|

市场调查报告书

商品编码

1644441

全球 5G 情势 -市场占有率分析、产业趋势与统计、成长趋势预测(2025-2030 年)Global 5G Landscape - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

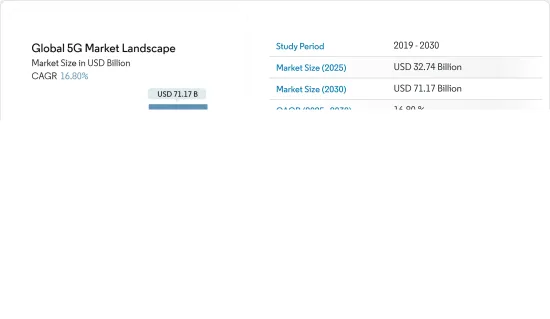

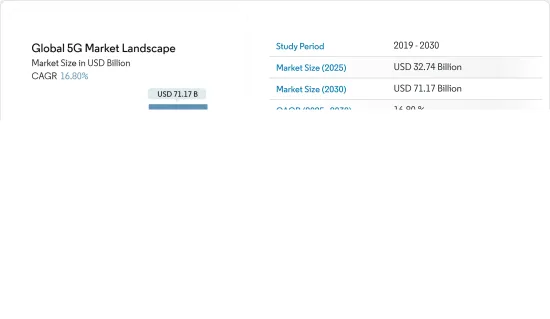

预计 2025 年全球 5G 市场规模为 327.4 亿美元,到 2030 年将达到 711.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.8%。

5G 网路(下一代行动网路标准)提供无缝覆盖、更快的资料速率、更低的延迟、显着提升的效能和高效的通讯,有望提供更好的最终用户体验。

智慧型手机领域将成为受 5G 连线影响的众多领域之一。例如,物联网 (IoT) 和机器对机器 (M2M) 基础设施的进步长期以来受到 4G 下载速度慢和延迟的限制。随着越来越多的设备连接到网路并相互通讯,延迟的累积效应变得更大且更加明显。例如,扩增实境凭藉其速度和频宽的提升,最终将使穿戴式科技无缝融入人们的日常生活。自动驾驶汽车之间的即时通讯对于自动驾驶汽车来说也是一个显着的优势。

此外,5G将大大改善智慧城市公共服务。在交通事故或恐怖攻击等情况下,对公共场所的视讯记录进行即时分析,结合生物识别软体,可以识别危险情况并立即自动向当局发出警报。与目前的CCTV系统不同,支援 5G 的装置将能够透过无线方式接收更新,并且资料管理平台将连结不同的服务。此外,5G 连接设备将扩展到无人机和机器人等移动形式,这些形式可以放置在行动网路覆盖的任何地方,从而无需固定布线。

此外,政府对扩大智慧城市计划的支持也是市场的主要动力。在住宅和城市事务部的支持下,印度的目标是到2023年发展4000座人口达500万的城市。此外,在英国,桑德兰市议会于 2021 年 10 月与 BAI Communications 签订了为期 20 年的策略伙伴关係,以设计、建置和营运下一代数位基础设施,包括私人 5G小型基地台网路。新的 5G 网路将有助于实现桑德兰市议会成为完全数位化智慧城市的愿景。

事实上,在新冠疫情爆发之后,消费者和专业人士比以往任何时候都更加依赖可靠、快速的网路效能,从而导致对连线的需求增加。例如,疫情限制措施导致许多企业和工业设施关闭,扰乱了製造流程和供应链。具有5G通讯功能的远端控制设备突然变得不可或缺。这使得人类驾驶员能够更快、更准确、更远距离地操作起重机、无人机和其他工业机械。这只是 5G 在确保业务连续性和提高未来中断时的弹性方面发挥关键作用的众多方式之一。

