|

市场调查报告书

商品编码

1690068

驾驶模拟器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Driving Simulator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

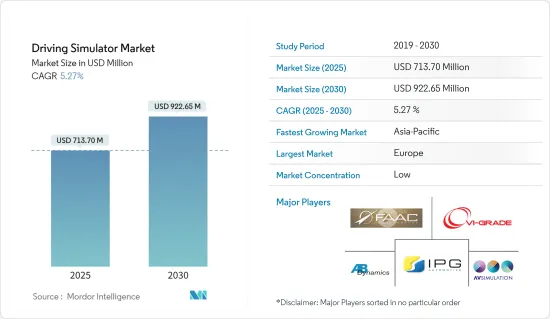

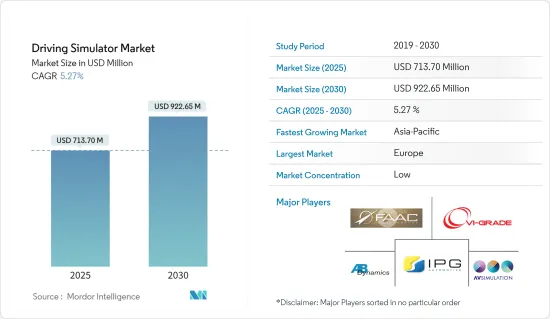

驾驶模拟器市场规模预计在 2025 年为 7.137 亿美元,预计到 2030 年将达到 9.2265 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.27%。

随着 COVID-19 疫情的爆发以及随后的封锁(以及随之而来的所有限制),驾驶模拟器市场出现下滑。与其他产业一样,疫情也对驾驶模拟器市场产生了负面影响。市场占有率较大的重点国家受到疫情影响,驾驶模拟器安装量下降。然而,随着经济逐渐恢復正常,市场开始以更快的速度復苏,预计在预测期内将实现正成长。

随着汽车技术的日益进步,对汽车安全功能的需求也增加。许多事故都是由于人为失误或驾驶技术不佳造成的。为了避免这种情况,驾驶模拟器是手动创建即时环境并虚拟提高驾驶员技能的最佳方式。此系统可协助驾驶控制局面。这样,驾驶模拟器就更有效率,而且更安全。

驾驶模拟器和分析技术在铁路、航空、航海、国防和汽车领域的应用正在增加。特别是在汽车领域,随着大多数国家推出新的立法来提高车辆安全性,对小型和中型汽车先进安全功能的需求持续增长。此外,更严格的安全和环境法规迫使製造商和当局投资创新设计的驾驶模拟器用于培训目的。这将大大降低新车先进功能的研发成本。

模拟器是新车开发和测试的关键要素。模拟器的结果可以帮助工程师在赛道上测试车辆时建立原型和运行虚拟模拟来做出关键决策。

此外,汽车零件的电气化、半自动和自动驾驶汽车的出现以及科技公司在汽车行业的影响力日益增强都是成长要素。汽车产业正向自动驾驶汽车迈进。

大多数汽车製造商都在致力于自动驾驶汽车技术的研究,而如果没有模拟器,这是不可能的,而且未来自动驾驶汽车领域可能会出现新的参与企业,从而推动预测期内的市场成长。大型汽车製造商、科技巨头和专业Start-Ups公司在过去五年中已向自动驾驶汽车 (AV) 技术开发投资超过 500 亿美元,其中 70% 的资金来自汽车产业以外。同时,政府部门看到了自动驾驶汽车带来巨大经济和社会效益的潜力。

驾驶模拟器市场趋势

自动驾驶汽车将成为市场成长引擎

自动驾驶汽车製造商正在努力解决自动驾驶汽车在公共道路上部署时的安全问题。这些製造商认为,自动驾驶汽车将比人类驾驶员安全得多。该标准将要求大幅增加现有的测试设施。

然而,儘管近年来在真实道路上对无人驾驶汽车的测试不断扩大,但考虑到自动驾驶汽车需要收集和处理大量资料,人们对其安全性的担忧正促使市场参与者转向使用模拟器对自动驾驶汽车进行测试。资料在物联网连接的车辆之间共用,并透过无线方式传输到云端系统。

