|

市场调查报告书

商品编码

1440104

药用管瓶和安瓿:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Pharmaceutical Glass Vials And Ampoules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

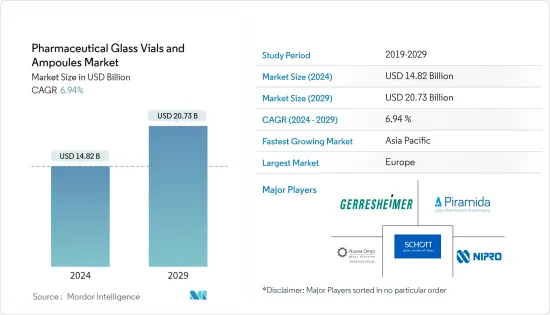

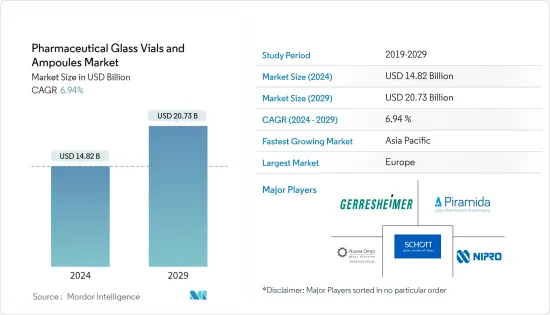

药用玻璃管瓶和安瓿市场规模预计到 2024 年为 148.2 亿美元,在预测期内(2024-2029 年)预计到 2029 年将达到 207.3 亿美元,复合年增长率为 6.94%。

多年来,玻璃一直是药品包装行业安全包装的首选材料,是维持各种化学成分的理想选择。玻璃管瓶和安瓿的透明度也更高,更容易检查和监控其内容物。

主要亮点

- 不断成长的製药业推动市场成长。人口稠密的国家对药用管瓶和安瓿的需求正在增加。这些国家药品产量的增加进一步增加了需求。此外,印度和中国等新兴国家医疗保健支出的增加是市场成长的另一个驱动力。

- 由于有利的人口结构、低廉的人事费用和丰富的资源,新兴市场被描述为成长和繁荣的国家。金砖国家(巴西、俄罗斯、印度、中国和南非)是顶级新兴经济体。对下游经济体进行分类有几种不同的方法。 MIST 国家包括墨西哥、印尼、韩国和土耳其。另一种解释将这两个群体分为果子狸(哥伦比亚、印尼、越南、埃及、土耳其和南非)和孟加拉、埃及、印尼、伊朗、韩国、墨西哥、奈及利亚、巴基斯坦、菲律宾、土耳其和越南。

- 玻璃的显着独特优势,例如化学耐久性和维持各种化学成分的适用性,是包装供应商选择玻璃作为製药材料的因素。此外,玻璃管瓶和安瓿瓶的透明度更高,更容易观察和监控内容物。这提供了进一步的保护,因为玻璃对大多数药物具有化学耐受性,并且相对不渗透空气和湿气。

- 传统上,铝和玻璃一直是整个药品包装的首选材料。随着时间的推移,这些材料由于原材料价格和其他因素而变得昂贵,并且不再为大众消费的包装产品提供经济可行的解决方案。这引入了塑料作为一种选择。

- COVID-19感染疾病在世界各地对管瓶和安瓿产生了巨大的需求。全球不同国家冠状病毒疫苗的大规模生产正在对市场格局产生重大影响。受疫情影响,研发创新经历了进步的黄金时期,药物输送和包装市场也经历了持续的成长和创新。无论管瓶、瓶子、安瓿、自动注射器、连网型设备,还是拯救生命的 COVID-19感染疾病的低温运输储存,药品包装和分销行业正在改变整个大流行整体的药品交付方式,发挥着重要作用。在。

