|

市场调查报告书

商品编码

1852205

脑机介面:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Brain-computer Interface - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

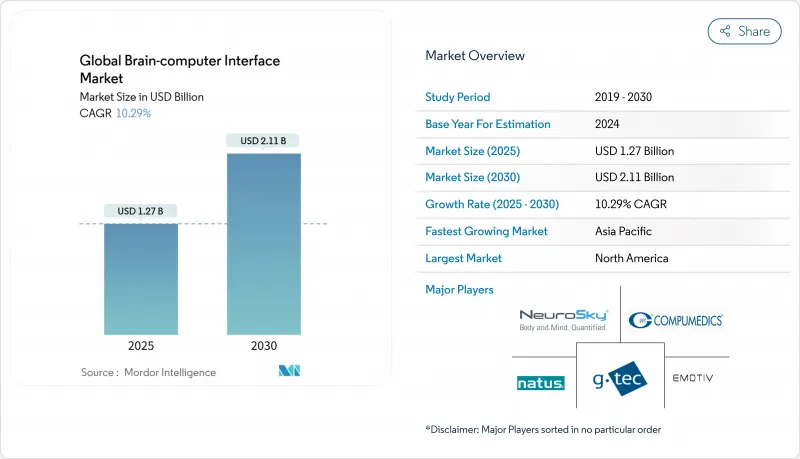

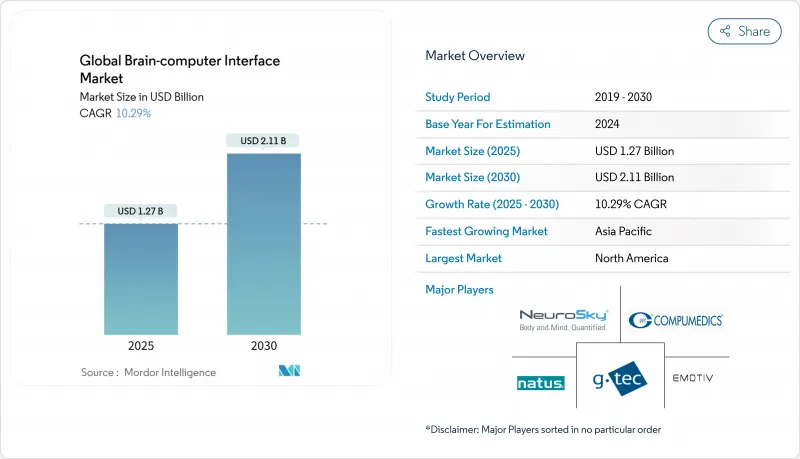

全球脑机介面市场预计到 2025 年价值 12.7 亿美元,预计到 2030 年将达到 21.1 亿美元,预测期(2025-2030 年)复合年增长率为 10.29%。

资本流入、硬体平台日趋成熟,以及神经解码与先进人工智慧的结合,是推动这项扩张的关键因素。资金筹措持续缩短商业化进程,医院加速采用植入式解决方案,而消费级头戴装置则将脑机介面市场拓展至游戏、健康和人机共生等领域。混合讯号架构和软体定义功能进一步推动产品差异化,而政府资助的临床试验则提升了安全性和伦理标准。在需求方面,神经退化性疾病的日益普遍以及人们对辅助沟通工具日益增长的需求,正将临床使用者推向产生收入的核心地位。

全球脑机介面市场趋势与洞察

对辅助通讯技术的需求迅速成长

一项由美国国立卫生研究院资助的研究使瘫痪患者的言语功能恢復清晰,词语级准确率高达99%。 [2] 随后,Syncron公司将其内建支架的植入植入与生成式人工智慧模型结合,使更多使用者能够实现免手输入。医院报告称,治疗週期缩短,患者自主性评分提高,临床适用族群也从肌萎缩侧索硬化症(ALS)扩展到创伤性脊髓损伤和脑干中风(使用者数据)。美国私人保险公司已开始考虑对语音解码植入进行早期报销,这表明支付方越来越认可其对患者生活品质的持久改善作用。欧洲的教学医院目前正将语言模型增强型脑机介面(BCI)纳入多学科神经復健计划,从而促进了该技术在整个全部区域的中期应用。

