|

市场调查报告书

商品编码

1642211

柔版印刷:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Flexographic Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

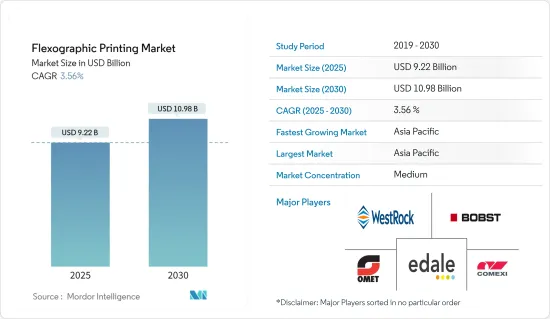

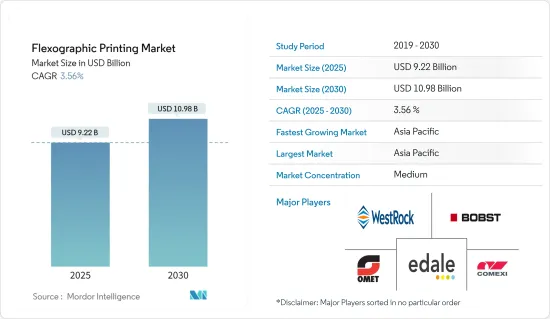

柔版印刷市场规模预计在 2025 年为 92.2 亿美元,预计到 2030 年将达到 109.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.56%。

柔版印刷在包装行业引起了广泛关注,它用于印刷标籤、纸箱和软质塑胶。该市场将受益于食品和饮料等行业的成长。

关键亮点

- 柔版印刷是发展最快的印刷过程之一。它的多功能性使其能够在多种基材上进行列印,从而扩展了其在多种产品中的效用。技术进步正日益影响柔版印刷市场。

- 对高生产速度和高效印刷的需求正在推动柔版印刷市场的发展。随着柔版印刷的进步,油墨市场正在扩大。包装印刷的趋势日益增长,特别是在食品和消费品领域,这推动了柔版印刷的快速应用。

- 柔版印刷的关键优势在于能够提供色彩鲜艳、影像清晰的高品质印刷品。这是透过油墨从一块印版转移到另一块印版的精确度来实现的,这是柔版印刷所独有的。此外,这些印刷机具有出色的色彩套准,确保了整个印刷过程的一致性。

- 柔版印刷的需求正在激增,这主要是因为与其他印刷方式相比它具有成本效益。这种效率来自于其快速的生产速度和与快干油墨的兼容性,尤其是与其他系统整合时。柔版印刷的需求是由电子商务领域所推动的,这得益于对短版印刷和快速输出的需求不断增加。柔版印刷是印刷各种材料(从瓦楞纸板到标籤到金属薄膜)的首选方法。

- 在历史上依赖劳动力的印刷业,离职率和就业趋势之间有密切的相关性。但机器设计和数数位化等领域的进步提高了生产力,使成长与直接就业脱钩。儘管取得了这些进步,但原材料成本的上涨却限制了市场参与企业。柔版印刷的重要材料包括纸张、油墨、承印材料和各种化学品。

柔版印刷市场趋势

折迭式纸盒预计将占据很大份额

- 柔版印刷以其快干和无毒的油墨而闻名,使其成为食品包装的热门选择。主要用途包括在牛奶盒、食品和饮料容器以及一次性杯子上进行印刷。

- 折迭式纸盒重量轻,因此在全球范围内需求量很大。确保实体纸箱和最终印刷品的品质至关重要。为了满足这种需求,印刷公司越来越多地采用多站点营运。值得注意的是,根据粮食及农业组织的预测,纸板产量预计将从 2022 年的 11,796 吨小幅增长至 2024 年的 11,993 吨。

- 消费者生活方式和饮食习惯的改变推动了对包装产品,尤其是食品的需求激增。这一趋势对折迭纸盒柔版印刷市场产生了重大影响。保质期的延长、消费者的安全性以及人口成长带来的人均可支配收入的提高等因素进一步推动了这项需求。

- 过去,切刀摺痕和平压模切作业主要与凹版印刷机和单张纸胶印机有关,而不是折迭纸箱印刷机。然而,随着柔版印刷品质的提高、水性和 UV 油墨的采用以及设备成本的降低,加工商越来越多地转向柔版印刷来生产优质的折迭纸盒。

- 值得注意的是,柔版印刷在折迭纸盒印刷领域有着悠久的历史,但最近开始使用中央广告曝光率机进行印刷。最初,柔版印刷主要用于披萨纸盒之类的产品。然而,在宽网上实现多色精确套准的能力正在扩大它的吸引力,特别是对于购买点的折迭纸盒应用而言。

亚太地区可望主导柔版印刷市场

- 该地区的电子商务行业正在快速成长,这是推动柔版印刷应用增加的主要因素。柔版印刷在标籤生产上极为重要,尤其适用于瓦楞纸板上的印刷。例如,Invest India 预测到 2030 年电子商务市场规模将激增至 3,500 亿美元。