- 此外,企业在开发有效疫苗方面活动的增加以及疫苗核准的增加也促进了该行业的成长。 2022年8月,美国FDA批准了Moderna COVID - 19感染疾病和辉瑞-BioNTech感染疾病作为首个疫苗,核准作为疫苗的二价製剂,在接种疫苗或加强接种后至少2个月内用作单次加强注射。因此, 感染疾病-19 后疫苗行业的持续发展增加了对管瓶和安瓿的需求。

药用管瓶和安瓿的市场趋势

疫苗占据主要市场占有率

- 疫苗需求的不断增长,加上慢性病盛行率的上升,推动了药品包装产业的整体成长。因此,管瓶和安瓿市场预计将大幅成长。

- 疫苗包装解决方案的需求激增是由于向消费者提供大量疫苗以及世界卫生组织和联合国儿童基金会等主流组织组织的大规模疫苗接种活动。这导致医院、诊断中心、调查计画和其他医疗保健部门等最终用途部门对玻璃安瓿和管瓶的需求显着增加。

- 此外,由于多种因素,包括持续努力对抗感染疾病、新出现的流行病以及人们对疫苗接种重要性的认识不断增强,全球对疫苗的需求正在稳步增长。

- 整个製造过程中的技术转移和合作伙伴关係将极大地影响供应弹性和扩充性,特别是在 COVID-19感染疾病的开发过程中。许多製造商依赖从其他製造商接收散装疫苗,将其装入管瓶、安瓿和包装中进行分发。

- 对药品包装(尤其是疫苗)的严格监管要求通常倾向于使用玻璃,因为玻璃具有化学惰性且能够承受灭菌过程。这种合规性增加了药品包装中对管瓶和安瓿的需求。确保充足的药用管瓶供应以在全球范围内分发疫苗对于全球应对措施的成功至关重要。世界各国政府和製药公司已下达数亿份订单,促使初级包装玻璃製造商提高产能。

- 这些努力在许多国家取得了成功,使政府能够获得和管理疫苗。例如,截至 2023 年 11 月,印度政府已接种了超过 22 亿例 COVID-19 疫苗。根据 CNN 和 OWID 报导,截至 2023 年 3 月 20 日,全球已接种约 130 亿剂 COVID-19感染疾病,其中美国约 6.72 亿剂。

亚太地区预计将出现显着成长

- 随着中国建立了製药业的标准框架,中国的药用玻璃安瓿和管瓶市场预计将扩大。国家越来越注重药品包装材料在药品储存过程中的稳定性以及包装在使用过程中的安全性。由于其耐用性、非反应性、透明性、环境友善性和多功能性,製药公司越来越多地使用玻璃包装。此外,医疗保健系统投资和研发的增加以及药品支出的增加正在推动对管瓶的需求。

- 日本的製药工业是世界上成长最快的工业之一,仅次于美国。这是由于该国继续专注于开发学名药药和取得专利的药物和疫苗,以及政府对希望在该国投资的国际公司采取放鬆管制的措施。

- 随着印度製药业的成长,印度对玻璃包装的需求预计将增加。为了帮助药品製造商应对日益复杂的产能和品质挑战,同时满足印度市场对基本药物的需求,因为行业相关人员专注于利用市场成长。我们在 开设了一家玻璃管工厂。

- 例如,2023年7月,美国科技公司康宁与法国药用玻璃製造商SGD Pharma成立的合资企业将在印度特伦甘纳邦建造药用玻璃管工厂,以扩大印度的药品生产。新厂将汇集康宁专有的玻璃涂层技术平台 Velocity Vial 和 SGD Pharma 的管瓶转换专业知识,以提高管瓶和填充线的生产率,并加快全球注射剂的交付。新工厂的奠基仪式将于2023年6月举行,该公司预计将在该工厂投资约50亿卢比(6,030万美元),预计将创造约150个就业机会。 SGD Pharma 的 Vemula 工厂预计将于 2024 年开始生产 Velocity 西林瓶,预计 2025 年开始生产药管。

