|

市场调查报告书

商品编码

1440173

内容服务平台 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Content Services Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

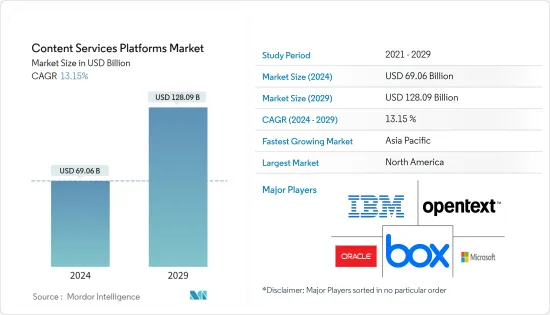

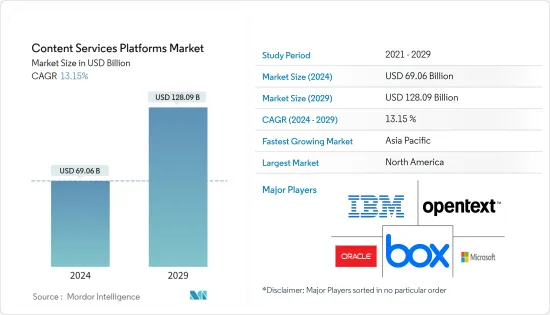

内容服务平台市场规模预计到 2024 年为 690.6 亿美元,预计到 2029 年将达到 1280.9 亿美元,在预测期内(2024-2029 年)CAGR为 13.15%。

推动内容服务平台市场的主要因素包括社交、行动、分析和云端 (SMAC) 技术的日益普及以及数位内容在企业中的激增。

主要亮点

- 内容服务平台 (CSP) 是一组整合的内容相关解决方案和工具,它们共享标准应用程式介面 (API) 和储存库以支援多个企业级内容使用。它们是传统企业内容管理 (ECM) 系统的下一个演进阶段。

- 许多组织正在走向无纸化,拥有远端员工,或者两者兼而有之,这使得将文件和文书工作保存在办公室的实体文件柜或文件箱中是不切实际的。基于云端的文件管理系统具有节省成本的优势。它减少了基础设施的大量初始资本投资,并提供轻鬆的共享、可扩展性以及与第三方的整合。因此,中小企业越来越多地采用基于云端的解决方案来简化成本和营运。

- 此外,案例管理系统(也称为客户管理系统)可协助组织追踪所有必要的资料,以满足选民的需求,并向他们提供计划和服务。医疗保健企业正在为各种案例管理部署整改解决方案,对全球案例管理解决方案市场的成长产生正面影响。

- 在医疗保健行业,如果组织需要遵守健康保险流通和责任法案 (HIPAA),它可能希望选择来自签署业务伙伴协议 (BAA) 的供应商的案例管理系统。 BAA 在组织和供应商之间建立了有关受保护健康资讯的隐私、安全、传输、储存和使用的合约协议。

- 将文件储存在组织的共用磁碟机上不足以满足行业合规性标准。除了法律规定之外,记录管理策略对于组织资讯的生命週期也至关重要。组织层面的策略将控制资讯的创建、储存、共享、追踪和保护方式。

内容服务平台市场趋势

本地部署模式占据主导地位

- 预计本地部署类型将在预测期内显着促进市场成长。 CSP 解决方案的本地部署需要组织进行初始高额投资,儘管它不需要像云端部署类型那样在整个所有权过程中增加成本。

- 如今,可以透过行动装置轻鬆存取企业资料;这增加了业务方之间的资料传输量,并增加了网路攻击和资料遗失的风险。因此,与客户私有资料相关的安全性问题是选择云端本地部署的重要原因。此类实施在大型企业中广泛存在。