另一方面,5G连接预计将为频谱增加多层复杂性,以提供全面的服务。频谱有限是5G发展的一大挑战。 5G 的频宽要求意味着更高的频段对于提供更快、更高品质的连线至关重要。 5G 标准使用毫米波,其波长比 4G 使用的波长短得多。波长更短意味着 5G 连接可以比 4G 更快地传输资料,而且通讯也更短。 4G波长的范围约为10英里。 5G 波长的范围约为 1,000 英尺,不到 4G 覆盖范围的 2%。因此,为了确保可靠接收 5G 讯号,需要在各处安装许多 5G 基地台和天线,从而增加安装成本。

5G市场趋势

5G 设备是市场驱动因素之一

- 据 GSMA 称,巴西、印尼和印度等收入水平较高的较大经济体将掀起新一轮 5G 浪潮,这可能会刺激 5G 设备的大规模生产,使低收入消费者更容易获得这些设备。此外,鑑于迄今为止大多数 5G 应用和使用案例都集中在已开发市场,5G 可能会刺激新兴地区创造出全新的商业和消费者应用。同时,5G行动电话的平均零售价目前低于 500 美元,Realme 等一些供应商提供的智慧型手机售价低于 150 美元。这将加速5G在欠开发中地区的推广,创造提供由该技术支援的尖端服务的机会。

- 此外,爱立信预计,2019年至2027年间,全球5G用户数将呈指数级增长,从1,200多万增至40多亿。预计签订合约最多的地区包括东北亚、东南亚、印度、尼泊尔和不丹。此外,GSMA预测,到2025年,5G连线将占亚太地区、北美和大中华区已开发地区所有行动连线的一半以上。

- 此外,笔记型电脑製造商正在拥抱 5G 技术以占领更大的市场占有率。例如,晶片製造商英特尔去年为宏碁、华硕和惠普的 30 多款笔记型电脑型号配备了其新型 5G Solution 5000 调製解调器。此外,英特尔正在增强其 Tiger Lake 系列 5GHz 超薄笔记型电脑。英特尔 5G 解决方案 5,000 是一款 M.2 模组,已通过 AT&T 和 Spring 等通讯业者的全球覆盖认证。英特尔可分别提供高达 1.25Gbps 的上传速度和 4.7Gbps 的下载速度。

- 此外,现代摩比斯今年10月宣布,已开发出基于5G的汽车通讯模组,以增强包括自动驾驶在内的联网汽车系统的性能。此模组可实现大量资料的即时处理。根据该提供者介绍,新模组采用超高速、超低延迟、超连接技术,结合了记忆体和通讯操作、射频电路和 GPS。

- 相反,大多数美国智慧型手机公司依靠 5G 设备来瞄准广泛的人群,这可能会影响消费者升级到 5G 的选择。据NPD集团称,美国智慧型手机用户的手机使用时间越来越长,对目前的智慧型手机市场构成了挑战。製造商和通讯业者希望 5G 能够帮助启动升级週期。但定价可能是另一个障碍。

中国占有绝对份额

- 中国预计将在 5G 汽车的早期推出方面发挥引领作用,并最终得到国内政府在基础设施能力、本地供应链的先进研发以及消费者对汽车内外即将推出的技术的兴趣方面的大力早期支持。这些车辆将专门针对中国庞大的国内市场,这一事实进一步简化了采用过程,因为 5G 基础设施和标准很可能将在整个领域中标准化。

- 南山区政务服务资料管理局介绍,作为一级城市发展政区,南山坚持做深做细顶层设计,积极布局5G+,支撑市级管理和服务。该计划透过考虑管治、公共服务和工业发展来解决大多数紧迫需求。从终端到网络,正在建构具有5G+IoT能力的特大城市级认知网络。透过全景式、层次式、动态式呈现城市5G细分市场成长趋势,再形成5G+智慧城市组合效应。

