|

市场调查报告书

商品编码

1445436

药用玻璃包装 - 市场份额分析、行业趋势与统计、成长预测(2024 - 2029)Pharmaceutical Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

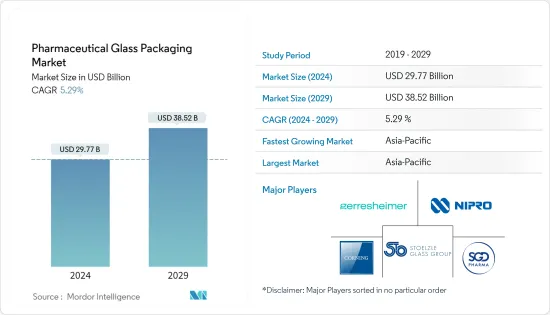

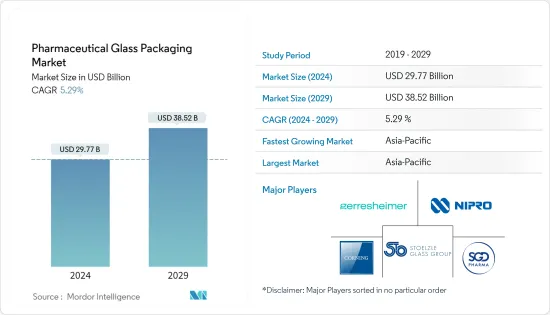

2024年药用玻璃包装市场规模预计为297.7亿美元,预计到2029年将达到385.2亿美元,在预测期内(2024-2029年)CAGR为5.29%。

玻璃包装解决方案主要作为药品的初级包装提供,是製药业领先的包装材料之一。这主要是由于其具有可持续、惰性、不渗透、可回收、不损失品质和可重复使用的优点。

主要亮点

- 随着製药业技术进步,对药品和药物的需求不断增长,直接创造了对瓶子、安瓿和其他玻璃包装解决方案的需求。

- 随着慢性病的增加以及生产大量针对 COVID-19 的疫苗剂量,预计对初级包装的需求将会增加,尤其是玻璃容器。

- 此外,玻璃的显着特性优势,例如化学耐久性和适合维持各种化学成分,是推动包装供应商选择玻璃作为製药材料的一些因素。此外,玻璃小瓶和安瓿瓶的透明度更高,方便检视和监控内容物。

- 传统上,药品包装的首选材料是铝和玻璃。随着时间的推移,由于原材料价格和其他因素,这些材料变得昂贵,并且无法为大众消费的包装产品提供经济可行的解决方案。这标誌着塑胶作为一种选择的出现。

- COVID-19 大流行带来了稳定的成长率和药品需求的增加。疫情期间药品需求激增带动了市场成长。随着药品製造商在不同国家批准和逐步淘汰新药和疫苗,玻璃包装的范围不断扩大,预计玻璃包装的应用范围将会扩大。

药用玻璃包装市场趋势

新兴经济体医药产业成长拉动经济成长

- 新兴市场被描述为日益繁荣的国家,儘管风险巨大,但投资仍有望增加利润。金砖国家(巴西、俄罗斯、印度、中国和南非)是最大的发展中经济体。对低线经济体进行分类有几种不同的方法。人们只使用少数国家作为 MIST(墨西哥、印尼、韩国和土耳其)。另一种解释将这两个群体分为果子狸(哥伦比亚、印尼、越南、埃及、土耳其和南非)和孟加拉、埃及、印尼、伊朗、韩国、墨西哥、奈及利亚、巴基斯坦、菲律宾、土耳其和越南。

- 儘管许多已开发国家的药品销售成长缓慢,但新兴市场的销售模式显示其持续扩张。一些经济和人口变数影响着这些市场的趋势,例如成熟市场的挑战性条件(由于专利到期而导致成长趋于平缓)、鼓励仿製药替代的成本削减措施以及严格执行限制。

- 药用玻璃包装产业在中国等国家已显着渗透。药品玻璃包装在已开发国家的应用越来越广泛。受新冠肺炎 (COVID-19) 影响,新兴国家的医疗保健和製药行业不断增长,这为中国药用玻璃包装市场带来了潜力。

