|

市场调查报告书

商品编码

1635368

汽车和交通领域的无损检测:市场占有率分析、行业趋势和成长预测(2025-2030)NDT in Automotive & Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

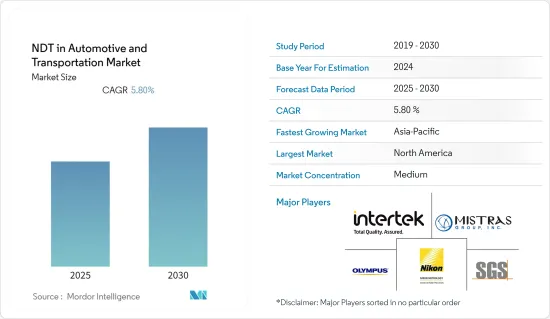

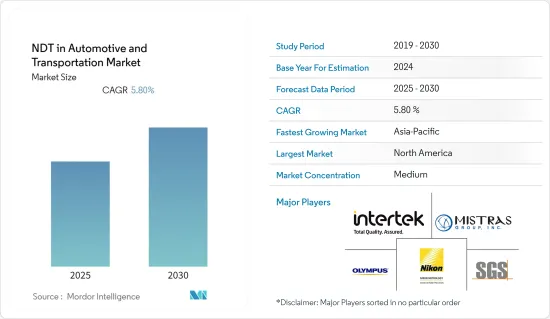

汽车和交通无损检测市场在预测期内的复合年增长率预计为 5.8%。

主要亮点

- 无损检测方法应用于汽车和交通运输行业,在不损坏被检物体的情况下检查不同材料的内部结构,透过对热、声、光、电等的不同反应来测试不同材料和零件。存在的各种缺陷。同时,透过检查可以获得形成的缺陷的类型、特征、数量、尺寸、位置等参数。

- 无损检测可用于检验各种材料的均匀性和可靠性,主要定量分析不同类型缺陷与强度之间的相关性,评估各种零件的剩余寿命和负载寿命,应用于检测内部结构等方面各种设备运作过程中出现的不完善和缺陷,可以更及时地发现设备问题,确保设备运作过程中的安全。

- 辐射侦测方法广泛应用于汽车产业。例如,辐射照射法利用不同材料具有不同的辐射吸收和衰减特性,利用底片的黑度可以侦测出材料中的缺陷。在汽车工业中,它们用于检查铸件和焊接零件。例如,检查凸轮轴和轮毂。

- 2021年4月,TACOMA计划宣布。该计划旨在透过增加碳纤维增强聚合物部件的使用来帮助减轻重量,从而为汽车行业开发先进的解决方案。儘管已经可以使用各种无损检测 (NDT) 技术来发现复合材料零件中的缺陷,但检查速度仍然是一个限制因素,尤其是在大批量生产环境中。此外,许多现有的无损检测技术只能发现特定的缺陷。该计划旨在透过提供独特的高速 X 光检测系统以及适用于大批量和高速汽车製造应用的影像处理软体来解决这些问题。这些努力可能有助于扩大研究目标市场。

- 然而,由于供应链中断、需求疲软、製程波动和原材料缺乏,COVID-19大流行对汽车产业产生了严重影响。例如,根据国际汽车製造商组织(OICA)的数据,预计全球汽车产量将从2018年的9,700万辆减少到2020年的7,800万辆。 2021年,全球汽车产量将接近8,000万辆,较2020年成长约3%。

汽车及交通领域无损检测市场趋势

涡流检测技术可望推动成长

- 电涡流检测利用电磁感应来检测和表征金属材料的表面和次表面缺陷和缺陷。电涡流检测可以检测铁磁和非铁磁材料。此外,不要求材料具有特定的电导率。

- 电涡流检测使用一种用交流电激励导线线圈的装置。线圈在其自身周围产生交变磁场。产生的磁场以与通过线圈的电流相同的频率振盪。当线圈接近导电材料时,根据楞次定律,材料中会感应出与线圈中的电流相反的电流,称为涡流。主要用于汽车检测阀门、球销、环座等。

- 最新一代手持式涡流计,如 Zetec 的 MIZ-21C,具有几乎可以在任何地方执行检查的处理能力、软体和电池寿命,包括为技术人员和製造人员提供即时视觉回馈的 C 扫描功能。即使是不规则的表面或复杂的几何形状,Zetec 的 Surf-X 阵列探头等柔性表面探头也能使涡流线圈靠近材料并名义上保持垂直。

