|

市场调查报告书

商品编码

1440447

无线连接晶片组:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Wireless Connectivity Chipset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

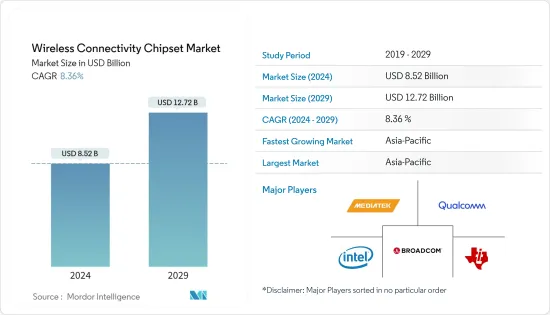

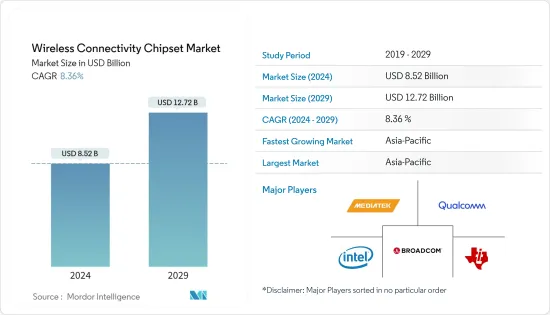

无线连接晶片组市场规模预计 2024 年为 85.2 亿美元,预计到 2029 年将达到 127.2 亿美元,在预测期内(2024-2029 年)增长 8.36%,复合年增长率为

市场成长主要是由于整个消费领域智慧家庭自动化的采用趋势不断增长以及汽车行业连接性的不断增强。

主要亮点

- 无线晶片组专为无线通讯设备和系统而设计,可让系统或电脑透过无线方式(例如 Wi-Fi、蓝牙、两者的组合或 WLAN)进行连接。

- 随着高速网路的日益普及,连网型设备和智慧家庭应用的采用不断增加,特别是在欧洲、北美和亚太地区等地区。主要解决方案包括语音助理、智慧恆温器、智慧照明、保全摄影机和智慧电器。

- 增加多个设备(例如在物联网中)会增加网路的表面积,并在此过程中建立更多潜在的攻击向量。即使连接到网路的单一不安全设备也可能成为对网路进行主动攻击的入口点。

- 由于冠状病毒感染疾病(COVID-19) 的爆发,所有第三代合作伙伴计划(3GPP) 现场会议均已取消。所有相关会议和讨论都将以电子方式举行,重点是实施协作工具。此外,5G 的新用例,例如需要支援越来越多的人在家工作,预计将推动未来对 5G 的投资。除了让人们在保持社交距离的世界中提高效率之外,它还可以引入 5G 连线。儘管供应链短缺造成了破坏,但此类案例仍积极推动了所研究的市场。

无线连接晶片组市场趋势

网路对家庭和企业的普及持续成长

- 在现代世界,网路的普及不断扩大。根据电讯的数据,到 2021 年,约有 49 亿人(占世界人口的近 63%)依赖网路。

- 此外,根据电讯的数据,2021年亚太地区将拥有全球最多的网路用户,其中中国和印度处于领先地位。这些因素为家庭和企业中的 Wi-Fi 供应商带来了机会,增加了对 Wi-Fi 晶片组的需求。

- Wi-Fi 网路技术的进步现在使用户能够体验更快的速度和更低的延迟。这导致资料密集型服务和应用程式的使用迅速增加。 Wi-Fi网路承载资料量的大幅成长主要是由消费者对视讯和业务的需求以及消费者向云端服务的迁移所推动的。这项因素预计将增加对无线 5G 连线的需求,无线 5G 连线可提供高速和高容量的网路。

- 根据爱立信的行动报告,到 2026 年,北美智慧型手机的平均每月行动资料使用量预计将达到 49 GB。我们相信,精通智慧型手机的消费群、丰富的视讯应用程式和大容量资料方案将推动流量成长。虽然短期内每部智慧型手机的流量可能会强劲增长,但从长远来看,由 AR 和 VR 驱动的身临其境型消费者 5G 连接的引入预计将带来更好的成长率。

- 低延迟可实现快速的虚拟实境和扩增实境视频,而不会出现故障或延迟。行动连线将由小型基地台基础设施提供支持,这将增强 5G 无线电讯号的密度,并改善讯号在混凝土建筑物和墙壁中的传输。小型基地台天线还增强了无线连接,支援同一网路上同时连接更多设备。预计此类发展将推动所研究的市场。

亚太地区预计将成为成长最快的市场

- 冠状病毒感染疾病(COVID-19)大流行的爆发部分推动了市场对平板电脑的需求。 COVID-19感染疾病迫使各种教育机构转向线上教育。对更宽、更方便的萤幕大小的需求不断变化预计将推动市场对平板电脑的需求,进而预计将增加市场对无线连接晶片组的需求。