- 例如,2022年9月,肖特製药扩大了在中国的药筒产量。数百万美元的投资旨在显着提高中国和匈牙利的药筒製造能力。

- 此外,研发在印度製药业也受到高度重视。印度透过扩大研发生态系统和增加药品出口,于2022年成为全球医疗巨头,为国内各种玻璃包装供应商创造了机会。

- 总体而言,由于製药市场的成长,重要市场现有企业的所有这些投资预计将在预测期内推动市场成长。

亚太地区将见证显着成长

- 随着中国多年来为製药业建立了标准体系,中国药用玻璃包装市场预计将快速成长。国家越来越重视药品包装材料在药品储存期间的稳定性和使用时的安全性。在此背景下,新型绿色、可降解、使用方便的药用包装材料和容器迎来了蓬勃发展的时代。

- 由于大型跨国製药公司的存在,中国庞大且快速成长的医疗保健市场一直是中国玻璃包装产业明显的机会目标,而这些公司是中国製药市场中最重要的收入来源。

- 在印度,由于医疗保健行业中通用注射药物的使用不断增加,药用玻璃包装一直在增长。药用玻璃包装有多种药物类型,例如注射剂和非注射剂。药用玻璃包装的显着特性是具有高化学耐久性,从而最大限度地提高产品的可靠性。

- 由于印度是全球药品市场中的重要且不断扩大的参与者,预计印度对玻璃包装的需求将快速增长。印度品牌资产基金会网站公布的资料显示,印度是全球最大的仿製药供应国,占全球供应量的20%,满足全球60%以上的疫苗需求。印度製药业的全球价值为 420 亿美元。印度医药市场在 2021 年 8 月较去年同期扩张 17.7%,高于 2020 年 7 月的 13.7%。根据 India Ratings & Research 的数据,印度医药市场营收在 2022 财年将成长 12% 以上。

- 在日本,最终用途市场玻璃容器出货量的增加支撑了市场的成长。玻璃容器是包装液体药品、化学品和各种其他易腐烂/不易腐烂产品的最优选材料之一。此外,人们对环保包装解决方案的日益青睐也影响了药用玻璃包装的采用。

- 亚太其他地区的范围包括印尼、澳洲、新加坡、泰国、韩国、马来西亚等多个国家。该市场是由国际合作伙伴关係的激增、生物仿製药、成品製剂出口的扩大以及强劲的仿製药市场推动的。

药用玻璃包装产业概况

药用玻璃包装市场趋于分散化。政府措施的激增以及对注射剂和其他药品的需求不断增加,为药用玻璃包装解决方案提供了利润丰厚的机会。整体而言,现有竞争对手之间的竞争激烈。此外,不同製药业大公司的扩张和合併预计将增加市场需求。主要参与者有格雷斯海默玻璃公司、康宁公司等。

2022 年 9 月,Gerresheimer AG 和 StevanatoGroup SpA 共同开发了高端即用型 (RTU) 解决方案平台,最初专注于基于 StevanatoGroup 市场领先的 EZ-fill 技术构建的小瓶。客户预计将从合作伙伴关係中受益,包括提高生产力、提高品质标准、加快上市时间、降低整体拥有成本 (TCO) 和降低供应链风险。 2022 年 7 月,医疗设备製造公司 Nipro Corporation Japan 投资 1 亿克罗埃西亚库纳(1,360 万美元/1,330 万欧元)在克罗埃西亚为製药业新建一座玻璃包装厂。生产用于包装救生药物的玻璃安瓿和小瓶的新工厂在萨格勒布郊区 Sesvete 落成,该工厂隶属于 Nipro PharmaPackaging 部门。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力——波特五力

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- COVID-19 对产业影响的评估

第 5 章:市场动态

- 市场驱动因素

- 新兴经济体製药业的成长

- 玻璃的商品价值随着可回收性的增加而增加

- 市场限制

- 替代材料的相关性增加

第 6 章:市场细分

- 产品

- 瓶子

- 小瓶

- 安瓿

- 药筒和注射器

- 其他产品

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- Gerresheimer AG

- Corning Incorporated

- Nipro Corporation

- SGD SA (SGD PHARMA)

- Stlzle-Oberglas GmBH (CAG Holding GmbH)

- Bormioli Pharma SpA

- West Pharmaceutical Services Inc

- Schott AG

- Shandong Medicinal Glass Co. Ltd

- Beatson Clark

- Arab Pharmaceutical Glass Co.

