|

市场调查报告书

商品编码

1441553

全球电动车 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Global Electric Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

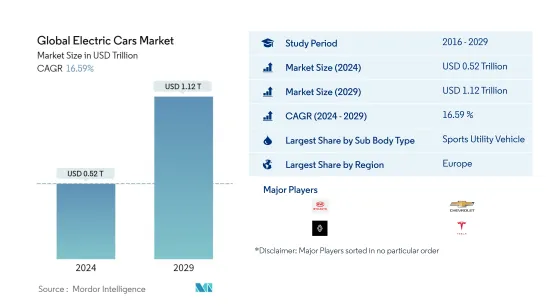

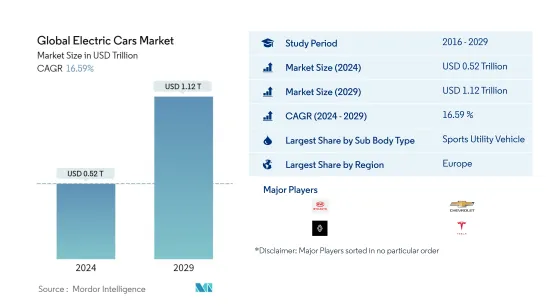

2024年全球电动车市场规模预计为0.52兆美元,预计2029年将达到1.12兆美元,预测期内(2024-2029年)CAGR为16.59%。

主要亮点

- 按燃料类型划分最大的细分市场 - 纯电动车:全球电气化程度的提高、新产品的推出、电池汽车的意识、政府提供的激励措施以及电力基础设施的发展正在推动对纯电动车的需求。

- 按燃料类型划分成长最快的细分市场 - FCEV:由于燃油效率更高且没有里程焦虑问题,不断上涨的燃油成本正在将消费者转向电动车。PHEV 是全球电动车市场中成长最快的细分市场。

- 最大的国家市场-德国:中国是全球电动车市场最大的国家,由于该国是电动车的主要生产国,政府的规范和诱因有助于市场的成长。

- 成长最快的国家市场-墨西哥:美国是全球电动车市场成长最快的国家。政府计划禁止内燃机汽车,政府提供的激励措施正在将消费者转向电动车。

电动车市场趋势

依车身类型划分,运动型多用途车是最大的细分市场。

- 汽车产业是受新冠病毒大流行带来的全球晶片短缺和供应链中断影响最严重的产业之一。但这并没有阻止特斯拉因对气候变迁做出贡献而受到批评,无论是透过製造过程还是生产的汽车。对于后者,欧盟汽车购买者似乎正在为减少化石燃料动力汽车的负面影响做出贡献。

- 过去一年,新冠病毒大流行对全球汽车市场产生了重大影响。 2020 年,随着越来越多的国家因 COVID-19 限制旅行,汽车行业经历了一系列挫折。 2020年,全球汽车销量为6,380万辆。预计2021年将出现小幅反弹,预计销售量将达6,600万辆。丰田和大众汽车集团的汽车交付量均减少了超过 100 万辆。

- 2021年,全球乘用车销量约5,640万辆,较上年成长近5%。 2021年,中国拥有最大的区域汽车市场,保有量略低于2,150万辆。汽车技术将在未来十年发生重大变化。预计到 2030 年,全球新车销量中约 26% 为电动车,预计到 2022 年,全球将新增 5,800 万辆自动驾驶汽车。由于技术进步,製造汽车所需的零件类型将发生变化。成品开始发生变化。这可以进一步细分汽车供应商市场,特别是汽车电子市场。自动化和电气化必将在不久的将来推动汽车市场的发展。

欧洲是按地区划分最大的部分。

- 2020 年,消费者购买电动车的支出增加至 1,200 亿美元。世界各国政府花费近 140 亿美元鼓励电动车的销售,2019 年增加了 25%,这主要是由于欧洲加大了激励措施。 2020年全球汽车电池产量较2019年成长33%至160GWh,成本下降13%至平均每个电池组137美元/kWh。世界各国政府国家电动车政策规定,购买或租赁电动车时,车辆(EV) ,无论是新车或二手车,驾驶均免征购置税和增值税。电动车车主也无需缴纳年度道路交通保险费。