市场上的几家主要企业正在大力投资开发自动驾驶汽车测试模拟系统和软体,目的是让这些汽车在上路行驶之前获得更高的安全评级。例如

在近日举办的2022亚洲展览会(CommunicAsia 2022)上,开发自动驾驶汽车模拟技术的韩国公司MORAI展示了「逼真的自动驾驶汽车驾驶模拟器」MORAI SIM Drive。 MORAI 为自动驾驶汽车和自动驾驶系统开发模拟工具和解决方案。

「MORAI SIM Drive」是一款用于自动驾驶汽车的真实驾驶模拟器,检验自动驾驶汽车,并包含忠实再现实况的模拟环境、感测器资料和车辆模型。 MORAI SIM Drive 自动建立虚拟环境,并透过高效能 3D 图形引擎 (Unity) 提供高清地图和精确的网路表示。

由于自动驾驶汽车需要大量资料收集和处理,汽车製造商正在大力投资自动驾驶汽车技术并建立伙伴关係以开发最好的自动驾驶汽车。所有资料都在物联网连接的车辆之间共用,并透过无线方式上传到云端系统,在那里可以进行分析并用于提高自动化程度。

- 2021 年 12 月,本田技术研发公司在试运行了Ansible Motion 最新的先进 Delta S3 DIL 模拟器后,扩大了与 Ansible Motion 的长期合作关係。这款多功能模拟器具有更大的运动空间和更大的动态范围,将使 Sakura 工程设施能够有效地开发未来的道路和赛车及其相关技术。

- 2021年3月,沃尔沃集团与英伟达签署协议,共同开发自动驾驶商用车与机器的决策系统。透过利用 Nvidia 的端到端人工智慧平台进行训练、模拟和汽车运算,该公司希望创建能够在公共道路和高速公路上安全且完全自主运作的系统。

- 2021年1月,通用汽车宣布与微软建立长期策略合作关係,以加速自动驾驶汽车的商业化。两家公司预计将结合非凡的软体和硬体工程能力、云端运算能力、製造技术以及合作伙伴生态系统来改变交通运输。

OEM)对自动驾驶的关注以及随之而来的电动车的成长预计将推动对驾驶模拟器的需求,特别是对于在市场上企业发展的OEM而言,用于测试和研究目的。

欧洲可望引领市场

欧洲以德国为主导,德国是世界上技术最先进的市场之一。该地区配备 ADAS(高级驾驶辅助系统,例如碰撞侦测、车道偏离警告和主动车距控制巡航系统)的 2 级和 3 级自动驾驶汽车正在快速增长。

从驾驶教练学院到赛道,驾驶模拟器越来越多地被用作驾驶员和赛车手培训和教育的战略工具。此外,还引入驾驶模拟器来评估乘坐舒适性、操控性、NVH(噪音、振动和声振粗糙度)、人机介面和硬件,预计将加快整个车辆开发过程的创新速度,同时减少物理原型的数量,从而减少开发时间和成本。

由于公益合作伙伴的各种投资和购买,德国驾驶模拟器市场正在蓬勃发展。例如

- 2022 年 4 月,驾驶模拟器开发商 VI-grade 宣布其 DiM250 动态模拟器的扩展版本已被长期客户本田采用。本田新收购的 DiM 是本田集团内的第二台 VI 级动态模拟器,该公司位于德国奥芬巴赫的研发基地自 2018 年以来一直使用 DiM250 模拟器的一个版本进行车辆开发和测试。

- 2022年2月,博世将收购Atlatec公司,后者是一家开发用于自动驾驶和模拟的高清地图的公司,从而扩展其在自动驾驶领域的专业知识并加强其市场地位。

一些公共产业平台和公司了解驾驶模拟器的深度准备,因此积极投资研究和技术,以提出先进且可靠的模拟解决方案。例如

- 2022年5月,法国泰雷兹公司完成瑞士RUAG模拟与训练公司(RUAG S&T)的收购。 RUAG 模拟与培训公司(RUAG S&T)的全部 500 名员工已转移到泰雷兹公司,泰雷兹公司拥有约 900 名员工。泰雷兹目前是 Uniwest 用户军事模拟和训练解决方案的主要企业和供应商之一。 RUAG S&T 去年的销售额约为 9,000 万欧元(9,450 万美元)。

