|

市场调查报告书

商品编码

1441571

Facade - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Facade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

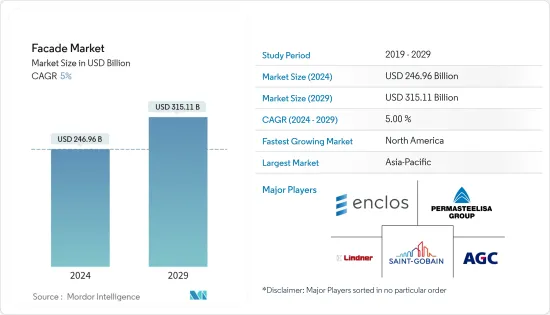

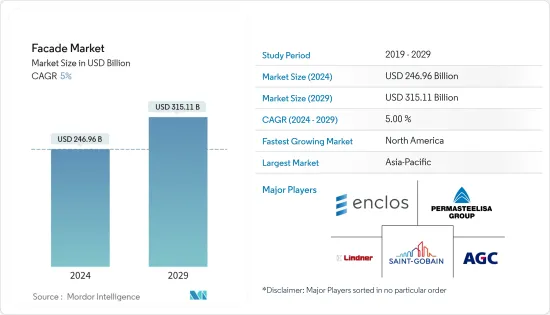

2024年,外墙市场规模预计为2,469.6亿美元,预计到2029年将达到3,151.1亿美元,在预测期内(2024-2029年)CAGR为5%。

COVID-19 严重打击了全球建筑业,导致工程延误、劳动力短缺,一些地方还因疫情限製而停工。

后来,限制放鬆后,建筑业缓慢復苏。目前,一些地区的商业和住宅项目正在显着成长,进一步推动了幕墙製造业的发展。

此外,立面装置在世界各地越来越受欢迎,这主要是由于人们对能源效率和外部美化方面的日益关注。此外,太阳能帷幕墙安装正在实现利润丰厚的成长,为了满足对太阳能帷幕墙不断增长的需求,大多数製造商都专注于开发新型和先进的太阳能帷幕墙。例如,2022年3月,加拿大太阳能技术製造商Mitrex推出了Solar Brick,它看起来像砖墙,但嵌入了太阳能模组。这些模组重量轻、耐用,并且可以储存能量,足以为建筑物供电。

此外,全球不断增加的商业和住宅项目推动了立面的采用。例如,2022 年,在欧洲,博杜安国王基金会计划资助超过 50 万欧元(534,175 美元),支持 11 个公共空间绿化项目,在比利时各地的公共建筑外观上创建垂直花园。此外,还提交了超过28个项目用于医院、市政厅、图书馆、文化中心、体育设施、游泳池、博物馆、剧院、图书馆和社区中心的外墙绿化,其中近11个项目被选中。因此,全球幕墙市场正在经历利润丰厚的成长。

帷幕墙市场趋势

亚太地区正见证显着成长

亚太地区正在经历大量的建设项目,该地区广泛关注外墙美化和能源效率因素,这些因素正在推动该国的外墙安装。此外,印度、日本、中国等发展中国家的快速城市化推动了该地区帷幕墙安装的需求。例如,2022年9月,中国揭开了世界上最扭曲的塔楼的面纱,也被称为「光之舞」摩天大楼。这座 180 公尺高的塔楼被外墙包围。

此外,立面装置在该地区越来越受欢迎,这主要是由于商业和住宅房地产开发的不断增加。例如,2022年12月,中国恆大集团计划恢復631个预售未交付专案的开工,以满足其物业交付费用。此外,该房地产开发商在2022年1月至11月期间交付了超过256,000套单位,预计到2023年底将交付近30万套单位。

同时,该地区的立面绿化正在显着成长。此外,印度和日本正积极采用立面绿化技术来实现其永续发展目标。此外,为了在气候变迁和建筑緻密化导致气温升高的情况下创造生活质量,立面绿化在城市地区发挥着至关重要的作用。而且,绿色办公理念也推动了立面绿化技术的发展。根据业界专家预测,2022年,日本东京的绿色办公室存量是亚太地区12个地区中最多的。此外,东京还拥有近900万平方公尺的环保认证办公空间。

商业部门正在推动外墙安装

大多数国家都致力于开发节能的商业建筑和办公空间。在未来几年,预计老化办公大楼翻修支出的增加将增加对立面安装的需求。近年来,商业建筑对美观的需求日益增长,推动了幕墙市场的扩张。

