|

市场调查报告书

商品编码

1689869

联网汽车-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Connected Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

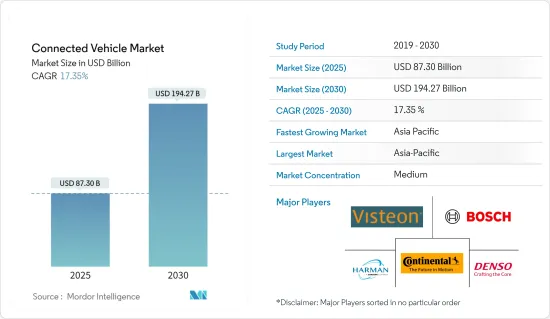

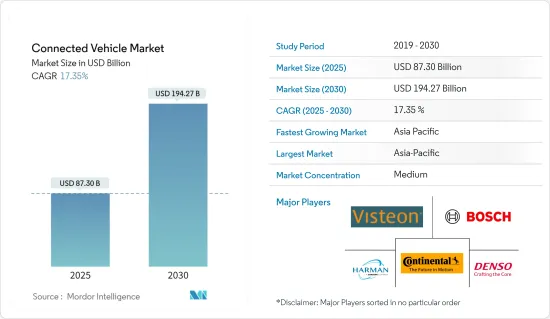

预计2025年联网汽车市场规模为873亿美元,到2030年预计将达到1942.7亿美元,预测期内(2025-2030年)的复合年增长率为17.35%。

新冠疫情对所研究的市场产生了重大影响,因为封锁和贸易限制扰乱了供应链并导致全球汽车生产停滞。然而,随着法规的放宽,公司已开始专注于减轻此类风险和发展,以在预测期内为市场创造动力。

随着 ADAS(高级驾驶辅助系统)和车辆资讯娱乐等先进的安全和舒适功能越来越多地融入车辆,市场正在经历显着增长。人们对乘客舒适度和安全性的认识不断提高,以及政府对安全功能的强制性规定,正在推动整合 ADAS 功能的车辆的生产,预计这将推动市场需求。此外,自动驾驶汽车的日益普及也有助于推动市场成长。

世界各国政府正致力于设计多项立法政策和法规来监控用户,并提案了强制和鼓励消费者在车辆上安装 ADAS 组件的政策,以减轻一些国家日益增多的道路交通事故。例如,印度政府非常重视提高汽车安全性,并已强制要求两轮车配备 ABS。印度目前正致力于在 2022-2023 年强制要求汽车安装 ESC(电子稳定控制)和 AEB(自动紧急煞车)。

联网汽车市场趋势

汽车对 ADAS 功能的需求不断增加

自动驾驶和联网汽车已经引起了消费者的兴趣,预计在预测期内将获得广泛认可。 ADAS(先进驾驶辅助系统)有望缩小传统车辆和未来车辆之间的采用差距。此外,随着汽车行业技术的不断进步,最终用户愿意在最新技术上投入更多资金,以增强驾驶体验并提高驾驶员和乘客的安全性。碰撞警告、车道辅助和盲点侦测等 ADAS 功能预计将对消费者行为产生重大影响,透过向车主发出车辆故障警报来减少车辆停机时间并提高车辆性能。

儘管 ADAS 已经取得了长足的进步,但连网汽车技术仍有很长的路要走。 V2V通讯具有进一步升级的潜力,因为车辆将能够直接相互通讯,共用有关其相对速度、位置、航向甚至控制输入(例如突然煞车、加速或改变方向)的资讯。利用这些资料以及车辆的传感器输入,还可以创建更详细的周围环境图像,并提供更准确的警告和纠正措施以避免碰撞。

然而,ADAS 组件的数量可能会继续增长,因为以前在高阶车型中发现的这些系统现在也被应用于入门级车型。这些系统为您的日常驾驶带来了额外的安全保障。许多此类系统允许车辆根据情况调整驾驶方式。车辆可以根据情况进行转向、煞车、加速等。例如,

