|

市场调查报告书

商品编码

1738472

印度资本支出:2025年第一季三年来首次放缓India Capex Starts to Ease in 1Q25 after 3 Big Years |

|||||||

印度政府正在寻求发展本地供应商生态系统,以便在没有外部援助的情况下建立智慧安全的电信网路。需要更多支出来推动新创企业的发展。

本报告探讨了印度电信业资本支出 (CAPEX) 的近期前景,分析了当前支出趋势与先前基于主要营运商(例如 Airtel、BSNL、Jio Platforms 和 Vodafone Idea (Vi))2025 年第一季度财务业绩的预测有何不同,并概述了影响投资决策的关键因素。报告还涵盖了对供应商的影响以及人工智慧、大型语言模型 (LLM) 和资料中心等新领域的发展。

视觉

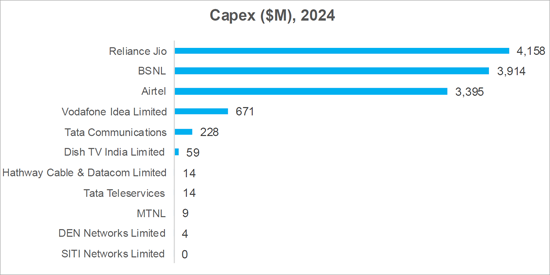

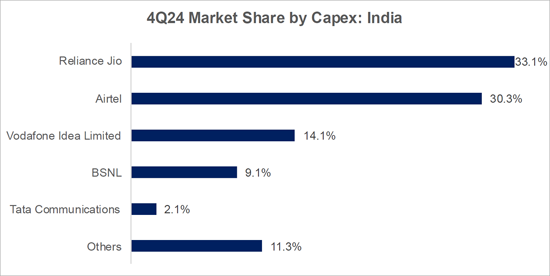

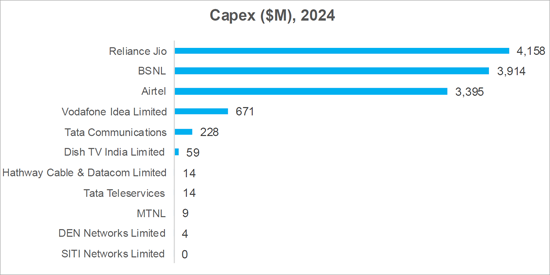

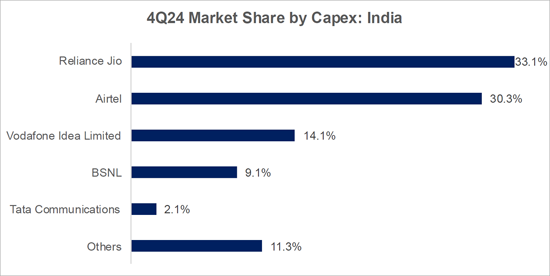

图2:印度的主要设备投资支出企业

CY24 vs 4Q24 ($M and % total)

出处MTN咨询

2024年,印度电信业将产生140亿美元的资本支出和410亿美元的收入,分别占全球总额的4.7%和2.3%。印度的资本支出与收入比率(资本密集度)已连续第三年超过30%。然而,儘管该行业规模庞大且具有战略重要性,但印度许多主要电信业者已表示计划在未来几年内缩减资本支出。这一趋势符合我们的预测,但与印度政府的政策目标相反。

新的政策措施旨在培育一个充满活力的国内电信技术生态系统,使其资金更加充足,也更具前瞻性。但开发下一代电信设备的国内新创公司需要在现实环境中进行测试和改进。但随着营运商为了恢復获利而缩减预算,这些机会正在减少。

如果情况继续这样发展,印度的创新目标可能会受到损害。切实可行的短期解决方案包括政府在BSNL大规模部署全覆盖5G网路方面发挥领导作用,在全国范围内部署5G网路时给予Vi优先待遇,以及提供补贴和激励措施,以提高印度製造的电信设备对海外市场的吸引力。这些措施将支持一些知名的印度新创企业,例如Astrome Tech,Coral Telecom,Frog Cellsat,Galore Networks,Niral Networks,Qbit Labs,Qnu Labs,Prenishq,Resonous Tech,Saankhya Labs,Scytale Alpha,Signaltron,Sooktha,VVDN,WiSig 等。

调查范围

刊载组织

|

|

|

目录

摘要

市场背景:印度

2025年第一季的业绩

BSNL

Bharti Airtel

Jio Platforms

Vodafone Idea (Vi)

附录

图表一览

The government aims to develop a local ecosystem of suppliers able to build smart & secure communications networks without foreign help. More spending is needed to give the startups a boost.

This brief examines the near-term outlook for telecom capital expenditures (capex) in India, based on the 1Q25 earnings of key operators: Airtel, BSNL, Jio Platforms, and Vodafone Idea (Vi). It analyzes how current spending patterns compare with previous forecasts, highlights the main forces shaping investment decisions, explores implications for vendors, and discusses trends in emerging areas such as AI, large language models (LLMs), and data centers.

VISUALS

Figure 2: Major capex spenders in India,

CY24 versus 4Q24 ($M and % total)

Source: MTN Consulting

India closed 2024 with $14.0 billion in telco capex and $41.0 billion in revenues, representing 4.7% and 2.3% of global industry totals, respectively. India's capex to revenue ratio, or capital intensity, has remained above 30% for three straight years. Yet despite the sector's scale and strategic importance, most Indian telcos are now guiding capex downward over the next few years. That trend is aligned with our forecasts, but at odds with the Indian government's policy ambitions.

New policy initiatives aim to foster a vibrant domestic telecom tech ecosystem, better funded and more forward-looking than past efforts. But local startups developing next-gen telecom gear need real-world opportunities to test and refine their solutions. Those opportunities are set to shrink as telcos tighten their budgets to restore profitability.

Absent a shift in trajectory, India risks undercutting its own innovation goals. The most practical near-term solution? A government-led push for BSNL to deploy true 5G networks at scale, favorable treatment for Vi as it attempts to build out nationwide 5G, plus subsidies and other enticements aimed to make local Indian gear attractive to overseas buyers. That would help such Indian startups making waves like Astrome Tech, Coral Telecom, Frog Cellsat, Galore Networks, Niral Networks, Qbit Labs, Qnu Labs, Prenishq, Resonous Tech, Saankhya Labs, Scytale Alpha, Signaltron, Sooktha, VVDN, and WiSig.

Coverage

Organizations mentioned:

|

|

|

Table of Contents

Summary

Market background - India

1Q25 results

BSNL

Bharti Airtel

Jio Platforms

Vodafone Idea (Vi)

Appendix

List of Figures and Tables

- Figure 1: Capex forecast for India telco market and recent changes

- Figure 2: Major capex spenders in India, CY24 versus 4Q24 ($M and % total)

- Figure 3: BSNL capex, capital intensity, and share of global capex

- Figure 4: Airtel capex, capital intensity, and share of global capex

- Figure 5: Jio Platforms capex, capital intensity, and share of global capex

- Figure 6: Vodafone Idea (Vi) capex, capital intensity, and share of global capex