- 同样,根据浙江省丽水市紧急管理局介绍,丽水是全国面积最大的地级市。全市森林覆盖率近90%,水资源覆盖率5%,农业用地覆盖率5%,各类灾害频繁,损失庞大。视觉化系统对于做出明智的决策、有效地指挥和调度以及快速解决事件至关重要。丽水5G紧急视觉化系统是根据紧急管理局惠及民生的要求,集云、管、端为一体的平台。该平台将搭载5G网路、5G移动方舱等能力,提供灾害预警、远端搜救、卫星通讯等功能。

- 此外,在热带海南省,中国联通和华为打造的融合MEC与AI的5G智慧医疗网络,正在提升医疗服务的效率和覆盖范围。市、县医院、340个乡镇卫生院、2693个村卫生室全部配备了远端医疗设备。该网路可以利用人工智慧进行远端咨询和诊断。患者平均等待时间减少了一半,治疗效果增加了 30%。

- 此外,中国正在见证智慧製造工厂的崛起,其中M2M通讯对于整个工厂的高效运作至关重要。这就是为什么各个终端用户产业都采用这项技术并开发 5G 连线的原因。例如,ROBOTECHNIK位于江苏苏州的工厂旨在成为全面支援5G的智慧工厂。该原型工厂计划在营运层部署5G网路取代固网和Wi-Fi连接,使设备更加智能,并推动向工业云端过渡,实现柔性化、智慧化製造。

5G行业概况

5G市场格局高度整合。目前的市场竞争非常激烈,因为所有参与製造的公司都在不断增强其产品供应,利用其高研发能力和投资,其中大多数是市场现有企业。

2022 年 8 月,中国晶片製造商紫光展锐宣布其第二代 5G 晶片将于 2022 年底至 2023 年初推出。据报道,紫光展锐已采用极紫外(EUV)技术开始量产 6nm 5G 设备,该技术是先进晶片製造必不可少的製程。目前,紫光展锐已向市场推出了三款5G晶片。

2022 年 5 月,联发科推出了首款 mmWave 5G 晶片组 Dimensity 1050 系统单晶片 [SoC],可实现无缝连接、显示、游戏和电源效率。 Dimensity 930 和 Helio G99 是该公司扩展其 5G 和游戏晶片组系列的另外两款晶片组。 Dimensity 1050 采用八核心CPU 和台积电 6nm 製造製程打造,结合 mmWave 5G 和 sub-6GHz 辅助网路频谱转换。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 5G 时间轴概览

- 目前采用週期 - 早期采用者、采用者、落后者

- 市场驱动因素(全球设备和终端数量持续成长 | 组件和设备级技术创新推动采用 | 5G 相较于领先具有关键优势 |虚拟网路架构的采用日益增多)

- 市场挑战(标准化延迟|设计与营运挑战)

- 市场机会(工业领域的需求不断增加 | 新兴国家正在努力普及 5G)

- 5G 及未来

- 新冠疫情对 5G 格局的影响

- 主要行业法规政策

第五章 技术简介

第 6 章:5G 应用市场格局

- 全球通讯业者数量 - 试验和商业发布情况(2018 年第二季至第一季)

- 5G部署的国家覆盖范围-投资和商业化趋势

- 行动通信基地台回程传输、大型基地台基地台回程传输和小型基地台基地台回程传输利用率(微波、卫星和 6 GHz 以下)

- 大型基地台基地台

- 小型基地台基地台

- 市场展望

第七章 5G连结市场展望

- 5G连线数(百万)

- 5G连线数(按类型)

- 行动宽频

- 固定无线存取

- M2M 和 IoT

- 关键任务

- 5G覆盖率(分地区)

- 5G 与 4G 渗透率及连接率

- 2G、3G、4G、5G市场占有率,百分比份额

- 美国、日本、欧洲、中国、独联体、拉丁美洲、中东和北非、撒哈拉以南非洲地区的 5G 连结数(2027 年)

- 5G 设备数量(2019 年 3 月 - 2020 年 4 月)

第八章 市场区隔(5G设备市场展望)