此外,儘管经济衰退,商业和工业仍实现了显着成长。此外,过去 18 个月美国建筑业的表现优于加拿大和墨西哥。与此同时,北美和欧洲地区正在经历大量商业项目。例如,2022年第二季度,美国基斯通贸易中心开工建设,第八办公大楼开工,在华盛顿州贝尔维尤建设占地50,167平方公尺、25层的办公大楼。等,这些项目将促进幕墙安装。

此外,欧洲地区的商业部门正在见证大量投资,导致新项目的建设,进一步推动了帷幕墙安装市场。然而,2022 年第一季度,跨国房地产交易有所增加。此外,由欧洲、中东和非洲组成的EMEA地区跨境交易量最大,达364亿美元。因此,全球不断成长的商业领域将为帷幕墙製造商创造巨大的机会。

帷幕墙产业概况

全球帷幕墙市场高度分散且竞争激烈,大公司占据了重要的市场份额。此外,一些关键参与者还参与合作、创新、业务扩张、奖励、合资企业和其他策略,以改善其产品足迹并保持市场竞争力。此外,市场上的一些主要参与者包括 Saint-Gobain SA、Enclos Corp.、Permasteelisa Sp 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究成果

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察与动态

- 当前市场概况

- 市场动态

- 市场驱动因素

- 全球高层建筑和摩天大楼数量的不断增加为帷幕墙系统创造了一个强劲的市场

- 建筑业主和开发商更加重视其结构的整体性能

- 市场限制

- 高品质的外墙材料和设计可能成本高昂,使得某些项目难以满足预算限制

- 外墙必须符合建筑规范和安全法规,这些法规和安全法规可能因地点而异

- 市场机会

- 装修和改造项目

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- 市场驱动因素

- 市场消费者行为变化洞察

- 市场中政府监管的见解

- 市场技术进步的见解

- COVID-19 对市场的影响

第 5 章:市场细分

- 按类型

- 通风

- 不通风

- 其他类型

- 按材质

- 玻璃

- 金属

- 塑胶和纤维

- 石头

- 其他材料

- 按最终用户

- 商业的

- 住宅

- 其他最终用户

- 按地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 德国

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地区

- 北美洲

第 6 章:竞争格局

- 公司简介

- Saint-Gobain SA

- Enclos Corp.

- Kawneer

- Permasteelisa SpA

- Aluplex

- AFS International

- Kingspan Group

- Lindner Group

- Norsk Hydro ASA

- AGC Glass Europe*

第 7 章:外墙市场的未来

第 8 章:附录

The Facade Market size is estimated at USD 246.96 billion in 2024, and is expected to reach USD 315.11 billion by 2029, growing at a CAGR of 5% during the forecast period (2024-2029).

COVID-19 hard hit on the construction sector across the globe, resulting in project delays, labor shortages, and halts in some places due to the pandemic restrictions.

Later, after easing the restrictions, the construction sector experienced a slow recovery. Currently, some of the regions are witnessing significant growth in commercial and residential projects, further driving the facade manufacturing sector.

Moreover, facade installations are gaining traction across the world, majorly driven by increasing concern towards energy efficiency and external beautification aspects. In addition, solar facade installations are exercising lucrative growth, and to meet the increasing demand for solar facades most manufacturers are focusing on developing new and advanced solar facades. For instance, in March 2022, a Canadian solar technology manufacturer, Mitrex, launched the Solar Brick, which looks like a brick wall but has embedded solar modules. These modules are lightweight and durable and can store energy, which is enough to power the building.

Furthermore, increasing commercial and residential projects across the globe fuel the facade's adoption. For instance, in 2022, in Europe, the King Baudouin Foundation planned to fund more than EUR 500,000 (USD 534,175) to support 11 projects to green the public space by creating vertical gardens on the facades of public buildings throughout Belgium. In addition, more than 28 projects were submitted for greening the outer walls of hospitals, town halls, libraries, cultural centers, sports facilities, swimming pools, museums, theatres, libraries, and community centers, out of which nearly 11 projects were selected. Thus, the facade market is witnessing lucrative growth across the globe.

Facade Market Trends

Asia-Pacific is Witnessing Significant Growth

Asia-Pacific is experiencing a significant number of construction projects, and the region is widely focusing on external wall beautification and energy efficiency factors, these factors are driving the installation of the facades in the country. In addition, rapid urbanization in developing countries such as India, Japan, China, etc. driving the demand for facade installations in the region. For instance, in September 2022, China unveiled the world's most twisted towers, also known as the Dance of Light skyscraper. This 180-meter tall tower was enveloped with facades.