- 例如,据思科系统公司称,到 2022 年,全球消费者 IP 流量资料量预计将达到每月 333 艾字节,年复合成长率为 27%。

- 此外,俄罗斯透过行动互联网传输的资料量不断增加。 2021年,行动资料流量较上年成长131%。

- 本地部署允许使用者将解决方案保留在内部,并在对组织有意义时扩展解决方案。本地解决方案依赖基础设施、IT 部门或其他资源,并维护和发展解决方案。本地部署意味着使用者可以成为 ECM 解决方案的内部专家,并且使用者可以轻鬆更改和增强解决方案。

- 此外,在印度等国家,对组织资讯的完整性、保密性和可取得性的威胁呈指数级增长。因此,必须专注于提供基于业务风险方法的标准化资讯安全模型,以便为客户建立、实施、操作、监控、审查、维护和改进整体资讯安全。

亚太地区预计将获得显着的市场份额

- 在亚太地区,由于印度和中国等经济发展中国家需要组织的资料流量不断增加以及资料和资讯的快速增长,预计该市场将快速成长。

- 此外,随着日本等国家人口老化和人口减少,人们对生产力和劳动力短缺的日益担忧正在推动这些国家在各个领域实现数位化。此外,日本政府计划在 2026 年新的日本国家檔案馆大楼启用时,对大多数公共记录进行数位化管理,旨在防止阻碍政府发展的记录管理问题。

- 该地区的云端采用率正在快速增长,预计这将对预测期内的市场成长产生积极影响。此外,新加坡是亚太地区 (APAC) 云端就绪程度最高的地区之一。在亚洲云端运算协会 (ACCA) 云端就绪指数 (CRI) 的最新版本中,它取代了香港的位置。此外,新加坡政府预计将在预测期内将其大部分 IT 系统转移到商业云端服务,以持续努力更快、更便宜地提供公民服务。预计这将对市场成长产生积极影响。

- 随着企业试图改善其数位计划,公共云端设施在该地区取得了巨大的发展势头。内容服务平台已成为当今公司实现更高敏捷性并满足客户需求的关键。各组织也合作优化实施效率并确保卓越的客户体验。

- 数位转型正迅速成为多个国家的首要任务,随着越来越多的公司正在实施正式策略来支持其努力,数位转型也迅速发展。

内容服务平台产业概览

内容服务平台市场竞争适度,由几个主要参与者组成。目前,这些主要参与者中很少有人在市场份额方面占据主导地位。内容服务平台市场的一些主要公司包括 Hyland、OpenText、Box、Laserfiche、Adobe、IBM、Nuxeo 和 Objective 等。这些在市场上占有显着份额的有影响力的参与者正致力于扩大其在国外的客户群。这些企业利用策略协作行动来提高市场占有率并提高获利能力。

2022 年 8 月,OpenText 宣布为 Salesforce AppExchange 新增三个新解决方案。这使得 AppExchange 产品总数达到六种,并使任何规模的客户都能从 OpenText 内容服务平台的治理、生产力和效率中受益。 OpenText Core Content 使用 SaaS 平台与 Salesforce 等程式交互,以促进现代工作,协助企业管理资讯。

2022 年 6 月,Box Inc. 宣布在 Salesforce AppExchange 上增强 Box for Salesforce 集成,使客户能够使用 Box 作为 Salesforce 中基于签名的流程和工作流程的内容管理解决方案。客户可以利用 Box Sign 的功能直接从 Salesforce 发送 Box 檔案以供签署。该版本还包括新功能和开发人员工具,使共同客户可以轻鬆地从任何地点建立和执行协议。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代产品的威胁

- 市场驱动因素

- 越来越多采用 SMAC 技术

- 整个企业数位内容的增加

- 提供情境化使用者体验的需求

- 市场限制

- 资料隐私和安全问题

- COVID-19 对产业影响的评估

第 5 章:市场细分

- 按组件

- 解决方案/软体

- 文件和记录管理

- 资料抓取

- 工作流程管理

- 资讯安全与治理

- 个案管理

- 其他解决方案

- 服务

- 整合部署

- 咨询

- 支援与维护

- 解决方案/软体

- 依部署类型

- 本地部署

- 云

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户行业垂直

- BFSI

- 政府和公共部门

- 医疗保健和生命科学

- 资讯科技和电信

- 运输与物流

- 其他最终用户行业垂直领域

- 地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 6 章:竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Box Inc.

