|

市场调查报告书

商品编码

1876599

跨国劳动力及移民解决方案市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Cross-Border Workforce and Migration Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

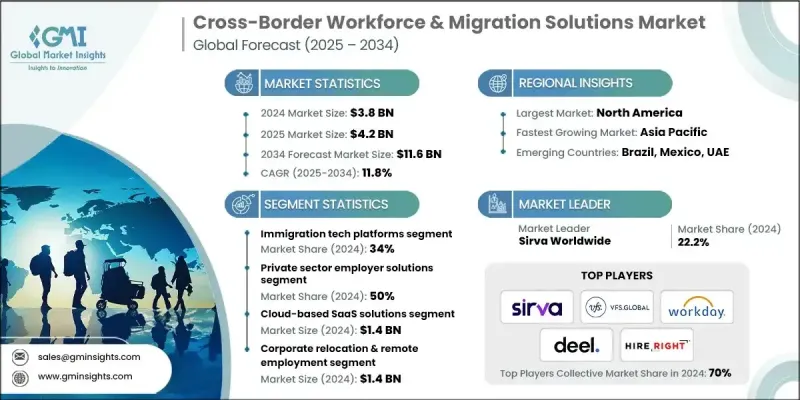

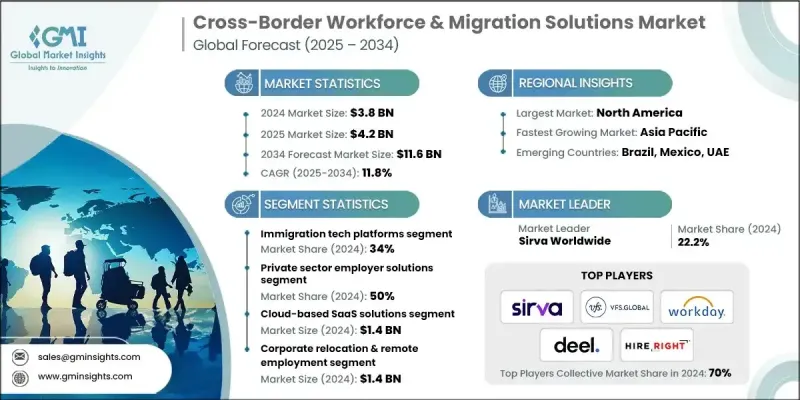

2024 年全球跨国劳动力和移民解决方案市场价值为 38 亿美元,预计到 2034 年将以 11.8% 的复合年增长率增长至 116 亿美元。

市场成长的驱动力来自企业全球化进程的加速、国际人才流动的持续扩大,以及对跨国员工管理中合规性和营运效率日益增长的重视。随着企业越来越多地进行跨国人才调动,服务提供者正积极推进自动化、智慧劳动力管理和数位化集成,以确保营运的无缝衔接和合规性。产业正朝着互联互通、数据驱动和自动化模式转型,重塑传统的人力资源和人才流动框架。人工智慧赋能的合规工具、云端劳动力系统以及自动化签证和移民管理平台的广泛应用,正在改变全球劳动力营运模式。这些创新有助于即时追踪派遣任务、提供预测性合规洞察,并简化雇主、监管机构和外部服务提供者之间的协调。透过采用远端人力资源管理、人工智慧分析和数位化工作流程,企业能够提高精准度、减少延误并优化成本,从而建立智慧化的、技术驱动的全球劳动力生态系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 116亿美元 |

| 复合年增长率 | 11.8% |

2024年,移民科技平台细分市场占据34%的市场份额,预计2025年至2034年将以11.4%的复合年增长率成长。该细分市场在全球劳动力管理中发挥着至关重要的作用,负责签证流程、数位化文件和即时合规性追踪。企业和机构不断部署基于云端的移民系统、人工智慧驱动的验证技术以及生物识别解决方案,持续巩固该细分市场的主导地位。对国际劳动力需求处理流程的透明度、效率和速度的日益增长的需求,持续吸引对先进移民技术的巨额投资。

2024年,私部门雇主解决方案细分市场占据50%的市场份额,预计到2034年将以11.5%的复合年增长率成长。此细分市场的领先地位归功于企业结构日益全球化、混合办公和远距办公模式的扩展,以及对基于技术的合规管理日益增长的需求。全球企业正优先投资于人工智慧驱动的员工流动系统、数位化签证管理和自动化人力资源合规平台,以简化跨多个司法管辖区的员工入职和调动流程。

美国跨国劳动力和移民解决方案市场占88%的市场份额,预计2024年市场规模将达到12亿美元。该地区之所以能够保持领先地位,得益于其高度集中的跨国公司、先进的数位基础设施以及互联劳动力平台的广泛应用。在北美营运的公司正越来越多地部署基于云端的人力资源系统、自动化移民管理工具和即时合规追踪系统,以增强全球流动性。该地区成熟的雇主记录(EOR)服务和整合式薪资解决方案,使企业能够在确保完全合规的同时,有效率地管理跨境员工。

