|

市场调查报告书

商品编码

1441619

汽车连接器 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

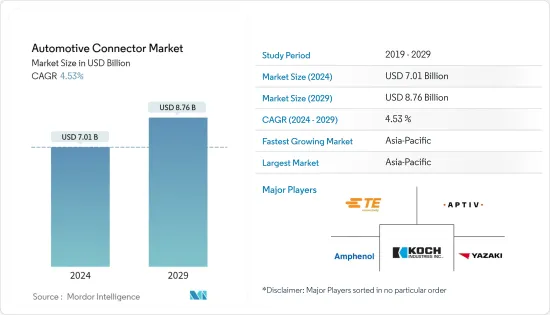

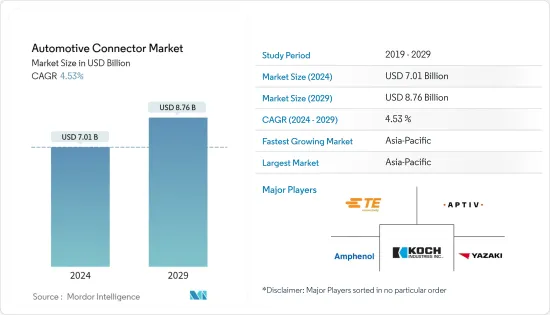

2024年汽车连接器市场规模预计为70.1亿美元,预计到2029年将达到87.6亿美元,在预测期内(2024-2029年)CAGR为4.53%。

COVID-19 大流行对市场产生了负面影响,由于一些车辆和零件製造工厂暂时关闭,导致车辆销售略有下降。然而,随着一些国家逐步解除封锁,对车辆的需求也略有增加。因此,随着需求的增加,主要参与者也在增加其製造设施以增加产量。

从长远来看,市场预计将主要由技术进步和系统创新所驱动。导航和资讯娱乐系统等的日益普及已成为全球大多数汽车的标准配置。为了连接这些系统,需要中央电子控制单元汽车连接器。

消费者对安全问题的日益关注,加上政府机构的安全相关倡议,提高了各种车辆系统对可靠连接器的要求。例如,车辆中使用的安全带、安全气囊和煞车等安全系统需要包含固定器和安全约束系统连接器的连接系统。因此,对汽车安全系统的需求不断增长,直接影响对汽车连接器的需求,进而推动市场的成长。

预计亚太地区在预测期内将占据市场主导份额。强劲的汽车工业和不断增长的电动和混合动力汽车,加上政府的倡议,预计将在预测期内支持该地区的需求。然而,由于市场对汽车连接器的需求增加,主要参与者也在该地区进行投资。

例如,2021年9月,李尔公司(Lear)宣布与台湾汽车连接器产品製造商Hu Lane Associate Inc.签署成立合资企业的最终协议。它将透过为全球汽车製造商提供的当前和未来的车辆架构设计和製造连接系统产品组合,立即扩大李尔的垂直整合能力。

汽车连接器市场趋势

资讯娱乐系统不断进步

汽车中越来越多地采用先进的安全功能,以及对电动车 (EV) 的需求不断增长,是推动市场成长的主要因素。此外,汽车感测器和资讯娱乐系统的日益复杂化增加了全球对汽车线束和连接器的需求。塑胶光纤 (POF) 正在取代汽车中的铜缆,以提高资料传输和设计灵活性,同时减轻车辆总重量。 POF 需要汽车连接器才能正常运作。

除此之外,由于技术扩散,空调系统和暖通空调系统的发展预计将对预测期内连接器的成长产生有利影响。市场上的主要参与者正在製造连接器并进行收购以满足车辆的功能。

例如,2021 年 2 月,JAE Electronics 开发了 MX79A 汽车资讯娱乐连接器,用于汽车导航系统、先进驾驶辅助系统、倒车摄影机和车载娱乐系统。此外,2021年6月,全球汽车座椅和电子系统技术领导者李尔公司与IMS Connector Systems GmbH签署了联合开发协议,IMS Connector Systems GmbH是一家位于德国洛芬根的技术公司,专门从事汽车高速乙太网路解决方案应用程式。

此外,先进的汽车系统中还使用记忆体和资料储存连接器来支援自动驾驶汽车中的 Wi-Fi 网路。再加上混合动力汽车的日益普及,正在推动市场成长。此外,自适应头灯、巡航控制、停车辅助和出发警告系统等产品创新,以及自动驾驶车辆中机器学习的结合,预计将在未来几年推动市场发展。

预计欧洲在预测期内将占据更大的市场份额

欧洲在实施车辆安全功能方面处于领先地位,美洲和亚太地区紧随其后。该地区对汽车电气化的需求不断增长,以及政府针对该国汽车工业发展的支持措施,预计将为预测期内汽车连接器的成长创造积极的前景。