- Oracle Corporation

- Hyland Software Inc.

- Laserfiche Inc.

- Hewlett Packard Enterprise (Micro Focus)

- Adobe Systems Inc.

- M-Files Inc.

- Newgen Software Technologies Limited

- Fabasoft AG

- Everteam SAS

- DocuWare Corporation

- Alfresco Software Inc.

第 7 章:投资分析

第 8 章:市场的未来

The Content Services Platforms Market size is estimated at USD 69.06 billion in 2024, and is expected to reach USD 128.09 billion by 2029, growing at a CAGR of 13.15% during the forecast period (2024-2029).

The major factors driving the content services platform market include the growing adoption of social, mobile, analytics, and cloud (SMAC) technologies and the proliferation of digital content across enterprises.

Key Highlights

- Content service platforms (CSP) are an integrated set of content-related solutions and tools that share standard application programming interfaces (APIs) and repositories to support multiple enterprise-level content usage. They are the next evolutionary phase of traditional enterprise content management (ECM) systems.

- Many organizations are going paperless, having remote employees, or both, making it unrealistic to keep documents and paperwork in physical filing cabinets or boxes in an office. A cloud-based document management system offers cost-saving benefits. It reduces substantial initial capital investment in infrastructure and provides easy sharing, scalability, and integration with third parties. Due to this, SMEs are increasingly adopting cloud-based solutions to streamline their costs and operations.

- Further, case management systems, also called client management systems, help an organization track all the necessary data to meet constituent needs and provide them with programs and services. Healthcare enterprises are deploying rectification solutions for a variety of case management, positively impacting the growth of the global case management solution market.

- In the healthcare industry, if an organization needs to comply with the Health Insurance Portability and Accountability Act (HIPAA), it may want to choose a case management system from a vendor that will sign a Business Associates Agreement (BAA). A BAA establishes a contractual agreement between an organization and the vendor regarding the privacy, security, transmission, storage, and use of protected health information.

- Storing files on an organization's shared drive is insufficient to meet industry compliance standards. Beyond legal mandates, records management strategy is vital to an organization's information life cycle. The strategy at an organizational level will govern how information is created, stored, shared, tracked, and protected.

Content Services Platforms Market Trends

The On-premises Deployment Mode Holds a Dominant Position

- The on-premises deployment type is anticipated to contribute to the market growth during the forecast period significantly. On-premise deployment of CSP solutions requires initial high investment by organizations, though it does not require incremental costs throughout the ownership, as in the cloud deployment type.

- Nowadays, corporate data can be accessed effortlessly from mobile devices; this has raised the amount of data transfer between business parties and has increased the risks of cyber-attacks and data losses. Therefore, security concerns associated with customers' private data are an important reason for the selection of on-premises deployment over the cloud. These kinds of implementations are widespread across large-sized enterprises.

- For instance, according to Cisco Systems, in 2022, worldwide consumer IP traffic data volume was expected to reach 333 exabytes per month at a 27% compound annual growth rate.

- Moreover, Russia's volume of data transferred via mobile internet continuously increased. In 2021, the mobile data traffic volume increased by 131% compared to the previous year.

- Deploying on-premises allows users to keep the solution in-house and grow the solution as it makes sense for the organization. An on-premises solution lives on one's infrastructure, IT department, or other resources and maintains and evolves one's solution. An on-premises deployment means one can become the in-house expert on ECM solutions, and changes and enhancements to one's solution are at the user's fingertips.

- Moreover, the threats to the integrity, confidentiality, and obtainability of organization information are increasing exponentially in countries such as India. Thus, it has become mandatory to focus on providing a standardized information security model based on a business risk approach to establish, implement, operate, monitor, review, maintain, and improve overall information security for customers.

