|

市场调查报告书

商品编码

1440385

半导体产业的流程控制 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Flow Control In The Semiconductor Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

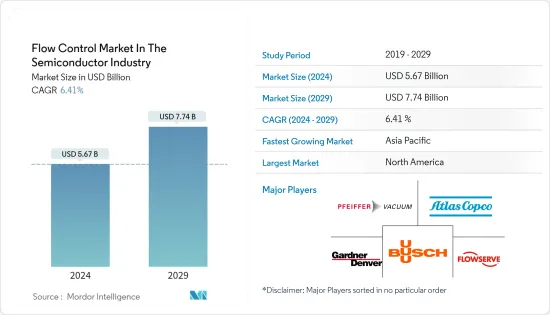

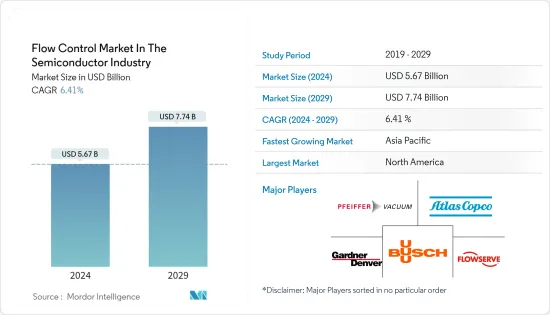

半导体产业的流量控制市场预计将从2024年的56.7亿美元成长到2029年的77.4亿美元,预测期间(2024-2029年)CAGR为6.41%。

半导体製造过程中对更严格製程控制的需求以及需求增加推动的新生产设施投资的增加是推动所研究市场成长的关键因素。

主要亮点

- 流量控制在半导体产业中非常关键,因为包括等离子蚀刻、化学气相沉积(CVD) 和许多其他製程在内的多种製程都需要这些气体中的两种或多种进行反应以产生钝化层或必要的薄膜,其中甚至气流的轻微偏差可能会导致过程失败。因此,精确计量进入处理室的气流至关重要。

- 半导体和电子产业的重大进步预计将推动工业成长。在家工作生活方式的广泛采用也可能加剧大流行引起的电子设备需求的激增。此外,凭藉技术进步和完善的分销网络,欧洲和美国电子製造商努力扩大在新兴国家的业务。此外,消费性电子产品在中国和印度年轻人中的日益普及预计将增加对半导体晶片的需求,进而对研究市场的成长产生正面影响。

- 在需求成长的推动下,半导体产业也出现了显着成长。例如,根据半导体产业协会(SIA)的数据,2022年全球半导体产业销售额达到5,801.3亿美元,比上年的5,558.9亿美元成长4.4%。儘管成长预计会放缓,但 SIA 预计 2023 年收入将达到 5,565.7 亿美元,但稳定成长将对所研究市场的成长产生积极影响。

- 由于全球和本地主要参与者的存在,目前所研究的市场是分散的。随着半导体製造的复杂性不断增加,对流量控制设备的要求也在增加,并且需要更复杂和技术先进的泵浦、阀门和密封件。全球对半导体产业能源效率研发和设施升级的投资也是企业之间激烈竞争的重要驱动力。市场上不断的产品开发和併购进一步增强了市场的竞争力。

- 然而,预计半导体製造成本较高仍将继续成为研究市场成长的主要挑战因素之一。此外,考虑到与半导体产业相关的应用的关键性质,设计流量控制设备/组件所涉及的设计复杂性也对所研究市场的成长提出了挑战。

- COVID-19 大流行对所研究的市场产生了不利影响,特别是在初始阶段,因为全球范围内实施的广泛封锁严重扰乱了晶片製造商的供应链和製造能力。然而,疫情期间对半导体晶片的需求大幅增加,预计这种情况将在预测期内持续下去,从而推动对新生产设施的投资,进而推动对流量控制解决方案的需求。

流量控制市场趋势

机械密封成长最快

- 机械密封的主要功能是防止流体或气体通过轴和容器之间的间隙洩漏。机械密封由两个由碳环隔开的面组成。旋转设备与静止的初始面接触。此外,密封圈(第一面)是密封件的主要部件,设备中的弹簧、波纹管或流体产生的机械力作用在密封圈上。在半导体产业中,密封件总是安装在处理系统的区域中,这些区域需要承受高腐蚀性气体、液体、气体和等离子体,通常在真空条件或高温下。

