|

市场调查报告书

商品编码

1438476

产业标籤:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

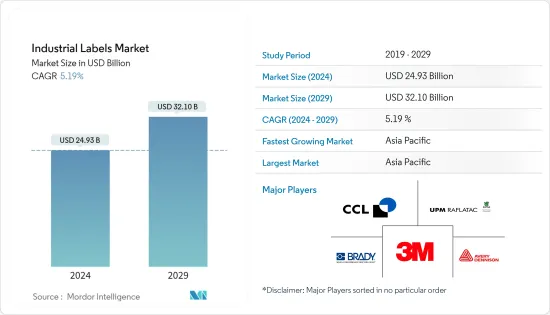

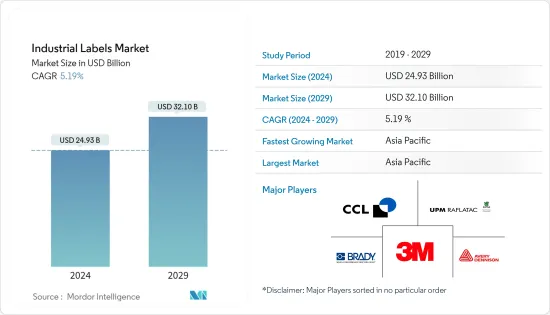

工业标籤市场规模预计到 2024 年为 249.3 亿美元,预计到 2029 年将达到 321 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.19%。

主要亮点

- 工业标籤增强产品的视觉和美学特性。工业标籤使製造商比提供类似产品的竞争对手更具优势。工业标籤提供的好处已被世界各地的製造商广泛接受。推动工业标籤市场成长的关键因素是这些产品根据特定需求配备附加功能,并且可以轻鬆自订尺寸和形状,以满足任何行业的不同最终用途。

- 物流和汽车行业对标籤的需求不断增长正在推动市场成长。标籤有助于在製造、运输、物流和许多其他行业中透过简单快速的扫描来识别资讯。采用 RFID 和条码扫描技术的智慧且未来性的标籤可以极大地帮助食品、饮料和製药公司维持供应链和无缝物流运输。收到订单、出货,供应商可以确定正在发生的事情以及沿途的地点。仓库工作人员挑选和扫描收到的订单后,标籤可立即简化扫描和识别。标籤使团队成员能够更快、更有效率地工作。

- 由于创新食品包装的成长、严格的政府法规以及相关印刷的进步等趋势,食品和饮料行业预计将在工业标籤市场中占据重要份额。品牌推广、促销宣传活动、综合配方、互动体验和促销内容是食品和饮料行业的关键领域,标籤技术正在获得越来越多的关注。由于众多产品类型的品牌细分相对较高,食品公司是数位印刷服务的主要用户。

- 此外,小型企业生产工业标籤的成本高昂,因为它需要高昂的投资成本和经过培训的能够操作机器的专业人员。此外,对一台机器上的一体化解决方案(例如包装、贴标和其他任务)的需求可能会增加机器成本并影响市场成长。

- COVID-19感染疾病对该行业产生了负面影响,导致全国范围内的封锁、公司将采购转移出中国并重新考虑包装材料。冠状病毒感染疾病(COVID-19) 史无前例的全球蔓延影响了世界各地的人们。新闻中还包括专门生产工业标籤的公司,这些公司迅速回应了新的市场需求。最终用户对特定应用的需求显着增加,并显着扩大了自动贴标机市场的范围。製药业预计,在 COVID-19感染疾病期间,药品产量的增加将带来进一步的动力。

工业标籤市场趋势

警告/安全标籤预计将大幅增加

- 由于各种原因,包括山寨产品的增加、安全问题以及品牌策略的变化,警告和安全标籤预计在未来几年将变得更加流行。此外,研发活动和技术创新的增加预计将为安全和警告标籤创造新的市场机会。

