|

市场调查报告书

商品编码

1439881

硝酸:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Nitric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

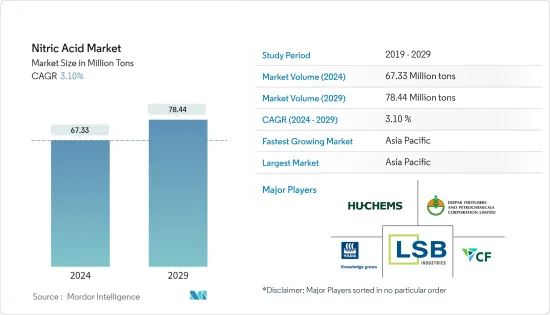

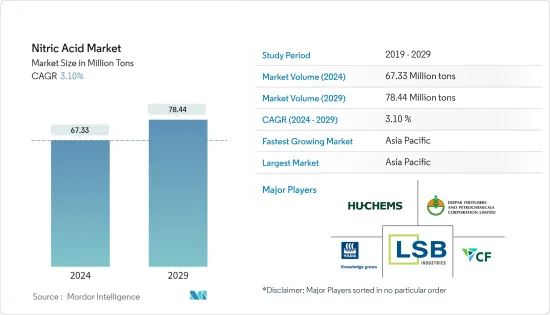

预计2024年硝酸市场规模为6,733万吨,预计2029年将达到7,844万吨,在预测期(2024-2029年)复合年增长率为3.10%。

由于新型冠状病毒感染疾病(COVID-19)的爆发,世界各地实施了国家封锁,製造活动和供应链中断以及生产停顿对硝酸市场产生了负面影响。市场现已从疫情中恢復,并正在经历显着成长。

主要亮点

- 短期内,化肥和炸药製造中对硝酸的需求不断增加预计将推动市场成长。

- 然而,硝酸造成的健康危害可能会阻碍市场成长。

- 儘管如此,硝酸生产的技术发展和最近的政府激励措施预计将在预测期内创造利润丰厚的市场机会。

- 预计亚太地区将主导全球市场,最大消费来自中国、日本和印度等国家。

硝酸市场趋势

化肥产业需求增加

- 80%以上的硝酸用于化学肥料生产。硝酸铵和硝酸铵钙等肥料是由硝酸製成的。需要更多的耕地来满足世界日益增长的粮食需求。因此,化肥需求不断增加,预计全球化肥料产业在预测期内的复合年增长率将达到5%左右。

- 硝酸铵是一种常见的高效能氮基肥料,其总氮含量约为35%(以重量计)。此外,硝酸铵钙 (CAN) 肥料的氮含量约为 25-28%。 CAN肥料用于提供氮以促进任何植物的生长。

- 硝酸铵钙是透过在约 170°C 下混合熔融硝酸铵和碳酸钙而生产的。它具有吸湿性,会吸收环境中的水分。因此,即使在没有足够水的土壤中,硝酸铵钙也可以使用。

- 根据美国粮食及农业组织(FAO)预测,2022年全球化肥料需求预计将达到2,0092万吨。

- 根据联合国同业贸易地图,2021年化肥出口额超过850亿美元,与前一年同期比较成长约50%。 2021年,全球化肥出口达到十年来的最高水准。

- 据欧洲肥料协会称,到2029/2030季节,欧盟氮肥的年消费量预计将达到1,060万吨,而目前的平均消费量1,120万吨。经过几年的復苏,未来十年化肥年消费量预计将连续第四年下降,从而限制市场成长。

- 因此,上述因素可能在预测期内影响肥料应用硝酸市场。

亚太地区主导市场

- 亚太地区预计将成为硝酸生产的主要市场,因为包括中国、印度和韩国在内的亚太国家是最大的化肥生产国和消费国。

- 根据ITC贸易地图,韩国是最大的硝酸出口国,2021年出口量为53.42万吨。 2020年中国是第二大进口国,进口量为15.28万吨,用于化肥、油墨、颜料、染料和化学製造业等各种最终用户。

- 印度化肥协会数据显示,2020-21年度化肥产品总产量为4,349万吨,较2019-20年成长1.7%。 2020-2021年氮肥产量达1,374万吨,2019-2020年小幅成长0.2%。