脑电图穿戴式头戴装置的快速普及

游戏工作室、电竞组织者和消费者健康品牌正在将干电极头戴装置整合到互动游戏、健身课程和冥想平台中。主播们正在展示透过神经输入实现对游戏的完全控制,而竞技联赛则在尝试利用专注力和情绪状态数据进行教练指导。这些应用正在不断完善低延迟讯号提取演算法,加速设备小型化,并向非相关人员受众普及脑机互动的日常益处。随着出货量的成长,规模经济将开始降低单位成本,使供应商能够捆绑订阅式分析服务,并提高每位用户的收入。

手术风险和监管障碍

植入式系统具有极佳的讯号保真度,但需要进行颅脑和血管手术,因此仅在少数医疗中心可用。电极移位、感染和设备召回的报告引起了临床医生和支付方的担忧。监管机构要求长期的安全监测,这延长了产品上市时间并增加了试验预算。这些障碍使得早期应用仅限于资金雄厚的教学医院和富裕的自费患者,减缓了其广泛普及。供应商已透过改进支架等输送工具和开发可逆植入来应对这些挑战,但他们仍需要经历长达数年的核准途径。

细分市场分析

非侵入式头戴装置和电极阵列将占2024年收入的76.50%,凸显了它们作为众多脑机介面市场开发者的入门级产品的地位。采用干电极和低功耗蓝牙技术的产品推出,缩短了设定时间,提高了舒适度,并支援虚拟实境游戏和远端神经反馈等日常应用场景。医院重视降低手术风险,而消费品牌则利用监管门槛低的优势加快产品上架速度。儘管竞争日益激烈,价格下降和信噪比提高仍将持续支撑两位数的成长。

软体和演算法层正以12.10%的复合年增长率快速成长,超过了硬体的成长速度。基于变压器的解码器、迁移学习和自校准框架正推动资讯传输速率实现三位数的成长。这些进步正在催生一个新的SaaS细分市场,预计到2030年,该市场规模将从19亿美元增长到51亿美元。服务供应商为缺乏内部专业知识的临床买家提供云端仪錶板、电气维护合约和合规性审核。这些业务活动维持了均衡的综合收益,使供应商免受纯硬体业务带来的利润挤压。

到2024年,马达/动力平台将占总支出的50.90%,这反映了临床上优先考虑恢復瘫痪患者游标控制、轮椅导航和义肢控制的功能。非侵入式深度学习解码器能够实现亚秒响应时间,其成功演示已使其应用范围扩展到加护病房之外。消费级开发者正在将这些突破性技术应用于扩增实境头戴装置和智慧家庭设备中的无手势输入,进一步推动了该领域的成熟。

结合脑电图 (EEG)、肌电图 (EMG)、功能性近红外线光谱 (fNIRS) 或聚焦超音波的混合架构正以 13.56% 的复合年增长率 (CAGR) 增长。融合多种神经和周边讯号可提高可靠性,并校正单模态系统常见的伪迹。在一项中风復健实验室设备研究中,83% 的患者在接受两週的混合脑肌训练后,恢復了可测量的手部功能。随着组件成本的下降,混合电路可望从实验室走向模组化消费级配件市场。

区域分析

美国仍将是脑机介面市场的中心,预计到2024年将占全球收入的48.54%。美国国立卫生研究院的资助、雄厚的创投资金以及专业的营运团队,共同支持涵盖语音解码、互动式感官知觉和忧郁症神经调控等领域的持续试验。该地区受益于率先将报销测试整合到临床工作流程中的医疗保健系统,加速了支付方的接受度。隐私法正在快速发展,这不仅增加了合规成本,也为那些早期投资于安全资料架构的公司带来了竞争优势。

亚太地区将以12.56%的复合年增长率成为成长最快的地区,这主要得益于中国政府将脑机介面列为战略产业。国家补贴正在推动产学研联盟的发展,而新的标准化机构也致力于制定讯号撷取通讯协定和伦理准则。中国新兴企业已在普通话语音解码方面实现了71%的准确率,凸显了该地区的强劲发展势头。日本的老龄化人口为神经退化性疾病的治疗管理带来了结构性需求驱动因素,而韩国电子巨头则在感测器小型化方面贡献了其专业技术。