- 该行业受到新兴国家药品市场扩张和药物输送技术进步的推动。产品多样性和医疗和製药领域材料包装解决方案的广泛使用推动了市场扩张。由于仿冒品数量不断增加,智慧标籤在製药业的需求量很大。据世界卫生组织称,网路上提供的所有药品都是仿冒品。假药给顾客带来严重的健康风险。活性物质经常被遗漏或被无效或有害的物质取代,使消费者的生命处于危险之中。製药公司因假药以旧换新而遭受重大财务和声誉损失。

- 根据Countercheck GmbH发布的报告,2022年全球仿冒品市场将由世界五个主要国家主导,其中美国占最大份额,其次是墨西哥、日本、中国和德国。

- 此外,为了因应全球性的诈欺和假药问题,食品药物管理局实施了《药品供应链安全法》(DSCSA),到 2023 年为该行业建立了全自动监管链。这需要处方药可追溯。在单位层面。结果是整合了 UHF 和 NFC 技术的智慧标籤,可实现产品级可追溯性和患者依从性。

- 最近,印度食品安全和标准局在食品包装正面强制添加警告标籤。印度至少 32% 的食品市场由加工业覆盖,这些行业受到了准则的影响。过去十年,印度超级成分食品的加工量增加,此类印刷标籤警告预计将对市场产生重大影响。

亚太地区将经历显着成长

- 中国正在实现标籤印刷产业的自动化。伺服马达、自动套准、线上冲压、模切和其他精加工流程是最近推出的机器中内建的一些智慧控制系统。标籤加工商开始整合 ERP(企业资源规划)和其他自动化管理系统,以进一步改善业务。

- 日本电子商务领域的快速扩张是工业标籤扩张的因素。这些标籤很快就受到在电子商务和物流包装上列印标籤的公司的普及,通常会出现送货地址、条码追踪号码、承运商资讯和退货标籤。此外,工业标籤在确保遵守监管要求和行业标准方面发挥重要作用。标籤显示运输危险或敏感货物所需的特定符号、警告或认证。遵守标籤法规可确保货物的安全处理和运输,降低事故风险,并避免罚款和海关延误。随着日本物流业的不断发展,工业标籤在出货和物流中的重要性将持续成长。

- 近年来,印度的印刷和贴标设备显着成长。国家包装模式的快速变化是产业扩张的主要驱动力之一。新颖的包装和标籤方法正在大规模采用。随着市场成长的增加和復苏,印度工业标籤市场潜力巨大。美国标籤市场不断扩大的主要驱动力是对各种产品的包装解决方案和高品质、快速贴标设备的需求不断增长。各国政府也透过教育消费者适当的标籤来支持市场。

- 韩国标籤和包装印刷市场是一个有趣的市场。由于凸版印刷和凹版印刷是最常见的传统印刷方式,市场被认为谨慎而谨慎。韩国市场则截然不同,有许多间歇胶印和凸版印刷技术。然而,在韩国,随着小批量、软包装和可变资料变得越来越流行,印刷标籤的类型正在改变。标籤更加详细,同时也更小。因此,即使平方公尺大致相同,也会因为尺寸较小而创建更多标籤。

- 在澳大利亚,食品工业是就业和收益的主要贡献者。甚至一些世界顶级的日常消费品公司,如雀巢、联合利华、玛氏和辛普劳,在澳洲也拥有悠久的代理商历史。食品包装是根据详细的要求和规定创建的。因此,创造有吸引力的包装设计和标籤需要采取彻底的方法,这预计将增加全国各地对包装和标籤供应商的需求。

- 在亚太地区,工业标籤的发展主要是由于物流业务和出货追踪方面法律规章规意识的提高而推动的。包装器材的新兴技术也可以被视为市场发展的驱动因素。不断成长的製药业和对便利包装的需求不断增加是该市场的主要成长要素。

工业标籤产业概况

工业标籤市场由艾利丹尼森公司、3M 公司、CCL Industries Inc. 和 Brady Corporation 等主要企业组成。作为产品组合扩张的一部分,公司专注于透过收购、合作或投资为其行业创新新的解决方案。

例如,2023年4月,CCL Industries宣布了两项智慧标籤收购。 CCL Industries 收购了 eAgile Inc 和 Alert Systems ApS。 EAgile Inc 是针对医疗保健产业的取得专利的硬体和软体解决方案,提供嵌入标籤中的 RFID嵌体。 Alert Systems 提供取得专利的防盗解决方案,与 Checkpoint 的商品可用性解决方案 (MAS) 产品线一起销售。