Asia-Pacific is Expected to Gain Significant market Share

- In the Asia-Pacific region, the market is anticipated to witness rapid growth, owing to the increasing data traffic and rapidly growing data and information that needs to be organized in economically developing countries, such as India and China.

- Also, the increasing concern about productivity and shortage of labor with a greying and shrinking population in countries like Japan is driving such nations toward digitalization in every sector. In addition, the Japanese government plans to shift toward digital management of most public records by the time the new National Archives of Japan building opens in 2026, aiming to prevent the record management problems that have hindered the growth of the government.

- Cloud adoption in the region is increasing at a rapid pace, which is expected to impact the market growth over the forecast period positively. Moreover, Singapore is one of the most cloud-ready regions in Asia-Pacific (APAC). It overtook the position of Hong Kong in the latest iteration of the Asia Cloud Computing Association's (ACCA) Cloud Readiness Index (CRI). Additionally, Singapore's government is anticipated to move the bulk of its IT systems to commercial cloud services over the forecast period in ongoing efforts to deliver citizen services faster and cheaper. This is anticipated to impact the market growth positively.

- Public cloud facilities have achieved enormous momentum in the region as companies are trying to improve their digital initiatives. Content service platforms have become the essence of how companies function nowadays to attain higher company agility and meet their clients. Organizations are also collaborating to optimize implementation efficiency and ensure excellent client experience.

- Digital transformation is rapidly becoming a top priority in multiple countries and moving rapidly as a greater number of companies are implementing formal strategies to support their efforts.

Content Services Platforms Industry Overview

The Content Services Platforms Market is moderately competitive and consists of several major players. Few of these major players currently dominate the market in terms of market share. Some major companies in the Content Services Platforms Market include Hyland, OpenText, Box, Laserfiche, Adobe, IBM, Nuxeo, and Objective, among others. These influential players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

In August 2022, OpenText announced the addition of three new solutions to the Salesforce AppExchange. This brought the total number of AppExchange offerings to six and enabled customers of any size to benefit from the governance, productivity, and efficiency of the OpenText content services platform. OpenText Core Content uses a SaaS platform that interfaces with programs like Salesforce to facilitate modern work to assist enterprises in managing information.

In June 2022, Box Inc. announced the enhancement of the Box for Salesforce integration on the Salesforce AppExchange, enabling customers to use Box as the content management solution for signature-based processes and workflows in Salesforce. Customers can send Box files for signature directly from Salesforce by utilizing the capability of Box Sign. New features and developer tools that make it simple for joint customers to establish and execute agreements from any location are also a part of this edition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of SMAC Technologies

- 4.3.2 Increase of Digital Content across the Enterprises

- 4.3.3 Demand for Delivering Contextualized User Experience

- 4.4 Market Restraints

- 4.4.1 Data Privacy and Security Concerns

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions/Software**

- 5.1.1.1 Document and Records Management

- 5.1.1.2 Data Capture

- 5.1.1.3 Workflow Management

- 5.1.1.4 Information Security and Governance

- 5.1.1.5 Case Management

- 5.1.1.6 Other Solutions

- 5.1.2 Services**

- 5.1.2.1 Integration and Deployment

- 5.1.2.2 Consulting

- 5.1.2.3 Support and Maintenance

- 5.1.1 Solutions/Software**

- 5.2 By Deployment Type

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 Small and Medium-Sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Government and Public Sector

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 IT and Telecom

- 5.4.5 Transportation and Logistics

- 5.4.6 Other End-user Industry Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 IBM Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 OpenText Corporation

- 6.1.4 Box Inc.

- 6.1.5 Oracle Corporation

- 6.1.6 Hyland Software Inc.

- 6.1.7 Laserfiche Inc.

- 6.1.8 Hewlett Packard Enterprise (Micro Focus)

- 6.1.9 Adobe Systems Inc.

- 6.1.10 M-Files Inc.

- 6.1.11 Newgen Software Technologies Limited

- 6.1.12 Fabasoft AG

- 6.1.13 Everteam SAS

- 6.1.14 DocuWare Corporation

- 6.1.15 Alfresco Software Inc.