- 5G 设备数量(依外形规格)

- 智慧型手机

- CPE(室内/室外)

- 模组

- 热点

- 笔记型电脑

- 工业级 CPE/路由器/网关

- 其他外形规格(无人机、HMD、平板电脑、电视、加密狗等)

- 5G 设备数量(按支援的频谱)

- 低于 6 GHz

- 毫米波

- 两个频谱带

- 主要供应商名单

第九章:5G智慧型手机市场展望

- 智慧型手机出货量(单位:百万部)

- 2022 年品牌市场占有率(%)

- Samsung

- Huawei

- Vivo

- Xiaomi

- LG

- OPPO

第十章:5G 晶片组市场展望

- 5G晶片组市场规模及预测

- 5G 晶片组市场按 IC 类型细分

- RFIC

- ASIC

- 毫米波IC

- 蜂巢 IC

- 5G 晶片组市场依部署细分

- 装置

- CPE

- 网路基础设施

- 其他的

- 供应商格局分析 - 按型号、类型、供应商、DL UL 速度、Sub-6 GHz、mmWave、LTE 相容性列出市场上的 5G 晶片组列表

- 主要供应商:高通、三星、联发科、海思

第十一章 5G连合收益的贡献

- 5G行动收益预测(兆美元)

- 各地区 5G 行动收益预测(单位:十亿美元)

- 欧洲

- 中国

- 日本

- 美国

- 韩国

- 5G 经济贡献(兆美元)(2024-2030 年)

- 5G 对全球劳动力的贡献

- 各主要产业的 5G 投资热门目的地

- 根据对行动宽频、M-IoT 和关键任务服务的投资情况分析关键垂直产业

第十二章 投资分析

第十三章 5G市场展望

The Global 5G Market size is estimated at USD 32.74 billion in 2025, and is expected to reach USD 71.17 billion by 2030, at a CAGR of 16.8% during the forecast period (2025-2030).

With seamless coverage, high data rates, low latency, much better performance, and efficient communications, the 5G network-the next generation of mobile networking standards-is ready to provide an improved end-user experience.

The sphere of smartphones will be one of many things that will be impacted by 5G connectivity. Infrastructural advancements in the Internet of Things (IoT) and Machine-to-Machine (M2M) have, for example, long been constrained by the slow download speeds and latency of 4G. The cumulative effect of any latency will be more significant and observable as more devices are connected to a network and communicating with one another. For instance, augmented reality will eventually enable wearable technology to seamlessly integrate with people's daily lives due to increased speed and bandwidth. Instantaneous communication amongst autonomous vehicles will be quite advantageous for them as well.

Additionally, 5G will dramatically improve smart city services for public security and safety. In instances like a car accident or terrorist attack, real-time analytics of video recordings from public spaces combined with biometric software will be able to identify unsafe circumstances and automatically warn authorities instantly. Contrary to current CCTV systems, 5G-enabled equipment will be able to get updates wirelessly, and data management platforms will link different services. Additionally, 5G connected equipment will be extended to mobile form factors like drones and robots and be able to be installed everywhere there is mobile network coverage, doing away with the requirement for fixed wire.

Furthermore, national governments aiding the expansion of smart city projects is also a key trend in the market. With the support of the Ministry of Housing and Urban Affairs in India, the nation aims to develop 4,000 cities to house a population of 5,00,000 each by 2023. Moreover, in England, Sunderland City Council awarded a 20-year strategic partnership to BAI Communications to design, build and operate next-generation digital infrastructure, including a private 5G small cell network, in October 2021. The New 5G network will realize Sunderland City Council's ambition to be a fully digitally enabled smart city.

Indeed, more than ever, consumers and professionals depend on reliable, fast internet performance after the COVID-19 pandemic, which has increased demand for connectivity. For instance, pandemic restrictions prompted the closure of numerous enterprises and industrial facilities, causing manufacturing processes and supply chains to be disrupted. Remotely controlled devices with 5G communication suddenly became essential. They made it possible for human drivers to operate cranes, drones, and other industrial machinery more quickly, accurately, and from a distance. This is just one of the many ways that 5G could be important for assisting businesses to continue operating and be resilient in the face of any future disruption.