- 提供涡流设备的公司包括 PCE Instruments、Trinity NDT、Ether NDE 和 Bokena,这些公司提供特定产业设备。例如,圆锥滚子线上涡流探伤仪YZGZET-01用于汽车和航太行业。该行业正在建立多个联盟,以发挥协同效应,并利用增强的技术力、扩大的製造能力以及积极的研发投资。

- 此外,电涡流检测系统可以实现自动化,并整合到大批量汽车零件生产场景的生产线中。与其他非破坏性检测方法不同,线上电涡流检测快速、干净,并允许您保持生产线移动。它还具有一致性的优点。

亚太地区预计将出现显着成长

- 随着亚太地区电子技术和电脑技术的快速发展,无损检测技术也不断朝向数位化、高效化方向变革,越来越多的无损检测技术呈现出高灵敏度、稳定高效的特点。该行业正在寻求新的测试方法来确定汽车零件的当前质量,预计这将对所研究的市场产生积极影响。例如,日本东芝公司开发了配备相位阵列的Matrixeye超音波探伤仪,可进行3D SAFT(合成孔径聚焦技术)检查。在汽车领域,Matrix Eye可用于在不造成损坏的情况下检查焊缝,并且机器人可以自动执行检查。

- 印度品牌股权基金会的数据显示,印度21财年汽车产量为2,265万辆,其中2021年4月至10月期间生产了1,300万辆。 2022 财年第三季电动车 (EV) 销量达 5,592 辆,创下历史新高。 2021 年,印度销售了 329,190 辆电动车 (EV),比前一年的 122,607 辆成长了 168%。

- 此外,根据中国工业协会(CAAM)的数据,中国汽车产量(乘用车和商用车)将从2020年的2,522.5万辆增加到2021年的2,608.2万辆。汽车产量的大幅增长以及该地区製造能力的扩大可能会为无损检测市场创造利润丰厚的机会。

- 此外,印度等开发中国家花费大量资金修復公路、铁路等关键基础设施,其中许多基础设施已经非常陈旧。印度铁路是印度经济和基础设施成长的支柱,也是世界领先的交通网络之一。据印度铁路公司称,该公司拥有机车、客车、货车和 119,724 座桥樑,遍布 62,495 英里的网路。因此,为了妥善维护,印度铁路采用了超音波检测等无损检测方法。印度铁路车辆经常使用 TVEMA 的超音波连续检测系统对机车车辆进行试运行运行。因此,新兴国家的基础设施发展可能会促进所研究市场的成长。

- 此外,该地区的几家公司正在开发新产品,用于测量汽车零件的焊接强度以及车门和车身的油漆厚度。例如,2021年4月,日本尼康公司宣布推出一款能够增材製造钛合金的新型光学加工系统「Lasermeister 102A」。 Lasermeister 系列使用高精度雷射以多种方式加工金属,包括 3D 列印、雷射焊接和增材製造。

汽车和交通领域无损检测概述

汽车和交通领域的无损检测市场竞争激烈,主要参与者包括 Mystras Group、 Olympus Corporation 和 SGS Group。透过合作、合併和重大研发投资,这些公司努力创新全面的产品和解决方案,以满足不断发展的汽车产业的复杂要求。

- 2022 年 1 月 - Roper Technologies, Inc. 的前子公司 Zetec 被 Eddyfi/NDT 完全收购。 Zetec 的所有人才和技术都将加入 Eddyfi Technologies 的投资组合中。 Eddyfi Technologies 将负责在成立的关键产业推广 Zetec 品牌,包括发电、航太、国防、铁路和製造业。

- 2022 年 1 月 - Aplus Plus Laboratories 开设了一个新的电动车电池测试实验室,专门从事 ECE R100 认证和 UN DOT 38.3 合规性的电池测试。专门从事 ECE R100 认证和 UN DOT 38.3 合规电池测试的新实验室已在英国测试中心 Applus+3C Test运作。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 价值链分析

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 电动车需求快速成长

- 缺陷检测的需求增加以降低维修成本

- 市场限制因素

- 缺乏技术纯熟劳工

第六章 市场细分

- 按类型

- 装置

- 按服务

- 透过检测技术

- 射线照相检查

- 超音波探伤检验

- 磁粉探伤与电磁探伤

- 液体液体渗透探伤

- 目视检查

- 涡流

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Mistras Group

- Baker Hughes(GE)

- NikonMetrology Inc.

