|

市场调查报告书

商品编码

1438452

非挥发性记忆体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Non-Volatile Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

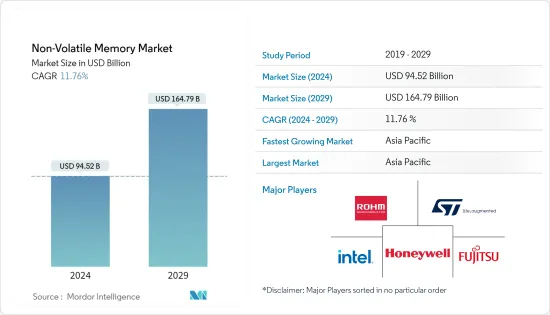

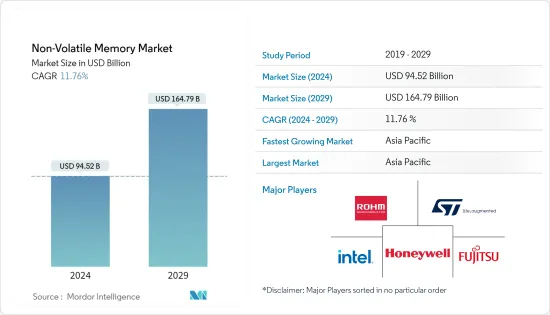

非挥发性记忆体市场规模预计到2024年为945.2亿美元,预计到2029年将达到1647.9亿美元,在预测期内(2024-2029年)复合年增长率预计为11.76%。

过去十年,可携式系统市场的成长推动了半导体产业对海量储存应用的非挥发性记忆体 (NVM) 技术的兴趣。对更高效率、更快记忆体存取和更低功耗的需求正在推动 NVM 市场的成长。

主要亮点

- 在蓬勃发展的消费性电子产业中,用户期望他们的设备不断变得更好,以闪电般的速度提供新功能,并储存更多的电影、照片和音乐。在过去的几十年里,快闪记忆体实现了重大的技术创新,但由于快闪记忆体遇到了阻碍进一步扩展的技术障碍,因此需要新一代记忆体。

- 快闪记忆体因其成本低、功耗低而被消费性电子产品采用,对市场成长具有重要意义。 NVM 用于智慧型手机和可穿戴设备,以实现大储存容量和快速记忆体存取。

- 该领域研究活动的活性化也促进了市场的成长。例如,2021年3月,英飞凌科技有限责任公司宣布推出其第二代非挥发性静态RAM,经过QML-Q和高可靠性工业规范认证,主要针对航太和工业应用等严苛应用,支援非挥发性代码您环境中的储存。

- 同样,2021 年初,三星宣布改进其 MRAM 的 MTJ 功能,并改进其 14 奈米製程以支援基于快闪记忆体的嵌入式 MRAM,旨在提高写入速度和密度。此外,该公司的目标是将新兴的 IC NVM 应用到穿戴式装置、微控制器和物联网装置。

- 然而,市场上非挥发性记忆体的问题往往是由读取/写入耐用性和资料保存特性引起的。例如,相变记忆体 (PCM) 和快闪记忆体是耐用性有限的 NVM 范例。这些 NVM 的耐用性较低,因为在经过多次写入周期(PCM 的重置週期和闪存的编程/擦除週期)后,存储单元会磨损并且无法可靠地存储信息,因为信息会消失。

- COVID-19 的爆发对智慧型手机产业等多个非挥发性记忆体最终用户产业产生了负面影响。在云端运算、人工智慧和物联网等重要大趋势的推动下,家庭活动对伺服器和 PC 记忆体的需求激增,预计在预测期内支援非挥发性记忆体的成长。

非挥发性记忆体市场趋势

快闪记忆体预计将占据较大市场占有率

- 消费性电子产品日益增长的需求和普及扩大了设备快闪记忆体的应用范围。这种记忆体类型可应用于笔记型电脑、GPS、电子乐器、数位相机、行动电话和许多其他装置。此外,它也被资料中心解决方案供应商广泛采用。随着云端解决方案的快速普及,对资料中心的需求也在快速成长。

- 此外,随着人工智慧/机器学习应用和物联网设备的成长趋势,高低延迟和高吞吐量的云端储存、快闪记忆体和企业资料中心针对训练深度神经网路进行了最佳化。资料中心数量和规模的成长预计将进一步增加需求。

- 为了满足不断增长的需求,市场上的供应商正在专注于开发具有更好功能的新解决方案。例如,2021年2月,Kioxia公司和西部数据公司宣布开发第六代162层3D快闪记忆体技术。这是该公司密度最高、最先进的 3D 快闪记忆体技术,利用了许多技术和製造创新。