- 注射剂的需求量很大,因为它们避免了困扰口服营养素的许多问题。随着医疗保健需求的增加,对药物、疫苗和其他包装在管瓶和安瓿中的医疗产品的需求也在增加,这给此类药物的生产带来了压力。这将迫使製药公司转向契约製造。例如,创新软体、生命科学和深度技术公司开发商 Bridgewest Group 于 2023 年 5 月推出了一个新的合约开发和製造组织 (CDMO),专注于无菌注射药品。 CMDO 位于西澳大利亚州,由 NovaCina 营运。

药用管瓶和安瓿产业概述

药用管瓶和安瓿市场高度分散,主要参与者包括 Schott AG、Gerresheimer AG、Stevanato Group、Nipro Corporation 和 Kapoor Glass India Pvt. Ltd。市场参与者正在采取合作伙伴关係和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 10 月 - Gerresheimer 推出含有 COP(环烯烃聚合物)的管瓶,这是适合敏感生物来源产品填充和储存的解决方案。 COP管瓶非常适合在低温和低温环境下使用 mRNA 活性成分。 Gerresheimer 使用结合了玻璃和塑胶最佳性能的高品质聚合物,扩大了各种品质的 RTF管瓶系列。

- 2023 年 2 月 - NOVA Ompi 签署预售协议,以估计价格 1600 万欧元(1691 万美元)购买位于拉丁(义大利)靠近斯蒂瓦那托集团其他资产的棕地地。维修的棕地工厂将生产 EZ 填充注射器、管瓶和其他产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 新兴国家製药业的成长

- 可回收性提高了玻璃的产品价值

- 市场限制因素

- 提高替代来源的相关性

第六章市场区隔

- 按用途

- 疫苗

- 其他(胰岛素、生物製药、其他)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章 竞争形势

- 公司简介

- Schott AG

- Gerresheimer AG

- Stevanato Group SPA

- NIPRO Corporation

- Kapoor Glass India Pvt. Ltd

- SGD SA(SGD Pharma)

- AAPL Solutions Pvt. Ltd

- CORNING INCORPORATED

- BOROSIL

- Stoelzle Oberglas GmbH

- Accu-Glass LLC

- Adit Containers Private Limited

- Agrado SA

- Birgimefar Group

- J. Penner Corporation

- BORMIOLI PHARMA SPA

- SISECAM

第八章投资分析

第9章市场的未来

The Pharmaceutical Glass Vials And Ampoules Market size is estimated at USD 14.82 billion in 2024, and is expected to reach USD 20.73 billion by 2029, growing at a CAGR of 6.94% during the forecast period (2024-2029).

Glass has long been the go-to material for safe packaging in the pharmaceutical packaging industry and is best suited to sustaining various chemical compositions. Also, glass vials and ampoules provide enhanced transparency, which allows easy inspection and monitoring of their contents.

Key Highlights

- The growing pharmaceutical industry aids the market's growth. The demand for pharmaceutical glass vials and ampoules arises in densely populated countries. The increasing pharmaceutical production in these countries is further increasing demand. In addition, growing healthcare spending in developing countries like India and China is another driver of the market's growth.

- Emerging markets are described as growing and prosperous nations owing to their favorable demographic conditions, low labor costs, and abundant resources. The BRICS nations (Brazil, Russia, India, China, and South Africa) are the top developing economies. There are a few different approaches to classifying lower-tier economies. MIST countries include Mexico, Indonesia, South Korea, and Turkey. Another interpretation separates the two groups into CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) and Bangladesh, Egypt, Indonesia, Iran, Korea, Mexico, Nigeria, Pakistan, the Philippines, Turkey, and Vietnam.

- The significant characteristic benefits of glass, such as chemical durability and suitability to sustain various chemical compositions, are some factors driving packaging vendors to choose glass as a pharmaceutical material. Additionally, glass vials and ampoules offer improved transparency, making viewing and monitoring the contents easier. This provides additional protection because glass is chemically resistant to most pharmaceuticals and comparatively impermeable to air and moisture.