- Magnaflux Corporation

- Olympus Corporation

- SGS Group

- Intertek Group PLC

- Applus Services, SA

- Yxlon International GmbH

- Tuv Rheinland Ag

第八章投资分析

第9章 未来展望

简介目录

Product Code: 91556

The NDT in Automotive & Transportation Market is expected to register a CAGR of 5.8% during the forecast period.

Key Highlights

- By using the non-destructive monitoring method in the automotive and transportation industry, it is possible to find out the various defects existing in different materials and components by testing the internal structure of different materials and showing different responses to heat, sound, light, electricity, etc., without damaging the object under inspection. Simultaneously, the type, characteristics, number, size, and location of the formed defects and other parameters can be obtained through inspection.

- NDT can be used to test the uniformity and reliability of various materials, mostly applied to aspects like quantitative analysis of the correlation between different types and intensity of defects; evaluation of the remaining life and load life of various components; detection of internal structural incompleteness and defects originated during the operation of different equipment, so as to find the problems of equipment in a more timely manner and ensure the safety of the equipment in operation.

- Radiation detection methods are being widely used in the automotive industry. For instance, the radiation irradiation method, based on the fact that different materials have different absorption and attenuation properties to the rays, is employed as the blackness of the negative can be used to detect the defects existing in the material. It is used in the automotive industry to inspect castings and welded components. For example, camshafts and wheel hubs are inspected.

- In April 2021, the TACOMA project was announced, which strives to develop an advanced solution for the automotive industry as it increases the use of carbon fibre reinforced polymer parts as an aid to light-weighting. While it is already possible to spot defects in composite parts using different non-destructive testing (NDT) techniques, the speed of inspection is still a limiting factor, especially for high-volume production environments. Additionally, many of the existing NDT techniques are only capable of locating certain defects. The project aims to solve these issues by delivering a unique rapid X-ray detection system complete with imaging software that is suitable for high-volume, high-speed automotive manufacturing applications. Such initiatives would aid in the expansion of the studied market.

- However, the COVID-19 pandemic severely impacted the automotive industry due to the disruptions in supply chain, slump in demand, fluctuation in process and unavailability of raw materials. For instance, according to the OICA (Organisation Internationale des Constructeurs d'Automobiles), the estimated worldwide motor vehicle production decreased from 97 million vehicles in 2018 to 78 million vehicles in 2020. In 2021, almost 80 million motor vehicles were produced worldwide, which translates into an increase of around 3%, compared with 2020.

NDT in Automotive & Transportation Market Trends

Eddy Current Testing Technology is Expected to Drive Growth

- Eddy current testing employs electromagnetic induction to detect and characterize surface and sub-surface flaws and defects in metallic materials. The eddy current inspection method can detect ferromagnetic and non-ferromagnetic materials. Additionally, the material is not required to have a specific electrical conductivity.

- The Eddy current detection method utilizes a device where a coil of the conductive wire is excited with an alternating electrical current. The wire coil creates an alternating magnetic field around itself. The field generated oscillates at the same frequency as the current passing through the coil. When the coil comes closer to a conductive material, currents opposed to the ones in the coil are induced in the material, known as eddy currents, according to Lenz's Law. It is mostly used in detector valves, ball pins, ring seats, and other components in automotive applications.

- The most recent generation of handheld eddy current instruments, like Zetec's MIZ-21C, have the processing power, software, and battery life to perform inspections nearly anywhere, including C-Scan functionality that offers the technician and production staff real-time visual feedback. Even when the surface is uneven or complicated geometry, eddy current coils may stay near and nominally perpendicular to the material with flexible surface probes like Zetec's Surf-X array probe.

- Some of the companies providing eddy current equipment are PCE Instruments, Trinity NDT, ETher NDE, and Bokena, among others, which provide industry-specific devices. For example, Tapered Roller Online Eddy Current Flaw Detector YZGZET-01 is used in the automotive and aerospace industries. The industry is witnessing several collaborations to leverage synergies and exploit enhanced technical capabilities, expanded manufacturing abilities, and robust investments in R&D.

- Further, eddy current inspection systems can be automated and incorporated into the production line in high-volume automotive component manufacturing scenarios. Unlike other non-destructive testing methods, in-line eddy current inspections are fast, clean, and keep the line moving. They also provide the benefit of consistency.