- 快速成长的物流产业是包装和印刷标籤的重要消费者,可望推动柔版印刷市场的发展。此外,随着地方政府加强推动製造业发展,柔版印刷的需求预计将随之上升。

- 儘管柔版印刷市场已达到一定的成熟度,但该行业仍在不断寻找重大创新和应用,以满足当前和未来的客户需求。在从出版到包装的持续转变以及印刷技术的进步的推动下,市场有望实现成长。此外,主要市场参与企业正在进入该地区并进行策略创新和伙伴关係,以扩大其市场影响力。预计这些合作将在未来几年推出产品并推动该地区柔版印刷的普及。

- 在该地区运营的公司正在透过创新扩大业务。例如,2024 年 3 月,总部位于印度艾哈默德巴德的 Flexure Print N Pack 公司为冷冻食品客户完成了商业印刷,并取得了里程碑式的成就。使用Echaar FlexoSmart HR300中央广告曝光率柔版印刷机,实现了208线/英寸(LPI)的出色印刷分辨率,标誌着柔版印刷技术的显着飞跃。

- 亚太地区在全球商业印刷市场中占据主导地位,由于中国、印度、日本、印尼、泰国和越南等新兴经济体的商业印刷消费不断增加,预计未来几年亚太地区将以同样的速度成长。

柔版印刷业概况

该研究考虑了各个市场供应商提供的柔版印刷服务所产生的收入。此外,它还考虑消费者支出、偏好趋势、供应动态和其他宏观经济因素等多种因素,以得出整体市场并预测其未来成长。

柔版印刷市场细分化,包括 Amcor PLC、Westrock Company、Sonoco Products Company 和 Bobst Group SA 等公司。从市场占有率来看,目前少数几家大公司占据着市场主导地位。凭藉较大的市场占有率,这些大公司正在寻求将基本客群扩展到其他国家。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 降低印刷成本

- 技术进步和印刷品质提高

- 市场限制

- 新印刷技术的出现

第六章柔版印刷市场现状

- 窄带

- 中型网页

- 单张馈纸

- 其他印刷设备

第七章 市场区隔

- 按应用

- 瓦楞纸箱

- 折迭式纸盒

- 软包装

- 标籤

- 印刷媒体

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第八章 竞争格局

- 公司简介

- InterFlex Group

- Pepin Manufacturing Inc.

- Siva Group

- Flexopack SA

- Wolverine Flexographic LLC(Crosson Holdings LLC)

- Bobst Group SA

- Edale UK Limited

- Heidelberger Druckmaschinen AG

- OMET SRL

- Star Flex International

- Comexi Group

第九章投资分析

第十章:市场的未来

The Flexographic Printing Market size is estimated at USD 9.22 billion in 2025, and is expected to reach USD 10.98 billion by 2030, at a CAGR of 3.56% during the forecast period (2025-2030).

Flexographic printing has garnered substantial attention in the packaging industry, finding applications in printing labels, cartons, and flexible plastics. The market is poised to benefit from the growth in industries like food and beverages.

Key Highlights

- Flexographic printing has emerged as one of the swiftest-growing print processes. Its versatility in printing on diverse substrates has expanded its utility to various products. Technological advancements are increasingly shaping the flexographic printing machine market.

- The demand for high production speeds and efficient printing drives the flexographic printing machine market. As flexographic printing advances, it opens up a broad market for inks. The rising trend of printing on packaging, particularly in the food and consumer goods sectors, is fast-tracking the adoption of flexographic printing equipment.

- Flexographic printing presses offer a crucial advantage: the capability to deliver high-quality prints with vibrant colors and sharp images. This is achieved through the precision of ink transfer facilitated by the plates unique to flexographic printing. Furthermore, these presses excel in color registration, guaranteeing consistency across the printing run.

- Flexographic printing machines are witnessing a surge in demand, primarily due to their cost-effectiveness compared to alternatives. This efficiency is attributed to their quicker production rates and compatibility with fast-drying inks, especially when integrated with other systems. The e-commerce sectors, driven by a rising appetite for short-run, swift outputs, fuel the demand for flexographic printing. Flexography is the go-to method for printing materials ranging from corrugated cardboard to labels and metallic films.

- Historically reliant on labor, the printing industry saw a close correlation between turnover and employment trends. However, advancements like machinery design and digitalization have boosted productivity, decoupling growth from direct employment. Despite these strides, escalating raw material costs have constrained market players. Critical materials in flexographic printing encompass paper, ink, printing materials, and various chemicals.

Flexographic Printing Market Trends

Folding Cartons Expected to Account for a Significant Share

- Flexographic printing, known for its quick-drying properties and use of non-toxic inks, is a favored choice for food packaging. It finds primary applications in printing on milk cartons, food and beverage containers, and disposable cups.

