|

市场调查报告书

商品编码

1441566

超级自动化:市场占有率分析、行业趋势和统计数据、成长预测(2024-2029)Hyperautomation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

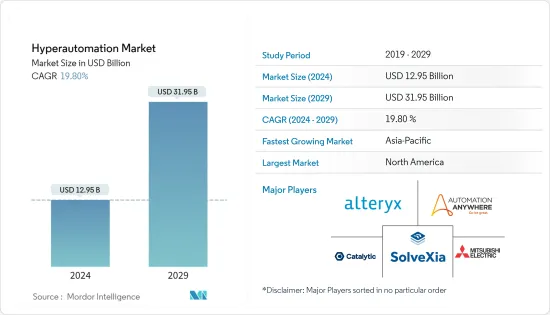

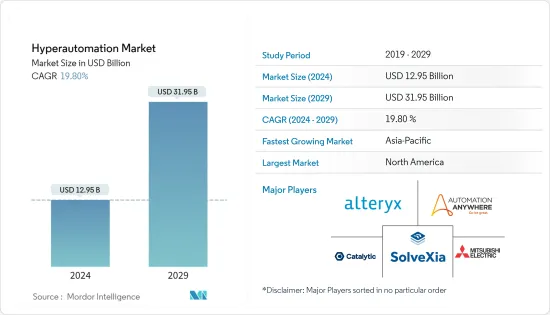

超自动化市场规模预计到 2024 年为 129.5 亿美元,预计到 2029 年将达到 319.5 亿美元,预测期内(2024-2029 年)复合年增长率为 19.80%。

推动全球超级自动化市场成长的主要原因是全球数位化的不断提高。由于业务自动化需求不断成长,需要有效后端处理管理的公司最常使用数位流程自动化解决方案。因此,更多的公司正在成立,包括 BFSI 商业、工业和线上零售商。随着公司更快采用自动化,市场正在进一步成长。透过将传统上由人类执行的所有重复性手动任务自动化,组织可以显着加快业务,同时减少错误。

主要亮点

- 製造业越来越多地采用自动化预计将推动超级自动化市场的发展。此外,思科预测,到 2022 年,全球 285 亿台连网装置中的一半以上将透过机器对机器 (M2M) 连线进行连线。下一代机器人和自动化技术为製造业提供了革命性的机会,可以提高生产力、品质、安全性和成本指标。世界各地的製造商都认识到这一点。此外,多年来机器人自动化支出的增加主要扩大了研究市场的关注范围。

- 此外,RPA和人工智慧的应用提高了国家和地区层面的安全标准。公司利用超级自动化来发现安全缺陷并避免灾难性事故。许多已开发国家的国防工业目前正在探索超级自动化,以实现安全通讯协定和程序的现代化。将 RPA 和人工智慧纳入通讯协定中受益最大的产业是航太。市场参与企业之间策略联盟的成长趋势可能会进一步促进全球市场的成长。公司扩大全球影响力并与其他组织合作以协助开发全球市场的情况很常见。

- 透过超级自动化扩大自动化将重新构想患者照护并改善健康结果。超级自动化透过为现有业务添加功能来增加人类专业知识和资料的价值。透过语音辨识和复杂的演算法,语音生物辨识技术分析患者的语音以确认其身份,并将其与登记表上输入的资讯进行比较。添加身份验证层以防止在接触过程中冒充患者。

- 此外,语音生物识别的一些应用在疫情期间引起了人们的关注。研究正在探索使用语音生物识别来检测受感染疾病 -19 影响的患者。例如,2021 年 9 月,人工智慧公司 Biometric Vox 与穆尔西亚 Cruces 医院和 Virgen de la Arixaca 医院心臟科主任 Domingo Pascual Figal 合作进行的一项研究表明,语音辨识。 COVID-19感染疾病的成功率为 80%。

- 相反,由于超级自动化相对较新,因此更多机构需要提供有关此类先进技术的优质培训。对技能型专业人员的需求和实际供给需要更加平衡。这可能会对全球产业的成长产生重大影响,因为专家需要更多时间才能实际有效地实施超级自动化。全球市场需要教育领域的更多投资者来创造学习机会,以培养超级自动化产业的合格技术人才。

