|

市场调查报告书

商品编码

1440246

数位农业:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Digital Agriculture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

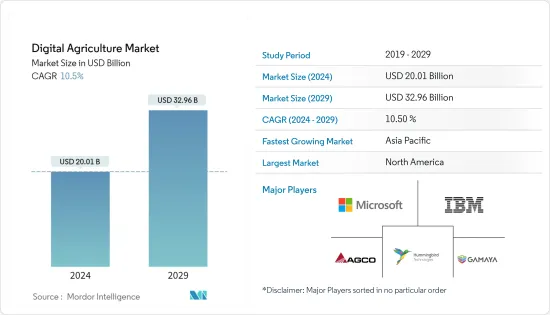

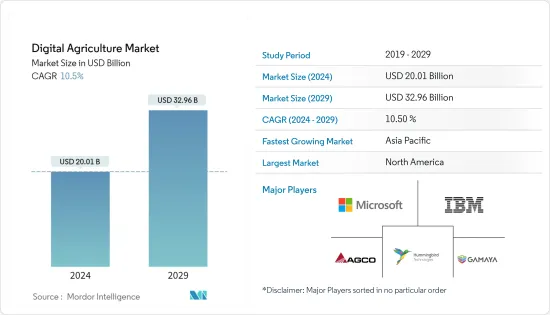

数位农业市场规模预计到2024年为200.1亿美元,预计到2029年将达到329.6亿美元,在预测期内(2024-2029年)复合年增长率为10.5%。

人们越来越认识到数位农业在优化农业生产方面的好处,正在推动农业市场的繁荣。随着人口增长对粮食的需求增加,数位农业工具的引入是不可避免的。

人们对粮食安全和营养的日益关注预计将为该行业的蓬勃发展提供一些机会。预计美国将进行大量投资来培育未来的食品生态系统。随着消费者对从农场到餐桌的新鲜度的了解进一步发展,我们预计美国零售店的新鲜蔬菜供应量将会增加。例如,2021 年 6 月,美国科学基金会的网路物理系统计画和美国农业部国家食品和农业研究所(NIFA) 向爱荷华州立大学和伊利诺伊大学厄巴纳分校的工程师领导的研究人员提供了700 万美元的津贴。假如。 - 加强农场管理业务,包括单一作物层面的感测、建模和决策。

英国政府已在其产业战略中引入人工智慧(AI),以提高作物生产力。该国承诺2027年将研发支出增加到GDP的2.4%。此外,剑桥还宣布了一个耗资 5 亿欧元的新计划,旨在加强英国作为不断发展的农业技术产业创新者的地位。该开发案将容纳多达 4,000 名员工,并将农业和科技公司聚集在一起,在世界农业创新和生产力中心发挥领导作用。

各国关于精密农业的策略政策决策预计将鼓励农民采用相关技术。农场咨询服务弥合了科学与实践之间的差距。这些服务帮助农民采用市场最新趋势的新技术和创新技术。它们可以更好地利用可用资源,具有成本效益,并有助于应对挑战。

技术进步和创新是推动数位农业市场的关键因素之一,帮助农民有效利用资源,最大限度地提高产量并最大限度地减少损失。因此,有限的自然资源稀缺性以及满足不断增长的人口需求的不断增长的需求预计将在预测期内推动全球数位农业市场。

数位农业市场趋势

提高生产力和改善作物健康的压力越来越大

农民始终面临着用更少的化学物质生产更多食物和饲料的压力。同时,必须减少能源和劳动力的使用,同时改善环境土地和水资源管理。随着人口的快速增长,养活不断增长的人口变得非常困难,提高农业生产力的压力很大。使用软体和物联网 (IoT) 工具(例如精密农业)可以满足所有这些要求。

根据粮农组织的资料,水稻、小麦、大麦、玉米和其他谷物等主要谷物的产量大幅下降,从2019年的41,079汞/公顷降至2020年小麦的40,708汞/公顷。大麦和其他粗粮也观察到类似的下降趋势。精密农业帮助农民了解他们需要种植什么种子、需要施用多少肥料、收穫作物的最佳时间以及预期产量。

欧洲和北美的技术引进提高了作物生产力。例如,2022年6月,法国Idele(Institut d'Elevage)开发了一个名为CAP'2ER的资料库线上应用程序,该资料库以30组活动资料进入该计划,以确定生态学指标。该应用程式包括农场的年度燃料消费量总量、动物生产力(繁殖力、生长情况、销售年龄)、购买的饲料、肥料数量和管理、树木、灌木、灌木、树篱、草屑、砖石等资讯。石墙、水体。