2023 年 4 月,艾利丹尼森创建了 AD XeroLinr DT,这是一种适用于可变资讯 (VI) 标籤的新型永续无线条选项。这对于当今发展中的物流和电子商务行业尤其重要,因为这些行业运送的包裹数量每天都在增加。 AD XeroLinr DT 将每卷标籤数量增加了 60%,减少了换卷次数并提高了客户生产效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

- 技术简介 - 识别技术

第五章市场动态

- 市场驱动因素

- 食品和饮料预计将大幅成长

- 亚太地区将显着成长

- 市场限制因素

- 原料高成本

第六章市场区隔

- 按原料分

- 金属标籤

- 塑胶/聚合物标籤

- 按机理

- 感压标籤

- 给收缩套管贴标籤

- 其他机制(热转印、黏剂标籤)

- 依产品类型

- 警告/安全标籤

- 品牌标籤

- 耐候标籤

- 设备资产标籤

- 其他产品类型(轮胎标籤、多重模切标籤)

- 透过印刷技术

- 类比印刷

- 数位印刷

- 按最终用户产业

- 电子工业

- 食品和饮料

- 车

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Avery Dennison Corporation

- 3M Company

- CCL Industries Inc.

- Brady Corporation

- UPM RAFLATAC

- DuPont de Nemours Inc.

- Brook+Whittle Ltd

- OMNI SYSTEMS

- Asean Pack

- Computer Imprintable Label Systems Ltd(CISL Ltd)

- LabelTac.com

- Orianaa Decorpack Pvt. Ltd

- Dura-ID Solutions Limited

- GA International Inc.

第八章投资分析

第9章市场的未来

The Industrial Labels Market size is estimated at USD 24.93 billion in 2024, and is expected to reach USD 32.10 billion by 2029, growing at a CAGR of 5.19% during the forecast period (2024-2029).

Key Highlights

- Industrial labels enhance the visual and aesthetic properties of products. Industrial labels give manufacturers an edge over competitors offering similar products. The benefits provided by industrial labels have become widely accepted by manufacturers worldwide. A significant factor driving the growth of the industrial label market is that these products can be easily customized in size and shape for different end uses in every industry, with additional features according to specific needs.

- Increasing demand for labels in the logistics and automotive sectors drives the market's growth. Labels assist in identifying information with a simple, quick scan in manufacturing, shipping, logistics, and many other industries. Smart and future-proof labels with RFID and barcode scanning technologies significantly help food, beverage, and pharmaceutical organizations maintain the supply chain and seamless logistics transportation. Orders are received, things are shipped, and suppliers can determine what and where everything is in the process. Just after the warehouse workers pick and scan the orders received, labels simplify scanning and identification. Labeling allows team members to operate faster and more efficiently.

- The food and beverage industry is expected to hold a significant share of the industrial labels market due to trends such as the growth of innovative food packaging, stringent government regulations, and advances in relevant printing. Branding, promotional campaigns, integrated recipes, interactive experiences, and promotional content are critical areas of the food and beverage industry, with label technologies gaining attention. The relatively high degree of brand fragmentation across numerous product categories has made food companies the primary users of digital printing services.

- Moreover, industrial label manufacturing in small-scale businesses is not affordable, as it needs high-cost investment costs and trained professionals able to operate the machine. Further, the demand for all-in-one solutions in one machine like packaging, labeling, and other operations has raised the cost of machines, which can impact the market's growth.

- The COVID-19 pandemic negatively impacted the industry, resulting in a nationwide lockdown, corporations shifting their sourcing away from China, and reconsidering packaging materials. The unprecedented global spread of the COVID-19 pandemic affected individuals across the globe. It also made headlines for companies specializing in industrial labels that quickly responded to new market demands. Significant growth in end-user demand in specific applications has significantly expanded the scope of the automatic labeling machines market. The pharmaceutical sector anticipated further gaining traction with increased production of pharmaceutical products during the COVID-19 pandemic.

