|

市场调查报告书

商品编码

1438409

快速消费品物流:市场占有率分析、产业趋势与统计、成长预测(2024-2029)FMCG Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

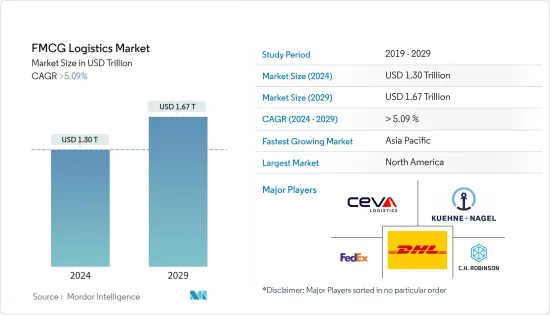

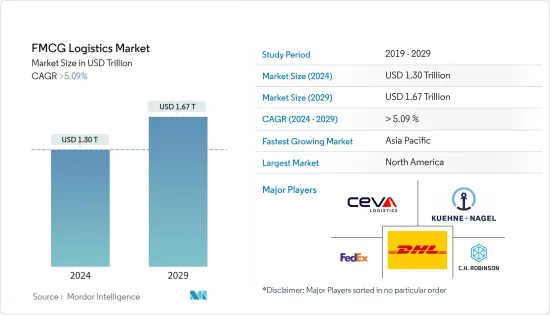

快速消费品物流市场规模预计到 2024 年将达到 1.3 兆美元,预计到 2029 年将达到 1.67 兆美元,预测期内(2024-2029 年)复合年增长率将超过 5.09%。

主要亮点

- 快速消费品被认为是一种独特的经营模式,需要在製造、品牌、广告和物流方面具有竞争优势。消费品产业的主要成长动力是生活方式的改变、交通便利性以及消费者习惯的快速变化。消费者希望本地商店和网路上随时可以买到各种产品。为了实现这一目标,消费品公司与高效、敏捷和永续性的全球供应链合作。快速消费品製造商正在采用协作物流解决方案,以更快、更有经济地将产品运送到商店。最近电子商务的蓬勃发展也为快速消费品产业带来了福音。

- 从传统的仓储、采购、物料管理,到综合物料管理,产业正进入供应链管理的新时代。快速消费品产业的物流业务通常采用中心辐射模式,物流中心位于主要城镇,为批发商和零售商提供服务。消费者期望跨多个管道快速履行订单。为了实现这一目标,消费品公司将物流业务外包,以弥合销售计划和业务流程之间的差距、改善预测、简化库存并缩短交货时间。

- 快速消费品企业预计将增加对物流服务供应商(LSP)的依赖,以满足新消费模式的需求。对供应链自动化的投资、现有製造设施的扩建以及仓储中心的出现是当前市场研究的重点领域。除了强大的供应链策略外,物流设施和地理位置很快将在快速消费品营运商的成功中发挥关键作用。为了保持更好的竞争力并进入关键需求群体,公司必须策略性地考虑位置以满足不断增长的需求。

快消品物流市场趋势

随着电子商务的日益普及,需要高效率的物流运作。

电子商务正在重塑全球零售市场。到目前为止,电子商务的繁荣不仅使旅游业受益,也使服装和电子量贩店受益。目前,电子商务在全球快速消费品市场的占有率不足7%。线上快速消费品普及的主要原因之一是确保新鲜和生鲜食品以最佳状态到达消费者手中所面临的物流挑战。此外,在已开发市场,特别是在德国等人口稠密的市场,许多快速消费品在实体店中很容易买到,而且离消费者很近。

然而,消费者对便利性的需求不断增长,技术和其他有利条件的改进正在加速全球线上快速消费品的成长。快速消费品的线上成长持续超过线下成长,大多数零售商和製造商需要全通路策略以确保未来的成功。未来几年,全球快速消费品的线上销售额将翻一番,新兴市场和发展中市场的成长速度预计将是已开发市场的两倍。预计亚洲地区将在未来五年内为线上快速消费品提供最大的成长机会。

当今的线上市场提供多种运输选项,包括库存状态和预计交货时间的可见性、免费追踪选项和轻鬆退货。为了提供免费送货,零售商需要从物流提供者获得低成本的解决方案。同样,为了快速提案消费者当日配送选择等服务,零售商需要高度优先且完全可靠的物流服务。

