|

市场调查报告书

商品编码

1440146

电动三轮车 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Electric Three-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

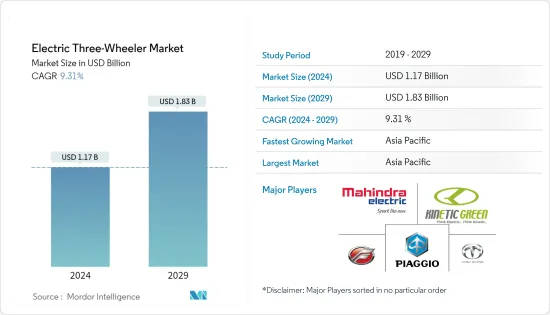

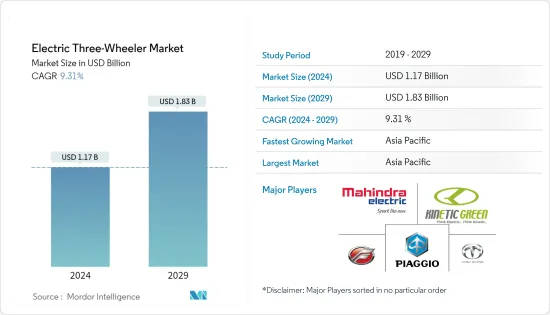

电动三轮车市场规模预计到 2024 年为 11.7 亿美元,预计到 2029 年将达到 18.3 亿美元,在预测期内(2024-2029 年)CAGR为 9.31%。

主要亮点

- 该市场主要受到政府严格污染控制规范、人们对汽油和柴油汽车排放有害影响的认识不断提高以及电动车采用率增加等因素的推动。

- 与传统三轮车相比,电动三轮车的平均运作和维护成本要低得多。

- 然而,续航里程小、电池组笨重是三轮汽车製造商关注的问题。电动三轮车充满电后可行驶约 125-130 公里,而传统车辆满箱燃油可行驶 200-220 公里。

电动三轮车市场趋势

日益关注排放控制推动市场

世界上一些低收入和中等收入国家的三轮车使用率很高,传统上由内燃机提供动力。然而,许多这些内燃机三轮车陈旧且效率低下,因此排放大量颗粒物 (PM) 和黑碳 (BC),这是一种强效的短期污染物。日益严格的排放控制标准促使製造商增加了电动三轮车的研发支出,最终使他们能够将其作为城市内出行的未来进行行销。

世界各地的政府和组织发起了各种计划和倡议,鼓励买家选择电动三轮车而不是传统车辆。例如,联合国环境署正在支持发展中国家製定在非洲和亚洲引进电动两轮和三轮车的国家计画。联合国环境署正在支持非洲和亚洲八个国家的电动两轮和三轮车计画:衣索比亚、摩洛哥、肯亚、卢安达、乌干达、菲律宾、泰国和越南。此类活动预计将推动电动三轮车的整合,这可能有助于从基于化石燃料的出行方式向电动出行方式的转变,从而推动市场的成长。

亚太地区将引领市场

近年来,亚太地区已成为电动三轮车的新兴市场。 2018-19 年,当所有其他汽车领域的需求增长较上年缓慢时,电动三轮车领域的销量比 2017-18 年该国电动三轮车的销量增长了约 21%。

该地区各国政府也正在采取措施减少该地区的污染。例如,

- 2019年12月,印度政府宣布了FAME India计画第二阶段,重点支持公共和共享交通的电气化,旨在透过激励措施支持电动巴士、e-3轮汽车。

- 在泰国,节能基金 (ECF) 批准了 1.06 亿泰铢的补贴,以激励嘟嘟车车主从液化石油气 (LPG) 转向电动嘟嘟车。

Terra Motors等该地区的几家主要参与者正在推出各种电动三轮车,用于前往印度、孟加拉和尼泊尔等潜在市场的客运和货运,以增加其市场占有率和份额。

电动三轮车产业概况

电动三轮车市场高度分散,多家参与者仅占较小的市场。电动三轮车市场的一些知名公司包括 Mahindra Electric、Piaggio、Bodo EV、Kinetic Green Energy Solution 等。这些企业正在大力投资电动三轮车的研发,以提高车辆的负载能力和行驶里程。例如,

- 2020 年 2 月,Omega Seiki Private Limited 推出了 Singha 和 Singha Max,后者采用电力运行,以满足 B2B 和电子商务行业的需求。

- 2019年12月,比亚乔在印度推出Ape电动三轮车,配备可更换锂离子电池,一次充电续航里程约70-80公里

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场挑战

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 最终用途

- 客运航空公司

- 货物承运人

- 电池类型

- 锂离子电池

- 铅酸

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Mahindra Electric

- Piaggion & C. Spa

- Bodo Vehicle Group Co. Ltd

- Kinetic Green Energy & Power Solutions Ltd

- Terra Motors Corporation

- Lohia Auto Industries

- E-Tuk Factory BV

- Goenka Electric Motor Vehicles Pvt. Ltd

- Omega Seiki Private Limited

- ATUL Auto Limited

第 7 章:市场机会与未来趋势

The Electric Three-Wheeler Market size is estimated at USD 1.17 billion in 2024, and is expected to reach USD 1.83 billion by 2029, growing at a CAGR of 9.31% during the forecast period (2024-2029).