- 许多政府政策都夸耀拥有世界上最大的人均插电式电动车保有量,并为购买电动车提供了多种诱人的激励措施。例如,挪威目前有超过16,000个充电站,而2011年只有3,000个。在所有重要路线上,包括全世界最高的快速充电站,挪威政府每50公里就建立一个快速充电站。电动车充电站在挪威似乎前景光明。

- 全球有多项针对电动车的极具吸引力的激励措施。整体而言,许多国家签署了巴黎气候政策目标,要求在2030年将温室气体排放量减少40%,并得到了汽车政策的支持。 2017 年的国家交通计画已经制定了国家汽车目标,包括到 2030 年销售完全零排放的汽车。挪威还承诺在 2030 年将温室气体排放量减少至少 40%。这些因素预计将在预测期内提振挪威电动车市场。

电动汽车产业概况

全球电动车市场较为集中,前五大企业占71.50%的份额。该市场的主要参与者包括比亚迪汽车公司、通用汽车公司、雷诺集团、特斯拉公司和大众汽车公司(按字母顺序排列)。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:执行摘要和主要发现

第 2 章:报告报价

第 3 章:简介

- 研究假设和市场定义

- 研究范围

- 研究方法论

第 4 章:主要产业趋势

- 人口

- 国内生产毛额

- CVP

- 通货膨胀率

- 汽车贷款利率

- 电池价格(每度电)

- 物流绩效指数

- 电气化影响

- 新 XEV 车型发布

- 充电站部署

- 规范架构

- 价值炼和配销通路分析

第 5 章:市场细分

- 体型

- 搭乘用车

- 掀背车

- 多用途车

- 轿车

- 运动型多用途车

- 搭乘用车

- 汽油种类

- 纯电动车

- 燃料电池汽车

- 油电混合车

- 插电式混合动力汽车

- 地区

- 非洲

- 南非

- 亚太

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 亚太地区其他地区

- 欧洲

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 欧洲其他地区

- 中东

- 阿联酋

- MEA 的其余部分

- 中东

- 北美洲

- 加拿大

- 墨西哥

- 我们

- 北美其他地区

- 南美洲

- 拉丁美洲其他地区

- 非洲

第 6 章:竞争格局

- 关键策略倡议

- 市占率分析

- 公司概况

- 公司简介

- BYD Motors Inc.

- Daimler AG

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Nissan Motor Company Ltd

- Tesla Inc.

- Toyota motor corporation

- Volkswagen AG

CHAPTER 7 : CEOへの主な戦略的质问

第 8 章:附录

- 全球概况

- 概述

- 波特的五力框架

- 全球价值链分析

- 市场动态 (DRO)

- 来源和参考文献

- 表格和图表清单

- 主要见解

- 数据包

- 专业术语

简介目录

Product Code: 93046

The Global Electric Cars Market size is estimated at USD 0.52 trillion in 2024, and is expected to reach USD 1.12 trillion by 2029, growing at a CAGR of 16.59% during the forecast period (2024-2029).

Key Highlights

- Largest Segment by Fuel Type - BEV : Increase in global electrification, new product launches, awareness of battery vehicles, Government offerings, such as incentives, and electric infrastructure development are fueling demand for BEV.

- Fastest-growing Segment by Fuel Type - FCEV : increasing fuel cost is shifting consumers to electric vehicles, due to Better fuel efficiency, and no range anxiety issues PHEV is the fastest-growing segment in electric vehicle market in globally.

- Largest Country Market - Germany : China is the largest country in the global electric car market, as the country is the major producer of electric vehicles, government norms and incentives are aided to the growth of market.

- Fastest Growing Country Market - Mexico : The United States is the fastest-growing country in the global electric cars market. Government plans to ban ICE vehicles and incentives offered by the government is shifting consumer to e-mobility.

Electric Cars Market Trends

Sports Utility Vehicle is the largest segment by Sub Body Type.