在欧洲,公共医疗保健系统为情绪改善试验和中风復健计画提供了大量资金。英国国家医疗服务体系(NHS)斥资650万英镑开展的基于超音波介面(BCI)试验,进一步强化了政策层面对非药物治疗精神健康问题的承诺。即将出台的欧盟人工智慧法案将把许多人工智慧医疗设备归类为高风险产品,迫使供应商采用严格的网路安全和效能检验程序,这在其他地区可能成为竞争优势。中东、非洲和南美洲正在投资远距復健和远端神经监测,充分利用行动连线和跨境培训伙伴关係。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子竞技和游戏公司迅速采用基于脑电图的可穿戴式耳机

- 在神经科技中心(硅谷、洛桑、维也纳),高额资金筹措加速了产品商业化的进程。

- 政府活性化研发投入,以改善技术

- 日本和欧盟老化社会中神经退化性疾病盛行率的上升促使临床试验的进行

- 市场限制

- 手术风险和监管障碍限制了植入式脑机介面系统的应用。

- 关于神经资料收集的资料隐私问题

- 公共医疗保健系统中基于脑机介面的復健治疗报销代码匮乏

- 大众市场脑电图设备中,头髮和头皮电阻导致讯号精度面临挑战。

- 供应链分析

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 替代品的威胁

- 买方的议价能力

- 供应商的议价能力

- 产业间竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 侵入性

- 非侵入性

- 其他的

- 软体与演算法

- 服务

- 硬体

- 按介面类型

- 马达/输出 BCI

- 脑机通讯

- 被动式/监测式脑机接口

- 混合脑机介面

- 透过使用

- 神经假体和运动功能恢復

- 通讯与控制

- 其他的

- 最终用户

- 医院和诊所

- 研究和学术机构

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争格局

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- G-Tech医疗工程股份有限公司

- 贝莱德神经科技

- Emotive 公司

- NeuroSky公司

- 核心

- 平行赛跑

- 心灵迷宫 SA

- 认知

- CTRL-Labs(元平台)

- Next Mind(Snap 公司)

- 开放式脑机介面

- 同步

- 神经质

- BrainCo, Inc.

- 轴间(缪斯)

- BitBrain Technologies

- 赛博动力学

- 工业株式会社

- 电脑化医疗

- Alea 神经治疗学

第七章 市场机会与未来展望

The Global Brain-computer Interface Market size is estimated at USD 1.27 billion in 2025, and is expected to reach USD 2.11 billion by 2030, at a CAGR of 10.29% during the forecast period (2025-2030).

Capital inflows, maturing hardware platforms, and the pairing of neural decoding with advanced artificial intelligence are the primary forces behind this expansion. Venture funding continues to shorten commercialization timelines, hospitals accelerate early adoption of implantable solutions, and consumer-facing headsets extend the reach of the Brain-Computer Interface market into gaming, well-being, and human-machine symbiosis. Hybrid signal architectures and software-defined features further support product differentiation, while government-funded clinical trials push forward standards for safety and ethics . On the demand side, rising prevalence of neuro-degenerative disorders and heightened expectations for assistive communication tools keep clinical users at the core of revenue generation.

Global Brain-computer Interface Market Trends and Insights

Surging demand for assistive communication technologies

National Institutes of Health-backed research restored intelligible speech for a paralyzed patient with 99% word-level accuracy [2]. Synchron subsequently paired its Stentrode implant with a generative-AI model, enabling hands-free texting for additional users. Hospitals report shorter caregiver cycles and higher patient-autonomy scores, expanding the clinical addressable pool beyond ALS to traumatic spinal-cord injury and brain-stem stroke (user data). Private insurers in the United States have begun reviewing early reimbursement cases for speech-decoding implants, indicating growing payer recognition of durable quality-of-life gains. European teaching hospitals now integrate language-model-enhanced BCIs in multidisciplinary neuro-rehabilitation programs, reinforcing mid-term adoption across the region.