全球跨境劳动力与移民解决方案市场的主要参与者包括Workday、Velocity Global、Papaya Global、HireRight、VFS Global、Deel、Sirva Worldwide、Topia、Envoy Global和Equus Software。这些关键企业正采取多种策略来巩固其全球布局并提升竞争优势。各公司正与企业客户、政府和技术供应商建立联盟,以开发可扩展的云端移民管理系统。对自动化、预测分析和人工智慧驱动的合规平台的投资,正在提高服务的精准度并最大限度地减少人工干预。一些公司还在统一的平台中整合数位化入职、签证管理和员工追踪功能,以提供端到端的流动性解决方案。向新兴经济体的地理扩张,以及人力资源技术生态系统的持续创新,使市场参与者能够提高客户留存率并扩展服务组合。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 全球人才流动性增强与国际扩张

- 快速的数位转型和劳动力流程自动化

- 严格的监管和合规要求

- 雇主记录 (EOR) 和全球薪资解决方案的日益普及

- 产业陷阱与挑战

- 复杂且不断变化的监管环境

- 资料安全和隐私问题

- 市场机会

- 人工智慧、预测分析和自动化技术的融合

- 拓展新兴市场与欠发达市场

- 全球远距办公人员队伍的扩张

- 企业搬迁与人才流动计划

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 移民和签证规定

- 劳动法和就业合规

- 税收和社会保障法规

- 资料隐私和安全合规性

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 基于云端的SaaS平台

- 人工智慧和机器学习的融合

- 行动和非接触式解决方案

- 区块链和分散式帐本系统

- 整合技术生态系统

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 最佳情况

- 劳动力流动趋势

- 远距和混合办公室全球化

- 数位游民计画和全球自由职业的兴起

- 雇主与员工关係的变化

- 移民政策改革与国际合作

- 劳动市场分析与人才流动图谱

- 劳动力人口统计分析

- 按技能等级分類的移工分布

- 性别多元与包容趋势

- 年龄和代际劳动模式

- 教育和专业资格简介

- 政策、贸易与地缘政治影响

- 未来展望与策略建议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依解法划分,2021-2034年

- 主要趋势

- 移民科技平台

- 流动性和搬迁管理

- 劳动力集中管理系统

- 劳动合规与验证系统

- 数位身分和背景调查

第六章:市场估计与预测:依技术平台划分,2021-2034年

- 主要趋势

- 基于云端的SaaS解决方案

- 人工智慧和机器学习平台

- 行动和非接触式解决方案

- 区块链和分散式帐本系统

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 企业搬迁和远距就业

- 技术工人移民

- 季节性及低技能劳动力流动性

- 医疗和教育流动性

- 国际学生移民

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 私部门雇主解决方案

- 科技与高技能产业解决方案

- 政府机构和监管机构

- 医疗保健产业迁移解决方案

- 农业和季节性工作管理

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Global Player

- Deel

- Envoy Global

- Equus Software

- Fragomen

- HireRight

- Papaya Global

- Topia

- Velocity Global

- VFS Global

- Workday

- Regional Player

- Airswift

- Cartus

- GulfTalent

- HireBorderless

- Mercans

- Rippling

- Santa Fe Relocation

- Sirva Worldwide

- Weichert Workforce Mobility

- Worksome

- 新兴参与者

- Lano

- MokaHR

- Newland Chase

- Relocate Me

The Global Cross-Border Workforce & Migration Solutions Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 11.8% to reach USD 11.6 billion by 2034.

Market growth is driven by the accelerating globalization of businesses, the continuous expansion of international talent mobility, and the growing emphasis on compliance and operational efficiency in managing cross-border employees. As organizations increasingly relocate talent across countries, service providers are advancing toward automation, intelligent workforce management, and digital integration to ensure seamless and compliant operations. The industry is shifting toward connected, data-driven, and automated models that are reshaping traditional human resource and mobility frameworks. The widespread implementation of AI-enabled compliance tools, cloud-based workforce systems, and automated visa and migration management platforms is transforming global workforce operations. These innovations facilitate real-time tracking of assignments, predictive compliance insights, and streamlined coordination between employers, regulatory bodies, and external service providers. By adopting remote HR management, AI-powered analytics, and digital workflows, companies are improving precision, minimizing delays, and optimizing costs, paving the way for intelligent, technology-driven global workforce ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 11.8% |

The immigration tech platforms segment held a 34% share in 2024 and is estimated to grow at a CAGR of 11.4% from 2025 to 2034. This segment plays a critical role in global workforce management by overseeing visa processes, digital documentation, and real-time compliance tracking. The increasing deployment of cloud-based immigration systems, AI-driven verification technologies, and biometric-enabled solutions by corporations and institutions continues to strengthen the segment's dominance. The rising need for transparency, efficiency, and speed in processing international workforce requirements continues to attract substantial investments in advanced immigration technologies.

The private sector employer solutions segment held a 50% share in 2024 and is expected to grow at a CAGR of 11.5% through 2034. The segment's leadership is attributed to the growing globalization of corporate structures, expansion of hybrid and remote work models, and heightened demand for tech-based compliance management. Global enterprises are prioritizing investment in AI-powered workforce mobility systems, digital visa management, and automated HR compliance platforms to streamline employee onboarding and relocation processes across multiple jurisdictions.

