|

市场调查报告书

商品编码

1643073

人力资源分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)HR Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

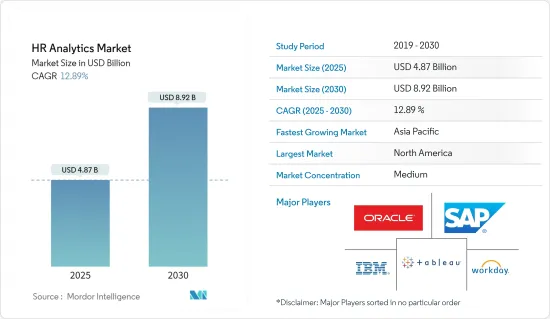

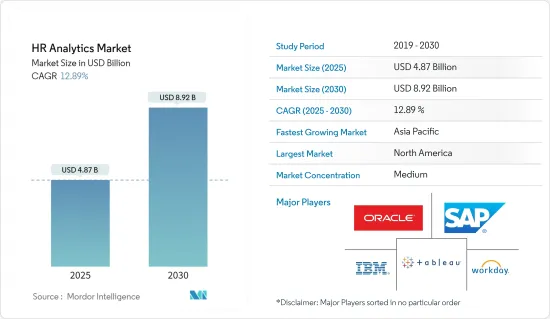

人力资源分析市场规模预计在 2025 年为 48.7 亿美元,预计到 2030 年将达到 89.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.89%。

人力资源分析利用收集的资料来预测绩效、留任、招募等关键因素,有助于提高人力资源服务的生产力。这些因素正在推动市场的扩张。

主要亮点

- 人力资源分析使人力资源部门能够做出基于资料决策、管理人员流失并确定可以实施自动化的领域。利用该解决方案的功能从员工回馈表中获取见解。人力资源分析还可以引入人工智慧招募人员来自动化面试安排,为员工提供即时回馈,并改善巨量资料人力资源分析的处理。这不仅节省了人力资源主管的时间,也节省了金钱。

- 人力资源分析最重要的用途之一是预测病假和假期。例如,金融保护福利提供者 Unum Group 已与疾病预测应用程式提供者 Sickweather 启动了先导计画。该计划将确定 Sickweather 的即时人类健康地图资料与 Unum 的家庭和医疗休假法案 (FMLA) 和编码病假带薪休假 (PTO)资料之间的相关性,以预测员工因疾病相关的缺勤情况。

- 确定当前和未来的技能差距是人力资源分析的另一个应用。墨西哥能源部正在使用预测性劳动力规划和分析模型来了解当前和预测未来 10 年石油和天然气行业技术纯熟劳工的短缺。该产业也开始在可再生能源和永续性等领域应用劳动力规划和分析。

- 全球各地组织面临的最大挑战之一是管理人员和人才。在不断努力改进招聘程序、员工满意度、薪酬问题和裁员的同时,人力资源专业人员需要让每个人都达成共识并符合公司和管理层的期望。自从在人力资源流程中引入资料分析以来,该方法变得比以往更加简单,为人力资源部门的日常业务带来了巨大的好处。

- 大都会人寿的员工社会福利趋势调查发现,72%的员工希望获得无限期休假的社会福利。然而,人力资源分析可以帮助您检查员工是否按照组织规定享有足够的休假。人力资源分析也有助于监控每位员工的加班时间。

- 过去几年来,远距工作的趋势逐渐扩大。然而,COVID-19 在短时间内急剧加速了这一趋势,迫使各种规模的企业迅速适应世界各国政府建议的自我隔离措施。疫情迫使更多人远距工作,分析解决方案对企业至关重要。这些解决方案有助于有效管理远端劳动力,并提供追踪劳动力状态的能力,以便公司可以报告和分析这些趋势及其对业务的影响。

人力资源分析市场趋势

电信和IT产业占了很大的市场份额

- 资料分析透过查看竞争基准化分析、能力差距分析、学习机会、劳动力模式、人才需求等,帮助人力资源管理整个人才生命週期。人力资源职能在技术和分析方面都在不断扩展。此外,在人工智慧 (AI)、机器语言 (ML) 和自然语言处理 (NLP) 的帮助下,公司正在采用各种工具和演算法,透过整体而非线性地查看和分析资料来解决业务问题。

- 近年来,IT 和电信业在离职率方面一直被看好。例如,在 Uber 和 Dropbox 等公司,技术员工的平均任期分别为 1.8 年和 2.1 年。人力资源分析帮助这些组织了解各种行业趋势,并且一些组织正在采用先进的分析解决方案来改善员工体验。

- 许多公司的 IT 团队很快就发现,培训、使用者支援和彙报请求令他们负担过重。商业智慧(BI) 解决方案可以减轻分析师的专案报告负担、提高公司的资料安全性并减少花在服务台支援上的时间。因此,该行业的公司依靠正确的策略和工具来确保员工具备所需的技能并适应组织文化。这是IT产业采用人力资源分析的主要驱动力。