Key Highlights

- The market is primarily driven by the factors such as strict government norm for pollution control, increasing awareness about harmful effects of emissions from gasoline and diesel vehicles and increase in adoption of electric vehicles.

- The average cost of operation and maintenance of electric three-wheelers are substantially low as compared to conventional three-wheelers.

- However, the low range of distance covered, and heavy battery pack are the areas of concern for the manufacturers of three-wheeler vehicles. As an electric three-wheeler covers around 125-130 kms with full charged battery as compared to 200-220 Kms covered by conventional vehicles on a full tank of fuel.

Electric Three-Wheeler Market Trends

Increasing Focus on Emission Control Driving the Market

Several low- and middle-income countries in the world have a high rate of usage of three-wheelers, which were traditionally powered by IC engines. However, many of these internal combustion engine three-wheelers are old and inefficient, thus, emitting substantial amounts of particulate matter (PM) and black carbon (BC), a potent short-lived pollutant. The growing emission control norms have propelled the manufacturers to increase their expenditure on R&D of electric three-wheelers, which eventually allowed them to market them as the future of intracity mobility.

Governments and organizations across the world have initiated various schemes and initiatives, which encourage buyers to choose electric three-wheelers over conventional vehicles. For instance, the UN Environment is supporting developing countries to develop national programs for the introduction of electric two- and three-wheelers in Africa and Asia. The UN Environment is supporting electric two- and three-wheeler projects in eight countries in Africa and Asia: Ethiopia, Morocco, Kenya, Rwanda, Uganda, the Philippines, Thailand, and Vietnam. Such activities are envisioned to propel the integration of electric three-wheelers, and this may help the transformation from fossil fuels-based mobility to electric mobility, thereby, driving the growth of the market.

Asia-Pacific Will Lead the Market

Over the past few years, the Asia-Pacific region has turned out to be an emerging market for electric three-wheeler. During the year 2018-19, when all other auto segment witnessed a slow demand growth as compared to previous year, sales of electric three-wheeler segment grew around 21 per cent from 2017-18 sales of electric three wheelers in the country.

The Governments in the region are also taking measures to reduce pollution in the region. For instance,

- In December 2019, the government of India announced the phase-II of FAME India scheme, which focus on supporting electrification of public & shared transportation, and aims to support e-buses, e-3 wheelers through incentives.

- In Thaniland, The Energy Conservation Fund (ECF) has approved a subsidy of THB 106 million, to motivate tuk-tuk owners to move from liquefied petroleum gas (LPG) to Electric ones.

Several major players in the region like Terra motors are launching various electric three-wheelers, both for passenger and cargo transportation to prospective markets like India, Bangladesh and Nepal to increase their market presence and share.

Electric Three-Wheeler Industry Overview

The Electric 3-Wheeler Market is highly fragmented, with several players accounting for a smaller portion of market share. Some of the prominent companies in the electric three-wheeler market are Mahindra Electric, Piaggio, Bodo EV, Kinetic Green Energy solution and others. These players are investing heavily in research and development of electric three-wheeler in increasing the load capacity along with the driving range of the vehicle. For instance,

- In February 2020, Omega Seiki Private Limited introduced Singha and Singha Max which runs on electric power to cater to the needs of the B2B and e-commerce industry.

- In December 2019, Piaggio launched Ape electric three wheeler in India, with swappable Lithium-ion battery and offers a range of around 70-80 km on a single charge

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Challenges

- 4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-Use

- 5.1.1 Passenger Carrier

- 5.1.2 Goods Carrier

- 5.2 Battery Type

- 5.2.1 Li-ion

- 5.2.2 Lead Acid

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Mahindra Electric

- 6.2.2 Piaggion & C. Spa

- 6.2.3 Bodo Vehicle Group Co. Ltd

- 6.2.4 Kinetic Green Energy & Power Solutions Ltd

- 6.2.5 Terra Motors Corporation

- 6.2.6 Lohia Auto Industries

- 6.2.7 E-Tuk Factory BV

- 6.2.8 Goenka Electric Motor Vehicles Pvt. Ltd

- 6.2.9 Omega Seiki Private Limited

- 6.2.10 ATUL Auto Limited