Industrial Labels Market Trends

Warning/Security Labels is Expected to Register a Significant Growth

- The Warning and Security labels are predicted to become more popular in the next years due to various causes, such as an increase in the number of similar items, safety concerns, and changes in branding strategies. Also, increased R&D activities and technology innovations are projected to create new market opportunities for Security and warning labels.

- The industry is being driven by the expanding pharmaceutical market in emerging nations and the advancement of drug delivery techniques. The extensive usage of packaging solutions for product diversity and material in the medical and pharmaceutical sectors promotes market expansion. Because of the increasing quantity of counterfeit products, the demand for smart labels is growing in the pharmaceutical industry. According to WHO, every second medicine acquired online is a forgery. Counterfeit medications pose serious health risks to customers. Active substances are routinely left out or replaced by ineffective or even harmful ones, putting the consumer's life at risk. Pharmaceutical firms suffer significant economic and reputational harm due to the trade-in of counterfeit drugs.

- According to a report published by Countercheck GmbH, the Global Counterfeit Market was dominated by five major countries globally in 2022, United States America with the largest share, followed by Mexico, Japan, China, and Germany.

- Furthermore, to counteract the global issue of fraudulent counterfeit drugs, the Food and Drug Administration has implemented the Drug Supply Chain Security Act (DSCSA) to have a complete, automated chain of custody for the industry by 2023. This requires prescription drugs to be traceable at the unit level. This gave rise to UHF and NFC technology-integrated intelligent labels for product-level traceability and drug adherence with patients.

- Recently, the Food Safety Standard Authority of India introduced a compulsion of putting warning labels on the front of food packages are required. At least 32% of the Indian food market is covered by the processing industry that is being impacted by a guideline. The processing of ultra-component food has increased in India in the last decade, and such print label warning is expected to put critically influence the market.

Asia Pacific to Witness Significant Growth

- China is automating its label printing industry. Servo motors, automatic registration, inline stamping, die cutting, and other finishing processes are some of the intelligent control systems that are included in recently introduced machines. Label converters have started integrating ERP (enterprise resource planning) and other automatic management systems to improve operations further.

- Japan's rapidly expanding e-commerce sector is a factor in expanding industrial labels. These labels are quickly becoming popular for businesses that print labels on packaging for e-commerce and logistics, often including shipping addresses, barcoded tracking numbers, carrier information, and return labels. In addition, industrial labels play a vital role in ensuring compliance with regulatory requirements and industry standards. Labels display specific symbols, warnings, or certifications required for transporting hazardous materials or sensitive goods. Compliance with labeling regulations ensures the safe handling and transportation of goods, reduces the risk of accidents, and avoids penalties or delays in customs clearance. As the Japanese logistics industry continues to evolve, the importance of industrial labels in shipments and logistics will continue to grow.

- Printing and application labeling equipment has grown significantly in India recently. The quick shifts in packaging patterns across the nation are one of the main drivers of industry expansion. There has been a massive uptake of novel packaging and labeling methods. India's market for industrial labels has a sizable potential because of increasing and recovering market growth. The main driver of the nation's expanding labels market is the increased need for packaging solutions for a variety of goods as well as for high-quality, fast labeling equipment. Also, the government is assisting the market by educating consumers about proper labeling.

- The South Korean label and packaging printing market is intriguing. The market is considered cautious and deliberate because letterpress and gravure are the two most popular traditional print methods. The market in Korea is very different, and there is a lot of intermittent offset and letterpress technology in existence. However, short runs, flexible packaging, and variable data are growing in popularity in Korea, and the types of printed labels are also changing. Labels are getting more detailed while also getting smaller. Consequently, more labels are created because they are smaller, even if the square meter is nearly identical.

- In Australia, the food industry contributes significantly to both jobs and revenue. Even the top FMCG firms worldwide, such as Nestle, Unilever, Mars, and Simplot, have a long history of being well-represented in Australia. A food product's packaging is created in accordance with the requirements and regulations listed in detail. A thorough approach is therefore required to create appealing packaging design and labeling, thus anticipated to fuel the demand for packaging and label vendors across the country.