On the flip side, a 5G connection is expected to add multiple layers of complexity to the spectrum due to the all-inclusive nature of services. Limited spectrum availability is a big challenge in the development of 5G. The bandwidth requirements of 5G mean a higher frequency spectrum would be fundamental in delivering high-speed, high-quality connectivity. The 5G standard, which uses millimeter waves, is a lot shorter than the wavelengths 4G uses. The shorter wavelength means a 5G connection can carry much data faster than 4G, but it also means a significantly shorter range. 4G wavelengths have a range of almost 10 miles. 5G wavelengths range about 1,000 feet, not even 2% of 4G's coverage. So, to ensure a robust 5G signal, there is a requirement for many 5G cell towers and antennas everywhere, increasing the setup cost.

5G Market Trends

5G Devices are One of the Factors Driving the Market

- According to GSMA, a new wave of the 5G rollouts in large economies with modest income levels (such as Brazil, Indonesia, and India) could encourage the mass production of 5G devices that are more accessible to lower-income people. It might also encourage the creation of brand-new 5G business and consumer applications in developing regions, given that most 5G applications and use cases to date have been concentrated on more developed markets. In the meantime, the average retail price of a 5G phone has now dropped below USD 500, with some suppliers, like Realme, offering smartphones for less than USD 150. This encourages 5G uptake in less developed regions and creates an opportunity for cutting-edge services based on the technology.

- Further, according to Ericsson, global 5G subscriptions are anticipated to jump dramatically between 2019 and 2027, from over 12 million to over 4 billion subscriptions. The regions with the most significant anticipated subscription numbers include North East Asia, South East Asia, India, Nepal, and Bhutan. Additionally, the GSMA predicts that by 2025, 5G connections will make up more than half of all mobile connections in the Developed Asia Pacific, North America, and Greater China.

- Moreover, laptop manufacturers are incorporating 5G technology to capture a wide market share. For instance, last year, Intel, a chipmaker, offered the new 5G Solution 5000 modem in laptops from Acer, ASUS, and HP in more than 30 laptop models. Additionally, Intel is enhancing its Tiger Lake series of 5GHz-capable ultra-thin notebooks. The Intel 5G Solution 5000 is an M.2 module that has received certification for global coverage from AT&T and Spring, among other carriers. Intel can provide upload and download speeds of up to 1.25 and 4.7 Gbps, respectively.

- Further, in October this year, Hyundai Mobis claimed to have created a 5G-based communication module for automobiles to enhance the performance of connected car systems, including autonomous driving. This module enables real-time, large-volume data processing. According to the provider, the new module uses ultra-high speed, ultra-low latency, and hyper-connection technologies to combine memory and communication operations, as well as radio frequency circuits and GPS.

- On the contrary, as most of the smartphone companies in the United States rely on a wide range of target audiences for 5G devices, this may affect the consumers' choice to upgrade to 5G. According to the NPD Group, US smartphone users hold on to their smartphones for more extended periods, which has presented a challenge for the smartphone market in the recent past. Manufacturers and carriers are expecting 5G to help reinvigorate the upgrade cycle. However, pricing could present another hurdle.

China Holds Prominent Share of the Market

- China is expected to lead the early deployment of 5G-capable vehicles, apex from strong early support from the domestic government in infrastructure capabilities, advanced research and development from the local supply chain, and consumers' appetite for the upcoming technology inside and outside of the vehicle. The fact that these vehicles will be exclusive to China's large domestic market further streamlines adoption because 5G infrastructure and standards are very likely to be standardized across the territory.