- 近年来,机械密封市场出现了大幅成长。预计未来几年将继续成长,这主要是由于对半导体製造设施的投资不断增加。在新兴国家,人工智慧、机器学习和物联网的兴起以及智慧型手机和消费性电子产品的发展预计将推动半导体产业的进一步发展政策和投资。集装式密封、平衡和不平衡密封、推桿和非推桿密封以及传统密封是影响机械密封市场扩张的机械密封的例子。

- 在半导体产品的製造中,密封可靠性和减少污染至关重要。化学过滤、化学转移、AODD 泵浦密封和硅片製造是重要的半导体应用,其中机械密封已被证明是最佳选择。

- 沉积、蚀刻、灰化/剥离、等离子体和热处理或退火是协同製程技术,构成了弹性体密封材料最困难的环境。这些在半导体积体电路的製造过程中经常遇到。采用无尘室製造的具有低颗粒和微量金属污染的密封件,以最大限度地减少产量损失和化学侵蚀率。这些密封件具有多种优势,例如增加系统正常运作时间、增加平均故障间隔时间 (MTBF)、减少湿式清洁或机械清洁频率,以及透过降低耗材成本 (CoC) 降低拥有成本 (CoO)。

- 近年来,数位化和自动化趋势显着增强了对半导体的需求。例如,根据SIA和WSTS的数据,2022年全球半导体销售额估值达到5,801.3亿美元,较去年同期成长4.4%。儘管预计未来几年将趋于稳定,但预计在预测期内将逐步成长,预计这将推动所研究市场在预测期内的成长。

预计美国将占重要市场份额

- 近年来,美国开始采取多项措施来促进半导体产业的成长。例如,2022年,拜登政府签署了《CHIPS和科学法案》。这项耗资 527 亿美元的工业计画旨在支持研究、提高供应链弹性并重振美国的半导体製造业。

- 自美国《晶片与科学法案》首次提出到2022年通过,美国国内晶片製造设施提案不断增加。新工厂的开发和研究与设计项目已获得投资总额超过2000亿美元。为了吸引原始晶片製造商(OCM)进入其边境,美国各州实施了立法,要求他们提供额外的融资。

- 俄勒冈州正在考虑为 OCM 提供总计 2 亿美元的激励措施和宽免贷款。纽约州承诺提供 55 亿美元的州激励措施,而密西根州则批准了超过 8 亿美元的激励措施。自《CHIPS 和科学法案》颁布以来,OCM 已将初始投资增加了两到三倍。台积电扩大对亚利桑那州工厂的投资,从120亿美元增加至400亿美元。

- 由于《晶片与科学法案》,美国正在稳步提高其在全球半导体生产中的比重,527亿美元旨在用于半导体产业的整体发展,其中包括390亿美元用于製造业激励、13.2美元10 亿美元用于研发和劳动力发展,5 亿美元用于半导体供应链活动和国际资讯通讯技术(ICT) 安全。

流量控制行业概况

由于各种主导品牌争夺全球市场份额,流量控制设备供应商之间的竞争程度适中,使得市场竞争适中。近年来,由于消费性电子产品和智慧型手机在发展中国家的大量普及,对真空帮浦的需求激增。这导致人们更加关注客户获取和製定分销管道作为关键策略。一些主要市场参与者包括 Pfeiffer Vacuum GmbH、Atlas Copco AB、Gardner Denver 和 Busch Holding GmbH。

2022 年 12 月,阿特拉斯科普柯透过建造新的半导体生产设施扩大了在美国的立足点。为了帮助快速扩张的北美半导体产业,阿特拉斯·科普柯集团的子公司 Edwards 在亚利桑那州和麻萨诸塞州启动了两个新的生产工厂。

2022 年 11 月,普发真空推出了首款用于质谱分析的密封旋片帮浦。 SmartVane 是用于製药和临床分析、食品和环境分析以及其他相关领域的质谱仪(ICP-MS、LC/MS)的备用帮浦。其真空帮浦的结构可确保不漏油,从而防止污染。 SmartVane 具有延长的维护间隔,因为整合马达无需传统密封件。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业分析-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- IIoT 数位化推动电子产业不断发展