根据 Canalys 的调查,2021 年上半年,欧洲销售的新车中,56% 安装了车道维持辅助系统,日本为 52%,中国当地为 30%,美国为 63%。车道维持系统辅助系统可在启动时提供转向辅助,帮助车辆维持在车道内。

市场上许多科技公司正在联手解决 ADAS(高阶驾驶辅助系统)开发的复杂性。例如

- 2022年6月,博泰车联网与美国高通公司(Qualcomm)进一步拓展合作,共同开发支援车辆智慧化、智慧汽车联网、服务导向架构(SOA)、基于集中控制设备的智慧驾驶座以及多领域融合的解决方案。

- 2021年7月,麦格纳国际公司宣布计画收购安全技术领导者维宁尔公司。麦格纳国际公司已与维宁尔达成最终合併协议,以收购这家汽车安全技术领导者。透过此次收购,麦格纳旨在加强其ADAS产品组合併扩大其行业地位。

亚太地区可望引领联网汽车市场

由于最新汽车车型的连接功能不断增强,亚太地区很可能在预测期内引领连网汽车市场。尤其是中国和印度等新兴经济体对汽车数位化功能的需求不断增长,预计将推动该地区连网汽车市场的发展。

中国是全球最大的汽车市场之一,2021年国内乘用车销量超过2,148万辆,较2020年成长6%。儘管受到疫情影响,中国仍然是全球最大的汽车销售国之一,这为预测技术在中国汽车市场发挥作用创造了绝佳机会。

中国政府正专注于电动车以及 ADAS 功能等多项先进汽车技术。因此,中国主要汽车製造商正在透过推出新的 2 级和 3 级 ADAS 功能来更新其产品组合。例如

- 2021年5月,长城汽车哈佛品牌全新紧凑级SUV赤兔上市,搭载1.5L涡轮增压引擎(最大输出功率135kW,最大扭力275Nm),组配7速湿式双离合器变速箱。此外,它还配备了 2 级 ADAS 系统,其功能因版本而异。

随着印度逐渐涉足汽车产业,专注于自动驾驶和人工智慧,并推出一系列新产品,联网汽车市场拥有巨大的潜力和机会。例如

- 2021 年,Morris Garage 推出了新款 SUV Gloster,配备了基于预测技术的最新 ADAS 功能,包括自动紧急煞车、自动停车辅助、盲点侦测、前方碰撞警报和车道偏离警告。同样在 2021 年,MG 推出了 Astor,这是一款经济实惠的紧凑型 SUV,配备 2 级 ADAS 功能,例如主动式车距维持定速系统、自动紧急煞车、盲点侦测、车道维持辅助和车道偏离警告。

亚太地区、北美和欧洲在收益方面占据最大的市场占有率,预计在预测期内将会成长。预测技术领域的努力,例如在汽车中实施 ADAS 功能,可能会促进市场发展。

联网汽车产业概况

联网汽车市场主要由大陆集团、罗伯特博世有限公司、哈曼国际工业公司、电装公司、Airbiquity 公司和伟世通公司主导。由于OEM已开始在其新车型中提供联网汽车联网汽车功能预计将成为中国和印度等新兴市场的普遍现象。例如

- 2022 年 5 月,LEVC(伦敦电动车公司)宣布与物联网和互联交通领域的全球领导者 Geotab 建立新的合作伙伴关係,为其一流的电动计程车、TX 和 VN5 货车提供尖端的车队管理系统。

- 2021 年 8 月,罗伯特博世有限公司与 Mahindra & Mahindra 合作开发连网汽车平台。此次伙伴关係将促进汽车互联平台的发展和进步。

- 2021年2月,福特汽车与Google达成策略伙伴关係关係,共同应用开发联网汽车服务应用。此次合作将有助于加强福特汽车的连网汽车业务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 依技术类型

- 4G/LTE

- 3G

- 2G

- 按应用

- 驾驶员辅助

- 远端资讯处理

- 资讯娱乐

- 其他的

- 按连接性

- 融合的

- 嵌入式

- 网路分享

- 车辆连接性别

- 车对车(V2V)

- 车辆到基础设施 (V2I)

- 车辆对行人 (V2P)

- 乘车

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Harman International

- AT&T Inc.