Rapid adoption of EEG-based wearable headsets

Gaming studios, e-sports organizers, and consumer-wellness brands integrate dry-electrode headsets into interactive titles, fitness programs, and meditation platforms. Streamers demonstrate full-gameplay control with neural inputs, while competitive leagues trial concentration and emotional-state data for coaching. These deployments sharpen algorithms for low-latency signal extraction, accelerate miniaturization, and educate non-medical audiences on everyday benefits of brain-computer interaction. As shipments grow, economies of scale begin to lower unit costs, allowing vendors to bundle subscription-based analytics that deepen revenue per user.

Surgical risks and regulatory hurdles

Implantable systems deliver superior signal fidelity yet involve cranial or vascular procedures that few centers can perform. Reports of electrode migration, infection, and device retrieval create caution among clinicians and insurers. Regulatory agencies require lengthy safety monitoring, stretching time-to-market and inflating trial budgets. These obstacles confine early adoption to well-funded academic hospitals and wealthy self-pay patients, slowing broad penetration. Vendors respond by refining stent-like delivery tools and developing reversible implants but must still navigate multi-year approval pathways.

Other drivers and restraints analyzed in the detailed report include:

- High VC funding in neuro-tech hubs

- Rising R&D activities by government

- Data-privacy concerns over neural data collection

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-invasive headsets and electrode arrays generated 76.50% of 2024 revenue, underscoring their role as the entry point for many developers in the Brain-Computer Interface market. Product launches with dry electrodes and low-energy Bluetooth have reduced setup times and improved comfort, enabling everyday usage scenarios such as virtual-reality gaming and remote neurofeedback. Hospitals appreciate the avoidance of surgical risk, and consumer brands leverage lower regulatory hurdles to speed shelf placement. Price declines and improved signal-to-noise ratios continue to support double-digit growth despite intensifying competition.

Software and algorithm layers are expanding at a 12.10% CAGR, a pace that outstrips hardware because every incremental headset installation yields recurring licensing opportunities. Transformer-based decoders, transfer learning, and self-calibrating frameworks raise information-transfer rates by triple-digit percentages. These advances create an emergent SaaS sub-segment forecast to climb from USD 1.9 billion to USD 5.1 billion by 2030. Service providers follow close behind, offering cloud dashboards, electrode-maintenance contracts, and compliance audits to clinical buyers who lack in-house specialists. Together, these activities sustain a balanced revenue mix that shields vendors from pure hardware margin compression.

Motor/output platforms accounted for 50.90% of spending in 2024, reflecting clinical priorities around restoring cursor control, wheelchair navigation, and prosthetic manipulation for paralysis patients. Successful demonstrations of non-invasive deep-learning decoders capable of sub-second response rates have widened appeal beyond the intensive-care unit. Consumer developers adapt these breakthroughs to gesture-less input for augmented-reality headsets and smart-home devices, reinforcing the segment's maturity.

Hybrid architectures, combining EEG, electromyography, functional near-infrared spectroscopy, or focused ultrasound, are on course for 13.56% CAGR. They lift reliability by fusing multiple neural and peripheral signals, thereby compensating for artifacts that hamper single-modality systems. Experimental stroke-rehabilitation rigs illustrate the benefit: after two weeks of hybrid brain-muscle training, 83% of patients regained measurable hand function. As component costs fall, hybrid circuitry will migrate from the laboratory into modular consumer accessories.

The Brain Computer Interface Market Report Segments by Component (Hardware, Software & Algorithm and Services), by Interface (Motor BCI, Communication BCI, and More), by Application (Neuro-Prosthetics & Motor Restoration and More), by End User (Hospitals & Clinics, Research & Academic Institutes, and Others) and by Geography ( Northa America, Europe and More) the Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 48.54% of 2024 revenue and remains the anchor of the Brain-Computer Interface market. National Institutes of Health funding, deep venture pools, and specialized surgical teams underpin a continuous trial pipeline that spans speech decoding, bidirectional sensation, and neuromodulation for depression. The region benefits from early adopter health systems that integrate reimbursement studies into clinical workflows, accelerating payer acceptance. Privacy legislation is evolving rapidly, creating both compliance overhead and competitive advantage for firms that invest early in secure data architectures.