- 市场挑战

- 市场整合的加剧预计将造成激烈的竞争

第 6 章:真空帮浦和阀门在半导体产业的主要应用

- 真空帮浦

- 物理气相沉积/溅射

- 化学气相沉积(等离子体/低于大气压力)

- 扩散/低压化学气相沉积 (LPCVD)

- 原子层沉积

- 干剥和清洁

- 介电蚀刻

- 导体和多晶硅蚀刻

- 原子层蚀刻

- 离子注入

- 装载锁定和转移

- 临界尺寸扫描电子显微镜

- 前开口通用吊舱内的空气分子污染与颗粒监测

- 空气中的分子污染

- 阀门

- 化学品供应

- 多晶硅工艺

- 晶圆製造

- 化学製造

- 浆料供应

- 溶剂供应

- 水处理

- 光刻

- 蚀刻

- 化学机械抛光

- 化学品和浆料回收

第 7 章:市场细分

- 组件类型

- 真空

- 阀门

- 球

- 蝴蝶

- 门

- 地球

- 其他类型阀门

- 机械密封

- 按国家/地区

- 美国

- 中国

- 台湾

- 韩国

- 日本

- 世界其他地区

第 8 章:竞争格局

- 公司简介 - 真空帮浦*

- Pfeiffer Vacuum Gmbh

- Atlas Copco AB

- Gardner Denver (ingersoll Rand Inc.)

- Flowserve Corporation

- Busch Holding Gmbh

- Kurt J. Lesker Company

- 公司简介 - 阀门*

- Fujikin Incorporation

- GEMU Holding GmbH & Co.KG

- VAT Vakuumventile AG

- Swagelok Company

- Festo SE & Co. KG

- GCE Group

- 公司简介 - 机械密封*

- DuPont De Nemours Inc.

- EKK Eagle SC Inc.

- EnPro Industries Inc.

- Freudenberg Group

- AESSEAL PLC

- Parker-Hannifin Corporation

- Greene, Tweed & Co. Inc.

第 9 章:投资与未来展望

The Flow Control Market In The Semiconductor Industry is expected to grow from USD 5.67 billion in 2024 to USD 7.74 billion by 2029, at a CAGR of 6.41% during the forecast period (2024-2029).

The need for tighter process control during semiconductor manufacturing and the growing investment in new production facilities driven by higher demand are among the key factors driving the growth of the studied market.

Key Highlights

- Flow control is highly critical in the semiconductor industry as several processes, including plasma-etch, chemical vapor deposition (CVD), and many other processes, require two or more of these gases to react to produce the passivation layer or essential film, wherein even a slight deviation in gas flow can cause the process to fail. Hence, accurate metering of gas flow into the process chamber is essential.

- Significant advancements in the semiconductor and electronics industries are expected to drive industrial growth. The strong adoption of the work-from-home lifestyle may also add to the surge in demand for electronic equipment caused by the pandemic. Furthermore, with technological advancements and well-established distribution networks, European and US electronics manufacturers strive to expand operations in emerging nations. Furthermore, the increasing popularity of consumer electronics among China's and India's youth is expected to boost the demand for semiconductor chips, which in turn will have a positive impact on the studied market's growth.

- Driven by the growing demand, the semiconductor industry is also witnessing significant growth. For instance, according to the Semiconductor Sector Association (SIA), the global semiconductor industry's sales reached USD 580.13 billion in 2022, a 4.4% growth over the previous year's total of USD 555.89 billion. Although the growth is anticipated to slow down, with SIA anticipating revenue of USD 556.57 billion in 2023, stable growth will positively influence the studied market's growth.

- Due to the existence of major global and local players, the market studied is fragmented as of now. With the increasing complexity of semiconductor manufacturing, the requirement for flow control equipment is also increasing, and much more sophisticated and technologically advanced pumps, valves, and seals are required. Global investment in research and development in power efficiency and facility upgrades in the semiconductor industries are also important drivers of severe competition among companies. The ongoing developments of products and mergers and acquisitions in the market further add to the market's competitiveness.

- However, a higher cost involved with semiconductor manufacturing is anticipated to continue to remain among the major challenging factors for the growth of the studied market. Additionally, the design complexity involved in designing flow control devices/components, considering the critical nature of applications associated with the semiconductor industry, also challenges the growth of the studied market.