- 印度的各种跨国教育科技公司(例如 Byju's)向学生提供平板电脑作为其教育课程的一部分,并透过数位方法和传统教学方法教育学生。

- 市场参与者的此类倡议将进一步推动市场对平板电脑、智慧型手机和其他消费性电器产品的需求,从而在预测期内推动该地区平板电脑市场的无线连接晶片组的发展。

- 亚太地区对网路服务不断增长的需求预计也将推动该地区无线连接晶片组的采用。印度总理表示,5G网路服务在印度的推出预计将为印度带来新的经济机会和社会效益。

- 5G智慧型手机的可用性和可负担性不断提高,以及智慧型手机在都市区和农村地区的快速普及,将导致5G用户数量快速增长,预计到年终该地区将达到约5000万。

无线连接晶片组产业概览

无线连接晶片组市场较为分散,有许多参与者,例如博通公司、高通公司、联发科公司、英特尔公司和德州仪器公司。这些公司还透过推出新产品、扩大业务或进行策略性合併、合作和收购来扩大其市场份额。

- 2022 年 9 月:日本内务部(MIC) 修订了日本无线电法的省令,允许在 6 GHz 频段使用 Wi-Fi 系统。日本已加入致力于提供这项最新 Wi-Fi 创新的国家行列。因此,使用 Qualcomm Technologies, Inc. 的 Wi-Fi 平台的 Wi-Fi 6E 装置可以在日本获得 6 GHz 作业认证。

- 2022 年 4 月:Broadcom Inc. 宣布提供适用于 Wi-Fi 7 生态系统的完整端对端晶片组解决方案的样品,涵盖 Wi-Fi 路由器、住宅网关、企业网路基地台和用户端设备。这些Wi-Fi 7晶片的速度是市场上Wi-Fi 6和6E解决方案的两倍以上,同时提供可靠、低延迟和远距的通讯。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 评估 COVID-19感染疾病对产业的影响

第五章市场动态

- 市场驱动因素

- 透过家庭自动化对连网家庭的需求增加

- 网路对家庭和企业的普及持续成长

- 市场挑战

- 与资料安全和隐私、设备连接和互通性相关的问题

- 对某些行动装置类型的需求疲软

第六章市场区隔

- 按类型

- 独立 Wi-Fi

- 蓝牙独立

- Wi-Fi 与蓝牙组合

- 低功耗无线IC

- 按最终用户使用情况

- 消费者

- 公司

- 行动电话

- 车

- 产业

- 其他最终用户用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Broadcom Inc.

- Qualcomm Incorporated

- Mediatek Inc.

- Intel Corporation

- Texas Instruments Incorporated

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Qorvo Inc.

- Skyworks Solutions Inc.

- Hisilicon Technologies Co. Ltd

- Tsinghua Unigroup Co. Ltd(unisoc(Shanghai)Technologies Co. Ltd)

第八章供应商市场占有率分析

第九章投资分析

第10章市场的未来

The Wireless Connectivity Chipset Market size is estimated at USD 8.52 billion in 2024, and is expected to reach USD 12.72 billion by 2029, growing at a CAGR of 8.36% during the forecast period (2024-2029).

The market growth is primarily due to the growing trend toward the adoption of smart home automation across the consumer sector and the increasing connectivity in the automotive industry.

Key Highlights

- Wireless chipsets are designed for wireless communication devices and systems that enable the system or computers to connect through wireless means, such as Wi-Fi, Bluetooth, a combination of both, or WLAN.

- With the growing penetration of high-speed internet, the adoption of connected devices and smart home applications is increasing, especially in regions such as Europe, North America, and Asia Pacific. Some major solutions include voice assistants, smart thermostats, smart lighting, security cameras, and smart appliances.

- The addition of several devices, such as in IoT, increases the surface area of a network, creating more potential attack vectors in the process. Even a single unsecured device connected to a network may serve as a point of entry for an active attack on the network.

- The COVID-19 outbreak led to the cancellation of all 3rd Generation Partnership Project (3GPP) face-to-face meetings. All relevant meetings and discussions are conducted electronically, focusing on adopting collaborative tools. Furthermore, emerging use cases for 5G, including the need to support increasing numbers of individuals schooling and working from home, are expected to drive 5G investment moving forward. In addition to making people more efficient in a socially distanced world, 5G connections can be deployed. Such cases have positively driven the market studied despite the disruption caused due to shortages in the supply chain.

Wireless Connectivity Chipset Market Trends

Increasing Internet Penetration into Homes and Enterprises

- Internet penetration scaled up in the modern world. According to the International Telecommunication Union, approximately 4.9 billion people, or close to 63% of the world's population, were dependent on the internet in 2021.

- Moreover, according to International Telecommunication Union, the Asia-Pacific region had the highest number of internet users worldwide in 2021, with China and India topping the list. These factors are driving opportunities for Wi-Fi vendors in homes and enterprises, increasing the demand for Wi-Fi chipsets.