- 此外,由于超低功耗的需求,NOR快闪记忆体也越来越受欢迎。例如,英飞凌科技于 2022 年 1 月宣布增加开发工具来支援其 SEMPER NOR 快闪记忆体元件系列。这使开发人员能够快速设计安全关键且本质安全的汽车、工业和通讯系统。

- 同样,旺宏国际于 2021 年 11 月宣布,它是业界第一家开始量产 1.2V 装置的串行 NOR 快闪记忆体製造商。据该公司介绍,其超低功耗(ULP)、高速120MHz MX25S串行NOR快闪记忆体支援物联网(IoT)、无线通讯技术、WiFi、窄带物联网系统、手持设备、蓝牙设备和消费性应用. 它将迎来新一代产品,其应用领域包括:

亚太地区预计将占据主要市场占有率

- 对线上娱乐、在家工作以及视讯和语音通话服务的需求激增,导致亚太地区各国增加了包括资料中心在内的新基础设施建设。随着数位经济的快速发展,中国、印度等国家需要建造大规模的巨量资料中心。

- 由于对 NAND 内存业务的积极态度,中国正在成为领先国家。例如,中国主要储存公司之一的长江储存科技(YMTC)正在国内小批量出货包括SSD在内的64层NAND,并计划在2021年开发并出货128层产品。

- 此外,开发非挥发性记忆体相关技术的新兴企业已在该地区获得了多项投资。例如,2021年4月,创星半导体(上海)在Pre-A轮资金筹措中筹集了约1亿美元。本轮资金筹措由上海联合投资主导,Atlas Capital 和 KQ Capital 跟投。该公司的目标是利用这笔投资生产电阻式随机存取记忆体(ReRAM)晶片和其他用于储存应用的晶片。

- 该地区的公司将非挥发性记忆体用于各种工业应用。 2021年11月,提供非挥发性记忆体(NVM)技术的Floadia公司宣布推出上海华虹半导体製造有限公司的高品质180BCD(Z8)平台,产品名称为ZT,支援150℃保留10年。我们宣布推出eNVM(嵌入式非挥发性记忆体)。

- 此外,该地区非挥发性记忆体 (NVM) 的研发活动正在增加。 2022年1月,三星电子宣布推出全球首个基于MRAM(磁阻随机存取记忆体)的记忆体内运算展示。预计这些趋势将在预测期内推动亚太地区研究市场的成长。

非挥发性记忆体产业概况

非挥发性记忆体市场竞争非常激烈,有几家主要公司进入该市场。该行业竞争企业之间的竞争主要取决于透过技术创新、市场渗透和竞争策略的强度来实现永续的竞争优势。由于它是一个资本集中市场,退出障碍也很高。

- 2022年1月,SK海力士宣布收购英特尔NAND和固态硬碟(SSD)业务的第一阶段交易已经完成。该公司表示,透过收购英特尔SSD业务和中国大连NAND快闪记忆体製造工厂,完成了第一阶段交易。

- 2021 年 10 月 - NSCore Inc. 宣布推出 OTP+(一次性可编程 Plus),这是适用于物联网技术应用的非挥发性记忆体解决方案。该公司表示,40奈米超低功耗OTP NVM IP解决方案可最大限度地减少新兴市场对关键物联网晶片的再製造需求。此外,与标准 OTP IP 解决方案不同,NSCore OTP+ 解决方案可以重新编程和修改。

- 2021 年 7 月 - 美光科技宣布全球首款 176 层 NAND 通用快闪记忆体储存 (UFS) 3.1 行动解决方案已开始量产出货。美光 UFS 3.1 离散行动 NAND 记忆体专为高阶和旗舰行动电话而设计,与前代产品相比,连续式写入和随机读取速度提高了 75%,释放了5G 的潜力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 连网型设备和穿戴式装置对非挥发性记忆体的需求不断增长

- 企业储存应用需求增加

- 市场挑战

- 写入耐久性低

第六章市场区隔

- 按类型

- 传统非挥发性记忆体

- 快闪记忆体

- EEPROM

- SRAM

- EPROM

- 其他传统非挥发性记忆体

- 下一代非挥发性记忆体

- MRAM

- FRAM

- 重新记忆体

- 3D-X 点

- 奈米记忆体

- 其他下一代非挥发性记忆体

- 传统非挥发性记忆体

- 按最终用户产业

- 消费性电子产品

- 零售

- 资讯科技和电讯

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- ROHM Co. Ltd

- STMicroelectronics NV

- Maxim Integrated Products Inc.