- The COVID-19 pandemic had a detrimental impact on the market studied, especially during the initial phase, as the widespread lockdown imposed across the globe significantly disrupted the supply chain and manufacturing capability of chip manufacturers. However, the demand for semiconductor chips significantly increased during the pandemic, which is anticipated to continue during the forecast period, driving investments in new production facilities, which in turn will drive the demand for flow control solutions.

Flow Control Market Trends

Mechanical Seals to Register the Fastest Growth

- A mechanical seal's primary function is to prevent fluid or gas leakage through the clearance between the shaft and the container. Mechanical seals are made up of two faces separated by carbon rings. The revolving equipment comes in touch with the initial face, which is stationary. Furthermore, the seal ring (first face) is the main component of the seal on which the mechanical force generated by springs, bellows, or fluids in the equipment acts. In the semiconductor industry, seals are invariably housed in areas of the processing system where they need to withstand highly corrosive gases, liquids, gases, and plasmas, often in vacuum conditions or at elevated temperatures.

- The mechanical seal market has seen substantial growth in recent years. It is expected to continue to grow in the coming years, primarily due to growing investment in semiconductor manufacturing facilities. In emerging nations, the rise of AI, ML, and IoT, as well as smartphone and consumer electronics development, is predicted to prompt further development policies and investments in the semiconductor industry. Cartridge seals, balanced and unbalanced seals, pusher and non-pusher seals, and conventional seals are examples of mechanical seals impacting the mechanical sealing market expansion.

- In the fabrication of semiconductor products, seal reliability and contamination reduction are crucial. Chemical filtration, chemical transfer, AODD pump sealing, and silicon wafer fabrication are essential semiconductor applications where mechanical seals have proven to be the best option.

- Deposition, etch, ash/strip, plasma, and heat processing or annealing are synergistic process technologies that constitute some of the most difficult environments for elastomer seal materials. These are frequently encountered during the fabrication of semiconductor-integrated circuits. Clean-room manufactured seals with low particle and trace metal contamination are used to minimize yield loss and chemical erosion rates. These seals can provide benefits such as increased system up-time, increased mean time between failure (MTBF), decreased wet clean or mechanical clean frequency, and reduced cost of ownership (CoO) through lower consumable costs (CoC).

- In recent years, the digitization and automation trends have significantly enhanced the demand for semiconductors. For instance, according to SIA and WSTS, sales of semiconductors reached a valuation of USD 580.13 billion globally in 2022, reporting a year-on-year growth of 4.4%. Although it is anticipated to stabilize in the coming years, gradual growth is anticipated during the forecast period, which is anticipated to drive the growth of the studied market during the forecast period.

United States is expected to Hold Significant Market Share

- In recent years, the United States has started taking several initiatives to boost the growth of the semiconductor industry. For instance, in 2022, the Biden administration signed the CHIPS and Science Act. This USD 52.7 billion industrial program intends to support research, improve supply chain resilience, and revive semiconductor manufacturing in the United States.

- The U.S. has experienced increased domestic chip manufacturing facility proposals since the U.S. CHIPS and Science Act was first proposed and up to its adoption in 2022. The development of new plants and research and design projects have received investments totaling more than USD 200 billion. To entice original chip manufacturers (OCMs) to their borders, U.S. states have implemented legislation requiring them to provide additional financing.

- Incentives and forgiven loans for OCMs totaling USD 200 million are being considered by Oregon. New York promised state incentives of USD 5.5 billion, while Michigan authorized over USD 800 million in incentives. Since the CHIPS and Science Act was enacted, OCMs have increased initial investments by a factor of two to three. From USD 12 billion to USD 40 billion, TSMC expanded its investment in Arizona-based factories.

- Due to the CHIPS and Science Act, the United States is well on its path to boosting its proportion of semiconductor production worldwide as the USD 52.7 billion aims for the overall development of the semiconductor industry, which include USD 39 billion as manufacturing incentives, USD 13.2 billion for R&D and workforce development, and USD 500 million for semiconductor supply chain activities and international information communications technology (ICT) security.