- 根据中国国家统计局数据,2021年粮食总合6.829亿吨,比去年的6.5亿吨增加2%。玉米种植面积较上年增加5%,产量增加4.6%。增加化肥的使用以提高生产力以满足耕地面积的减少预计将推动该国的市场。

- 硝酸用作油墨、颜料和染料的原料,主要应用于纺织工业。根据工业和资讯化部(工信部)统计,2021年前9个月,中国纺织工业平稳增长,利润总合达到1711亿元人民币(约合268亿美元),与前一年同期比较% .我做到了。

- 硝酸用于生产三硝基甲苯 (TNT)、硝化纤维素和硝化甘油等炸药,用于采矿应用。例如,2021年3月,印度煤炭有限公司(CIL)核准了32个新煤矿开采计划,其中24个是现有计划的扩建,其余为待开发区。该计划估计费用为 4,700 亿印度卢比(约 56.7564 亿美元),将扩大潜在市场。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

硝酸产业概况

硝酸市场本质上是分散的。研究的市场主要企业包括(排名不分先后)CF Industries Holdings Inc.、HUCHEMS、Yara、LSB INDUSTRIES 和 Deepak Fertilizers and Petrochemicals Corporation Ltd (DFPCL)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大化肥领域的使用

- 炸药製造需求增加

- 抑制因素

- 硝酸对健康造成的损害

- 环境法规政策

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争强度

- 贸易流量分析

- 成本分析

第五章市场区隔(市场规模、数量)

- 最终用户产业

- 肥料

- 航太

- 油墨、颜料、染料

- 化学製造

- 霹雳

- 其他最终用户产业(製药、食品加工)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- CF Fertilisers UK

- Deepak Fertilisers and Petrochemicals Corporation Ltd(DFPCL)

- Gujarat Narmada Valley Fertilizers &Chemicals Limited(GNFC)

- Hanwha Corporation

- HUCHEMS

- INEOS

- LSB INDUSTRIES

- MAXAMCORP HOLDING SL

- Mitsubishi Chemical Corporation

- Nutrien Ltd

- Sasol Ltd

- Sinopec Nanjing Chemical Industries Co. Ltd(China Petrochemical Corporation)

- Sumitomo Chemical Co. Ltd

- Yara

第七章市场机会与未来趋势

- 硝酸生产的技术发展和政府近期激励措施

The Nitric Acid Market size is estimated at 67.33 Million tons in 2024, and is expected to reach 78.44 Million tons by 2029, growing at a CAGR of 3.10% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the world, disruptions in manufacturing activities and supply chains, and production halts negatively impacted the nitric acid market. Currently, the market has recovered from the pandemic and is growing at a significant rate.

Key Highlights

- Over the short term, the increasing demand for nitric acid from fertilizer and explosives manufacturing is expected to drive the market's growth.

- However, health-related hazards caused by nitric acid are likely to hinder the growth of the market.

- Nevertheless, technological development in nitric acid manufacturing and recent government incentives are expected to create lucrative market opportunities over the forecast period.

- The Asia-Pacific region is expected to dominate the market, globally, with the largest consumption from countries such as China, Japan, and India.

Nitric Acid Market Trends

Increasing Demand from the Fertilizer Industry

- Over 80% of nitric acid is used in manufacturing fertilizers. Fertilizers, like ammonium nitrate and calcium ammonium nitrate, are produced from nitric acid. To meet the increasing global food demand, more arable land is required for cultivation. Hence, fertilizer demand is increasing, with the global fertilizer industry expected to witness a CAGR of about 5% during the forecast period.

- Ammonium nitrate is a popular, efficient nitrogen-based fertilizer with around 35% (by mass) of total nitrogen content. Moreover, calcium ammonium nitrate (CAN) fertilizer has a nitrogen content of ~25-28%. CAN fertilizer is used to supply nitrogen to advance the growth of any plant.

- Calcium ammonium nitrate is manufactured by mixing molten ammonium nitrate and calcium carbonate at a temperature of around 170°C. It is hygroscopic and can absorb moisture from the environment. Thus, calcium ammonium nitrate can be used in soil without sufficient water.

- According to the US Food and Agriculture Organization (FAO), the global demand for fertilizers was expected to reach 200.92 million tons in 2022.