- 通讯业正在采用先进的分析技术来管理其基本客群、增强价值提案并创造新产品。此外,通讯业者才刚开始应用分析。然而,通讯业正越来越依赖技术创新来升级其招募和参与策略。他们也开始利用人力资源分析解决方案来提高整个组织的组织和人才效率。

北美占据很大市场份额

- 过去几年来,人力资源分析在北美得到了广泛的认可。这是因为该地区的大型企业越来越多地采用云端基础设施,而该地区有 IBM 公司等重要的人力资源分析供应商。

- 例如,LinkedIn 发布的报告指出,在过去五年中,北美负责人在个人资料中列出分析技能和类似关键字的数量增加了三倍。

- 研究进一步发现,与建筑、频谱和製造业等其他产业相比,北美的人力资源分析使用集中度较高,其中银行业采用率最高,而高科技软体采用率最低。

- 此外,纽约、华盛顿特区和旧金山在北美人力资源分析采用方面名列前茅,重点是各行各业的社会福利、生产力、薪酬和绩效。例如,华盛顿特区等技能短缺最严重的城市正在使用人力资源分析工具进行劳动力规划。

- 鼓励美国教育机构和专业组织审查其课程设置,包括人力资源分析课程,以培养主题专家。从学生研究中获得的宝贵见解将丰富人力资源分析知识体系,并为公司开发解决劳动力管理问题的人力资源解决方案提供基础。然而,由于人力资源分析是一个持续的阶段,公共部门等行业缺乏认识和采用,以及最近全球疫情的影响导致该地区的组织停止招聘,可能会阻碍市场的成长。

人力资源分析行业概览

人力资源分析市场相当分散,主要供应商包括 SAP SE、Oracle Corporation 和 IBM Corporation。为了扩大基本客群和增加市场占有率,供应商正在透过策略合作和收购来获得竞争优势并加强其产品供应。因此,市场集中度适中。

2022年8月,财务与人力资源企业云端应用程式领导者Workday Inc.宣布,Workday Scheduling and Labor Optimization在《人力资源执行长》杂誌的「2022年度最佳人力资源产品」竞赛中被评为得奖者。

2022 年 7 月,SAP SE 宣布收购专注于搜寻主导分析的新兴企业Askdata。透过收购 Askdata,SAP 将增强其利用人工智慧主导的自然语言搜寻来帮助企业做出更明智决策的能力。用户可以搜寻、互动和协作即时资料,以最大限度地提高商业洞察力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 基于云端基础的解决方案日益流行

- 增加劳动力并减少离职率的需要

- 市场挑战

- 熟练劳动力短缺

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 依部署方式

- 本地

- 云

- 按最终用户产业

- 通讯和 IT

- BFSI

- 消费品和零售

- 卫生保健

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- SAP SE

- Oracle Corporation

- Workday Inc.

- Tableau Software Inc.

- IBM Corporation

- Nakisa Inc.

- Zoho Corporation Pvt. Ltd

- Kronos Inc.

- Gaininsights Solutions Pvt. Ltd

第八章投资分析

第九章 市场机会与未来趋势

The HR Analytics Market size is estimated at USD 4.87 billion in 2025, and is expected to reach USD 8.92 billion by 2030, at a CAGR of 12.89% during the forecast period (2025-2030).

By using data gathered, HR analytics aids in improving the productivity of HR services by making predictions about crucial factors, including performance, retention, and recruiting. These elements are all driving the market's expansion.

Key Highlights

- By using HR analytics, HR departments can make data-backed decisions when it comes to managing attrition and spot areas where automation can be introduced. They can leverage the solution capabilities to capture insights on employee feedback forms. HR analytics can also implement artificial intelligence recruiters to automate interview scheduling, provide real-time feedback to employees, and improve the handling of Big Data HR analytics. This will not only help HR executives to save time but also money.

- One of the most important applications of HR analytics is the prediction of sick leaves or days off. For instance, the provider of financial protection benefits, Unum Group, launched a pilot project with the illness forecast application provider, Sickweather. The project identifies correlations between Sickweather's data from its real-time human health map and Unum's Family and Medical Leave Act (FMLA) and coded sick leave paid time off (PTO) data to forecast employee illness-related absence.

- Identifying the current and future skill gaps is another application for HR analytics. Mexico's Ministry of Energy uses a predictive workforce planning and analytics model to learn about the current shortage of skilled workers in the oil and gas industry and predict one over a 10-year horizon. The industry also started using workforce planning and analytics for renewable energy and sustainability in such sectors.

- One of the biggest challenges faced by organizations around the world is the management of people and talent. While continuing to work on improving hiring procedures, employee satisfaction, payroll issues, and retrenchment, an HR professional needs to keep everyone on the same page and still manage to get things done as expected by the company and managers. Due to the introduction of data analytics in HR processes, the approach has become simpler than ever, proving to be a major advantage for HR in their everyday work.

- The employee benefits trends survey by Metlife found that 72% of workers would desire limitless vacation time as a benefit. However, HR analytics can assist in making sure that employees are taking enough time off following the organization's regulations. HR analytics can also assist in monitoring each employee's overtime hours.