巴西精密农业研究网络(Embrapa)由巴西农业研究公司创立,针对大豆、玉米、小麦、稻米、棉花、牧草、尤加利、松树等作物开发了多种工具。巴西精密农业的应用提高了作物产量并保护了环境。例如,2022 年 6 月,圣卡洛斯酒庄 Terras Altas(里贝朗普雷图,SP)与圣保罗州立大学合作开展了一项研究,透过采用双重修剪系统的精密农业生产优质葡萄酒。和其他管理实务。

因此,使用MapShots、AgDNA和AgroSense等精密农业软体将有助于提高作物生产力,从而改善土壤健康并推动世界其他地区对数位农业的需求。

亚太地区是成长最快的市场

近年来,中国农业部门在采用智慧农业实践方面经历了一场突破性的革命。儘管物联网 (IoT)行动电话设备、基于齿轮感测器的灌溉和施肥设备以及阀门位置感测器等基于感测器的技术的出现对该行业来说相对较新,但该国正在经历对感测器的新需求。发现,这主要是由于机械化率的提高和农民采用的智慧农业实践。

中国对农业科技进步的贡献率,标誌着中国农业现代化的振兴策略。 2020年,中国中央政府推出了「数位乡村」试点计划,以促进资讯科技的应用,刺激国内消费,带动行动互联网主导的经济繁荣。

同样,印度农业对数位化的需求不断增长是众所周知的,并且正在努力实现现有价值链的数位化。 2021 年 9 月,联邦农业和农民福利部长与 CISCO、Ninjacart、Jio Platforms Limited、ITC Limited 和 NCDEX e-Markets Limited 签署了五份谅解备忘录 (MoU),并启动了 2021-2025 年数字农业任务。 。 (NeML),透过先导计画促进数位农业。 2021-2025年数位农业任务旨在支援和加速基于人工智慧、区块链、遥感探测、GIS技术以及无人机和机器人使用等新技术的计划。

2020 年 2 月,Reliance Group of Companies推出了Jio Agri (JioKrishi) 平台,旨在数位化农业生态系统,并为整个价值链上的农民赋能。该平台的核心功能使用独立的应用程式资料来提供咨询服务。高级功能使用各种来源的资料并将资料输入人工智慧 (AI)/机器学习 (ML) 演算法,以提供准确、个人化的建议。该倡议的先导计画将在贾尔纳和纳西克(马哈拉斯特拉邦)进行。因此,技术主导农业机械的可用性不断增加,以及政府对设立技术公司的资助不断增加,正在推动亚太地区数位农业市场的发展。

数位农业产业概况

数位农业市场高度分散,各种小公司与巨头争夺市场占有率。市场上产生收益的主要企业包括 AGCO Corporation、HummingBird Technologies、IBM Corporation、Gamaya SA、Bayer Cropscience AG、Microsoft Corporation 和 Trimble Inc.。

随着领导企业采取併购、扩张、合作和产品发布等各种策略来扩大业务和进行投资,预计未来市场将变得更加整合。两家公司都可能推出新的产品线,并与其他公司合作,以实现数位农业业务的多元化。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 新进入者的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 作物监测

- 科技

- 引导系统

- 遥感探测

- 可变利率技术

- 解决方案

- 硬体

- 软体

- 服务

- 其他解决方案

- 目的

- 现场测绘

- 土壤监测

- 作物调查

- 产量监控

- 浮动利率的应用

- 其他用途

- 科技

- 人工智慧

- 目的

- 天气追踪

- 精密农业

- 无人机分析

- 配置

- 云

- 本地

- 混合

- 目的

- 精密农业

- 目的

- 作物管理

- 财务管理

- 农场库存管理

- 人力资源管理

- 气象追踪与预报

- 其他用途

- 类型

- 本地/基于网路

- 云端基础

- 目的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 澳洲

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- Company Profile

- Gamaya SA

- Easytosee Agtech

- AGCO Corporation

- Small Robot Company

- Microsoft Corporation

- IBM Corporation

- Hummingbird Technologies Limited

- Deere &Company

- AgEagle Aerial Systems Inc.

- Bayer CropScience AG

- Case IH Agriculture(CNH Industrial America LLC.)

- DTN(CLEAR AG SOLUTIONS)

- Conservis Corporation

- Raven Industries

- Topcon Positioning Systems

- Trimble Inc.

第七章市场机会与未来趋势

The Digital Agriculture Market size is estimated at USD 20.01 billion in 2024, and is expected to reach USD 32.96 billion by 2029, growing at a CAGR of 10.5% during the forecast period (2024-2029).