超自动化市场趋势

机器学习领域预计将推动市场成长

- 机器学习 (ML) 是人工智慧 (AI) 的一个子领域,它使训练演算法能够透过统计方法进行分类和预测,从而揭示资料探勘计划中的重要见解。这些见解推动应用程式和业务内的决策,并在理想情况下影响关键成长指标。这围绕着演算法、模型和计算复杂性,需要熟练的专业人员来开发这些解决方案。资料科学和人工智慧的进步提高了自动化机器学习的性能。随着企业意识到这项技术的潜力,其采用率在预测期内可能会增加。公司以订阅方式销售自动化机器学习解决方案,让客户可以轻鬆使用该技术。此外,它还提供付费使用制的弹性。

- 人工智慧允许机器独立于人类进行推理并得出结论。人工智慧的主要目标是创建能够像人类一样思考的电脑程式或机器人。被称为机器学习 (ML) 的人工智慧领域使用学习演算法从过去学习并让我们进步。汽车可以被编程为遵守交通号誌灯,但它们也可以学习其他汽车和自己的驾驶经验,以减少道路上发生事故的频率。因此,作为超自动化的一部分,它成为帮助设备在根据工作流程执行之前学习和思考所需的最重要的技术之一。

- 据精算师协会 (SOA) 称,近三分之二的高阶主管预计预测分析工具到 2023 年可将组织成本降低 15% 或更多。未来的分析将开启超级自动化在该产业的应用。

- 本公司开发新的解决方案或将新功能融入现有产品中,以满足不同客户的广泛需求并增加市场占有率。例如,2021 年 3 月,Oracle Machine Learning AutoML 使用者介面使初学者和经验丰富的资料科学家可以更轻鬆地设计和部署机器学习模型。 OML AutoML UI 是 Oracle 自治资料库上的 Oracle 机器学习的新元件,提供基于浏览器的无程式码介面,只需点击几下即可自动执行机器学习建模并减少配置。 OML AutoML UI 是 Oracle 实验室开发的先进专有技术,并使用 Oracle Machine Learning 的先进资料库库内演算法。

- 此外,企业中机器学习使用案例的增加为超自动化市场的成长创造了机会。例如,根据 Algorithmia 的数据,57% 的受访者表示,2021 年人工智慧和机器学习的主要用例是改善客户体验。人工智慧和机器学习可用于改善多种业务运作。

预计北美将占据主要市场占有率

- 北美是全球超自动化市场的重要地区之一,因为许多重要的市场相关人员都驻扎在那里。根据 MAPI 的数据,2018 年至 2021 年美国製造业产量预计将成长 2.8%,进一步增加超级自动化和控制技术在该国的采用。此外,最近的关税上调可能会迫使美国製造商透过自动化以更低的成本生产产品。投资关税前超级自动化的汽车公司处于领先地位,并已成为其他公司削减成本的蓝图。

- 汽车经销商或许能够透过超级自动化来预测客户的需求,并且拥有运作良好的供应链。借助预测分析,人们可以预测车辆需求的意外变化,系统将立即做出回应。提供减少错误和开销的建议。此系统分析销售历史记录并使用正确的标准来预测需求趋势并使您的仓库保持最新状态。

- 此外,汽车产量的增加预计将推动该地区所研究的市场。例如,根据 OICA 的数据,2021 年北美生产了超过 1,343 万辆汽车。北美经济严重依赖汽车生产。更重要的是,2021年,美国汽车产业生产了约917万辆汽车。

- 在美国,过去两年,UPMC 健康计画负责人发现,透过新实施的 Astrata NLP 辅助工具,他们的工作速度可以提高约 38 倍。作为一个拥有 40 家医院的医疗系统,我们为三个州的数百万患者提供服务。 2021 年 2 月,UPMC Enterprises 宣布推出Astrata,这是 UPMC Enterprises 内成立的最新公司。此外,Astrata 的目标是在明年将员工数量增加 30%,并于最近加入了 UPMC。新公司的资料科学家将使用云端基础的NLP 来建立工具,使付款人能够更好地理解非结构化 EHR资料,并提高医疗保健有效性资料和资讯集的品质和人口健康衡量标准,为更准确的评估铺平道路。