- The evolution of the Wi-Fi network technology allowed users to experience faster speeds and lower latency. It prompted the rapidly increasing use of data-heavy services and applications. The significant rise in the volume of data being carried by Wi-Fi networks has been primarily driven by consumer demand for video and business and consumer moves to cloud services. This factor is expected to drive the need for a wireless 5G connection that offers fast and high-capacity networks.

- According to Ericsson's Mobility Report, the monthly average usage of mobile data in North America is expected to reach 49GB per month and smartphones in 2026. A smartphone-savvy consumer base, video-rich applications, and large data plans will drive traffic growth. While there may be robust growth in traffic per smartphone in the near term, the adoption of immersive consumer 5G connections utilizing AR and VR is expected to lead to an even better growth rate in the long term.

- Lower latency is also poised to enable high-speed virtual and augmented reality video without glitches or delays. Mobile connectivity can be strengthened with small cell infrastructure, densifying 5G wireless signals and improving their movement through concrete buildings and walls. Small-cell antennas will also enhance wireless connection supporting more devices on the same network simultaneously. Such developments are expected to drive the market studied.

Asia Pacific is Expected to be the Fastest-growing Market

- The outbreak of the COVID-19 pandemic partially promoted the demand for tablets in the market. Due to the COVID-19 pandemic, various educational institutions were forced to shift toward online education. This shift in the need for more extensive and convenient screen sizes is expected to promote the demand for tablets in the market, thereby increasing the demand for wireless connectivity chipsets in the market.

- Various Indian multinational educational technology companies, such as Byju's, provide their students with a tablet as a part of their educational curriculum to educate the students via digital methods along with the traditional methods of teaching.

- Such initiatives by the companies in the market are expected to further promote the demand for tablets, smartphones, and other consumer electronics in the market, thereby driving the wireless connectivity chipsets market for tablets in the region during the forecast period.

- The increasing demand for internet services in the Asia-Pacific region is also expected to promote the adoption of wireless connectivity chipsets in the region. As per the prime minister of India, the launch of 5G internet services in India is expected to bring new economic opportunities and societal benefits to the nation.

- Due to the increasing availability and affordability of 5G smartphones and the rapid adoption of smartphones in urban and rural areas, 5G subscriptions are expected to rapidly increase to reach approximately 50 million in the region by the end of 2023.

Wireless Connectivity Chipset Industry Overview

The Wireless Connectivity Chipset Market is fragmented, with many players like Broadcom Inc., Qualcomm Incorporated, Mediatek Inc., Intel Corporation, and Texas Instruments Incorporated. The companies are also increasing their market presence by introducing new products, expanding their operations, or entering into strategic mergers, partnerships, and acquisitions.

- September 2022: The Ministry of Internal Affairs and Communications (MIC) of Japan amended the Ministerial ordinance of Japanese radio law to allow Wi-Fi systems to be used in the 6 GHz band. Japan joined the countries committed to delivering this latest Wi-Fi innovation. As a result, Wi-Fi 6E devices that use Qualcomm Technologies, Inc.'s Wi-Fi platforms can be certified for 6 GHz operations in Japan.

- April 2022: Broadcom Inc. announced the sample availability of its complete end-to-end chipset solutions for the Wi-Fi 7 ecosystem, spanning Wi-Fi routers, residential gateways, enterprise access points, and client devices. These Wi-Fi 7 chips more than double the speed of Wi-Fi 6 and 6E solutions on the market while simultaneously delivering reliable low-latency communications and extended range.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Connected Homes Through Home Automation

- 5.1.2 Increasing Internet Penetration into Homes and Enterprises

- 5.2 Market Challenges

- 5.2.1 Issues Related to Security and Privacy of Data and Connectivity of Devices and Interoperability

- 5.2.2 Slow Demand for Some Mobile Handset Types

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wi-Fi Standalone

- 6.1.2 Bluetooth Standalone

- 6.1.3 Wifi and Bluetooth Combo

- 6.1.4 Low-power Wireless IC

- 6.2 By End-User Application

- 6.2.1 Consumer

- 6.2.2 Enterprise

- 6.2.3 Mobile Handsets

- 6.2.4 Automotive

- 6.2.5 Industrial

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Qualcomm Incorporated

- 7.1.3 Mediatek Inc.

- 7.1.4 Intel Corporation

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 STMicroelectronics NV

- 7.1.7 NXP Semiconductors NV

- 7.1.8 On Semiconductor Corporation

- 7.1.9 Infineon Technologies AG

- 7.1.10 Microchip Technology Inc.

- 7.1.11 Qorvo Inc.

- 7.1.12 Skyworks Solutions Inc.

- 7.1.13 Hisilicon Technologies Co. Ltd

- 7.1.14 Tsinghua Unigroup Co. Ltd (unisoc (Shanghai) Technologies Co. Ltd