|

市场调查报告书

商品编码

1439766

包装印刷:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Packaging Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

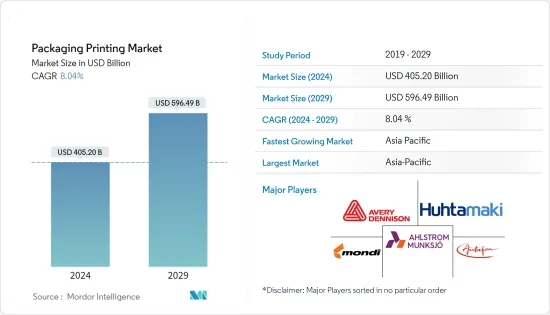

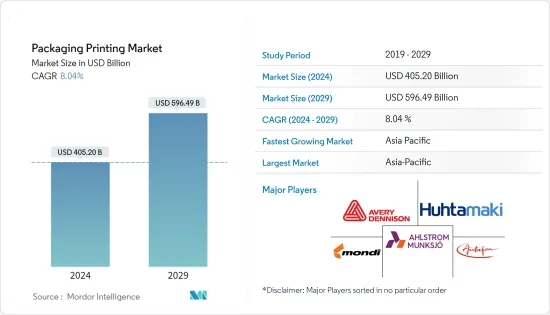

预计2024年包装印刷市场规模为4,052亿美元,预计2029年将达到5964.9亿美元,在预测期内(2024-2029年)复合年增长率为8.04%。

技术进步,加上激烈的竞争以及品牌认知度驱动的对独特包装的需求,预计将推动市场成长。特别是,食品、食品和饮料和化妆品等最终用户产业对创新包装的需求不断增长,预计将导致市场扩张。

主要亮点

- 数位印刷技术的快速崛起促进了印刷标籤市场的成长,这使得标籤印刷市场更加复杂,并增加了数位印刷标籤的采用。弹性、多功能性和高图形标准是主要的成长要素。弹性凸版印刷方法可以在金属薄膜、塑胶、赛珞玢、纸张和纸板表面进行印刷。

- 此外,人工智慧、机器学习、物联网、资料分析等的进步使得所提供的服务变得更加个人化。数位印刷的融合使得大量订单的印刷个人化具有优势。然而,成本因素仍然是一个主要障碍。

- RFID(无线射频辨识)使用无线电波无线识别各种「标记」物体和人。 RFID 技术在市场研究中发挥着重要作用,因为它提高了列印技术的有效性。支援 RFID 的印表机有各种尺寸和容量,并且可以配置 RFID 印表机软体,以满足广泛的安全和其他业务需求。

- 包装印刷产业的发展、美学需求、产品差异化和技术进步是数位印刷包装市场的驱动因素。安装生产和印刷设备需要大量初始投资。设立工厂和购买印刷机需要较高的投资。对经济且永续的创新印刷技术的需求不断增长。

- 在 COVID-19 期间,包装行业很少出现封锁,因为与其他行业相比,包装、食品和饮料以及医疗行业被认为是至关重要的。此外,人们对主食和药品的巨大需求是由于恐慌性抢购造成的。多种供应链限制对包装印刷市场的成长产生了复杂的影响。

包装印刷市场趋势

食品和饮料行业预计将占据很大的市场占有率

- 由于全球新兴企业的增加、食品和非食品类别的多样化以及大流行期间食品和饮料需求的增加,包装行业在过去几年中经历了重大转型。

- 由于饮食习惯的改变,消费者对包装产品的需求不断增加,食品包装印刷的需求不断增加,而不断变化的生活方式可能对市场产生至关重要的影响。由于高阻隔性、保质期和消费者安全,人均可支配收入的增加和人口成长预计将促进产品需求。食品包装上的印刷用于消费者资讯和行销目的。印刷用于各种包装材料。塑胶、纸张、纸板和软木可直接印刷。

- 随着食品内容被印在产品上,买家对食品的认知度不断提高,对产品透明度的需求不断增加,从而增加了食品领域对包装印刷的需求。人们对经过最少加工或未经加工、不含防腐剂且保质期较长的天然、优质食品的需求不断增长。包装食品有多种用途,包括屏障、预防污染、方便性和份量控制。永续包装透过安全考虑来减少食品废弃物和损失,预防食品源性疾病和化学污染,并维持食品品质。

- 消费者的购买行为在包装食品市场的成长中扮演重要角色。近年来,消费者开始转向方便食品。快节奏、忙碌的生活方式、准备用餐的时间限制、电子商务的成长以及可支配收入的增加正在推动包装食品的销售。对便利性的日益偏好预计将推动受访市场的需求。