- 此外,北美生物识别发展的兴起预计将在预测期内推动所研究的市场。例如,2021年4月,微软公司和Nuance Communications Inc.宣布,双方已就微软收购Nuance达成最终协议。 Nuance 是一家总部位于麻萨诸塞州伯灵顿的跨国电脑软体技术公司,销售语音辨识和人工智慧软体。 Nuance 为世界各地的企业提供人工智慧专业知识和消费者参与解决方案。解决方案包括互动式语音应答 (IVR)、虚拟助理以及数位和生物识别解决方案。为了创建下一代客户参与和安全解决方案,该公司将这些知识与 Azure、Teams 和 Dynamics 365 等 Microsoft 云端的广度和深度相结合。

超自动化产业概述

全球超级自动化市场适度分散,并且拥有许多公司。两家公司继续投资于策略合作伙伴关係和产品开发,以扩大市场占有率。目前市场上发生的一些事件包括:

2022 年 6 月 - 低程式码自动化和整合播放器 Tray.io 宣布推出旨在加速企业超级自动化工作的新功能。 Tray.io 使用 Connector Builder 为所有使用者类型提供端对端连接,让低程式码开发人员快速、有效率、直觉地按需建立可重复使用连接器。此外,为开发人员提供的全新 Connectivity API 体验让他们更轻鬆地将数百个底层端点整合到三个 API 呼叫中。

2022 年 5 月 - 全球数位付款领域的 Visa 与品牌语言优化领域的 Phrasee 宣布签署欧洲独家协议。这份为期三年的协议是 Visa 对包括欧洲顶级 B2B 金融服务公司在内的客户进行策略性投资的一部分。 Phrasee 透过其经销商计划向 Visa 客户提供先进的机器学习和自然语言生成技术。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 价值链分析

- 技术简介

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 製造领域自动化趋势不断发展

- 数位化不断渗透,对提高效率和降低营运成本的需求不断增加。

- 扩大RPA和AI的应用

- 市场限制因素

- 初始实施成本很高

- 缺乏熟练人才

第六章市场区隔

- 依技术类型

- 生物识别

- 情境感知计算

- 自然学习生成

- 聊天机器人

- 机器人流程自动化

- 机器学习

- 按最终用户产业

- BFSI

- 零售

- 资讯科技与电信

- 教育

- 车

- 製造业

- 医疗保健和生命科学

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Alteryx

- Automation Anywhere

- SolveXia

- Mitsubishi Electric Corporation

- Catalytic Inc

- OneGlobe LLC

- Automate.io

- UiPath

- akaBot

- Rocketbot

- Simple Fractal

第八章投资分析

第9章市场的未来

The Hyperautomation Market size is estimated at USD 12.95 billion in 2024, and is expected to reach USD 31.95 billion by 2029, growing at a CAGR of 19.80% during the forecast period (2024-2029).

The key reason fueling the growth of the global hyperautomation market is the increase in digitalization worldwide. A digital process automation solution is most frequently used in firms that need effective back-end processing administration due to the rising demand for business automation. As a result, more enterprises are being founded, including BFSI businesses, industrial industries, and online retailers. The market is growing more due to companies adopting automation faster. An organization can significantly speed up operations while lowering errors by automating all of the repetitive manual tasks previously carried out by humans.

Key Highlights

- The increasing implementation of automation in the manufacturing sector is expected to drive the hyperautomation market. Further, Cisco has predicted that by 2022, over half of the 28.5 billion connected devices on the planet will get connected via machine-to-machine (M2M) connections. The next generation of robotics and automation technologies represents a revolutionary opportunity for manufacturing to improve productivity, quality, safety, and cost metrics. It is something that manufacturers all over the world are aware of. Additionally, rising spending on robotic automation year over year is primarily broadening the study market's focus.

- Moreover, applications of RPA and AI have enabled the rise of security standards at the national and regional levels. Companies use hyperautomation to spot safety lapses and avert catastrophic mishaps. Many industrialized economies' defense industries are now exploring hyperautomation to modernize their security protocols and procedures. The industry that stands to gain the most from incorporating RPA and AI in its protocols is aerospace. Due to the rising trend in strategic alliances among market participants, there is more potential for increased worldwide market growth. It is common to see businesses partnering with other organizations to expand their global reach and assist the development of the worldwide market.

