|

市场调查报告书

商品编码

1438405

服装物流 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Apparel Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

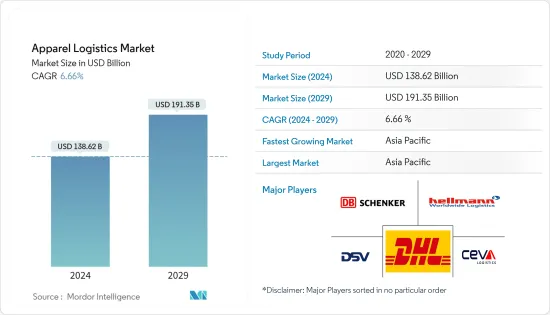

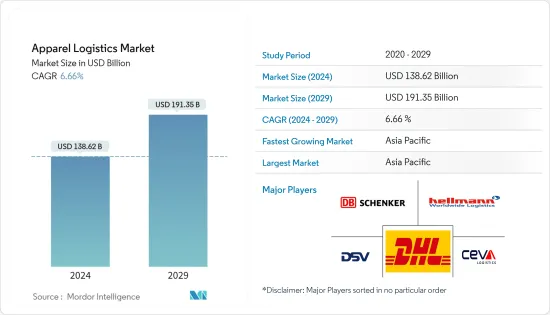

2024年服装物流市场规模预估为1,386.2亿美元,预估至2029年将达到1,913.5亿美元,预测期(2024-2029年)CAGR为6.66%。

服装业的快速补货週期是推动市场成长的主要因素。从零售商到製造商,服装供应链都在激烈竞争,以提供最新趋势和最佳客户体验。同时,不断变化的消费者期望和履行模式给服装企业带来压力。

COVID-19 大流行导致跨地区的运输组织封锁、线路限制和崩溃。随着案件数量的迅速增加,整个服装物流市场正受到多方面的影响。劳动力的可及性正在扰乱服装物流市场的库存网络,因为封锁和感染的蔓延迫使人们留在室内。

许多领先的时尚零售商已经接受了在单一设施内使用单一资讯系统进行多通路分销的概念,从而显着提高了劳动生产力和库存优化。服装市场正在不断发展和重塑。新的销售管道正在开发,要求企业不断评估和重塑其物流和运输网络。

由于不断变化的时尚趋势,全球服装行业异常活跃。由于竞争激烈,服装公司正在实施资料分析和人工智慧等新技术。服装业拥有大量的外包业务,为物流企业提供了相当多的国内和国际营运机会,使其成为一个竞争激烈的行业。供应链的任何中断都会对服装公司造成巨大损失。因此,为了尽量减少对供应链的影响,服装公司通常更愿意将业务外包给物流公司。

服装物流市场趋势

线上服装销售的成长与消费者行为的改变

2021年6月,快时尚电商网站shein.com是全球时尚服饰类别中访问量最大的网站,占桌面流量的3.29%。瑞典服饰零售商HM的电商入口网站排名第二,访问量为1.75%。 2020 年和 2021 年,线上服装零售网站由于其数位市场的存在而实现了销售额增长。这种影响推动了市场参与者的方式发生变化,预计这种变化可能会在未来几年持续下去,更加重视电子商务、行动购物的成长以及满足客户不断增长的个人期望。

根据网站流量的年度百分比增长,shein.com 在 2020 年第四季度成为美国领先的快时尚零售商网站。虽然消费者经常访问网站来比较价格和产品,但全球在线平台计划扩大其网站时尚品牌合作并发展额外的参与方法,以保持在数位购物领域的竞争力。为了处理不断增长的线上订单,第三方物流公司正在占用数百万平方英尺的空间,并将其出租给消费品、电子商务、製造和服装公司。

不断增长的服装市场推动服装物流的成长

在研究期间,服装市场产生的收入稳定成长。 2020年,市场收入约为1.46兆美元。消费科技品牌长期以来一直瞄准澳洲、日本和韩国的线上购物者。然而,服装和美容行业的品牌也瞄准了其他地区。因此,品牌可能会继续专注于在地化并迎合千禧世代客户,他们是这些产品的主要购买者。

2020年,服装鞋类的年增率出现严重下滑。在COVID-19大流行的背景下,增速总计下降了10%以上。体育用品和大众/俱乐部零售在2020 年实现成长。耐吉和阿迪达斯等全球运动服装和鞋类品牌正在放弃其他地区,转而增加在越南等新兴东南亚国家的产量,这为运输公司和其他第三方物流带来了积极的前景服务供应商。