Moreover, facade installations are gaining traction in the region, majorly due to increasing commercial and residential property development. For instance, in December 2022, China Evergrande Group planned to resume its work on 631 pre-sold and undelivered projects to meet its property delivery charger. In addition, the property developer delivered more than 256,000 units between January to November of 2022, and they expect to deliver nearly 300,000 units by the end of 2023.

Meanwhile, facade greening is witnessing significant growth in the region. In addition, India and Japan are actively adopting facade greening techniques to reach their sustainability targets. In addition, to create a quality of life against rising temperatures due to climate change and building densification, facade greening plays a vital role in urban areas. Moreover, the green office concept also promotes the facade greening technology. In 2022, as per industry experts, Tokyo, Japan, had the largest inventory of green offices among the 12 Asia-Pacific areas. Also, Tokyo owns nearly 9 million square meters of environmentally certified office spaces.

Commercial Sector is Driving the Facades Installation

Most countries are focusing on developing commercial buildings and office spaces that are energy efficient. In the upcoming years, it is anticipated that increased spending on the renovation of aging office buildings will increase demand for facade installations. A growing need for aesthetic appearance in commercial buildings has emerged in recent years, which has fuelled the expansion of the facade market.

Moreover, commercial and industrial witnessed significant growth despite the recession. In addition, the United States construction sector has outperformed Canada and Mexico over the past 18 months. Meanwhile, North America and Europe regions are experiencing a significant number of commercial projects. For instance, in Q2 2022, construction of the Keystone Trade Center was started in the United States, and the Eight Office Tower was started, which involves the construction of 50,167 square meters and a 25-story office tower in Bellevue, Washington. etc., these projects will boost the facade installations.

Furthermore, the commercial sector in the European region is witnessing a positive number of investments, resulting in the construction of new projects, further driving the facade installation market. However, in Q1 2022, cross-border real estate transactions increased. In addition, the EMEA region, consisting of Europe, the Middle East, and Africa, received the largest volume of cross-border transactions, amounting to USD 36.4 billion. Thus, the growing commercial sector across the globe will create a huge opportunity for facade manufacturers.

Facade Industry Overview

The global facade market is highly fragmented and competitive, with large companies claiming significant market share. Moreover, several key players engage in collaborations, innovations, business expansion, awards, joint ventures, and other strategies to improve their product footprint and remain competitive in the market. Furthermore, some of the major players in the market include Saint-Gobain S.A, Enclos Corp., Permasteelisa S.p., etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems

- 4.2.1.2 Building owners and developers are placing greater emphasis on the overall performance of their structures

- 4.2.2 Market Restraints

- 4.2.2.1 High-quality facade materials and designs can be costly, making it challenging for some projects to meet budget constraint

- 4.2.2.2 Facades must comply with building codes and safety regulations, which can vary based on location

- 4.2.3 Market Opportunities

- 4.2.3.1 Renovation and Retrofitting Projects

- 4.2.4 Porter's Five Forces Analysis

- 4.2.4.1 Bargaining Power of Suppliers

- 4.2.4.2 Bargaining Power of Buyers/Consumers

- 4.2.4.3 Threat of New Entrants

- 4.2.4.4 Threat of Substitute Products

- 4.2.4.5 Intensity of Competitive Rivalry

- 4.2.1 Market Drivers

- 4.3 Insights on Changes in Consumer Behavior in the Market

- 4.4 Insights on Government Regulations in the Market

- 4.5 Insights on Technological Advancements in the Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ventilated

- 5.1.2 Non-Ventilated

- 5.1.3 Other Types

- 5.2 By Material

- 5.2.1 Glass

- 5.2.2 Metal

- 5.2.3 Plastic and Fibres

- 5.2.4 Stones

- 5.2.5 Other Materials

- 5.3 By End-User

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.3.3 Other End-Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 United Arab Emirates

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of Middle East & Africa

- 5.4.5 Latin America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of Latin America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Saint-Gobain S.A

- 6.2.2 Enclos Corp.

- 6.2.3 Kawneer

- 6.2.4 Permasteelisa S.p.A

- 6.2.5 Aluplex

- 6.2.6 AFS International

- 6.2.7 Kingspan Group

- 6.2.8 Lindner Group

- 6.2.9 Norsk Hydro ASA

- 6.2.10 AGC Glass Europe*