- According to the Government Services and Data Management Bureau of Nanshan District, to support city-level administration and services, Nanshan, a developed administrative region in the first-tier city, adheres to a thorough top-level design plan powered by cutting-edge 5G + technology. The program addresses the majority's most urgent requirements by considering governance, public services, and industry development. A super-large city-level cognitive network with 5G + IoT capability has been developed from terminals to networks. It reshapes the coupling effects of 5G + smart cities by presenting growth trends of the urban 5G sector in a panoramic, layered, and dynamic manner.

- Similarly, according to the Bureau of Emergency Management of Lishui, in Zhejiang Province, Lishui is the prefecture-level city with the most significant land area. The city experiences a variety of calamities that frequently occur and result in substantial losses due to its almost 90% forest coverage, 5% water content, and 5% farm area. A visualization system is essential for making informed decisions, effective command and scheduling, and resolving situations promptly. Based on the demands of the Bureau of Emergency Management for the benefit of people's livelihood, Lishui 5G emergency visualization system is a platform integrating cloud, management, and terminal. The platform offers features like disaster early warning, remote search and rescue, and satellite communication thanks to the 5G network, 5G mobile cabin, and other capabilities.

- Further, in the tropical province of Hainan, a 5G smart healthcare network integrating MEC and AI, developed by China Unicom and Huawei, has increased the efficiency and reach of medical services. Each municipal and county hospital, as well as 340 township health centers and 2693 village clinics, all have telemedicine equipment installed. The network offers remote consultations and diagnosis with AI assistance. Average patient wait times have been cut in half, while medical treatment effectiveness has increased by 30%.

- Moreover, China is also witnessing an upward trend in smart manufacturing plants where M2M communication is crucial to the efficient function of the entire plant. Therefore, the increasing uptake of these technologies by various end-user industries is leading to increased development in 5G connections. For instance, the RoboTechnik plant in Suzhou, Jiangsu Province, is moving towards a complete 5G-enabled smart plant. The prototype plant planned to install a 5G network to replace the fixed lines and Wi-Fi connections at the operational layer to make the equipment more intelligent and facilitate the transformation of the industrial applications to the cloud to achieve flexible and smart manufacturing.

5G Industry Overview

The 5G market Landspace is highly consolidated. All the companies involved in the production continue to enhance their product offerings frequently, leveraging their high R&D capabilities and investments, leaving the current market scenario highly competitive and mostly market incumbents.

In August 2022, Chinese chip manufacturer UNISOC released its second-generation 5G chip in the second half of 2022 or the first part of 2023. Extreme ultraviolet (EUV) technology, a crucial process for advanced chip manufacturing, was reportedly used by UNISOC to start mass-producing 6nm 5G devices. UNISOC already has three distinct types of 5G chips on the market.

In May 2022, MediaTek introduced Dimensity 1050 system-on-chip [SoC], the company's first mmWave 5G chipset, which offers seamless connection, displays, gaming, and power efficiency. Dimensity 930 and Helio G99 are two other chipsets that were also introduced as part of the company's expansion of its 5G and gaming chipset families. The Dimensity 1050 is constructed using an octa-core CPU and the TSMC 6nm fabrication process, combining mmWave 5G and sub-6GHz to aid network spectrum migration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 5G Timeline Overview

- 4.3 Current Adoption Cycle -Forerunners, Adopters & Laggards

- 4.4 Market Drivers (Sustained increase in number of devices & endpoints worldwide| Technological innovations at a component & device level to aid adoption| Key benefits offered by 5G over its predecessors| Growing adoption of virtual networking architecture)

- 4.5 Market Challenges (Standardization delays| Design & Operational Challenges )

- 4.6 Market Opportunities (Anticipated rise in demand from industrial sector| Ongoing efforts towards introduction of 5G in emerging countries)

- 4.7 5G and Beyond -The Path Ahead

- 4.8 Impact of COVID-19 on the 5G Landscape

- 4.9 Key Industry Regulations & Policies

5 TECHNOLOGY SNAPSHOT

6 5G ADOPTION MARKET LANDSCAPE

- 6.1 Number of Operators Worldwide-Breakdown by Trials & Commercial Launches (Q2'18- Q1 '20)