服装物流业概况

服装物流市场呈现分散化状态,既有大型全球企业,也有中小型本土企业。一些主要参与者占据了大部分市场份额。大多数全球物流企业都设有零售和服装物流部门来满足市场需求和需求。此外,本地企业正在不断增强其在机队规模、服务产品、处理的产品和技术方面的能力。电商销售的激增为物流公司在速度、交付等方面带来了机会和挑战。拥有大量资本和资产的全球公司可以投资先进的仓储空间和履行中心,并从这种情况中受益。另一方面,区域和本地参与者正在提出更好的行业解决方案来支持生产公司和零售商的需求。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场概览

- 当前的市场状况

- 市场动态

- 司机

- 限制

- 产业吸引力-波特五力分析

- 产业价值链分析

- 政府法规和倡议

- 聚焦全球物流业

- 全球服装产业简介

- 聚焦-电子商务对传统服装物流供应链的影响

- 退货货物流回顾与评论

- 服饰业快速补货週期对物流市场的影响

- 聚焦合约物流与综合物流需求

- COVID-19 对市场的影响

第 5 章:市场细分

- 按服务

- 运输

- 仓储和库存管理

- 其他加值服务

- 按地理

- 亚太

- 中国

- 日本

- 印度

- 韩国

- 东协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 巴西

- 墨西哥

- 美洲其他地区

- 欧洲

- 英国

- 德国

- 义大利

- 西班牙

- 法国

- 欧洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:关键的定性和定量见解

- 按供应链流程

- 生产物流

- 销售物流

- 逆向物流

- 按服务性质

- 企业物流

- 第三方物流

- 电商物流及即时配送

第 7 章:全球主要时尚零售商洞察(公司概况、产品组合、物流合作伙伴等)

- 印地纺 (ZARA)

- H&M

- 迅销有限公司

- 盖璞公司

- 安踏

- L 品牌公司

- PVH公司

- 拉尔夫劳伦公司*

第 8 章:竞争格局

- 公司简介

- Ceva Logistics

- DB Schenker

- Deutsche Post DHL Group

- DSV

- Hellmann Worldwide Logistics

- Apparel Logistics Group Inc.

- Logwin AG

- PVS Fulfillment-Service GmbH

- Bollore Logistics

- GAC Group

- Nippon Express

- Genex Logistics

- Expeditors International of Washington Inc.

- Agility Logistics

- BGROUP SRL*

第 9 章:市场机会与未来趋势

第 10 章:附录

第 11 章:免责声明

The Apparel Logistics Market size is estimated at USD 138.62 billion in 2024, and is expected to reach USD 191.35 billion by 2029, growing at a CAGR of 6.66% during the forecast period (2024-2029).

Rapid replenishment cycles of the apparel industry are the main factor driving the market's growth. From retailers to manufacturers, apparel supply chains compete strongly to provide the latest trends and the best customer experience. Meanwhile, changing consumer expectations and fulfillment models pressure apparel businesses.

The COVID-19 pandemic caused lockdowns, line limitations, and breakdown of transportation organizations across regions. With the rapidly increasing cases, the overall apparel logistics market is being influenced from multiple points of view. The accessibility of the labor force is disturbing the inventory network of the apparel logistics market, as the lockdowns and the spread of the infection are forcing individuals to remain indoors.

Many leading fashion retailers have embraced the concept of performing multi-channel distribution within a single facility with a single information system, achieving dramatic improvements in labor productivity and inventory optimization. The apparel marketplace is evolving and reinventing itself regularly. New sales channels are being developed, requiring companies to continuously evaluate and remodel their logistics and transportation networks.

The global apparel industry is extremely dynamic due to the ever-changing fashion trends. Due to the intense competition, apparel companies are implementing new technologies, such as data analytics and AI. The apparel industry has massive outsourcing operations that provide logistics players with considerable opportunities in domestic and international operations, making it a highly competitive industry. Any disruption in the supply chain leads to a huge loss for apparel companies. Thus, to have a minimal impact on their supply chain, apparel companies usually prefer outsourcing their operations to logistics players.

Apparel Logistics Market Trends

Growing Online Apparel Sales and Changing Consumer Behavior

In June 2021, the fast-fashion e-commerce site, shein.com, was the most visited in the fashion and apparel category worldwide, accounting for 3.29% of desktop traffic. The e-commerce portal of the Swedish clothing retailer HM ranked second, with 1.75% visits. In 2020 and 2021, online apparel retail sites experienced a sales increase due to their digital market presence. This effect has fuelled changes in the approach of the market players, which may be expected to continue in the coming years, with more emphasis on the growth of e-commerce, mobile shopping, and meeting ever-rising expectations of personalization among customers.