- The trend towards remote work has been gradually growing for the past few years. However, COVID-19 has dramatically accelerated this trend in an extremely short period of time, forcing companies, irrespective of their size, to adapt quickly to the self-isolation measures that governments across the globe were recommending. With the pandemic requiring much more people to work remotely, analytics solutions are becoming essential for companies as these solutions can help in managing the remote workforce efficiently and provide the ability to track the status of the workforce so that the company can report and analyze these trend and impact on the business.

HR Analytics Market Trends

Telecom and IT Industry is Witnessing a Significant Share in the Market

- Data analysis assists HR in managing the full talent lifecycle by looking into competitive benchmarking, competency gap analysis, learning opportunities, workforce patterns, talent demands, etc. The human resource function is expanding from both a technological and an analytics perspective. Additionally, enterprises are being helped by Artificial Intelligence (AI), Machine Language (ML), and Natural Language Processing (NLP) to see and analyze data holistically rather than just linearly, employing various tools and algorithms to solve business problems.

- IT and telecom have been seen in a negative light for the past few years when it comes to attrition rates. For instance, in companies such as Uber and Dropbox, the average tenure of a tech employee is 1.8 years and 2.1 years, respectively. HR analytics is helping these organizations with the ability to understand various industry trends, and multiple organizations are deploying advanced analytics solutions to improve employees' experience.

- Numerous firms' IT teams are quickly becoming overburdened with requests for training, user support, and reporting. Ad hoc reporting burdens on analysts can be decreased using Business Intelligence (BI) solutions, which can improve data security for the company and cut down on time spent on help desk support. Therefore, companies in this industry rely on the appropriate tactics and tools to guarantee that employees have the necessary skills and fit their organizational culture. This is the main factor influencing the IT industry's adoption of HR analytics.

- The telecom industry has adopted advanced analytics to manage its customer base, enhance value propositions, and create new products. Moreover, operators are just beginning to apply analytics. However, the telecom industry is turning increasingly to technological innovations to upgrade its recruitment and engagement strategies. It started leveraging HR analytics solutionsto achieve organizational and people effectiveness throughout the entire organization.

North America to Hold the Significant Share in The Market

- Over the past few years, HR analytics has had considerable acceptance in North America. This is due to the fact that more large regional companies are employing cloud infrastructure and that there are significant HR analytics vendors in the region, such as IBM Corporation.

- For instance, LinkedIn published a report stating that it has found a 3x increase in HR professionals from North America who list analytics skills and similar keywords in their profile in the last five years.

- The survey further claims that it has discovered a concentrated use of HR analytics in North America, with banking holding the highest adoption and tech software holding the lowest adoption, compared to other industries like architecture, spectrum, and manufacturing.

- Additionally, New York, Washington, DC, and San Francisco are among the top regions in North America with a high adoption rate of HR analytics, with a greater emphasis on benefits, productivity, compensation, and performance across diverse industries. For instance, cities like Washington, DC that have the highest levels of skill scarcity use HR analytic tools for workforce planning.

- It is recommended that educational and professional institutions in the US review their course offerings to include HR analytics courses in creating subject matter experts. The excellent findings from their students' research will contribute to the body of knowledge on HR analytics and give businesses a platform for developing HR solutions to employee management problems. However, the lack of awareness and adoption of HR analytics across industries such as the public sector due to its continuum phase and the impact of the recent global pandemic COVID-19 with organizations halting their recruitments in the region, may hinder the growth of the market.

HR Analytics Industry Overview

HR Analytics Market is moderately fragmented with the presence of major vendors, including SAP SE, Oracle Corporation, and IBM Corporation. The vendors are enhancing the product line by leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to expand their customer base and gain market share. Thus, market concentration is medium

In August 2022, Workday Inc., a leader in enterprise cloud applications for finance and human resources, announced that Workday Scheduling and Labor Optimization has been named a winner of Human Resource Executive's 2022 Top HR Products of the Year competition.

In July 2022, SAP SE announced that it had acquired Askdata, a startup focused on search-driven analytics. With the acquisition of Askdata, SAP strengthens its ability to help organizations make better-informed decisions by leveraging AI-driven natural language searches. Users are empowered to search, interact and collaborate on live data to maximize business insights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Competitive Rivalry

- 4.2.5 Intensity of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Trends in Cloud-based Solutions

- 5.1.2 Increase in Workforce and Need for Reduction in Attrition Rate

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-User Industry

- 6.3.1 Telecom and IT

- 6.3.2 BFSI

- 6.3.3 Consumer Goods and Retail

- 6.3.4 Healthcare

- 6.3.5 Manufacturing

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 Workday Inc.

- 7.1.4 Tableau Software Inc.

- 7.1.5 IBM Corporation

- 7.1.6 Nakisa Inc.

- 7.1.7 Zoho Corporation Pvt. Ltd

- 7.1.8 Kronos Inc.

- 7.1.9 Gaininsights Solutions Pvt. Ltd