- TomTom NV

- Airbiquity Inc.

- Qualcomm Technologies Inc.

- Sierra Wireless

- Infineon Technologies

- Magna International

- ZF Friedrichshafen AG

第七章 市场机会与未来趋势

The Connected Vehicle Market size is estimated at USD 87.30 billion in 2025, and is expected to reach USD 194.27 billion by 2030, at a CAGR of 17.35% during the forecast period (2025-2030).

The COVID-19 pandemic had a massive impact on the market studied as lockdowns and trade restrictions have led to supply chain disruptions and a halt of vehicle production across the globe. However, as restrictions eased, players started focusing on mitigating such risks and developments to create momentum in the market during the forecast period.

The rising integration of advanced safety and comfort features in the vehicle, such as advanced driver assistance systems, vehicle infotainment, and many others witnessing major growth in the market. Growing production of vehicles with integrated ADAS features in the wake of rising awareness toward comfort and safety of passengers and government regulations mandating safety features are expected to drive demand in the market. Moreover, the rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market.

Governments across the globe are focusing on designing several legislative policies and regulations to monitor the users and are proposing policies mandating and encouraging consumers to install ADAS components in vehicles to mitigate rising road accidents across several countries. For instance, the Indian government has already mandated a requirement for ABS on motorcycles with a focus on improving vehicle safety. Currently, India is working to make Electronic Stability Control (ESC) and Autonomous Emergency Braking (AEB) mandatory in cars by 2022-2023.

Connected Vehicle Market Trends

Growing demand for ADAS features in vehicle

Autonomous cars and connected vehicles are gaining consumers' interest and are anticipated to gain wider acceptance over the forecast period. The advanced driver assistance systems (ADAS) featured are expected to diminish the penetration gap between traditional cars and tomorrow's cars. Moreover, With the rising technological advancements in the automotive industry, end users are ready to spend more on the latest technologies, which enhance the driving experience and increase the safety of drivers and riders. ADAS features, such as collision warning, lane assistance, blind spot detection, etc., have a significant impact on consumer behavior and are expected to enhance vehicles' performance by reducing vehicle downtime by alerting the owner of any faults in the vehicle.

ADAS has advanced considerably, but there is still a long way to go with connected vehicle technology. V2V communication has the potential to upgrade it further, as vehicles may communicate with each other directly and share information on relative speeds, positions, directions of travel, and even control inputs, such as sudden braking, accelerations, or changes in direction. By using this data with the vehicle's sensor inputs, it is possible to create a more detailed picture of the surrounding area and provide more accurate warnings or even corrective actions to avoid collisions.

However, the number of ADAS components may keep growing, as these previously available systems in high-end models are now being used in entry-level vehicles. These systems bring added safety and security to daily driving. Many of these systems allow the vehicle to make driving adjustments according to the condition. Functions, such as steering, braking, and accelerating, can be performed by the vehicle in certain situations. For instance,

Research conducted by Canalys shows that the lane-keep assist feature, which when activated provides steering assistance to keep a vehicle in its lane, was installed in 56% of new cars sold in Europe in the first half of 2021, 52% in Japan, 30% in Mainland China, and 63% in the United States.

Many technology companies in the market are teaming up to solve the complexities of developing advanced driver-assistance systems (ADAS). For instance,

- In June 2022, PATEO Corporation and Qualcomm Technologies, Inc. (Qualcomm) expanded their relationship to develop solutions to support vehicle intelligence, smart car connectivity, Service-Oriented Architecture (SOA), and intelligent cockpits and multi-domain fusion based on central controllers.

- In July 2021, Magna International Inc. announced its plans to acquire safety tech major Veoneer Inc. Magna International Inc. entered a definitive merger agreement with Veoneer Inc., under which the company plans to acquire Veoneer Inc., a leading player in automotive safety technology. With this acquisition, Magna's aimed to strengthen and broaden its ADAS portfolio and industry position.