- Piramal Glass Private Limited (Piramal Group)

- Sisecam Group

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Pharmaceutical Glass Packaging Market size is estimated at USD 29.77 billion in 2024, and is expected to reach USD 38.52 billion by 2029, growing at a CAGR of 5.29% during the forecast period (2024-2029).

Glass packaging solutions are offered mainly as the primary packaging for pharmaceutical products and are among the leading packaging materials for the pharmaceutical industry. This is mainly due to being sustainable, inert, impermeable, and recyclable with no loss in quality and reusable advantages.

Key Highlights

- The increasing demand for pharmaceutical drugs and medicines associated with technological advancements in the pharmaceutical industry is directly creating the demand for bottles, ampules, and other glass packaging solutions.

- With a rise in chronic diseases and a significant number of vaccine doses being manufactured for COVID-19, the demand for primary packaging is anticipated to rise, especially glass containers.

- Moreover, The significant characteristic benefits of glass, such as chemically durable and suitability to sustain various chemical compositions, are some factors driving packaging vendors to choose glass as pharmaceutical material. Additionally, glass vials and ampoules offer improved transparency, making viewing and monitoring the contents.

- Traditionally, the preferred materials across pharmaceutical packaging have been aluminum and glass. Over time, these materials became expensive due to raw material prices and other factors and could not provide economically viable solutions for packaging products across mass consumption. That marked the advent of plastics as an option.

- The COVID-19 pandemic left a steady growth rate with increased demand for medicines. The surge in demand for pharmaceutical drugs during the pandemic has driven the market's growth. It is expected to grow as new drugs and vaccines are being approved and phased out in different countries by pharmaceutical manufacturers, expanding the scope of glass packaging.

Pharmaceutical Glass Packaging Market Trends

Growth of Pharmaceutical Industry in Emerging Economies to Drive Growth

- Emerging markets are described as growing prosperous nations where investment is anticipated to increase profits despite significant risks. The BRICS (Brazil, Russia, India, China, and South Africa) nations are the top developing economies. There are a few different approaches to classifying lower-tier economies. One only uses a select few as the MIST (Mexico, Indonesia, South Korea, and Turkey). Another interpretation separates the two groups into CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) and Bangladesh, Egypt, Indonesia, Iran, Korea, Mexico, Nigeria, Pakistan, the Philippines, Turkey, and Vietnam.

- While pharmaceutical sales grow slowly in many developed nations, emerging market sales patterns indicate ongoing expansion. Several economic and demographic variables influence the trend in these markets, such as challenging conditions in established markets, with which growth has been flattened due to patent expiration, cost-cutting measures that encourage generic replacement, and strict enforcement of restrictions.

- The pharmaceutical glass packaging industry has seen significant penetration in nations like China. Glass packaging for pharmaceuticals is becoming more widely used in developed countries. As a result of COVID-19, the healthcare and pharmaceutical sectors are growing in emerging nations, which presents the potential for the Chinese market for pharmaceutical glass packaging.

- For instance, in September 2022, SCHOTT Pharma expanded cartridge output in China. Several million investments are intended to significantly improve the manufacturing capabilities for pharmaceutical cartridges in China and Hungary.

- Additionally, R&D was highly valued in the pharmaceutical sector in India. India became a worldwide medical giant in 2022 by enlarging its R&D ecosystem and raising pharmaceutical exports, creating opportunities for various domestic glass packaging vendors.

- Overall, all these investments by significant market incumbents due to the growth of the pharmaceutical market are expected to drive market growth in the forecast period.

Asia Pacific to Witness Significant Growth

- China's pharmaceutical glass packaging market is expected to grow very fast as China has built a standard system for the pharmaceutical industry over the years. The country pays more and more attention to the stability of pharmaceutical packaging materials during the drug storage period and safety when used. Against this background, new types of green, degradable, and easy-to-use pharmaceutical packaging materials and vessels are in the palmy days.