- Traditionally, the preferred materials across pharmaceutical packaging have been aluminum and glass. Over time, these materials became expensive due to raw material prices and other factors and could not provide economically viable solutions for packaging products across mass consumption. That marked the advent of plastics as an option.

- The COVID-19 pandemic caused massive demand for vials and ampoules worldwide. The large-scale production of the Coronavirus vaccine in various countries worldwide has significantly affected the market scenario. As a result of the pandemic, R&D innovation has experienced a golden period of advancement, and the drug delivery and packaging markets have also experienced continuous growth and innovation. Whether vials, bottles, ampoules, auto-injectors, connected devices, or cold chain storage of lifesaving COVID-19 vaccines, the pharmaceutical packaging and delivery sectors have played a critical role in the pandemic in transforming the way of delivering medicines in general.

- Further, increasing company activities in developing effective vaccines and growing vaccine approvals are also contributing to the segment's growth. In August 2022, the US FDA approved the Moderna COVID-19 vaccine and the Pfizer-BioNTech COVID-19 vaccine as bivalent formulations of the vaccines for use as a single booster dose at least two months following primary or booster vaccination. Therefore, these continued developments in the vaccine industry post-COVID-19 have bolstered the demand for glass vials and ampoules.

Pharmaceutical Glass Vials and Ampoules Market Trends

Vaccines to Hold Significant Market Share

- The increasing demand for vaccines, coupled with the rising prevalence of chronic diseases, contributes to the overall growth of the pharmaceutical packaging industry. The market for glass vials and ampoules is expected to witness a substantial increase as a result.

- The surge in demand for vaccine packaging solutions is aided by the high number of vaccines acquired by consumers and the major vaccination drives organized by mainstream organizations like WHO and UNICEF. This has led to a significant increase in demand for glass ampoules and vials in end-use sectors such as hospitals, diagnostic centers, research programs, and other healthcare units.

- Furthermore, the global demand for vaccines has been steadily increasing due to various factors, including ongoing efforts to combat infectious diseases, emerging pandemics, and a growing awareness of the importance of vaccination.

- The flexibility and scalability of supply are greatly impacted by technology transfers and partnerships throughout the manufacturing process, particularly with the development of COVID-19 vaccines. Many manufacturers rely on receiving bulk vaccines from another manufacturer that they then fill into vials, ampoules, and packages for distribution.

- Stringent regulatory requirements for pharmaceutical packaging, especially for vaccines, often favor using glass due to its chemical inertness and the ability to withstand sterilization processes. This compliance drives the demand for glass vials and ampoules in pharmaceutical packaging. Ensuring an adequate supply of pharmaceutical glass vials for the distribution of the vaccine worldwide is crucial for the success of a global response. Governments and pharmaceutical companies worldwide are placing hundreds of millions of orders and urging primary packaging glass manufacturers to increase their production capacity.

- These initiatives proved successful in many countries, acquiring and administrating vaccines by their respective governments. For example, as of November 2023, the Indian government had administered more than 2.2 billion COVID-19 vaccinations. According to CNN and OWID, as of March 20, 2023, about 13 billion COVID-19 vaccine doses had been administered globally, with the United States accounting for almost 672 million.

Asia Pacific Expected to Witness Major Growth

- The Chinese pharmaceutical glass ampoules and vials market is expected to expand as China has established a standard framework for the pharmaceutical industry. The country is increasingly focusing on the stability of pharmaceutical packaging materials during drug storage and the safety of the packaging when used. Pharmaceutical companies increasingly use glass packaging because of its durability, non-reactivity, transparency, eco-friendliness, and versatility. Additionally, glass vials are in high demand due to increasing investment and R&D in healthcare systems and rising drug spending.

- Japan's pharmaceutical industry is one of the fastest growing in the world, second only to the United States. This is due to the country's continued focus on developing generic and patented drugs and vaccines and the government's deregulatory measures for international companies wishing to invest in the country. In May 2023, Nipro Corporation Japan, one of the world's largest companies, presented its investment of over PGK 100 million (USD 26.48 million) at the Sesvete plant, where it is constructing a new ampoules and vial factory (Pharmaceuticals) Nippro Pharma Packaging (Hrvatska) for the pharmaceutical industry. Nippro Corporation Japan purchased the old Piramida factory (Sesvete) from the Blue Sea Capital fund (which was recently named the year's most successful acquisition).