泰雷兹表示,此次合併将使其能够扩大其在陆地市场的影响力,同时保持其直升机和军用飞机解决方案的专业知识。此次收购也加强了该公司在法国、瑞士、德国和英国的本地影响力,并扩大了在阿拉伯联合大公国和澳洲的业务。

考虑到德国驾驶模拟器的持续发展和购买,预计预测期内该产品的需求将出现高成长率。

驾驶模拟器产业概况

驾驶模拟器市场由几家活跃的参与企业主导,其中包括大型现有企业和新兴企业。市场的主要企业包括 Cruden BV、AutoSim AS、AVSimulation 和 Ansible Motion。公共利益合作伙伴和OEM正在大力投资开发用于车辆测试和公路式动力学的先进驾驶模拟器技术。两家公司已结成策略联盟。范例包括:

- 2022 年 9 月,AB Dynamics PLC 收购了 Ansible Motion Limited,后者是全球汽车市场领先的先进模拟器供应商。此次收购的总对价为 3,120 万英镑,其中包括 1,920 万英镑的初始对价和 1,200 万英镑的付款(取决于是否符合某些绩效标准)。

- 2022年6月,香港研究机构微美全像研究院宣布将与全像科学研发中心密切合作,以促进车辆驾驶系统对虚拟实境技术的持续需求。

- 2022 年 5 月,Ansible Motion 宣布了其可投入生产的 Delta Series S3 驾驶员在环 (DIL) 模拟器的完整规格,旨在检验实现电气化趋势、自主性、驾驶辅助、HMI 和动态所需的技术。

- 2021年7月,英国Dynisma公司宣布推出一款新型高级驾驶模拟器。这些 Dynisma 运动发电机 (DMG) 专为汽车製造商和供应商设计,用于先进车辆的开发和测试。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按车辆类型

- 搭乘用车

- 商用车

- 按应用程式类型

- 训练

- 检查和调查

- 依模拟器类型

- 小型模拟器

- 全尺寸模拟器

- 进阶模拟器

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 巴西

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- AutoSim AS

- AVSimulation

- VI-grade GmbH

- Ansible Motion Ltd

- Cruden BV

- Tecknotrove Simulator System Pvt. Ltd

- IPG Automotive GmbH

- AB Dynamics PLC

- Virage Simulation

- XPI Simulation

- FAAC Incorporated

第七章 市场机会与未来趋势

The Driving Simulator Market size is estimated at USD 713.70 million in 2025, and is expected to reach USD 922.65 million by 2030, at a CAGR of 5.27% during the forecast period (2025-2030).

Due to the COVID-19 pandemic outbreak and the subsequent lockdowns (with all the restrictions followed), the driver simulator market witnessed a decline. Like any other industry, the pandemic showed a negative impact on the driving simulator market as well. Major countries with a large market share are negatively impacted by the pandemic, reducing the installation of driving simulators. However, as the economies slowly returned to a state of normalcy, the market is picking up pace and is expected to grow positively during the forecast period.

As technologies in automobiles are improving day by day, there is also a significant need for safety features in them. Most accidents happen due to human errors, lack of driving skills, etc. To avoid such situations, driving simulators are the best way to enhance driver skills virtually, where a real-time environment is created artificially. This system helps the driver in managing the situation in a controlled manner. Thus, a driving simulator is more efficient and improves safety to a great extent.

The adoption of driving simulators and analysis technology has experienced an increase in the railways, aviation, marine, defense, and automotive sectors, as it helps in testing and analyzing the designs of products in a virtual environment. Especially in the automobile sector, there is a consistent increase in the demand for advanced safety features in compact and mid-sized automobiles, as most countries are bringing in new laws to improve vehicular safety. Moreover, increasing stringency of safety and environmental regulations has compelled manufacturers and authorities to invest in driving simulators with innovative designs for training. This drastically decreases the research and development cost of the advanced features in a new vehicle.