The increasing awareness about the benefits of digital agriculture in optimizing agricultural production has resulted in a great boom in the agriculture market. With the growing food demand, owing to the increasing population, the adoption of digital agriculture tools is inevitable.

Growing concerns regarding food security and nutrition are anticipated to provide several opportunities for the industry to prosper. The United States is expected to invest a significant share in facilitating the ecosystem for future foods. As more consumer insights are developed in terms of 'fresh-from-farm-to-table,' the availability of freshly harvested vegetables across retail outlets is expected to increase in the United States. For instance, in June 2021, the National Science Foundation's Cyber-Physical Systems program and the USDA's National Institute of Food and Agriculture (NIFA) provided USD 7 million in grants to researchers led by engineers from the Iowa State University and the University of Illinois Urbana-Champaign on operations of farm managing, like sensing, modeling, and decision-making at the level of individual crops.

The United Kingdom government, in its industrial strategy, has put artificial intelligence (AI) aimed at escalating crop productivity. The country has committed to boosting R&D spending to 2.4% of the GDP by 2027. Furthermore, a new EUR 500 million project has been announced in Cambridge, which seeks to cement Britain's position as an innovator in the growing agri-tech industry. The development will accommodate up to 4,000 employees and will bring together agricultural and tech companies to spearhead a center of global agricultural innovation and productivity.

Strategic policymaking for precision farming by the countries is expected to encourage farmers to adopt the related technologies. Farm advisory services are bridging the gap between science and practice. These services help farmers in adopting new innovative technologies, which is the latest trend in the market. They are more efficient in utilizing the available resources, are cost-effective, and can help face challenges.

Technological advancements and innovations are among the major factors driving the digital agriculture market, helping farmers maximize their yield and minimize losses with efficient use of resources. Hence, the increased need to meet the demand of the growing population, along with the limited scarcity of natural resources, is anticipated to drive the market for digital farming globally during the forecast period.

Digital Agriculture Market Trends

Increasing Pressure for Higher Productivity and Improved Crop Health

There is constant pressure on the farmers to produce more food and animal feed with lesser amounts of chemicals. At the same time, it is essential to use less energy and labor while improving the management of environmental land and water. With the population growing rapidly, it is becoming very difficult to feed the increasing population, thereby creating high pressure to increase agricultural productivity. The use of software such as precision farming, along with the Internet of Things (IoT) tools, is a solution to all these requirements.

According to the FAO data, the yield for major cereal crops like rice, wheat, barley, corn, and other grains reduced considerably from 41,079 hg/ha in 2019 to 40,708 hg/ha in 2020 for wheat; a similar reduced trend for barley and other coarse grains was observed. Precision farming helps farmers know the seeds that have to be planted, the number of fertilizers that need to be applied, the best time to harvest the crops, and the expected output.

The adoption of technology in Europe and North America has increased crop productivity. For instance, in June 2022, Idele (Institut d'Elevage), France, developed a data-based online application called CAP'2ER, with thirty sets of activity data entered into the program to determine agro-ecological indicators. This application analyzes five sets of databases, such as livestock, manure management, fields, feed, and energy consumption, by analyzing total annual fuel consumption, animal productivity (fertility, growth, and marketing age), feed purchased, manure quantities and management, number of trees and thickets, shrubs, hedges, grass strips, stone piles and stone walls, and water bodies on the farm.

The Brazilian Precision Agriculture Research Network (Embrapa), established by Brazil Agricultural Research Corporation, has generated various tools for soybean, maize, wheat, rice, cotton, pasture, eucalyptus, pines, and other crops. The use of precision agriculture in Brazil has led to improvements in crop yields as well as environmental protection. For instance, in June 2022, a study was conducted by Embrapa instrumentation, Sao Carlos, in the winery Terras Altas (Ribeirao Preto, SP), in partnership with the Sao Paulo State University, to produce distinguished wines by precision farming by double pruning systems and other management practices.

Thus, the use of precision farming software, such as MapShots, AgDNA, AgroSense, and others, will help increase crop productivity, thereby improving soil health and driving the demand for digital agriculture in other regions of the world.

Asia-Pacific is the Fastest-growing Market

The Chinese agricultural sector has undergone a groundbreaking revolution with respect to the adoption of smart farming practices in recent years. Although the advent of sensor-based technologies, such as Internet of Things (IoT) cellular devices, gear tooth sensor-based irrigation and fertilization equipment, and valve position sensors, among others, is relatively new in the domain, the country has been witnessing a new-found demand for sensors, primarily due to the increased rate of mechanization and smart agricultural practices adopted by the farmers.