Asia-Pacific delivers the fastest 12.56% CAGR, propelled by Chinese government designation of brain-machine interfaces as a strategic industry. State grants encourage industrial-academic consortia, while new standards bodies tackle signal-acquisition protocols and ethical guidelines. Chinese start-ups have already demonstrated 71% accuracy in decoding Mandarin speech, underscoring regional momentum. Japan's aging demographics add a structural demand driver for neuro-degenerative disease management, and South-Korean electronics majors contribute sensor miniaturization expertise.

Europe holds a significant share, with public-health systems funding mood-enhancement trials and stroke-recovery programs. The National Health Service's GBP 6.5 million ultrasound-based BCI trial reinforces policy-level commitment to non-pharma approaches for mental-health conditions. The forthcoming EU AI Act classifies many AI-enabled medical devices as high-risk, compelling vendors to adopt rigorous cyber-security and performance-validation procedures that can become competitive differentiators in other regions. Smaller but growing markets in the Middle East, Africa, and South America invest in tele-rehabilitation and remote neuromonitoring, leveraging mobile connectivity and cross-border training partnerships.

- g.tec medical engineering

- Blackrock Neurotech

- Emotiv, Inc.

- NeuroSky, Inc.

- Kernel

- Paradromics, Inc.

- MindMaze SA

- Cognixion

- CTRL-Labs (Meta Platforms)

- NextMind (Snap Inc.)

- OpenBCI

- Synchron

- Neurable

- BrainCo, Inc.

- Interaxon Inc. (Muse)

- Bitbrain Technologies

- Cyberkinetics

- Nihon Kohden

- Compumedics

- Alea Neurotherapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of EEG-based wearable headsets by eSports and gaming companies

- 4.2.2 High VC funding in neuro-tech hubs (Silicon Valley, Lausanne, Vienna) accelerating product commercialization timelines

- 4.2.3 Rising R&D Activities by Government to Improve the Technology

- 4.2.4 Rising prevalence of neuro-degenerative disorders in ageing populations of Japan and EU spurring clinical trials

- 4.3 Market Restraints

- 4.3.1 Surgical risks and regulatory hurdles limiting adoption of implantable BCI systems

- 4.3.2 Data-privacy concerns over neural data collection

- 4.3.3 Scarcity of reimbursement codes for BCI-based rehabilitation therapies in public healthcare systems

- 4.3.4 Signal accuracy challenges due to hair & scalp impedance in mass-market EEG devices

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Threat of Substitutes

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Bargaining Power of Suppliers

- 4.6.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Component (Value)

- 5.1.1 Hardware

- 5.1.1.1 Invasive

- 5.1.1.2 Non-invasive

- 5.1.1.3 Others

- 5.1.2 Software & Algorithms

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Interface Type (Value)

- 5.2.1 Motor / Output BCI

- 5.2.2 Communication BCI

- 5.2.3 Passive / Monitoring BCI

- 5.2.4 Hybrid BCI

- 5.3 By Application (Value)

- 5.3.1 Neuro-prosthetics & Motor Restoration

- 5.3.2 Communication & Control

- 5.3.3 Others

- 5.4 By End-User (Value)

- 5.4.1 Hospitals & Clinics

- 5.4.2 Research & Academic Institutes

- 5.4.3 Others

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia- Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 6. Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 g.tec medical engineering GmbH

- 6.4.2 Blackrock Neurotech

- 6.4.3 Emotiv, Inc.

- 6.4.4 NeuroSky, Inc.

- 6.4.5 Kernel

- 6.4.6 Paradromics, Inc.

- 6.4.7 MindMaze SA

- 6.4.8 Cognixion

- 6.4.9 CTRL-Labs (Meta Platforms)

- 6.4.10 NextMind (Snap Inc.)

- 6.4.11 OpenBCI

- 6.4.12 Synchron Inc.

- 6.4.13 Neurable

- 6.4.14 BrainCo, Inc.

- 6.4.15 Interaxon Inc. (Muse)

- 6.4.16 Bitbrain Technologies

- 6.4.17 Cyberkinetics

- 6.4.18 Nihon Kohden Corporation

- 6.4.19 Compumedics Ltd

- 6.4.20 Alea Neurotherapeutics