人口成长推动快速消费品产业扩张

人口成长是推动全球快速消费品产业扩张的主要原因之一。事实上,人口的快速成长与消费品消费的增加呈负相关。类似的因素包括定期产品发布、消费者对各种快速消费品的认知度提高、中阶可支配收入的增加、消费品的获取便利性,开发中国家消费者生活方式的重大变化、强有力的品牌广告和有吸引力的价格分布。其中包括此类公司强大的物流和分销管道、线上商务的扩张以及市场现有企业和新参与企业增加的研发支出。

此外,社交媒体和互联网的增加使用在过去创造了丰富的发展可能性,并且在未来肯定会继续这样做。作为占领相当一部分市场的主要方式之一,一些业内顶尖的国际公司致力于为消费者提供个人化的解决方案。其中一些策略包括产品介绍和收购。

现今的消费者越来越需要便利、更健康的替代品以及本地采购的有机产品。这种对便捷的需求创造并繁荣了电子商务。公司正在大力投资数位分析,许多人认为零售业可能是消费产业中转型最成熟的产业。

快消品物流行业概况

快消品物流市场高度分散,既有大型企业,也有中小型本地企业,相当数量的企业占市场占有率。 DHL 集团、CH Robinson、Kuehne+Nagel、Ceva Logistics、DB Schenker、DSV 和 XPO Logistics 是全球主要竞争对手。世界上大多数物流公司都设有零售和消费品物流部门,以满足市场的需求和需求。此外,本地公司正在日益加强其在库存处理、服务提供、处理产品和技术方面的能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

- 分析调查方法

- 调查阶段

第三章执行摘要

第四章市场概况

- 目前的市场状况

- 市场动态

- 促进因素

- 消费者对快速高效运输的需求不断增长

- 简化供应链营运的需要

- 抑制因素

- 运输成本高

- 生鲜产品管理的复杂性

- 机会

- 引进先进技术

- 扩大电子商务平台

- 促进因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 政府法规和倡议

- 全球物流业(概述、LPI 得分、主要货运统计数据等)

- 聚焦全球快消品产业(概况、通路、主要产品类型等)

- 聚焦-电商对传统快消品物流供应链的影响

- 快消零售业快速补货週期对物流市场的影响

- 重视合约物流和综合物流需求*

第五章市场区隔

- 按服务

- 运输

- 仓储、运输和库存管理

- 其他附加价值服务

- 按产品类型

- 食品和饮料

- 个人护理

- 家务护理

- 其他消耗品

- 按地区

- 亚太地区

- 北美洲

- 欧洲

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- DHL Group

- CH Robinson

- Kuehne+Nagel

- Ceva Logistics

- XPO Logistics

- DB Schenker

- Hellmann Worlwide Logistics

- DSV

- Bollore Logistics

- Rhenus Logistics

- FM Logistic

- Kenco Logistics

- Penske Logistics*

- 其他公司

第七章 市场的未来

第8章附录

- 以主要活动国家分類的 GDP 分布

- 快消品零售统计

- 经济统计 运输和仓储业对经济的贡献(主要国家)

- 世界消费品流量统计

The FMCG Logistics Market size is estimated at USD 1.30 trillion in 2024, and is expected to reach USD 1.67 trillion by 2029, growing at a CAGR of greater than 5.09% during the forecast period (2024-2029).

Key Highlights

- FMCG is considered a unique business model that requires competitive advantages in manufacturing, branding, advertising, and logistics. The key growth drivers for the consumer goods industry are changing lifestyles, ease of access, and rapidly changing consumer habits. Consumers expect a wide array of products to be always available in local stores and online. to achieve this, consumer goods companies tie up with global supply chains that are highly efficient, agile, and sustainable. FMCG manufacturers are adopting collaborative logistics solutions that deliver products to stores faster and more cost-effectively. The recent e-commerce boom has also been a blessing for the FMCG industry.

- From traditional storekeeping, purchasing, materials management, and integrated materials management, the industry is entering a new era of supply chain management. The logistics operations in FMCG businesses are typically operated on a hub-and-spoke model type with distribution hubs in major towns and cities serving both the wholesalers and retailers. Consumers are expecting fast order fulfilment through multiple channels. To make this possible, consumer goods companies outsource their logistics operations to bridge the gap between sales planning and operational processes, improve forecasting, streamline inventory, and speed up delivery times.

- FMCG players are expected to rely more on logistics service providers (LSPs) to meet demand from new consumption patterns. Investment in supply chain automation, expansion of existing manufacturing facilities, and the emergence of warehouse hubs are essential areas of focus in the current market study. Distribution facilities and locations, along with a strong supply chain strategy, will play a critical role in the success of FMCG operators soon. To maintain a better competitive position and access key demand demographics, businesses will need to consider the location strategically to meet the growing demand.