- Fujitsu Ltd

- Intel Corporation

- Honeywell International Inc.

- Micron technologies Inc.

- Samsung Electronics Co. Ltd

- Crossbar Inc.

- Infineon Technologies AG

- Avalanche Technologies Inc.

- Adesto Technologies Corporation(Dialog Semiconductor PLC)

第八章投资分析

第9章市场的未来

The Non-Volatile Memory Market size is estimated at USD 94.52 billion in 2024, and is expected to reach USD 164.79 billion by 2029, growing at a CAGR of 11.76% during the forecast period (2024-2029).

In the last decade, the growth of the portable systems market attracted the interest of the semiconductor industry in non-volatile memory (NVM) technologies for mass storage applications. Demand for greater efficiency, faster memory access, and low-power consumption drive the NVM market growth.

Key Highlights

- In the flourishing consumer electronics industry, users expect their devices to continually become more powerful, provide new functionality with incredible speed, and store more movies, pictures, and music. While flash enabled substantial innovation during the past few decades, a new generation of memory is required as flash hits technology roadblocks, preventing it from scaling much further.

- The adoption of flash memories in consumer electronics due to their low price and power consumption is significant for the market's growth. NVM is used in smartphones and wearable devices to enable more storage and faster memory access.

- The increasing research activities in this space are also driving the market's growth. For instance, in March 2021, Infineon Technologies LLC announced the launch of second-generation non-volatile Static RAMs that are qualified for QML-Q and high-reliability industrial specifications to mainly support non-volatile code storage in harsh environments, including aerospace and industrial applications.

- Similarly, in early 2021, Samsung announced the improvement of its MRAM's MTJ function and advanced its 14 nm process to support its flash-type embedded MRAM designed to increase the write speed and density. In addition, the company targets the IC emerging NVM's application in wearables, microcontrollers, and IoT devices.

- However, troubles with non-volatile memories in the market are often caused by the read/write endurance and data retention characteristics. For instance, Phase-change memories (PCMs) and flash memories are examples of NVM's with limited endurance. These NVM's have little endurance because after undergoing several writing cycles (RESET cycles for PCM, program/erase cycles for flash memory), the memory cells wear out and can no longer reliably store information.

- The COVID-19 outbreak negatively impacted several end-user industries of non-volatile memories, such as the smartphone industry. Spurred demand for server and PC memory for stay-at-home activities, driven by important megatrends like cloud computing, AI, and the IoT, is expected to support the growth of non-volatile memory during the forecast period.

Non-Volatile Memory Market Trends

Flash Memory is Expected to Hold a Significant Market Share

- The growing demand and penetration of consumer electronics led to device flash memory applications. This memory type finds applications in laptops, GPS, electronic musical instruments, digital cameras, cell phones, and many others. Additionally, it is extensively adopted by data center solution vendors. With exponential growth in the adoption of cloud solutions, the demand for data centers is also surging.

- Further, with increasing propensity toward AI/ML applications and IoT devices that require high low latency and high throughput cloud storage, flash storage and enterprise data centers are optimized to train deep neural networks. The growing number and size of data centers are expected to augment demand further.

- To cater to the growing demand, vendors operating in the market focus on developing new solutions with better capabilities. For instance, in February 2021, Kioxia Corporation and Western Digital Corp. announced the development of a sixth-generation, 162-layer 3D flash memory technology. This was the company's highest density and most advanced 3D flash memory technology that utilizes many technology and manufacturing innovations.

- Furthermore, NOR Flash memory is also gaining traction due to ultra-low-power needs. For instance, in January 2022, Infineon Technologies announced additional development tools to support its family of SEMPER NOR Flash devices. It will further help developers to quickly design safety-critical and inherently secure automotive, industrial, and communication systems.

- Similarly, in November 2021, Macronix International Co., Ltd. announced itself as the industry's first Serial NOR Flash memory manufacturer to bring 1.2V devices to mass production. According to the company, the ultra-low-power (ULP), high-speed 120MHz MX25S Serial NOR Flash memories are poised to usher in a new generation of products targeted at applications that include Internet of Things (IoT), wireless communications technologies, WiFi, and Narrowband IoT systems, hand-held and Bluetooth devices, and consumer applications.

Asia Pacific is Expected to Account for a Significant Market Share

- The construction of new infrastructure, including data centers, has been growing across various countries of the Asia Pacific region, owing to a surge in demand for online entertainment, telecommuting, and video and voice call services. With the fast development of the digital economy, building large big data centers in countries such as China and India is becoming necessary.

