|

市场调查报告书

商品编码

1441626

钠离子电池:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sodium-ion Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

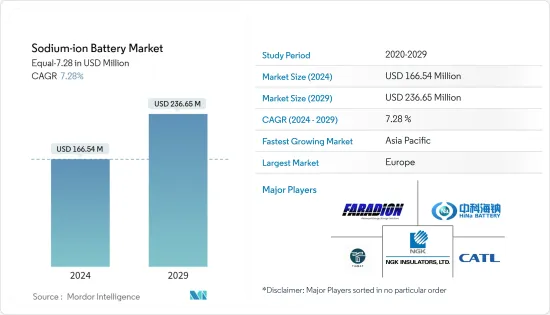

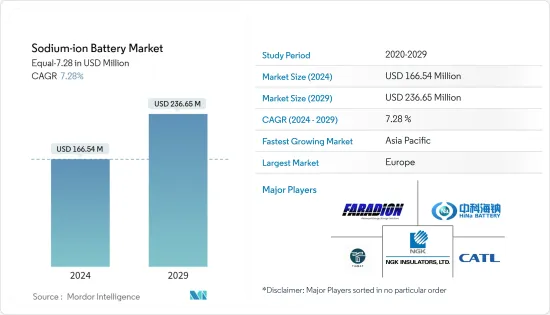

钠离子电池市场规模预计将从2024年的1.6654亿美元成长到2029年的2.3665亿美元,预测期间(2024-2029年)复合年增长率为7.28%。

主要亮点

- 中期推动市场的主要因素是,由于全球温室气体排放的增加,对清洁能源的需求不断增加。此外,使用钠离子电池储存太阳能和风能发电也可能推动市场发展。

- 另一方面,岚的不成熟技术预计将阻碍预测期内的市场成长。

- 儘管如此,风能和太阳能预计将推动可再生能源的强劲成长,而水力发电可能仍然是重要的能源来源。到 2030 年,预计澳洲、德国、墨西哥和英国超过 50% 的总发电量将来自太阳能和风能。据估计,到2050年,太阳能、风能和水力发电将生产全球约80%的电力。钠离子电池是一种替代电池,具有储存太阳能和风力发电的额外优势,因此有望在不断增长的太阳能和风力发电市场中获得机会。

- 预计欧洲将主导市场,大多数将电池技术商业化的公司都位于该地区。此外,由于风能和太阳能等可再生能源发电的增加,预计该地区将在预测期内主导市场。

钠离子电池市场趋势

固定式能源储存是市场的重要领域

- 电池在能源储存系统中极为重要,特别是在住宅能源储存系统中,并且占系统总成本的很大一部分。钠离子电池因其能量密度高、充电时间短和充电循环次数较多等特性而非常适合此应用。

- 钠离子电池也是大规模能源储存应用上可行的能源储存手段。这主要是由于钠与锂相比成本较低,其化学性质和嵌入动力学与锂相似,以及钠离子电池中碳阳极的不可逆容量,因为它低于。

- 预计在预测期内,钠离子电池在能源储存系统应用上将具有巨大潜力。太阳能、风能等可再生能源发电量显着增加,能源储存对于确保能源供应的连续性至关重要。

- 根据国际可再生能源机构(IRENA)的数据,2022年全球装置容量达到约1046.61吉瓦,与前一年同期比较增22.38%。同样,2022年全球风电装置容量超过898吉瓦,较2021年成长9%以上。

- 此外,随着政府加强支持力度以及雄心勃勃的再生能源目标,可再生能源可能会继续成长。此外,根据国际能源总署(IEA)预计,到2050年,太阳能、风能和水力发电将占全球发电量的约80%。

- 太阳能和风力发电储存预计将为不断增长的太阳能和风力发电市场提供重大机会,因为钠离子电池是一种重要的能源储存技术,具有额外的优势。

- 另一方面,钠离子电池的循环效率尚不清楚。这主要是由于硬碳负极所获得的倍率性能较低。

- 然而,2020 年初,斯科尔技术大学和莫斯科国立大学的科学家发现了与钠离子电池 (SIB)阳极材料中的电荷积累相关的电化学反应,钠离子电池是一类很有前途的电化学电源。该团队开发的研究成果和阳极製造方法将帮助俄罗斯和其他国家更接近用于固定能源储存的钠离子电池的商业化。