Based on the yearly percentage growth in terms of website traffic, shein.com emerged as the leading fast-fashion retailer website in the United States in Q4 2020. While consumers frequently visit websites to compare prices and products, global online platforms plan to expand their fashion brand partnerships and develop additional engagement methods to stay competitive in the digital shopping space. To handle the growing online orders, third-party logistics companies are absorbing millions of sq. ft of space and letting it out to consumer goods, e-commerce, manufacturing, and apparel companies.

Growing Apparel Market Boosting the Growth of Apparel Logistics

Revenue generated by the apparel market steadily increased through the study period. In 2020, the market revenue was approximately USD 1.46 trillion. Consumer technology brands have long targeted online shoppers in Australia, Japan, and South Korea. However, brands in the apparel and beauty sectors are also targeting other regions. Hence, brands may continue focusing on localization and catering to millennial customers who are the key buyers of these products.

The Y-o-Y growth rate for apparel and footwear experienced severe losses in 2020. Against the backdrop of the COVID-19 pandemic, growth declined by a total of over 10%. Sporting goods and mass/club retail grew in 2020. Global sports apparel and footwear brands like Nike and Adidas are ditching other regions and increasing their production in emerging Southeast Asian countries like Vietnam, offering a positive outlook for transportation companies and other third-party logistics service providers.

Apparel Logistics Industry Overview

The apparel logistics market is fragmented with the presence of large global players and small- and medium-sized local players. Some of the key players occupy most of the market share. Most global logistics players have a retail and apparel logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of fleet size, service offerings, products handled, and technology. The surging e-commerce sales are creating opportunities and challenges for logistics companies in terms of speed, delivery, etc. Global companies with high capital and assets can invest in advanced storage spaces and fulfillment centers and benefit from this scenario. On the other hand, regional and local players are coming up with better sector solutions to support the needs of the production companies and retailers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Industry Value Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Spotlight on Global Logistics Sector

- 4.7 Brief on Global Apparel Industry

- 4.8 Spotlight - Effect of E-commerce on Traditional Apparel Logistics Supply Chain

- 4.9 Review and Commentary on Return Logistics

- 4.10 Effect of Apparel Industry's Fast Replenishment Cycles on the Logistics Market

- 4.11 Spotlight on the Demand for Contract Logistics and Integrated Logistics

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing, and Inventory Management

- 5.1.3 Other Value-added Services

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 Japan

- 5.2.1.3 India

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Brazil

- 5.2.2.4 Mexico

- 5.2.2.5 Rest of Americas

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 Germany

- 5.2.3.3 Italy

- 5.2.3.4 Spain

- 5.2.3.5 France

- 5.2.3.6 Rest of Europe

- 5.2.4 Middle-East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 KEY QUALITATIVE AND QUANTITATIVE INSIGHTS

- 6.1 By Supply Chain Process

- 6.1.1 Production Logistics

- 6.1.2 Sales Logistics

- 6.1.3 Reverse Logistics

- 6.2 By Nature of Service

- 6.2.1 Enterprise Logistics

- 6.2.2 Third-party Logistics

- 6.2.3 E-commerce logistics and Instant Delivery

7 INSIGHTS ON GLOBAL MAJOR FASHION RETAILERS (Company Overview, Product Portfolio, Logistics Partner, Etc.)

- 7.1 Inditex (ZARA)

- 7.2 H&M

- 7.3 Fast Retailing Co. Ltd

- 7.4 Gap Inc.

- 7.5 Anta

- 7.6 L Brands Inc.

- 7.7 PVH Corp.

- 7.8 Ralph Lauren Corporation*

8 COMPETITIVE LANDSCAPE

- 8.1 Overview (Market Concentration, Major Players)

- 8.2 Company Profiles

- 8.2.1 Ceva Logistics

- 8.2.2 DB Schenker

- 8.2.3 Deutsche Post DHL Group

- 8.2.4 DSV

- 8.2.5 Hellmann Worldwide Logistics

- 8.2.6 Apparel Logistics Group Inc.

- 8.2.7 Logwin AG

- 8.2.8 PVS Fulfillment-Service GmbH

- 8.2.9 Bollore Logistics

- 8.2.10 GAC Group

- 8.2.11 Nippon Express

- 8.2.12 Genex Logistics

- 8.2.13 Expeditors International of Washington Inc.

- 8.2.14 Agility Logistics

- 8.2.15 BGROUP SRL*