- China has emerged as the leading country owing to its aggressive approach to the NAND memory business. For instance, Yangtze Memory Technologies Co. Ltd (YMTC), one of China's major memory companies, had shipped 64 layers of NAND domestically in low volumes, including SSDs, with 128-layer production in development and shipments in 2021.

- Furthermore, startups in the region that are engaged in developing technologies related to non-volatile memory are receiving several investments. For instance, in April 2021, InnoStar Semiconductor (Shanghai) Co. Ltd raised around USD 100 million in a pre-series A financing round. The funding round was led by Shanghai Lianhe Investment, and new investors who joined the round included state-backed Atlas Capital and KQ Capital. The company aims to use the investment to produce resistive random-access memory (ReRAM) chips and other chips for storage applications.

- Companies in the region are utilizing non-volatile memory for various industrial applications. In November 2021, Floadia Corporation, a provider of Non-Volatile Memory (NVM) technology, announced the availability of its high-quality eNVM (embedded Non-volatile Memory), with product name ZT, supporting 150 degrees C retention of 10 years, in Shanghai Huahong Grace Semiconductor Manufacturing Corporation 180BCD (Z8) platform.

- Furthermore, the region is also witnessing an increase in R&D activities in Non-Volatile Memory (NVM). In January 2022, Samsung Electronics announced the demonstration of one of the world's first in-memory computing based on MRAM (Magnetoresistive Random Access Memory). Such trends are expected to drive the growth of the studied market in the Asia Pacific region during the forecast period.

Non-Volatile Memory Industry Overview

The non-volatile memory market is competitive and consists of several major players. The competitive rivalry in this industry is primarily dependent on sustainable competitive advantage through innovation, levels of market penetration, and power of competitive strategy. Since the market is capital intensive, the barriers to exit are high as well. Some of the major players operating in the market include Rohm Co. Ltd, STMicroelectronics NV, Fujitsu ltd, and Intel Corporation. Some of the recent developments in the market are:

- January 2022 - SK Hynix Inc. announced the completion of the first phase of the transaction to acquire Intel's NAND and solid-state drive (SSD) business. According to the company, it has closed the first phase of the transaction by acquiring Intel's SSD business and the Dalian NAND flash manufacturing facility in China.

- October 2021 - NSCore Inc. introduced OTP+, One-Time-Programmable Plus, a non-volatile memory solution for IoT technology applications. According to the company, the 40 nm Ultra-Low-Power OTP NVM IP Solution can minimize the need to re-spin the fabrication of an IoT chip, which is critical in the emerging market. In addition, the NSCore OTP+ solution can be reprogramed and modified, unlike standard OTP Ip solutions.

- July 2021 - Micron Technology announced that it began mass shipping the world's first 176-layer NAND Universal Flash Storage (UFS) 3.1 mobile solution. Designed for high-end and flagship phones, Micron's UFS 3.1 discrete mobile NAND memory unlocks the potential of 5G with sequential write and random read speeds of up to 75% compared to previous generations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Non-volatile Memory in Connected and Wearable Devices

- 5.1.2 Increasing Demand for Enterprise Storage Applications

- 5.2 Market Challenges

- 5.2.1 Low Write Endurance Rate

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Traditional Non-volatile Memory

- 6.1.1.1 Flash Memory

- 6.1.1.2 EEPROM

- 6.1.1.3 SRAM

- 6.1.1.4 EPROM

- 6.1.1.5 Other Traditional Non-volatile Memories

- 6.1.2 Next-generation Non-volatile Memory

- 6.1.2.1 MRAM

- 6.1.2.2 FRAM

- 6.1.2.3 ReRAM

- 6.1.2.4 3D-X Point

- 6.1.2.5 Nano RAM

- 6.1.2.6 Other Next-generation Non-volatile Memories

- 6.1.1 Traditional Non-volatile Memory

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Retail

- 6.2.3 IT and Telecom

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 India

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ROHM Co. Ltd

- 7.1.2 STMicroelectronics NV

- 7.1.3 Maxim Integrated Products Inc.

- 7.1.4 Fujitsu Ltd

- 7.1.5 Intel Corporation

- 7.1.6 Honeywell International Inc.

- 7.1.7 Micron technologies Inc.

- 7.1.8 Samsung Electronics Co. Ltd

- 7.1.9 Crossbar Inc.

- 7.1.10 Infineon Technologies AG

- 7.1.11 Avalanche Technologies Inc.

- 7.1.12 Adesto Technologies Corporation (Dialog Semiconductor PLC)