- The demand for glass packaging in India is expected to increase as the Indian pharmaceutical industry grows. Players in the industry are focusing on capitalizing on market growth, so they are opening glass tubing facilities to help the companies support drug manufacturers in addressing progressively complex capacity and quality challenges while fulfilling the need for essential medicines in the Indian market.

- For instance, in July 2023, a joint venture between United States technology company Corning and French pharmaceutical glassmaker SGD Pharma will build a pharmaceutical glass tubing facility in the Indian state of Telangana to scale up pharmaceutical manufacturing in India. The new facility will bring together Corning's proprietary glass coating technology platform, Velocity Vial, and SGD Pharma's vial converting expertise to enhance vial and fill-line productivity and the delivery speed for injectable treatments worldwide. The groundbreaking ceremony for the new facility was held in June 2023, and the company expects to invest approximately INR 5 billion (USD 60.3 million) in the facility, which is expected to create about 150 jobs. The manufacturing of Velocity Vials is expected to start at SGD Pharma's Vemula facility in 2024, with the production of pharmaceutical tubing expected to begin in 2025.

- The demand for injectables is increasing as they can bypass many issues plaguing orally administered nutrients. As healthcare needs increase, the demand for pharmaceuticals, vaccines, and other medical products packaged in vials and ampoules will also increase, creating pressure on the production of such medicines. This leads to pharmaceutical companies switching to contract manufacturers. For instance, in May 2023, Bridgewest Group, a company developing innovative software, life sciences, and deep tech companies, launched a new contract development and manufacturing organization (CDMO) focusing on sterile injectable drug products. The CMDO is located in Western Australia and will operate under NovaCina.

Pharmaceutical Glass Vials and Ampoules Industry Overview

The pharmaceutical glass vials and ampoules market is highly fragmented, with the presence of major players like Schott AG, Gerresheimer AG, Stevanato Group, Nipro Corporation, and Kapoor Glass India Pvt. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - Gerresheimer has launched vials containing COP (Cyclic Olefin Polymer), a suitable solution for filling and storing susceptible biological products. COP vials are ideal for using mRNA-active ingredients in cold and cryogenic environments. Gerresheimer is broadening its range of RTF glass vials, which are available in various qualities, with a high-quality polymer that combines the best properties of both glass and plastic.

- February 2023 - NOVA Ompi entered into a pre-sale agreement to purchase a brownfield site in Latin (Italy), close to other facilities of the Stevanato group, for an approximate price of EUR 16,0 million (USD 16.91 million). After renovation, the brownfield site is expected to produce EZ-filled syringes, vials, and other products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Pharmaceutical Industry in Emerging Economies

- 5.1.2 Commodity Value of Glass Increased with Recyclability

- 5.2 Market Restraints

- 5.2.1 Increased Relevance of Alternate Sources

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Vaccines

- 6.1.2 Others (Insulin, Biopharma, Others)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schott AG

- 7.1.2 Gerresheimer AG

- 7.1.3 Stevanato Group SPA

- 7.1.4 NIPRO Corporation

- 7.1.5 Kapoor Glass India Pvt. Ltd

- 7.1.6 SGD SA (SGD Pharma)

- 7.1.7 AAPL Solutions Pvt. Ltd

- 7.1.8 CORNING INCORPORATED

- 7.1.9 BOROSIL

- 7.1.10 Stoelzle Oberglas GmbH

- 7.1.11 Accu-Glass LLC

- 7.1.12 Adit Containers Private Limited

- 7.1.13 Agrado SA

- 7.1.14 Birgimefar Group

- 7.1.15 J. Penner Corporation

- 7.1.16 BORMIOLI PHARMA SPA

- 7.1.17 SISECAM