- 本已蓬勃发展的电子商务产业在疫情期间销售额激增。疫情期间,许多杂货店已转向线上业务并促进非接触式购物。根据 UNCTAD 的数据,2020 年线上零售业的销售额从 16% 成长至 19%。

- 根据专门从事线上食品订购和宅配的荷兰线上平台Just Eat Takeaway.com 的数据显示,2021 年Just Eat Takeaway.com 收到约10.9 亿份订单和5.88 亿份订单,与前一年相比大幅增长,带动包装印刷市场向前发展。

亚太地区可望成为快速成长的市场

- 亚太地区的包装印刷市场广泛普及,印刷技术多样,应用广泛。中国、印度、日本和韩国等国家与食品和饮料饮料、消费性电子产品等相关的各个行业正在为该地区的包装解决方案创造巨大的需求。

- 亚太地区对包装印刷的需求预计将随着包装产业的成长而增加。核心家庭的增加、新包装材料、客户舒适度需求的增加以及人口老化正在推动包装行业的发展。预计推动消费者成长的另一个因素是对包装饮料的需求不断增长。对瓶装水、酒精饮料、碳酸饮料和罐装果汁不断增长的需求正在增加瓶装饮料的购买和消费。

- 包装印刷广泛应用于食品和饮料、药品、家居及化妆品、电子设备、汽车业。例如,由于在食品和饮料和食品和饮料包装上印刷数位资料以传达产品有效期限、内容物和营养价值的趋势不断增加,包装印刷在食品和饮料行业中普遍使用。

- 包装印刷应用的需求不断增长可能会推动预测期内的市场成长。此外,永续印刷需求的成长、软包装需求的增加、成本效益和包装废弃物的减少等因素正在推动包装印刷市场的发展。医疗保健产业的成长和便利包装的普及是包装印刷市场的主要驱动因素。

- 在亚太地区,包装印刷市场主要受到个人消费增加和对永续产品需求不断增长的推动。加工食品消费的增加正在推动市场成长。包装印刷的新兴技术也正在推动要素市场发展。製药业的成长和对方便包装的需求不断增加是该市场的主要成长要素。

包装印刷业概况

由于 Mondi PLC、Ahlstrom-Munksjo Oyj、Autajon CS、Huhtamaki 软包装 (Huhtamaki Oyj) 和 Avery Dennison Corporation主要企业的存在,包装印刷市场竞争对手之间的竞争非常激烈。我们不断创新产品的能力使我们比竞争对手更具竞争优势。透过策略合作伙伴关係、研发和併购,每家公司都能够在市场上占据更大的份额。

- 2022 年 5 月 - 艾利丹尼森图形解决方案宣布与 Siser North America 合作,进军 DIY/工匠领域。 Siser 是传热乙烯基市场的领导者,也是个人化和改装专家,已涉足消费品工艺品市场 40 多年。

- 2022 年 5 月 - Mondi 在芬兰库奥皮奥工厂投资 1.25 亿欧元。这项重大资本投资计划将提高产能、增强竞争力、提高安全性并改善当地环境,符合 Mondi 的 MAP2030永续性目标。对库奥皮奥工厂的投资认可了 Mondi 的永续产品系列及其对当地经济的重要性。库奥皮奥工厂生产 ProVantage Powerfrude,这是一种高性能、高品质瓦楞纸板级半化学瓦楞纸,用作新鲜水果和蔬菜托盘和盒子的组成部分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间存在敌对关係

- 市场驱动因素

- RFID和数位印刷的使用需求

- 对数位印刷和永续包装印刷的需求不断增长

- 市场限制因素

- 高资金投入

- 包装印刷规定

第五章市场区隔

- 透过印刷技术

- 平张胶印

- 凹版印刷

- 弹性凸版印刷

- 数位印刷

- 网版印刷

- 按墨水类型

- 溶剂型油墨

- UV固化油墨

- 水性油墨

- 按包装类型

- 标籤

- 塑胶

- 玻璃

- 金属

- 纸板

- 按用途

- 化妆品/家庭护理

- 食品和饮料

- 药品

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Mondi PLC

- Ahlstrom-Munksjo Oyj

- Autajon CS

- Huhtamaki Flexible Packaging(Huhtamaki Oyj)

- Avery Dennison Corporation

- CCL Industries Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Amcor PLC

- Smurfit Kappa Group PLC

- DS Smith PLC

- Georgia-Pacific LLC

- International Paper Company

- Sealed Air Corporation

- WestRock Company

- Stora Enso Oyj

- Sonoco Products Company

- Mayr-Melnhof Karton AG

- Trustpack UAB

- Duncan Printing Group

第七章 投资分析

第八章市场的未来

The Packaging Printing Market size is estimated at USD 405.20 billion in 2024, and is expected to reach USD 596.49 billion by 2029, growing at a CAGR of 8.04% during the forecast period (2024-2029).