- In the Asia Pacific region, Industrial labels are primarily driven by increasing awareness of regulatory compliance and tracking shipments in logistic operations. Emerging Technologies for packaging machinery can also be seen as a driving factor for the development of the market. The growing pharmaceutical industry and the increasing demand for convenient packaging are major growth factors for this market.

Industrial Labels Industry Overview

The industrial labels market is fragmented, with the presence of key players such as Avery Dennison Corporation, 3M Company, CCL Industries Inc., Brady Corporation, and more. Companies are focused on innovating new solutions to the industry through acquisitions, collaborations, or investments as part of expanding their portfolio.

For instance, in April 2023, CCL Industries announced two intelligent label acquisitions. CCL Industries acquired eAgile Inc. and Alert Systems ApS. EAgile Inc is a patented hardware and software solution for the healthcare industry supplied alongside RFID inlays embedded into labels. Alert Systems provides patented anti-theft solutions sold alongside Checkpoint's Merchandise Availability Solutions (MAS) product lines.

In April 2023, Avery Dennison created AD XeroLinr DT, a new sustainable, lineless option for variable information (VI) labels, which is especially important in today's developing logistics and e-commerce industries as the number of parcels being delivered grows by the day. AD XeroLinr DT provides up to 60% more labels per roll and fewer roll changes, increasing client productivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Technology Snapshot - Identification Technology

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Food and Beverage is Expected to Register Significant Growth

- 5.1.2 APAC to Witness Significant Growth

- 5.2 Market Restraints

- 5.2.1 High Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Metal Labels

- 6.1.2 Plastic/Polymer Labels

- 6.2 By Mechanism

- 6.2.1 Pressure Sensitive Labelling

- 6.2.2 Shrink Sleeve Labelling

- 6.2.3 Other Mechanisms (Heat Transfer, Glue-Applied Labelling)

- 6.3 By Product Type

- 6.3.1 Warning/Security Labels

- 6.3.2 Branding Labels

- 6.3.3 Weatherproof Labels

- 6.3.4 Equipment Asset Tags

- 6.3.5 Other Product Types (Tire Labels, Multiple Die-cut Labels)

- 6.4 By Printing Technology

- 6.4.1 Analog Printing

- 6.4.2 Digital Printing

- 6.5 By End-user Industry

- 6.5.1 Electronics Industry

- 6.5.2 Food & Beverage

- 6.5.3 Automotive

- 6.5.4 Healthcare

- 6.5.5 Other End-user Verticals

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 United States

- 6.6.1.2 Canada

- 6.6.2 Europe

- 6.6.2.1 Germany

- 6.6.2.2 United Kingdom

- 6.6.2.3 France

- 6.6.2.4 Spain

- 6.6.2.5 Rest of Europe

- 6.6.3 Asia Pacific

- 6.6.3.1 China

- 6.6.3.2 Japan

- 6.6.3.3 India

- 6.6.3.4 South Korea

- 6.6.3.5 Australia

- 6.6.3.6 Rest of Asia Pacific

- 6.6.4 Latin America

- 6.6.4.1 Brazil

- 6.6.4.2 Mexico

- 6.6.4.3 Argentina

- 6.6.4.4 Rest of Latin America

- 6.6.5 Middle East and Africa

- 6.6.5.1 United Arab Emirates

- 6.6.5.2 Saudi Arabia

- 6.6.5.3 South Africa

- 6.6.5.4 Rest of Middle East and Africa

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Avery Dennison Corporation

- 7.1.2 3M Company

- 7.1.3 CCL Industries Inc.

- 7.1.4 Brady Corporation

- 7.1.5 UPM RAFLATAC

- 7.1.6 DuPont de Nemours Inc.

- 7.1.7 Brook + Whittle Ltd

- 7.1.8 OMNI SYSTEMS

- 7.1.9 Asean Pack

- 7.1.10 Computer Imprintable Label Systems Ltd (CISL Ltd)

- 7.1.11 LabelTac.com

- 7.1.12 Orianaa Decorpack Pvt. Ltd

- 7.1.13 Dura-ID Solutions Limited

- 7.1.14 GA International Inc.