- According to United Nations Comtrade and Trade Map, fertilizer exports were over USD 85 billion in 2021, representing a roughly 50% rise over the previous year's figures. In 2021, global fertilizer exports reached a decade high.

- According to the FERTILIZERS EUROPE, the annual nitrogen fertilizer consumption in the European Union is expected to reach 10.6 million tons by the 2029/2030 season, compared to the current average consumption of 11.2 million tons. After several years of recovery, annual fertilizer consumption over the next ten years is foreseen to decrease for the fourth consecutive year, thereby restricting the market growth.

- Thus, the above-mentioned factors are likely to affect the nitric acid market for fertilizer application during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to be the dominant market in nitric acid production, owing to the largest production and consumption of fertilizers in Asia-Pacific countries, including China, India, and South Korea.

- According to ITC Trade Map, South Korea is the largest exporter of nitric acid, with an exported quantity of 534.2 thousand ton in 2021. China is the second-largest importer in 2020, with an imported quantity of 152.8 thousand ton for various end-user industries like fertilizers, inks, pigments, dyes, and chemical manufacturing.

- According to the Fertilizer Association of India, the production of total fertilizer products stood at 43.49 million MT during 2020-21, which showed an increase of 1.7% over 2019-20. The production of nitrogen-based fertilizers stood at 13.74 million MT during 2020-21 and recorded a marginal increase of 0.2% over 2019-2020.

- According to the National Bureau of Statistics of China, in 2021, the grain production totaled 682.9 million ton, up from 650 million ton last year, registering an increase of 2%. Corn acreage rose by 5% from last year, and output rose by 4.6%. The growing use of fertilizers to increase productivity to keep up with the declining cultivated area is expected to drive the market in the country.

- Nitric acid is used as a raw material for inks, pigments, and dyes, which find major applications in the textile industry. The textile industry of China grew steadily during the first nine months of 2021, with profits collectively worth CNY 171.1 billion (approximately USD 26.80 billion), a 31.7% increase Y-o-Y, according to the Ministry of Industry and Information Technology (MIIT).

- Nitric acid is used to produce explosives such as trinitrotoluene (TNT), nitrocellulose, nitroglycerin, and others, which are being used in mining applications. For instance, in March 2021, Coal India Ltd (CIL) approved 32 new coal mining projects, of which 24 are the expansion of the existing projects, and the remaining are greenfield. The project's estimated cost is INR 47,000 crores (~USD 5,675.64 million), thereby augmenting the market studied.

- Therefore, the factors mentioned above are expected to have a significant impact on the market in the coming years.

Nitric Acid Industry Overview

The nitric acid market is fragmented in nature. The major companies in the market studied (not in any particular order) include CF Industries Holdings Inc., HUCHEMS, Yara, LSB INDUSTRIES, and Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Drivers

- 4.1.1 Increasing Usage from the Fertilizers Segment

- 4.1.2 Increasing Demand from Explosives Manufacturing

- 4.2 Restraints

- 4.2.1 Health Hazards Caused by Nitric Acid

- 4.2.2 Environmental Regulations and Policies

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive RiIvalry

- 4.5 Trade Flow Analysis

- 4.6 Cost Analysis

5 Market Segmentation (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Fertilizers

- 5.1.2 Aerospace

- 5.1.3 Inks, Pigments, and Dyes

- 5.1.4 Chemical Manufacturing

- 5.1.5 Explosives

- 5.1.6 Other End-user Industries (Pharmaceuticals, Food Processing)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Mexico

- 5.2.2.3 Canada

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Merger and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CF Fertilisers UK

- 6.4.3 Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL)

- 6.4.4 Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC)

- 6.4.5 Hanwha Corporation

- 6.4.6 HUCHEMS

- 6.4.7 INEOS

- 6.4.8 LSB INDUSTRIES

- 6.4.9 MAXAMCORP HOLDING SL

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Nutrien Ltd

- 6.4.12 Sasol Ltd

- 6.4.13 Sinopec Nanjing Chemical Industries Co. Ltd (China Petrochemical Corporation)

- 6.4.14 Sumitomo Chemical Co. Ltd

- 6.4.15 Yara

7 Market Opportunities and Future Trends

- 7.1 Technological Developments in Nitric Acid Manufacturing and Recent Government Incentives