The technological advancements, coupled with demand for creative packaging, driven by intense competition and brand awareness, are expected to aid the growth of the market. The growing demand for innovative packaging from end-user segments, such as food, beverage, and cosmetics, among others, is expected to lead to the expansion of the market studied.

Key Highlights

- The growth of the print label market is augmented by the rapid rise of digital print technology that has made the label printing market more sophisticated and increased the adoption of digital print labels. Their flexibility and versatility, along with the high graphics standards, are the major growth features. It is possible to print on metallic films, plastics, cellophane, paper, and corrugated surfaces using the flexographic method.

- Moreover, advancements such as AI, machine learning, IoT, and data analytics, have personalized offerings to a great extent. The convergence in digital printing enables superiority in terms of print personalization for large-volume orders. However, the cost factor remains a big hurdle.

- RFID (Radio Frequency Identification) uses radio waves to identify various "tagged" objects or people wirelessly. RFID technology plays a vital role in the market study because it enhances the effectiveness of printing technology. RFID-enabled printers come in various sizes and capacities and can be configured using RFID printer software to meet a wide range of security and other business needs.

- Development in the packaging printing industry, demand for aesthetics, product differentiation, and technological advancements are some digitally printed packaging market drivers. A significant initial investment is required to install production and printing equipment. Setting up a factory or purchasing a printing press requires higher investments. There is a growing demand for economical, sustainable, and innovative printing technologies.

- During COVID-19, as compared to other industries, fewer lockdowns were observed in the packaging industry as the packaging, food, beverage, and medical industries were considered essential. Furthermore, the huge demand for staples and medicines was due to panic-driven buying. Several supply chain constraints resulted in a mixed COVID-19 impact on the packaging printing market growth.

Packaging Printing Market Trends

Food and Beverage Sector is Expected to Hold Significant Market Share

- The packing industry has undergone an immense transformation over the last couple of years, owing to the increase in the number of start-ups worldwide, the introduction of diversified categories of food and non-food products, and increased demand for food and beverage during the pandemic.

- The demand for printing in food packaging is increasing owing to rising consumer demand for packaged products due to the shift in eating habits, and evolving lifestyles may have an imperative impact on the market. A rise in per capita disposable income and a growing population are expected to aid in the product demand owing to high barrier properties, shelf life, and consumer safety. Printing on food packaging materials is used for consumer information and marketing purposes. Printings are used with many different packaging materials. Plastics, paper, board, and cork may be directly printed.

- As the food contents are printed on the product helps in the awareness regarding the food item; the demand for product transparency increased among the buyers, which has led to high demand for packaging printing in the food sector. There is a growing demand for natural and highquality foods, which are minimally processed or unprocessed, do not contain preservatives, and offer a longer shelf-life. Packaged food is used for various purposes, such as barrier and contamination protection, convenience, and portion control. Sustainable packaging addresses food waste and loss reduction by safety issues by preventing food-borne diseases and chemical contamination and preserving food quality.

- A consumer's buying behavior plays a vital role in the growth of packaged food market. For a couple of years, consumers have been tilted toward convenient food. A fast-paced, hectic lifestyle, time constraints for meal preparations, developing e-commerce, and rising disposable income have boosted packaged food sales. An increasing preference for convenience is expected to bolster the demand in the market studied.

- The e-commerce sector, which was already booming, saw a sudden increase in sales during the pandemic. During the pandemic, many grocers shifted their business online to promote no-contact shopping. According to UNCTAD, the online retail sector grew its sales from 16% to 19% in 2020.

- According to Just Eat Takeaway.com, a Dutch online platform specializing in online food ordering and home delivery, in 2021, Just Eat Takeaway.com received approximately 1.09 billion orders, a significant increase compared to the previous year when the company counted 588 million, which propelled the packaging printing market.

Asia-Pacific is Expected to be the Fastest-growing Market

- The packaging printing market is widespread in the Asia-Pacific region concerning multiple printing technologies and applications in various industries. Various industries related to food and beverage, consumer electronics, etc., in countries like China, India, Japan, and South Korea have resulted in significant demand for packaging solutions in the region.