- One of the industries most affected by the global chip shortages and supply chain disruptions brought on by the coronavirus pandemic is the automotive sector. This has not stopped Tesla from coming under fire for contributing to climate change, whether through the manufacturing process or the automobiles produced. Regarding the latter, European Union car buyers appear to be contributing to reducing the negative effects of fossil fuel-powered vehicles.

- The past year has seen a substantial effect of the coronavirus pandemic on global auto markets. As more and more nations restricted travel due to COVID-19 in 2020, the automotive industry experienced a number of setbacks. In 2020, there were 63.8 million cars sold worldwide. A slight rebound is expected in 2021, with 66 million cars expected to be sold. Toyota and the Volkswagen Group both saw reductions in their deliveries of more than a million cars.

- In 2021, approximately 56.4 million passenger cars were sold worldwide, representing a nearly 5% increase over the previous year. China had the largest regional automobile market in 2021, with slightly less than 21.5 million units. Automotive technology will undergo significant change in the next ten years. Around 26% of new automobile sales worldwide are expected to be electric vehicles by 2030, with an estimated 58 million new self-driving cars added to the global fleet by 2022. As a result of technological advancements, the types of components required to create the finished product begin to change. This allows for further segmentation of the automotive supplier market, particularly the automotive electronics market. Automation and electrification will surely boost the car market in the near future.

Europe is the largest segment by Region.

- Consumer spending on electric car purchases increased to USD 120 billion in 2020. Governments worldwide spent nearly USD 14 billion to encourage the sales of electric vehicles, which increased by 25% in 2019, primarily due to increased incentives in Europe. The output of automotive batteries increased by 33% from 2019 to 160 GWh, and their cost decreased by 13% to an average of USD 137/kWh per battery pack globally in 2020. Worldwide government National EV Policy stipulates that when buying or leasing an electric vehicle (EV), whether new or used, drivers are exempt from both purchase tax and VAT. EV owners are also excluded from paying an annual road traffic insurance charge.

- Many government policies boast the world's largest per capita fleet of plug-in electric cars and offer several enticing incentives for buying electric vehicles. For instance, there are currently more than 16,000 charging stations in Norway, up from just 3,000 in 2011. On all important routes, including the highest fast-charging station in the entire world, the Norwegian government has erected fast-charging stations every 50 km. EV charging stations appear to have a promising future in Norway.

- There are several highly attractive incentives for electric vehicles globally. Overall, many countries signed Paris climate policy targets, which call for a 40% decrease in greenhouse gas emissions by 2030, which are supported by the automobile policy. National vehicle targets, including the sale of entirely zero-emission cars by 2030, were already established by the National Transport Plan in 2017. Norway has also committed to reducing greenhouse gas emissions by at least 40% by 2030. These factors are all expected to boost the Norwegian electric car market over the forecast period.

Electric Cars Industry Overview

The Global Electric Cars Market is fairly consolidated, with the top five companies occupying 71.50%. The major players in this market are BYD Motors Inc., General Motors Company, Groupe Renault, Tesla Inc. and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP

- 4.3 CVP

- 4.4 Inflation Rate

- 4.5 Interest Rate For Auto Loans

- 4.6 Battery Price (per Kwh)

- 4.7 Logistics Performance Index

- 4.8 Electrification Impact

- 4.9 New XEV Models Announced

- 4.10 Charging Stations Deployment

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Body Type

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Type

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Japan

- 5.3.2.6 Malaysia

- 5.3.2.7 South Korea

- 5.3.2.8 Thailand

- 5.3.2.9 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 UAE

- 5.3.4.2 Rest-of-MEA

- 5.3.5 Miidle East

- 5.3.6 North America

- 5.3.6.1 Canada

- 5.3.6.2 Mexico

- 5.3.6.3 US

- 5.3.6.4 Rest-of-North America

- 5.3.7 South America

- 5.3.7.1 Rest-of-Latin America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Motors Inc.

- 6.4.2 Daimler AG

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 Groupe Renault

- 6.4.6 Nissan Motor Company Ltd

- 6.4.7 Tesla Inc.

- 6.4.8 Toyota motor corporation

- 6.4.9 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219