Asia-Pacific is Likely to Lead the Connected Vehicle Market

Asia-Pacific is likely to lead the connected vehicle market over the forecast owing to the increase in the connectivity features in the latest car models. The rise in demand for digital features in vehicles, especially in developing countries like China and India, is anticipated to drive the connected vehicle market in the region.

China is one of the largest automotive markets in the world, and more than 21.48 million passenger cars were sold in the country in 2021 and recorded a 6% surge in sales compared to 2020. Despite the pandemic, China is still one of the largest sellers of automobiles, which is a great opportunity for predictive technology to make its place in the Chinese automobile market.

The Chinese government is focusing on several advanced vehicles technology, like ADAS features, along with electric mobility. With that, major automakers in the country are updating their portfolio with the introduction of the new level 2 and level 3 ADAS features. For instance,

- In May 2021, the HAVAL brand of Great Wall Motor Co. Ltd launched the new Chitu compact SUV, and it is equipped with a 1.5L turbocharged engine (maximum power output of 135kW, peak torque of 275Nm) in combination with a 7-speed wet dual-clutch transmission. In addition, the vehicle includes a Level 2 ADAS system, with varying functions depending on the version.

India has a potential and opportunity for a connected vehicle market as India is stepping gradually into the autonomous and artificial intelligence-oriented automotive industry along with many new product launches. For instance,

- In 2021, Morris Garage launched its new SUV Gloster, which is equipped with the latest ADAS features based on predictive technology such as automatic emergency brake, automatic parking assist, blind spot detection, forward collision warning, and lane departure warning. MG, in 2021, has launched another SUV, the Astor, an affordable compact SUV with level-2 ADAS features such as Adaptive Cruise Control, Automatic Emergency Braking, Blind Spot Detection, Lane-keeping Assist, and Lane Departure Warning.

Followed by Asia-Pacific, North America, and Europe, also witnessing significant market share in terms of revenue and are projected to grow during the forecast period. Initiatives toward the predictive technology sector, such as implementing ADAS features in cars, are going to boost the market.

Connected Vehicle Industry Overview

The connected vehicle market is dominated by Continental AG, Robert Bosch GmbH, Harman International Industries, Inc., DENSO Corporation, Airbiquity Inc, and Visteon Corporation. Connected vehicles' features are poised to become a common phenomenon in developing nations such as China, India, etc., market over the forecast period, as OEMs have started offering connected car features in their new respective models. For instance,

- In May 2022, LEVC (London Electric Vehicle Company) announced a new partnership with the global leader in IoT and connected transportation, Geotab, providing state-of-the-art fleet management systems on its class-leading electric TX taxi and VN5 van.

- In August 2021, Robert Bosch GmbH joined with Mahindra & Mahindra for the development of a connected vehicle platform. This partnership helps to grow and boost the connected platform in vehicles.

- In February 2021, Ford Motors and Google signed a strategic partnership for the development of connected car service applications. This partnership helps to enhance the ford motors connected vehicle business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology Type

- 5.1.1 4G/LTE

- 5.1.2 3G

- 5.1.3 2G

- 5.2 By Application

- 5.2.1 Driver Assistance

- 5.2.2 Telematics

- 5.2.3 Infotainment

- 5.2.4 Others

- 5.3 By Connectivity

- 5.3.1 Integrated

- 5.3.2 Embedded

- 5.3.3 Tethered

- 5.4 By Vehicle Connectivity

- 5.4.1 Vehicle to Vehicle (V2V)

- 5.4.2 Vehicle to Infrastructure (V2I)

- 5.4.3 Vehicle to Pedestrian (V2P)

- 5.5 By Vehicle

- 5.5.1 Passenger cars

- 5.5.2 Commercial Vehicle

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle-East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Continental AG

- 6.2.3 Denso Corporation

- 6.2.4 Visteon Corporation

- 6.2.5 Harman International

- 6.2.6 AT&T Inc.

- 6.2.7 TomTom N.V.

- 6.2.8 Airbiquity Inc.

- 6.2.9 Qualcomm Technologies Inc.

- 6.2.10 Sierra Wireless

- 6.2.11 Infineon Technologies

- 6.2.12 Magna International

- 6.2.13 ZF Friedrichshafen AG