此外,为了满足不断增长的消费者需求(尤其是电动车行业製造商的需求),积极开发的重点是开发创新解决方案。随着人们对车辆安全和保全功能的认识不断增强,连接器製造商预计将重点开发功能以满足需求。

例如,2021 年 9 月,TE Connectivity (TE) 收购了 ERNI Group AG (ERNI)。收购 ERNI 补充了 TE 广泛的连接产品组合,特别是用于工厂自动化、汽车、医疗和其他工业应用的高速和细间距连接器。此外,浩亭技术集团于 2021 年 1 月扩展了 IX Industrial® 微型资料连接器产品线,推出了用于资讯娱乐和乘客资讯系统以及其他产品变体的新型电缆组件。该解决方案非常适合火车和公共汽车中的资讯娱乐和乘客资讯系统。此连接器比铁路应用中常用的同类圆形连接器更小、更轻。

由于汽车工业的进步,预计在预测期内连接器在欧洲市场将显着成长。

汽车连接器产业概况

汽车连接器市场是一个适度整合的市场,主要参与者包括 TE Connectivity Ltd、Yazaki Corporation、JST Mfg、Ampheno Corporation、Aptiv PLC 和 Sumitomo Wiring Systems Ltd,占据了市场的重要份额。这些公司正致力于在全球扩展其连接器业务,以抓住车辆中先进电子和安全系统的成长趋势。

例如,2021 年 4 月,TactoTek 和 Ampheno ICC 宣布合作开发适用于 TactoTek IMSE 技术的汽车级模内连接器。 Ampheno ICC 将透过 TactoTek 的 IMSE 等变革性技术与 Ampheno ICC 的汽车级 MicroSpace 连接器平台和 Duflex 压接技术相结合,为客户带来新技术产品。

此外,2021年3月,京瓷推出了适用于汽车应用的0.4毫米间距8152系列电子连接器。它符合高速传输标准 MIPI D-PHY (2.5 Gbps)、PCI Express Gen2 (5Gbps) 和 Gen3 (8Gbps)。该框架经过屏蔽,设计坚固,可降低 EMI,适合要求苛刻的汽车应用。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场区隔(市场规模(百万美元))

- 应用

- 动力总成

- 舒适、便利、娱乐

- 安全保障

- 车身接线及配电

- 导航和仪表

- 车辆类型

- 搭乘用车

- 商用车

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 亚太其他地区

- 世界其他地区

- 巴西

- 阿根廷

- 南非

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- TE Connectivity Ltd

- Yazaki Corporation

- JST Mfg Co. Ltd

- Molex Incorporated (Koch Industries Inc. )

- Amphenol Corporation

- Luxshare Precision Industry Co. Ltd

- Aptiv PLC

- Hirose Electric Co. Ltd

- Samtec

- Lumberg Holding

- Sumitomo Wiring Systems Ltd

第 7 章:市场机会与未来趋势

The Automotive Connector Market size is estimated at USD 7.01 billion in 2024, and is expected to reach USD 8.76 billion by 2029, growing at a CAGR of 4.53% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market, as there was a slight decline in vehicle sales due to several vehicles and component manufacturing facilities shutting down temporarily. However, with the gradual removal of lockdowns in several countries, the demand for vehicles has slightly increased. Therefore with the increase in demand, key players are also increasing their manufacturing facilities to increase production.

Over the long term, the market is expected to be primarily driven by technological advancements and innovations in systems. Rising adoption of navigation and infotainment systems, among others, have become standard features in most cars across the world. To connect these systems, central electronic control unit automotive connectors are required.

The increase in safety concerns among consumers, coupled with safety-related initiatives from government agencies, has elevated the requirement for a reliable connector in various vehicle systems. For instance, safety systems like seatbelts, airbags, and brakes used in vehicles require a connection system comprising a retainer and safety restraint system connector. Thus, the increasing demand for automotive safety systems has a direct influence on the demand for automotive connectors, in turn driving the growth of the market.

Asia-Pacific is expected to hold a dominant share of the market during the forecast period. The strong automotive industry and rising electric and hybrid vehicles, coupled with government initiatives, are anticipated to support demand across the region during the forecast period. However, key players are also investing in the region due to the increase in the demand for automotive connectors in the market.

For instance, in September 2021, Lear Corporation (Lear) announced the signing of a definitive agreement for a joint venture with Hu Lane Associate Inc., a Taiwanese manufacturer of automotive connector products. It will immediately broaden Lear's vertical integration capabilities by engineering and manufacturing a portfolio of connection systems products for current and future vehicle architectures offered by global automakers.