- Scaling automation through hyperautomation is rethinking patient care and improving health outcomes. Hyperautomation increases the value of human expertise and data by adding capabilities to existing operations. Through speech recognition and clever algorithms, voice biometrics technology analyzes patients' voices to verify their identities and compare them to the information they gave on their registration forms. It adds a layer of authentication to prevent patient impersonation during any contact.

- Furthermore, several applications were noted for voice biometrics during the pandemic. Research studies have explored the use of voice biometrics in detecting COVID-19-affected patients. For instance, in September 2021, research undertaken by artificial intelligence company Biometric Vox, in collaboration with the Cruces hospital and Domingo Pascual-Figal, head of Cardiology at Murcia's Virgen de la Arrixaca hospital, outlined the use of voice recognition to help in the detection of COVID-19 cases with 80% success rate.

- On the Flipside, since hyperautomation is relatively new, more institutions need to provide high-quality training in such advanced technology. The demand and the actual supply of skilled professionals need to be more balanced. Because it will take more time to train professionals before they can practically and effectively execute hyperautomation, this could significantly impact the growth of the global industry. For creating learning opportunities to develop qualified and skilled people in the hyperautomation industry, the global market needs additional investors in the educational sector.

Hyper Automation Market Trends

The Machine Learning Segment is Expected to Drive the Market's Growth

- Machine Learning (ML) is a subfield of Artificial Intelligence (AI) that enables training algorithms to make classifications or predictions through statistical methods, uncovering critical insights within data mining projects. These insights drive decision-making within applications and businesses, ideally impacting key growth metrics. Since it revolves around algorithms, models, and computational complexity, skilled professionals must develop these solutions. The performance of automated machine learning has advanced due to data science and artificial intelligence improvements. Companies recognize the potential of this technology, and hence its adoption rate is likely to rise over the forecast period. Companies are selling automated machine learning solutions on a subscription basis, making it easier for customers to use this technology. Furthermore, it offers flexibility on a pay-as-you-go basis.

- AI enables machines to reason independently of humans and comes to their conclusions. The main goal of AI is to create computer programs or robots capable of thinking similarly to humans. A branch of AI known as machine learning, or ML, uses learning algorithms to enable it to learn from the past and advance. People can program a car to follow traffic lights, but it can also learn from other vehicles and from its own driving experience to reduce the frequency of accidents on the road. So, as a part of hyper-automation, it will be one of the most crucial technologies required to help devices learn and think before performing according to the workflow.

- According to the Society of Actuaries (SOA), nearly two-thirds of executives anticipate that predictive analytic tools will cut organizational costs by 15% or more by 2023. Future analytics will open up hyperautomation applications in this industry.

- The companies are developing new solutions or incorporating new features in their existing products to cater to a wide range of needs of different customers and to expand their market share. For instance, in March 2021, The Oracle Machine Learning AutoML User Interface made it simple for novice and experienced data scientists to design and deploy machine learning models. OML AutoML UI, a new component of Oracle Machine Learning on Oracle Autonomous Database, provides a no-code browser-based interface that automates machine learning modeling and reduces deployment to a few clicks. OML AutoML UI is an advanced, proprietary technology developed by Oracle Labs that uses Oracle Machine Learning's sophisticated in-database algorithms.

- Further, the rise in the use case of machine learning for companies will create an opportunity for the hyperautomation market to grow. For instance, according to Algorithmia, the top use cases for artificial intelligence and machine learning in 2021, as per 57% of respondents, are for increasing customer experience. Using AI and ML can improve several business operations.

North America is Expected to Hold a Major Market Share

- North America is one of the prominent regions for the global hyperautomation market because many essential market players are situated there. According to MAPI, US manufacturing production will increase by 2.8% from 2018 to 2021, further increasing the adoption of hyperautomation and control technologies in the country. Also, the recent increase in tariffs will likely force manufacturers in the US to produce goods at a lower cost, achieved through automation. Auto companies that invested in hyperautomation pre-tariffs are ahead of the game and are the cost-saving blueprint for other companies.