FMCG Logistics Market Trends

Growing Penetration of E-commerce Demands Efficient Logistics Operations

E-commerce is reshaping the global retail market. Till date, the e-commerce boom has favored the travel sector, as well as apparel and electronics retailers. E-commerce currently contributes less than 7% of the global fast-moving consumer goods (FMCG) market. One of the key reasons for the slower uptake of online FMCG has been the logistical challenges associated with ensuring fresh and perishable products arrive at the consumer in top condition. Additionally, in advanced markets, especially those with dense populations such as Germany, many FMCG products are readily available in close proximity to consumers at brick-and-mortar stores.

However, with increasing consumer demand for convenience, and better technology and other enabling conditions, online FMCG growth is accelerating across the globe. FMCG online growth will continue to outpace offline growth, and most retailers and manufacturers need Omnichannel strategies to ensure future success. Online FMCG sales are set to double globally over the next few years and will grow twice as fast in developing markets than in developed markets. The Asia region is expected to provide some of the biggest growth opportunities for online FMCG over the next five years.

The current online marketplace offers visibility of inventory status and expected delivery time and a variety of shipping options including free tracking options and easy returns. To provide free shipping, retailers need to get low-cost solutions from their logistics providers. Equally, to propose fast, including same-day delivery options to their consumers, retailers need high-priority and entirely reliable logistics services.

The rising population driving the expansion of the FMCG Industry

The growing population is one of the key reasons driving the expansion of the global FMCG industry. In actuality, the quick expansion in population is inversely correlated with the rise in consumer goods consumption. Similar factors include regular product launches, increased consumer awareness of various FMCG products, rising middle-class disposable incomes, easier access to consumer goods, a noticeable shift in consumers' lifestyles in developed and developing nations, strong brand advertising, and attractive price points, strong logistics and distribution channels of such companies, expansion of online commerce, and increased R&D spending by both established players and newcomers in the market.

Also, the increasing use of social media and the internet has created a wealth of development prospects in the past and is certain to do so in the future. As one of their primary methods to capture a sizeable portion of the market, several top international businesses in the industry are dedicated to offering consumers personalized solutions. A few of these tactics involve product introductions and acquisitions.

Consumers nowadays are increasingly looking for convenience, healthier alternatives, and locally produced organic products. This demand for ease was what gave rise to eCommerce, which has flourished. Companies are making significant investments in digital analytics, and many think that among all consumer industries, the retail sector is perhaps the ripest for transformation.

FMCG Logistics Industry Overview

The FMCG logistics market is fairly fragmented with the presence of large players and small and medium-sized local players with quite a few players who occupy the market share. DHL Group, C.H. Robinson, Kuehne + Nagel, Ceva Logistics, DB Schenker, DSV, and XPO Logistics are among Global's top competitors. Most of the global logistics players have a retail and consumer goods logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rising consumer demand for fast and efficient delivery

- 4.2.1.2 The need for streamlined supply chain operations

- 4.2.2 Restraints

- 4.2.2.1 High trasnportation costs

- 4.2.2.2 Complexity of managing perishable goods

- 4.2.3 Opportunities

- 4.2.3.1 The adoption of advanced technologies

- 4.2.3.2 Expansion of e-commerce platforms

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, etc.)

- 4.7 Focus on Global FMCG Industry (Overview, Distribution Channels, Major Product Categories, etc.)

- 4.8 Spotlight - Effect of E-commerce on Traditonal FMCG Logistics Supply Chain

- 4.9 Effect of FMCG Retail Sector's Fast Replenishment Cycles on the Logistics Market

- 4.10 Spotlight on the Demand for Contract Logistics and Integrated Logistics*

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing, Distribution, and Inventory Management

- 5.1.3 Other Value-added Services

- 5.2 By Product Category

- 5.2.1 Food and Beverage

- 5.2.2 Personal Care

- 5.2.3 Household Care

- 5.2.4 Other Consumables

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 DHL Group

- 6.2.2 C.H. Robinson

- 6.2.3 Kuehne + Nagel

- 6.2.4 Ceva Logistics

- 6.2.5 XPO Logistics

- 6.2.6 DB Schenker

- 6.2.7 Hellmann Worlwide Logistics

- 6.2.8 DSV

- 6.2.9 Bollore Logistics

- 6.2.10 Rhenus Logistics

- 6.2.11 FM Logistic

- 6.2.12 Kenco Logistics

- 6.2.13 Penske Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 FMCG Retail Statistics

- 8.3 Economic Statistics Transport and Storage Sector, Contribution to Economy (Key Countries)

- 8.4 Global Consumer Goods Flow Statistics