Simulators are one of the crucial aspects of the development and testing of new vehicles. The simulator's result helps engineers make important decisions by running virtual simulations while building the prototype and testing the vehicle on the track.

Additionally, the electrification of automotive components, the advent of semi-autonomous and autonomous vehicles, and the increasing influence of technology companies in the automotive industry are growth factors for the driving simulator market. The automotive industry is heading toward autonomous vehicles.

Most vehicle manufacturers are working on autonomous vehicle technology, which is not possible without simulators, and in the future, new players are likely to enter the field of autonomous vehicles, which may drive market growth in the forecast period. Major automaker companies, technology giants, and specialist start-ups have invested more than USD 50 billion over the past five years to develop autonomous vehicle (AV) technology, with 70% of the money coming from other than the automotive industry. At the same time, public authorities see that AVs offer substantial potential economic and social benefits.

Driving Simulator Market Trends

Autonomous Vehicle Acts as a Growth Engine for the Market

Autonomous vehicle makers are working hard to address the issue of autonomous vehicle safety when they are deployed on public roads. These players believe that autonomous vehicles will be far safer drivers than human drivers. This standard necessitates a large increase in existing testing installations.

However, while testing of driverless vehicles on actual roads has expanded in recent years, safety worries about autonomous vehicles are prompting market firms to engage in simulator testing for autonomous vehicles, as autonomous vehicles require a massive amount of data collection and processing. The data is shared among IoT-connected automobiles and wirelessly transferred to a cloud system to be examined and utilized to improve automation.

Several key market companies are substantially investing in the development of testing simulation systems and software for autonomous cars for these vehicles to be released on the road with considerably higher safety ratings. For instance,

At the most recent CommunicAsia 2022 trade show, MORAI, a Korean company that creates simulation technology for autonomous vehicles, demonstrated its MORAI SIM Drive, a "true-to-life autonomous vehicle driving simulator.' As an autonomous vehicle and autonomous system, MORAI develops simulation tools and solutions.

The realistic driving simulator for autonomous vehicles, MORAI SIM Drive, can verify autonomous vehicles and offer simulation environments, sensor data, and vehicle models that are exact replicas of the real thing. MORAI SIM Drive automates building virtual environment and offers accurate network representation with HD map and a high-performance 3D graphic engine (Unity).

Vehicle manufacturers are investing heavily in autonomous car technology and entering partnerships to develop the best autonomous vehicle, as autonomous vehicles require enormous data collecting and processing. The entire data is shared between IoT-connected cars and uploaded wirelessly to a cloud system to be analyzed and used to improve automation.

- In December 2021, Honda R&D Co. extended its long-term relationship with Ansible Motion after commissioning the latest advanced Delta S3 DIL simulator. With its larger motion space and increased dynamic range, the versatile simulator would enable the efficient development of future road and race vehicles and their associated technologies at its Sakura engineering facility.

- In March 2021, Volvo Group signed an agreement with NVIDIA to jointly develop the decision-making system of autonomous commercial vehicles and machines. Utilizing NVIDIA's end-to-end artificial intelligence platform for training, simulation, and in-vehicle computing, the resulting system is expected to be designed to handle fully autonomous driving on public roads and highways safely.

- In January 2021, General Motors announced they had entered a long-term strategic relationship with Microsoft to accelerate the commercialization of self-driving vehicles. The companies are expected to bring together their software and hardware engineering excellence, cloud computing capabilities, manufacturing know-how, and partner ecosystem to transform transportation.

With OEM's focus on automated driving soon and subsequent growth of electric vehicles is anticipated to drive the demand for driving simulators, especially for testing and research by the OEMs operating in the market.

Europe is Expected to Lead the Market

Europe is led by Germany, one of the global most technologically superior markets. There is rapid growth for Level 2 and Level 3 autonomous cars in this region, equipped with advanced driver assistance systems like collision detection, lane departure warning, and adaptive cruise control.