- 因此,可再生能源发电的快速成长、持续不断的研发活动以及对固定能源储存钠离子电池的投资预计将在预测期内推动市场发展。

预计欧洲将主导市场

- 电池能源储存系统和电动车的持续研究和越来越多的采用使欧洲在 2022 年成为钠离子电池市场最大的地区。

- 欧盟资助的新计划NAIMA「钠离子材料作为製造非汽车应用坚固电池的重要组成部分」已在法国启动。欧盟委员会已向该计划授予约 800 万欧元的 Horizon2020 计画拨款。该计画期限为36个月,从2019年12月开始,到2022年12月结束。

- NAIMA计划已确定,在计划期间开发和测试的两代具有竞争力且安全的钠离子电池将为当前和未来的储能应用提供最强大且最具成本效益的锂基技术替代方案。证明它们是产品的一部分。

- NAIMA 汇集了联盟,其中包括来自 8 个欧洲国家(包括法国、德国、瑞典、保加利亚、西班牙、荷兰、斯洛维尼亚和比利时)的 15 个合作伙伴。其中研发机构5家(CNRS、CEA、NIC、IHE、VITO),中小企业6家(TIAMAT、BIOKOL、IEIT、GOLDLINE、ACC、ZABALA IC),大型企业4家(EDF、GESTAMP) ).、SOLVAY 和UMICORE)。这些合作伙伴概况涵盖整个电池价值链以及计划所需的多元化基础研发领域。

- 该计划由专门从事钠离子电池设计、开发和製造的法国公司TIAMAT主导,主要针对行动和固定储能领域的快速充电和高放电电流应用。

- 在计划框架内,六款钠离子电池原型机在三个多规模商业场景中进行了测试,为该技术在三个自然环境(可再生发电、工业和私人家庭)中的竞争力提供了有力的证据,预计你会得到它。

- 总部位于英国的 Faradion Ltd 是全球领先的钠离子电池製造商之一。该公司是英国政府耗资3.3842亿美元的法拉第电池挑战赛的受益者之一,该挑战赛旨在到2024-2025年供应年产能超过1GWh、价值约1亿美元或以上的钠离子电池。我们正在做准备。

- 因此,持续的研究工作、增加的投资以及对电动车不断增长的需求预计将在不久的将来为欧洲地区的参与者创造充足的机会。

钠离子电池产业概况

钠离子电池市场是半整合的。市场主要企业(排名不分先后)包括Faradion Limited、Contemporary Amperex Technology Co. Limited、NGK Insulators Ltd、TIAMAT SAS、HiNa Battery Technology、Altris AB、Natron Energy Inc.等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028 年之前的市场规模与需求预测(美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 对清洁能源的需求不断增长

- 能源储存系统越来越多地采用钠离子电池

- 抑制因素

- 技术限制的可用性

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 目的

- 固定式能源储存

- 运输

- 地区

- 北美洲

- 美国

- 加拿大

- 其他的

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他的

- 亚太地区

- 中国

- 印度

- 日本

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他的

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Faradion Limited

- AMTE Power PLC

- NGK Insulators Ltd

- HiNa Battery Technology Co. Ltd.

- TIAMAT SAS

- Contemporary Amperex Technology Co. Limited

- Altris AB

- Natron Energy Inc.

第七章市场机会与未来趋势

- 全部区域不断提高的可再生能源目标

The Sodium-ion Battery Market size in terms of Equal-7.28 is expected to grow from USD 166.54 million in 2024 to USD 236.65 million by 2029, at a CAGR of 7.28% during the forecast period (2024-2029).

Key Highlights

- Over the medium period, the primary driver of the market is the increasing demand for cleaner energy, with rising greenhouse gas emissions around the world. Additionally, using sodium-ion batteries for electricity storage, generated through solar or wind, is likely to drive the market.

- On the other hand, the non-matured technology of the storm is expected to hinder market growth during the forecast period.