China's contribution rate to its agricultural science and technology progress indicates the country's revitalization strategy in terms of agricultural modernization. In 2020, the Chinese central government launched a pilot project named ''digital village', promoting the use of information technology to stimulate domestic consumption, leading to a boom in the mobile internet-driven economy.

Similarly, the rising demand for digitization in Indian agriculture is well acknowledged, with efforts being made toward digitizing the prevailing value chain. In September 2021, the Union Minister of Agriculture & Farmers Welfare launched the initiation of the Digital Agriculture Mission 2021-2025 while signing five memoranda of understanding (MoUs) with CISCO, Ninjacart, Jio Platforms Limited, ITC Limited, and NCDEX e-Markets Limited (NeML), to forward digital agriculture through pilot projects. The Digital Agriculture Mission 2021-2025 aims to support and accelerate projects based on new technologies, like AI, blockchain, remote sensing, and GIS technology and the use of drones and robots.

In February 2020, the Jio Agri (JioKrishi) platform was launched by Reliance Group of Company to digitize the agricultural ecosystem along the entire value chain to empower farmers. The core function of the platform uses stand-alone application data to provide advisory services. The advanced functions use data from various sources, feed the data into artificial intelligence (AI)/machine learning (ML) algorithms, and provide accurate, personalized advice. The pilot project for this initiative will take place at Jalna and Nashik (Maharashtra). Thus, the rise in technology-driven agricultural equipment availability and an increase in government funding for the establishment of tech firms are driving the digital agriculture market in the Asia-Pacific region.

Digital Agriculture Industry Overview

The digital agriculture market is highly fragmented, with various small players competing against giant firms to occupy market share. Some of the major revenue-generating companies in the market include AGCO Corporation, HummingBird Technologies, IBM Corporation, Gamaya SA, Bayer Cropscience AG, Microsoft Corporation, and Trimble Inc.

The market is expected to be more consolidated in the future, with the major players expanding and investing in their businesses by adopting various strategies, such as mergers and acquisitions, expansions, partnerships, and product launches. The companies are likely to introduce new product lines and partner with other firms to diversify their digital agriculture businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Crop Monitoring

- 5.1.1 Technology

- 5.1.1.1 Guidance System

- 5.1.1.2 Remote Sensing

- 5.1.1.3 Variable Rate Technology

- 5.1.2 Solution

- 5.1.2.1 Hardware

- 5.1.2.2 Software

- 5.1.2.3 Services

- 5.1.2.4 Other Solutions

- 5.1.3 Application

- 5.1.3.1 Field Mapping

- 5.1.3.2 Soil Monitoring

- 5.1.3.3 Crop Scouting

- 5.1.3.4 Yield Monitoring

- 5.1.3.5 Variable Rate Application

- 5.1.3.6 Other Applications

- 5.1.1 Technology

- 5.2 Artificial Intelligence

- 5.2.1 Application

- 5.2.1.1 Weather Tracking

- 5.2.1.2 Precision Farming

- 5.2.1.3 Drone Analytics

- 5.2.2 Deployment

- 5.2.2.1 Cloud

- 5.2.2.2 On-premise

- 5.2.2.3 Hybrid

- 5.2.1 Application

- 5.3 Precision Farming

- 5.3.1 Application

- 5.3.1.1 Crop Management

- 5.3.1.2 Financial Management

- 5.3.1.3 Farm Inventory Management

- 5.3.1.4 Personnel Management

- 5.3.1.5 Weather Tracking and Forecasting

- 5.3.1.6 Other Applications

- 5.3.2 Type

- 5.3.2.1 Local/Web-based

- 5.3.2.2 Cloud-based

- 5.3.1 Application

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 Australia

- 5.4.3.3 China

- 5.4.3.4 Japan

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profile

- 6.3.1 Gamaya SA

- 6.3.2 Easytosee Agtech

- 6.3.3 AGCO Corporation

- 6.3.4 Small Robot Company

- 6.3.5 Microsoft Corporation

- 6.3.6 IBM Corporation

- 6.3.7 Hummingbird Technologies Limited

- 6.3.8 Deere & Company

- 6.3.9 AgEagle Aerial Systems Inc.

- 6.3.10 Bayer CropScience AG

- 6.3.11 Case IH Agriculture (CNH Industrial America LLC.)

- 6.3.12 DTN (CLEAR AG SOLUTIONS)

- 6.3.13 Conservis Corporation

- 6.3.14 Raven Industries

- 6.3.15 Topcon Positioning Systems

- 6.3.16 Trimble Inc.