- Global demand for folding cartons is rising due to their lightweight nature. Ensuring quality in both the physical carton and the final print is paramount. To keep up with this demand, printers are increasingly adopting multi-site operations. Notably, the Food and Agriculture Organization projects a slight uptick in carton board production, from 11,796 metric tons in 2022, and it is expected to reach 11,993 metric tons in 2024.

- Changing consumer lifestyles and eating habits are fueling a surge in demand for packaged products, especially in food. This trend is significantly impacting the flexographic printing market for folding cartons. Factors such as enhanced shelf life, consumer safety, and the increasing per capita disposable income, alongside a growing population, further bolstered this demand.

- In the past, cutter-crease or platen die-cutting operations were predominantly associated with rotogravure or sheet-fed offset presses, not folding carton presses. However, with advancements in flexographic printing quality, water-based or UV ink adoption, and reduced equipment costs, converters are increasingly turning to flexographic printing for high-quality folding cartons.

- While flexographic printing has a history of printing folding cartons, the recent shift towards using central impression presses for this purpose is notable. Initially, flexo printing was primarily used for products like pizza cartons. However, the capability to achieve multi-color prints with precise registration on the wide web has broadened its appeal, especially for point-of-purchase folding carton applications.

Asia-Pacific Expected to Dominate the Flexographic Printing Market

- The e-commerce industry in the region is witnessing rapid growth, which is a key driver behind the increasing adoption of flexographic printing machines. Flexographic printing is pivotal for producing labels and is extensively utilized, especially in printing on corrugated cardboard. For instance, Invest India projects the e-commerce market to surge to USD 350 billion by 2030.

- The burgeoning logistics sector, a significant consumer of packaging and printed labels, is poised to propel the flexographic printing market. Furthermore, as regional governments intensify efforts to bolster the manufacturing sector, the demand for flexographic printing machines is expected to rise correspondingly.

- Despite the flexographic printing market achieving a degree of maturity, the industry continues to witness significant technological innovations and applications, addressing present and future client demands. Driven by a persistent transition from publications to packaging and advancements in printing technologies, the market is poised for growth. Moreover, key market players are forging strategic innovations or partnerships to enter the region and expand their market presence. These collaborations will introduce the area to product offerings and drive the adoption of flexographic printing machines in the coming years.

- Companies operating in the region are growing their business through innovations. For instance, in March 2024, Flexure Print N Pack, based in Ahmedabad, India, achieved a milestone by completing a commercial print run for a frozen food client. It achieved an exceptional print resolution of 208 lines per Inch (LPI) using the Echaar FlexoSmart HR300 central impression flexographic printing press, showcasing a notable leap in flexographic printing technology.

- Asia-Pacific is dominating the global commercial printing market and is expected to witness similar growth over the coming years owing to the increasing consumption of commercial printing in emerging economies such as China, India, Japan, Indonesia, Thailand, and Vietnam.

Flexographic Printing Industry Overview

The study considers revenues from the sales of flexographic printing services offered by various market vendors. Further, multiple factors, such as consumer spending, preference trends, supply dynamics, and other macroeconomic factors, are considered to arrive at the overall market and future growth projections.

The flexographic printing market is fragmented, with several companies such as Amcor PLC, Westrock Company, Sonoco Products Company, and Bobst Group SA. In terms of market share, few of the major players currently dominate the market. With a significant market share, these major players aim to expand their customer base across other countries. These companies leverage strategic collaborative initiatives to augment their market share and increase profitability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduced Printing Costs

- 5.1.2 Technological Advancements and Improved Print Quality

- 5.2 Market Restraints

- 5.2.1 Advent of New Printing Technologies

6 FLEXOGRAPHIC PRINT EQUIPMENT MARKET LANDSCAPE

- 6.1 Narrow Web

- 6.2 Medium Web

- 6.3 Sheet Fed

- 6.4 Other Printing Equipment

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Corrugated Boxes

- 7.1.2 Folding Carton

- 7.1.3 Flexible Packaging

- 7.1.4 Labels

- 7.1.5 Print Media

- 7.1.6 Other Applications

- 7.2 By Geography

- 7.2.1 North America

- 7.2.1.1 United States

- 7.2.1.2 Canada

- 7.2.2 Europe

- 7.2.2.1 United Kingdom

- 7.2.2.2 Germany

- 7.2.2.3 France

- 7.2.2.4 Italy

- 7.2.2.5 Spain

- 7.2.3 Asia-Pacific

- 7.2.3.1 China

- 7.2.3.2 India

- 7.2.3.3 Japan

- 7.2.3.4 Australia and New Zealand

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

- 7.2.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 InterFlex Group

- 8.1.2 Pepin Manufacturing Inc.

- 8.1.3 Siva Group

- 8.1.4 Flexopack SA

- 8.1.5 Wolverine Flexographic LLC (Crosson Holdings LLC)

- 8.1.6 Bobst Group SA

- 8.1.7 Edale UK Limited

- 8.1.8 Heidelberger Druckmaschinen AG

- 8.1.9 OMET SRL

- 8.1.10 Star Flex International

- 8.1.11 Comexi Group