhythm SIEM, NDR, and UEBA. With the help of Axon, security teams could easily and intuitively obtain seamless visibility across cloud and on-premises log sources, laying the groundwork for their security procedures.

In July 2022, a strategic Managed Security Services Provider (MSSP) agreement between Securonix Inc., a developer in Next-Gen SIEM, and DigiGlass, a managed security services brand of Redington in the middle east and Africa, was announced. According to the contract conditions, DigiGlass has been permitted to offer managed services for customers all around the region using the Securonix Next-Gen SIEM platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Security Concerns

- 5.1.2 Increasing Adoption of BYOD

- 5.2 Market Restraints

- 5.2.1 High Cost of Deployment and Scalability

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organisation Type

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Manufacturing

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Splunk Inc.

- 7.1.3 Fortinet Inc.

- 7.1.4 LogRhythm Inc.

- 7.1.5 McAfee LLC

- 7.1.6 Micro Focus International PLC

- 7.1.7 RSA Security LLC (Dell Technologies)

- 7.1.8 Rapid7 Inc.

- 7.1.9 Exabeam Inc.

- 7.1.10 Securonix Inc.

- 7.1.11 AlienVault Inc.

- 7.1.12 Hewlett Packard Enterprise Company