United States Cross-Border Workforce & Migration Solutions Market held an 88% share and generated USD 1.2 billion in 2024. The region maintained its dominance due to its strong concentration of multinational organizations, advanced digital infrastructure, and broad adoption of connected workforce platforms. Companies operating in North America are increasingly implementing cloud-based HR systems, automated migration management tools, and real-time compliance tracking to enhance global mobility. The region's mature Employer of Record (EOR) services and integrated payroll solutions allow businesses to manage cross-border employees efficiently while maintaining full regulatory compliance.

Prominent participants in the Global Cross-Border Workforce & Migration Solutions Market include Workday, Velocity Global, Papaya Global, HireRight, VFS Global, Deel, Sirva Worldwide, Topia, Envoy Global, and Equus Software. Key players in the Cross-Border Workforce & Migration Solutions Market are pursuing multiple strategies to reinforce their global footprint and strengthen competitive positioning. Companies are forming alliances with enterprise clients, governments, and technology providers to develop scalable, cloud-enabled migration management systems. Investments in automation, predictive analytics, and AI-driven compliance platforms are enhancing service precision and minimizing manual intervention. Several firms are also integrating digital onboarding, visa management, and workforce tracking within unified platforms to deliver end-to-end mobility solutions. Geographic expansion into emerging economies, coupled with continuous innovation in HR tech ecosystems, allows market participants to increase client retention and expand service portfolios.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Technology Platform

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global talent mobility and international expansion

- 3.2.1.2 Rapid digital transformation and automation of workforce processes

- 3.2.1.3 Stringent regulatory and compliance requirements

- 3.2.1.4 Growing adoption of employer of record (EOR) and global payroll solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex and evolving regulatory environments

- 3.2.2.2 Data security and privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of artificial intelligence, predictive analytics, and automation

- 3.2.3.2 Expansion into emerging and underserved markets

- 3.2.3.3 Expansion of global remote workforces

- 3.2.3.4 Corporate relocation and talent mobility programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Immigration and visa regulations

- 3.4.2 Labor laws and employment compliance

- 3.4.3 Taxation and social security regulations

- 3.4.4 Data privacy and security compliance

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Cloud-based SaaS platforms

- 3.7.2 AI and machine learning integration

- 3.7.3 Mobile and contactless solutions

- 3.7.4 Blockchain and distributed ledger systems

- 3.7.5 Integrated technology ecosystems

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Workforce Mobility Trends

- 3.14.1 Remote and hybrid work globalization

- 3.14.2 Rise of digital nomad programs and global freelancing

- 3.14.3 Changing employer-employee relationships

- 3.14.4 Migration policy reforms and international cooperation

- 3.14.5 Labor Market Analytics & Talent Flow Mapping

- 3.15 Workforce Demographic Analysis

- 3.15.1 Migrant worker distribution by skill level

- 3.15.2 Gender diversity and inclusion trends

- 3.15.3 Age and generational workforce patterns

- 3.15.4 Educational and professional qualification profiles

- 3.16 Policy, Trade, and Geopolitical Influences

- 3.17 Future Outlook & Strategic Recommendations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Immigration tech platforms

- 5.3 Mobility & relocation management

- 5.4 Workforce centralized management systems

- 5.5 Labor compliance & verification systems

- 5.6 Digital identity & background screening

Chapter 6 Market Estimates & Forecast, By Technology Platform, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cloud-based SaaS solutions

- 6.3 AI & machine learning platforms

- 6.4 Mobile & contactless solutions

- 6.5 Blockchain & distributed ledger systems

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Corporate relocation & remote employment

- 7.3 Skilled labor migration

- 7.4 Seasonal & low-skilled workforce mobility

- 7.5 Medical & educational mobility

- 7.6 International student migration

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Private sector employer solutions

- 8.3 Technology & high-skilled sector solutions

- 8.4 Government agencies & regulatory bodies

- 8.5 Healthcare sector migration solutions

- 8.6 Agriculture & seasonal work management

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Deel

- 10.1.2 Envoy Global

- 10.1.3 Equus Software

- 10.1.4 Fragomen

- 10.1.5 HireRight

- 10.1.6 Papaya Global

- 10.1.7 Topia

- 10.1.8 Velocity Global

- 10.1.9 VFS Global

- 10.1.10 Workday

- 10.2 Regional Player

- 10.2.1 Airswift

- 10.2.2 Cartus

- 10.2.3 GulfTalent

- 10.2.4 HireBorderless

- 10.2.5 Mercans

- 10.2.6 Rippling

- 10.2.7 Santa Fe Relocation

- 10.2.8 Sirva Worldwide

- 10.2.9 Weichert Workforce Mobility

- 10.2.10 Worksome

- 10.3 Emerging Players

- 10.3.1 Lano

- 10.3.2 MokaHR

- 10.3.3 Newland Chase

- 10.3.4 Relocate Me