- The demand for packaging printing is expected to rise in the Asia-Pacific region alongside the packaging industry. The packaging industry is propelled by the growing increase of nuclear families, new packaging material, increasing customer comfort needs, and population aging. Another factor anticipated to drive consumer growth is the rising demand for packaged drinks. The growing demand for bottled water, alcoholic beverages, carbonated soft drinks, and canned juices has increased the purchase and consumption of bottled beverages.

- Packaging printing has broadly used in the food and beverage, pharmaceutical, household and cosmetic, electronic, and automobile industries. For example, packaging printing is commonly used in the food and beverage industry, owing to the growing trend of digital data printing on food packages to convey the product's shelf-life, content, and nutritional value.

- The rising demand for packaging printing applications would fuel market growth over the forecast period. Moreover, factors such as growth in demand for sustainable printing, growing demand for flexible packaging, cost-effectiveness, and decreased packaging waste, drive the packaging printing market. The growing healthcare sector and the popularity of convenient packaging are the main drivers of the packaging printing market.

- In the Asia-Pacific region, the packaging printing market is primarily driven by increasing consumer spending and rising demand for sustainable products. An increase in processed food consumption is driving the market's growth. Emerging technologies for packaging printing can also be seen as a driving factor for the development of the market. The growing pharmaceutical industry and the increasing demand for convenient packaging are major growth factors for this market.

Packaging Printing Industry Overview

The competitive rivalry in the packaging printing market is high, owing to the presence of some key players, such as Mondi PLC, Ahlstrom-Munksjo Oyj, Autajon CS, Huhtamaki Flexible Packaging (Huhtamaki Oyj), and Avery Dennison Corporation, among others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over others. Through strategic partnerships, R&D, and mergers and acquisitions, the players have been able to gain a greater footprint in the market.

- May 2022 - Avery Dennison Graphics Solutions stated that it would join forces with Siser North America to penetrate the DIY/crafter sector. Siser, a market leader in heat-transfer vinyl and a specialist in personalization and modification, has been in the consumer craft market for more than 40 years.

- May 2022 - Mondi invested EUR 125 million in the Kuopio mill in Finland. Following Mondi's MAP2030 sustainability objectives, the major capex project will boost production capacity, strengthen competitiveness, improve safety, and help the local environment. Mondi's investment in the Kuopio mill recognizes its importance to Mondi's sustainable product portfolio and the local economy. Kuopio mill manufactures semi-chemical fluting - ProVantage Powerflute, a high-performance, high-quality containerboard grade used as an integral component of fresh fruit and vegetable trays and boxes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Demand for the Use of RFIDs and Digital Printing

- 4.4.2 Growing Demand for Digital and Sustainable Packaging Printing

- 4.5 Market Restraints

- 4.5.1 High Capital Investments

- 4.5.2 Packaging and Printing Regulations

5 MARKET SEGMENTATION

- 5.1 By Printing Technology

- 5.1.1 Offset Lithography

- 5.1.2 Rotogravure

- 5.1.3 Flexography

- 5.1.4 Digital Printing

- 5.1.5 Screen Printing

- 5.2 By Ink Type

- 5.2.1 Solvent-based Ink

- 5.2.2 UV-curable Ink

- 5.2.3 Aqueous Ink

- 5.3 By Packaging Type

- 5.3.1 Label

- 5.3.2 Plastic

- 5.3.3 Glass

- 5.3.4 Metal

- 5.3.5 Paper and Paperboard

- 5.4 By Application

- 5.4.1 Cosmetic and Homecare

- 5.4.2 Food and Beverage

- 5.4.3 Pharmaceutical

- 5.4.4 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mondi PLC

- 6.1.2 Ahlstrom-Munksjo Oyj

- 6.1.3 Autajon CS

- 6.1.4 Huhtamaki Flexible Packaging (Huhtamaki Oyj)

- 6.1.5 Avery Dennison Corporation

- 6.1.6 CCL Industries Inc.

- 6.1.7 Clondalkin Group Holdings BV

- 6.1.8 Constantia Flexibles Group GmbH

- 6.1.9 Amcor PLC

- 6.1.10 Smurfit Kappa Group PLC

- 6.1.11 DS Smith PLC

- 6.1.12 Georgia-Pacific LLC

- 6.1.13 International Paper Company

- 6.1.14 Sealed Air Corporation

- 6.1.15 WestRock Company

- 6.1.16 Stora Enso Oyj

- 6.1.17 Sonoco Products Company

- 6.1.18 Mayr-Melnhof Karton AG

- 6.1.19 Trustpack UAB

- 6.1.20 Duncan Printing Group