- Auto dealers may anticipate what client wants with hyper-automation and outfit themselves with a well-functioning supply chain. With the aid of predictive analytics, people can expect any unforeseen changes in vehicle demands, and the system responds promptly. It offers advice on reducing errors and overhead expenditures. The system analyses the sales history and forecasts demand behavior using pertinent criteria to keep the warehouse current.

- Further, the rise in automotive production is expected to drive the studied market in the region. For instance, according to OICA, In 2021, over 13.43 million automobiles were made in North America. The North American economy is heavily dependent on the production of vehicles. The further point is that in 2021, the US car sector produced about 9.17 million vehicles.

- In the US, over the last two years, the UPMC Health Plan abstractors found they can work around 38 times faster with the new implementation of Astrata's NLP-assisted tools. As a 40-hospital health system, it serves millions of patients across three states. In February 2021, UPMC Enterprises announced the launch of Astrata, the newest company incubated in UPMC Enterprises. Further, Astrata aims to increase its workforce by 30% over the coming year, and it joined a UPMC in recent years. Data scientists at the new company use cloud-based NLP to build tools enabling the payers to understand unstructured EHR data better, paving the way toward more accurate assessments of quality and population health measurements against Healthcare Effectiveness Data and Information Set.

- Moreover, the rise of the developments towards biometrics in North America will drive the studied market over the forecasted period. For instance, in April 2021, Microsoft Corp. and Nuance Communications Inc. announced they reached a definitive deal for Microsoft to buy Nuance. Nuance is a Burlington, Massachusetts-based multinational computer software technology firm that sells speech recognition and AI software. Nuance provides AI expertise and consumer engagement solutions to enterprises worldwide. The solutions include Interactive Voice Response (IVR), virtual assistants, and digital and biometric solutions. To create next-generation customer engagement and security solutions, companies will combine this knowledge with the breadth and depth of Microsoft's cloud, including Azure, Teams, and Dynamics 365.

Hyper Automation Industry Overview

The global hyperautomation market is moderately fragmented, with the presence of many companies. The companies continuously invest in strategic partnerships and product developments to gain more market share. Some of the current events in the market are:

June 2022 - Tray.io, a low-code automation and integration player, announced new capabilities designed to accelerate enterprise hyper-automation initiatives. With Connector Builder, Tray.io provides end-to-end connectivity for all user types, enabling low-code developers to create reusable connectors on-demand fast, efficiently, and visually. Additionally, the integration of hundreds of underlying endpoints into only three API calls is made simpler with a new Connectivity API experience for developers.

May 2022 - A global player in digital payments, Visa, and Phrasee, a player in brand language optimization, announced the establishment of an exclusive agreement for Europe. The three-year contract is a component of Visa's strategic investment in its customers, including the top B2B financial services companies in Europe. Phrasee will make its advanced machine learning and natural language generation technologies available to Visa customers through its reseller program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation Trends in the Manufacturing Sector

- 5.1.2 Increased penetration of digitalization, coupled with growing demand for improved efficiency and reduced operating costs

- 5.1.3 Growing applications of RPA and AI

- 5.2 Market Restraints

- 5.2.1 High initial cost of adoption

- 5.2.2 Lack of skilled personnel

6 MARKET SEGMENTATION

- 6.1 By Technology Type

- 6.1.1 Biometrics

- 6.1.2 Context-Aware Computing

- 6.1.3 Natural Learning Generation

- 6.1.4 Chatbots

- 6.1.5 Robotic Process Automation

- 6.1.6 Machine Learning

- 6.2 By End-User Industry

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 IT & Telecom

- 6.2.4 Education

- 6.2.5 Automotive

- 6.2.6 Manufacturing

- 6.2.7 Healthcare & Life Science

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Asia-Pacific

- 6.3.3 Europe

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alteryx

- 7.1.2 Automation Anywhere

- 7.1.3 SolveXia

- 7.1.4 Mitsubishi Electric Corporation

- 7.1.5 Catalytic Inc

- 7.1.6 OneGlobe LLC

- 7.1.7 Automate.io

- 7.1.8 UiPath

- 7.1.9 akaBot

- 7.1.10 Rocketbot

- 7.1.11 Simple Fractal