- 6.2 Country-level coverage on 5G Adoption - Investment & Commercialization Trends

- 6.3 Total Cell-site Backhaul, Macro & Small Cell-site Backhaul Usage - In Percentage (Microwave, Satellite, Sub-6 GHz)

- 6.3.1 Macro-Cell Site

- 6.3.2 Small-Cell Site

- 6.3.3 Market Outlook

7 5G CONNECTION MARKET LANDSCAPE

- 7.1 Number of 5G Connections, In Millions

- 7.2 Number of 5G Connections, by Type

- 7.2.1 Mobile Broadband

- 7.2.2 Fixed Wireless Access

- 7.2.3 M2M & IoT

- 7.2.4 Mission-Critical

- 7.3 5G Coverage, % of Geography

- 7.4 Adoption of 5G vs 4G, Percentage of Connections

- 7.5 Market share of 2G, 3G, 4G, 5G-Percentage Share

- 7.6 Number of 5G Connections by US, Japan, Europe, China, CIS, LATAM MENA, SSA (2027)

- 7.7 Number of 5G Devices (March 2019 - April 2020)

8 MARKET SEGMENTATION (5G DEVICES MARKET LANDSCAPE)

- 8.1 Number of 5G Devices, by Form Factor

- 8.1.1 Smartphone

- 8.1.2 CPE (Indoor/Outdoor)

- 8.1.3 Modules

- 8.1.4 Hotspots

- 8.1.5 Laptops

- 8.1.6 Industrial Grade CPE/Router/Gateway

- 8.1.7 Other Form Factors(Drones, HMDs, Tablets, TV, Dongles, etc.)

- 8.2 Number of 5G Devices, by Spectrum support

- 8.2.1 Sub-6 GHz

- 8.2.2 mmWave

- 8.2.3 Both Spectrum Bands

- 8.3 List of Major Vendors

9 5G SMARTPHONE MARKET LANDSCAPE

- 9.1 Smartphone Shipments - in Million Units

- 9.2 Brand Market Share, In Percentage, 2022

- 9.2.1 Samsung

- 9.2.2 Huawei

- 9.2.3 Vivo

- 9.2.4 Xiaomi

- 9.2.5 LG

- 9.2.6 OPPO

10 5G CHIPSET MARKET LANDSCAPE

- 10.1 5G Chipset Market Size & Forecasts

- 10.2 5G Chipset Market Segmentation, By IC Type

- 10.2.1 RFIC

- 10.2.2 ASIC

- 10.2.3 mmWave IC

- 10.2.4 Cellular IC

- 10.3 5G Chipset Market Segmentation, By Deployment

- 10.3.1 Device

- 10.3.2 CPE

- 10.3.3 Network Infrastructure

- 10.3.4 Others

- 10.4 Vendor Landscape Analysis - List of Commercially Available 5G Chipsets, by Model, Type, Vendor, DL UL Speed, Sub-6 GHz,mmWave& LTE Compatibility

- 10.5 Key Vendor coverage to include Qualcomm, Samsung, Mediatek, HiSilicon

11 5G CONSOLIDATED REVENUE CONTRIBUTION

- 11.1 5G Mobile Revenue Forecast, In USD Trillion

- 11.2 5G Mobile Revenue Forecast, by Region, In USD Billion

- 11.2.1 Europe

- 11.2.2 China

- 11.2.3 Japan

- 11.2.4 United States

- 11.2.5 South Korea

- 11.3 5G Contribution to Economy, In USD Trillion (2024 - 2030)

- 11.4 5G contribution to global workforce

- 11.5 Major spenders on 5G across key industry verticals

- 11.6 Analysis of key industry verticals based on their investment on Mobile Broadband, M-IoT and Mission Critical Services