Flow Control Industry Overview

The competitive rivalry among the flow control equipment providers is moderate, owing to the presence of various dominating brands competing for market shares globally, making the market moderately competitive. The demand for vacuum pumps has spiked in recent years due to the massive consumer electronics and smartphone penetration across developing countries. This is leading to an increased focus on customer acquisition and formulating distribution channels as key strategies. Some key market players include Pfeiffer Vacuum GmbH, Atlas Copco AB, Gardner Denver, and Busch Holding GmbH.

In December 2022, Atlas Copco expanded its foothold in the US by building new semiconductor production facilities. To help the quickly expanding North American semiconductor industry, Edwards, a subsidiary of the Atlas Copco Group, kicked off two new production plants in Arizona and Massachusetts.

In November 2022, Pfeiffer Vacuum offered the first hermetically sealed rotary vane pump for mass spectrometry. The SmartVane is a backup pump for mass spectrometers (ICP-MS, LC/MS) used in pharmaceutical and clinical analytics, food and environmental analytics, and other related fields. Its vacuum pump's construction prevents contamination by making sure there are no oil leaks. The SmartVane features extended maintenance intervals because there is no need for a traditional seal due to the integrated motor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Analysis - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Electronics Industry Driven By IIoT Digitalization

- 5.2 Market Challenges

- 5.2.1 Increasing Market Consolidation Is Expected To Create Stiff Competition

6 MAJOR APPLICATIONS OF VACUUM PUMPS AND VALVES IN THE SEMICONDUCTOR INDUSTRY

- 6.1 Vacuum Pumps

- 6.1.1 Physical Vapor Deposition/sputtering

- 6.1.2 Chemical Vapor Deposition (plasma/sub-atmospheric)

- 6.1.3 Diffusion/low Pressure Chemical Vapor Deposition (LPCVD)

- 6.1.4 Atomic Layer Deposition

- 6.1.5 Dry Stripping and Cleaning

- 6.1.6 Dielectric Etch

- 6.1.7 Conductor and Polysilicon Etch

- 6.1.8 Atomic Layer Etching

- 6.1.9 Ion Implantation

- 6.1.10 Load Lock and Transfer

- 6.1.11 Critical Dimension Scanning Electron Microscope

- 6.1.12 Airborne Molecular Contamination And Particles Monitoring In Front Opening Universal Pods

- 6.1.13 Airborne Molecular Contamination

- 6.2 Valves

- 6.2.1 Chemical Supply

- 6.2.2 Polysilicon Process

- 6.2.3 Wafer Manufacturing

- 6.2.4 Chemical Manufacturing

- 6.2.5 Slurry Supply

- 6.2.6 Solvent Supply

- 6.2.7 Water Treatment

- 6.2.8 Lithography

- 6.2.9 Etching

- 6.2.10 CMP

- 6.2.11 Chemical and Slurry Recovery

7 MARKET SEGMENTATION

- 7.1 Type of Component

- 7.1.1 Vacuum

- 7.1.2 Valves

- 7.1.2.1 Ball

- 7.1.2.2 Butterfly

- 7.1.2.3 Gate

- 7.1.2.4 Globe

- 7.1.2.5 Others Types of Valves

- 7.1.3 Mechanical Seals

- 7.2 By Country

- 7.2.1 United States

- 7.2.2 China

- 7.2.3 Taiwan

- 7.2.4 South Korea

- 7.2.5 Japan

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - Vacuum Pumps*

- 8.1.1 Pfeiffer Vacuum Gmbh

- 8.1.2 Atlas Copco AB

- 8.1.3 Gardner Denver (ingersoll Rand Inc.)

- 8.1.4 Flowserve Corporation

- 8.1.5 Busch Holding Gmbh

- 8.1.6 Kurt J. Lesker Company

- 8.2 Company Profiles - Valves*

- 8.2.1 Fujikin Incorporation

- 8.2.2 GEMU Holding GmbH & Co.KG

- 8.2.3 VAT Vakuumventile AG

- 8.2.4 Swagelok Company

- 8.2.5 Festo SE & Co. KG

- 8.2.6 GCE Group

- 8.3 Company Profiles - Mechanical Seals*

- 8.3.1 DuPont De Nemours Inc.

- 8.3.2 EKK Eagle SC Inc.

- 8.3.3 EnPro Industries Inc.

- 8.3.4 Freudenberg Group

- 8.3.5 AESSEAL PLC

- 8.3.6 Parker-Hannifin Corporation

- 8.3.7 Greene, Tweed & Co. Inc.