Automotive Connector Market Trends

Increasing Advancement in Infotainment ystem

The increasing incorporation of advanced security features in automobiles, as well as the rising demand for electric vehicles (EVs), is the primary factor driving the market growth. Furthermore, the increasing sophistication of automotive sensors and infotainment systems has increased the global demand for automotive wiring harnesses and connectors. Plastic optical fiber (POF) is replacing copper cables in automobiles to improve data transmission and design flexibility while also reducing overall vehicle weight. POF requires automotive connectors to function properly.

In addition to this, the evolution of air conditioning systems and HVAC systems, owing to technological proliferation, is expected to favorably impact connectors' growth during the forecast period. Major players in the market are manufacturing the connectors and entering acquisitions to meet the features in the vehicles.

For instance, in February 2021, JAE Electronics developed MX79A Automotive Infotainment Connectors for use in automotive navigation systems, advanced driver assistance systems, backup cameras, and in-vehicle entertainment. Additionally, in June 2021, Lear Corporation, a global automotive technology leader in seating and e-systems, signed a joint development agreement with IMS Connector Systems GmbH, a technology company based in Loffingen, Germany, specializing in high-speed Ethernet solutions for automotive applications.

Furthermore, memory and data storage connectors are used in advanced automotive systems to support Wi-Fi networks in automated vehicles. This, combined with the increasing adoption of hybrid vehicles, is fueling market growth. Furthermore, product innovations such as adaptive front lighting, cruise control, park assistance, and departure warning systems, as well as the incorporation of machine learning in self-driving vehicles, are expected to propel the market in the coming years.

Europe is Expected to Capture a Larger Market Share During the Forecast Period

Europe leads the way in implementing vehicle safety features, with the Americas and Asia-Pacific following in its footsteps. Growing demand for vehicle electrification in the region, as well as supportive government measures aimed at the development of the country's automotive industry, are expected to create a positive outlook for the growth of automotive connectors during the forecast period.

Furthermore, active developments to meet growing consumer demand, particularly from manufacturers in the electric vehicle industry, are focusing on developing innovative solutions. With increased awareness of vehicle safety and security features, connector manufacturers are anticipated to focus on developing features to meet the demand.

For instance, in September 2021, TE Connectivity (TE) acquired ERNI Group AG (ERNI). The acquisition of ERNI complements TE's broad connectivity product portfolio, particularly in high-speed and fine-pitch connectors for factory automation, automotive, medical, and other industrial applications. Additionally, in January 2021, HARTING Technology Group expanded its IX Industrial® line of miniature data connector products with new cable assemblies intended for infotainment and passenger information systems and other product variants. This solution is ideal for infotainment and passenger information systems in trains and buses. The connector is significantly smaller and lighter than the comparable circular connectors commonly used in railway applications.

As a result of the advancement of the automotive industry, connectors are expected to grow significantly in the European market during the forecast period.

Automotive Connector Industry Overview

The automotive connector market is a moderately consolidated market due to the major players, like TE Connectivity Ltd, Yazaki Corporation, J.S.T. Mfg Co. Ltd, Amphenol Corporation, Aptiv PLC, and Sumitomo Wiring Systems Ltd, capturing significant shares in the market. These companies are focusing on expanding their connector business globally to capture the growing trend of advanced electronics and safety systems in vehicles.

For instance, in April 2021, TactoTek and Amphenol ICC announced that they were collaborating to develop automotive-grade in-mold connectors for TactoTek IMSE technology. Amphenol ICC will bring new technology products to customers with transformational technologies like TactoTek's IMSE combined with Amphenol ICC's automotive-grade MicroSpace connector platform and Duflex crimp technology.

Additionally, in March 2021, KYOCERA launched 0.4mm-Pitch 8152 series electronic connectors for automotive applications. It conforms to high-speed transmission standard MIPI D-PHY (2.5 Gbps), PCI Express Gen2 (5Gbps), and Gen3 (8Gbps). The frame is shielded for a robust design and EMI reduction suitable for demanding automotive applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Million)

- 5.1 Application

- 5.1.1 Powertrain

- 5.1.2 Comfort, Convenience, and Entertainment

- 5.1.3 Safety and Security

- 5.1.4 Body Wiring and Power Distribution

- 5.1.5 Navigation and Instrumentation

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 South Africa

- 5.3.4.4 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 TE Connectivity Ltd

- 6.2.2 Yazaki Corporation

- 6.2.3 J.S.T. Mfg Co. Ltd

- 6.2.4 Molex Incorporated (Koch Industries Inc. )

- 6.2.5 Amphenol Corporation

- 6.2.6 Luxshare Precision Industry Co. Ltd

- 6.2.7 Aptiv PLC

- 6.2.8 Hirose Electric Co. Ltd

- 6.2.9 Samtec

- 6.2.10 Lumberg Holding

- 6.2.11 Sumitomo Wiring Systems Ltd