- China's large and rapidly growing healthcare market has been an obvious target of opportunity for the glass packaging sector in China due to the presence of major multinational pharmaceutical companies, and these companies are among the most significant revenue earners in the Chinese pharmaceutical market.

- In India, pharmaceutical glass packaging has been growing due to the increasing usage of generic injectable drugs in the healthcare industry. Pharmaceutical glass packaging is available in various drug types, such as injectable and non-injectable. The significant property of pharmaceutical glass packaging has high chemical durable properties, which maximizes the reliability of the products.

- The demand for glass packaging in India is expected to grow rapidly as India is a prominent and expanding player in the global medicines market. According to data published on the India Brand Equity Foundation website, India is the world's largest provider of generic pharmaceuticals, accounting for 20% of the worldwide supply and meeting over 60% of global vaccine demand. The Indian pharmaceutical industry is valued at USD 42 billion globally. The Indian pharmaceutical market expanded by 17.7% Y-o-Y in August 2021, up from 13.7% in July 2020. According to India Ratings & Research, the Indian pharmaceutical market revenue will increase by more than 12% in FY22.

- In Japan, the market's growth is supported by the increase in glass container shipments in end-use markets. Glass containers are one of the most preferred materials for packaging liquid-based pharmaceutical products, chemicals, and a variety of other perishable/non-perishable products. Moreover, the rising preference for environment-friendly packaging solutions impacts pharmaceutical glass packaging adoption.

- The scope of the Rest of the Asia-Pacific region includes multiple countries such as Indonesia, Australia, Singapore, Thailand, South Korea, and Malaysia. The market is driven by the surge of international partnerships, biosimilars, an expansion in the export of finished formulations, and a robust generics market.

Pharmaceutical Glass Packaging Industry Overview

The pharmaceutical glass packaging market is inclined towards fragmentation. The surge in government initiatives and increasing demand for injectables and other medicines provide lucrative pharmaceutical glass packaging solutions opportunities. Overall, the competitive rivalry among existing competitors is high. Further, expansion and mergers of large companies in different pharmaceutical industries are expected to increase the demand in the market. Key players are Gerresheimer Glass Inc., Corning Incorporated, etc.

In September 2022, Gerresheimer AG and StevanatoGroup SpA developed together a high-end ready-to-use (RTU) solution platform with an initial focus on vials built on StevanatoGroup's market-leading EZ-fill technology. The customers are expected to benefit from the partnership in terms of increased productivity, higher quality standards, quicker time to market, the lower total cost of ownership (TCO), and reduced supply chain risk. In July 2022, Nipro Corporation Japan, a Medical equipment manufacturing company, invested HRK 100 million (USD 13.6 million/EUR 13.3 million) in a new glass packaging plant for the pharmaceutical industry in Croatia. The new factory that produces glass ampoules and vials to package life-saving drugs was inaugurated in Zagreb's suburb Sesvete, Nipro's division Nipro PharmaPackaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Pharmaceutical Industry in Emerging Economies

- 5.1.2 Commodity Value of Glass Increased with Recyclability

- 5.2 Market Restraints

- 5.2.1 Increased Relevance of Alternate Material

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Bottles

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Cartridges and Syringes

- 6.1.5 Others Products

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.5.3 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerresheimer AG

- 7.1.2 Corning Incorporated

- 7.1.3 Nipro Corporation

- 7.1.4 SGD SA (SGD PHARMA)

- 7.1.5 Stlzle-Oberglas GmBH (CAG Holding GmbH)

- 7.1.6 Bormioli Pharma SpA

- 7.1.7 West Pharmaceutical Services Inc

- 7.1.8 Schott AG

- 7.1.9 Shandong Medicinal Glass Co. Ltd

- 7.1.10 Beatson Clark

- 7.1.11 Arab Pharmaceutical Glass Co.

- 7.1.12 Piramal Glass Private Limited (Piramal Group)

- 7.1.13 Sisecam Group