From driver instructor academies to the race track, driving simulators are increasingly used as strategic tools in training education for drivers and racers. Moreover, the driving simulator will be deployed to assess ride and handling, NVH (Noise, Vibration, and Harshness), human-machine interface, and hardware in the loop in the hope of accelerating the rate of innovation in the overall vehicle development process while reducing the number of physical prototypes, and development time and costs.

The German driving simulator market is booming due to various investments and purchases ensured by utility partners. For instance,

- In April 2022, Simulation and driving simulator developer VI-grade announced that an extended version of its DiM250 Dynamic simulator had been adopted by long-standing customer Honda. Honda's newly acquired DiM is the second VI-grade Dynamic simulator within the Honda Group, with the company's R&D site in Offenbach, Germany, relying on a version of the DiM250 simulator for vehicle development and testing since 2018.

- In February 2022, Bosch could expand its expertise in automated driving and strengthen its market position by acquiring Atlatec, a developer of high-definition maps for autonomous driving and simulation.

Several utility platforms and companies understand the deep readiness of driving simulators and thus actively invest in research and technologies to come up with advanced and reliable stimulation solutions. For instance:

- In May 2022, Thales, based in France, completed its acquisition of Switzerland's RUAG Simulation and Training (RUAG S&T). All 500 RUAG Simulation and Training (RUAG S&T) employees have transferred to Thales, which employs approximately 900 people. Thales is now one of Europe's leading companies in the development and supply of simulation and training for the military, as brought to users by Uniwest. RUAG S&T made around €90 million (US$94.5 million) in sales last year.

Thales claims that the consolidation will expand its footprint in the land market while maintaining its expertise in helicopters and military aircraft solutions. This acquisition also allows it to strengthen its local footprint in France, Switzerland, Germany, and the United Kingdom, while expanding its presence in the United Arab Emirates and Australia.

Considering these ongoing developments and purchases for driving simulators in Germany, demand for the same is expected to witness a high growth rate during the forecast period.

Driving Simulator Industry Overview

The driving simulator market is dominated by several active players' presence, which includes major existing companies and new startups. Some of the major players in the market are Cruden BV, AutoSim AS, AVSimulation, and Ansible Motion. utility partners and OEMs are heavily investing in developing advanced driving simulator technology for their vehicle testing and its on-road dynamics. Players are carrying strategic alliances for the same. For instance:

- In September 2022, AB Dynamics PLC acquired Ansible Motion Limited, a leading provider of advanced simulators to the global automotive market. The acquisition was announced for a total fee of Pound 31.2 Million, which comprises a Pound 19.2 Million initial consideration and a Pound 12 Million payment subject to meeting certain performance criteria.

- In June 2022, WIMI Hologram Academy, which is a research institute in Hong Kong, announced that it is deeply working in close partnership with Holographic Science Innovation Center in order to felicitate the ongoing demand for virtual reality technology in vehicle driving systems.

- In May 2022, Ansible Motion unveiled all the specifications for the production Delta series S3 Driver-in-the-Loop (DIL) simulator, which is intended to validate the technologies required to enable the emerging electrification trends, autonomy, driver assistance, as well as HMI and vehicle dynamics.

- In July 2021, Dynisma Ltd of the United Kingdom announced the release of its new advanced driving simulators. These Dynisma Motion Generators (DMGs) were specifically designed for automotive manufacturers and suppliers for advanced vehicle development and testing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Application Type

- 5.2.1 Training

- 5.2.2 Testing and Research

- 5.3 By Simulator Type

- 5.3.1 Compact Simulator

- 5.3.2 Full-scale Simulator

- 5.3.3 Advanced Simulator

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 AutoSim AS

- 6.2.2 AVSimulation

- 6.2.3 VI-grade GmbH

- 6.2.4 Ansible Motion Ltd

- 6.2.5 Cruden BV

- 6.2.6 Tecknotrove Simulator System Pvt. Ltd

- 6.2.7 IPG Automotive GmbH

- 6.2.8 AB Dynamics PLC

- 6.2.9 Virage Simulation

- 6.2.10 XPI Simulation

- 6.2.11 FAAC Incorporated