Asia Pacific Region is Expected to Witness Significant Growth

- At the same time of the rapid development of electronic technology and computer technology in the APAC region, NDT technology is also continuously changing in the direction of digitalization, efficiency, and more NDT technologies show the characteristics of high sensitivity, stability, and efficiency. The industry is demanding new test methods to determine the present quality of automobile parts, which is expected to influence the studied market positively. For example, in order to perform 3D SAFT (Synthetic Aperture Focusing technique) inspections, Toshiba, a Japan-based company, created the Matrixeyeultrasonic testing device, a phased array-equipped piece of equipment. The automotive sector may use Matrixeye to test welds without causing any damage, and robots can carry out the inspection automatically.

- According to the Indian Brand Equity Foundation, In FY21, India produced 22.65 million cars annually, with 13 million built between April and October 2021. Sales of electric vehicles (EVs) hit a new high of 5,592 units in the third quarter of FY22. Overall, 329,190 electric vehicles (EVs) were sold in India in 2021, representing a 168% YoY increase over the 122,607 units sold the previous year.

- Further, according to the China Association of Automobile Manufacturers(CAAM), China's production of cars (passenger cars and commercial vehicles) witnessed an increase from 25,225 thousand units in 2020 to 26,082 thousand units in 2021. Such a huge increase in automotive production, and manufacturing capacity expansions in the region, would create lucrative opportunities for the NDT market.

- Additionally, significant expenditures are being made on repairing the key infrastructure in developing nations like India, including roads, and railways, many of which are very old. The backbone of the Indian economy and infrastructural growth, the Indian Railways is one of the greatest transportation networks in the world. According to Indian railways, it has a sizable fleet of locomotives, carriages, and wagons, as well as 119,724 bridges spread across a wide network of 62,495 route miles. Hence, to carry out proper maintenance, the Indian Railway is employing non-destructive testing such as ultrasonic testing. The Indian Railway frequently conducts test runs of the diagnostic railcar with a system for continuous ultrasonic inspection made by TVEMA. Thus, maintaining infrastructure in emerging countries is likely to drive the growth of the market studied.

- Moreover, to determine the welding strength of the automotive parts and to gauge the painting thickness on the doors and body of the vehicles., several companies in the region are developing new products. For instance, in April 2021, a Japan-based company, Nikon Corporation, introduced the Lasermeister102A, a new optical processing system capable of titanium alloy additive manufacturing. A high-precision laser is used in the Lasermeister series to process metal in a variety of ways, including 3D printing, laser welding, and additive manufacturing.

NDT in Automotive & Transportation Industry Overview

The NDT in Automotive & Transportation Market is competitive with significant players like Mistras Group, Olympus Corporation, SGS Group, etc. The market players are striving to innovate comprehensive products and solutions to cater to the evolving automotive industry's complex requirements through collaborations, mergers, and extensive R&D investments.

- January 2022 - Zetec, a former subsidiary of Roper Technologies, Inc., had been fully acquired by Eddyfi/NDT. All of Zetec's people and technologies would be added to Eddyfi Technologies' portfolio. Eddyfi Technologies would be responsible for promoting the Zetec brand in major industries where it is well established, including power generation, aerospace, defense, rail, and manufacturing.

- January 2022 - Applus+ Laboratories opened a new laboratory for testing EV batteries, dedicated to battery testing for ECE R100 homologation and UN DOT 38.3 compliance. The new lab, dedicated to battery testing for ECE R100 homologation and UN DOT 38.3 compliance, is already up and running at their UK test center, Applus+ 3C Test.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Upsurge in the Demand for EVs

- 5.1.2 Increase in Demand for Flaw Detection to Reduce Repair Cost

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Equipment

- 6.1.2 Services

- 6.2 By Testing Technology

- 6.2.1 Radiography Testing

- 6.2.2 Ultrasonic Testing

- 6.2.3 Magnetic Particle Testing and Electromagnetic Testing

- 6.2.4 Liquid Penetrant Testing

- 6.2.5 Visual Inspection

- 6.2.6 Eddy Current

- 6.2.7 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdm

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mistras Group

- 7.1.2 Baker Hughes(GE)

- 7.1.3 NikonMetrology Inc.

- 7.1.4 Magnaflux Corporation

- 7.1.5 Olympus Corporation

- 7.1.6 SGS Group

- 7.1.7 Intertek Group PLC

- 7.1.8 Applus Services, S.A.

- 7.1.9 Yxlon International GmbH

- 7.1.10 Tuv Rheinland Ag

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219