- Nevertheless, wind and solar PV power are expected to drive strong growth in renewable energy, while hydro is likely to remain a key source. By 2030, solar and wind are expected to produce more than 50% of the total generation in Australia, Germany, Mexico, and the United Kingdom. By 2050, solar PV, wind, and hydro are estimated to produce approximately 80% of the global electricity generation. As sodium-ion batteries are an alternative with additional benefits, storing the energy of solar and wind, they are expected to have an opportunity in the growing solar and wind energy market.

- Europe is expected to dominate the market, with the majority of companies commercializing the battery technology being located in the region. Moreover, with the rising renewable energy generation, such as wind and solar, the region is expected to dominate the market during the forecast period.

Sodium Ion Battery Market Trends

Stationary Energy Storage is a Significant Segment for the Market

- Batteries are crucial in energy storage systems and are responsible for a significant portion of the system's total cost, especially in residential energy storage systems. Properties of sodium-ion batteries, such as high energy density, low charging time, a higher number of charging cycles, etc., make it preferable for this application.

- Sodium-ion batteries are also a viable means of energy storage in large-scale energy storage applications. This is mainly due to the low cost of sodium compared to lithium, similar chemistry, and intercalation kinetics to that of lithium, and the irreversible capacity of carbon anodes in sodium-ion batteries being less than that in lithium-ion batteries.

- The Sodium-ion batteries are expected to have considerable potential in energy storage system applications during the forecast period. The amount of energy generated by renewable sources such as solar and wind is witnessing massive growth, and energy storage is essential to ensure the continuity of energy supply.

- According to the International Renewable Energy Agency (IRENA), the world's total installed solar PV capacity reached around 1046.61 GW in 2022, witnessing a 22.38% growth compared to the previous year. Likewise, the global wind installed capacity was more than 898 GW in 2022, recording more than 9% growth compared to 2021.

- Furthermore, renewable energy growth is likely to continue with the increasing support from the government and its ambitious renewable power targets. Moreover, according to the International Energy Agency (IEA), by 2050, solar PV, wind, and hydro are estimated to produce approximately 80% of the global electricity generation.

- As sodium-ion batteries are an essential energy storage technology with additional benefits, storing solar and wind energy is expected to provide a vital opportunity in the growing solar and wind energy market.

- On the other side, the cycling efficiency of sodium-ion batteries is not well-known, mainly because the rate capability obtained from hard carbon anodes is poor.

- However, in early 2020, scientists from Skoltech and the Moscow State University identified the electrochemical reaction associated with charge storage in the anode material for sodium-ion batteries (SIB), a promising class of electrochemical power sources. The findings and the anode manufacturing method developed by the team help bring closer the sodium-ion battery commercialization for stationary energy storage in Russia and beyond.

- Hence, the surging growth in renewable energy generation, the rising number of ongoing research development activities, and investments in sodium-ion batteries for stationary energy storage are expected to drive the market during the forecast period.

Europe is Expected to Dominate the Market

- In 2022, Europe became the largest region in the sodium-ion battery market owing to the ongoing research and increasing deployment of battery energy storage systems and electric vehicles.

- The new EU-funded project NAIMA, "Na Ion materials as essential components to manufacture robust battery cells for non-automotive applications," had kickstarted in France. The European Commission awarded this project a Horizon2020 program grant of almost EUR 8 million. The duration of the program is 36 months, which started in December 2019 and ended in December 2022.

- The NAIMA project is expected to demonstrate that two new generations of highly competitive and safe sodium-ion cells developed and tested during the project are some of the most robust and cost-effective alternatives to current and future Li-based technologies for storage applications.

- NAIMA brings together a consortium, including 15 partners from eight European countries (including France, Germany, Sweden, Bulgaria, Spain, the Netherlands, Slovenia, and Belgium): Five being R&D organizations (including CNRS, CEA, NIC, IHE, and VITO), six SMEs (including TIAMAT, BIOKOL, IEIT, GOLDLINE, ACC, and ZABALA IC), and four large companies (including EDF, GESTAMP, SOLVAY, and UMICORE). These partners' profiles cover the entire battery value chain and the diverse fundamental R&D fields required in the project.

- The project is led by the French company TIAMAT, which specializes in the design, development, and manufacture of sodium-ion battery cells and targets fast charging and high discharge current applications in mobility and stationary storage sectors.

- Within the project framework, six sodium-ion battery prototypes are expected to be tested in three multi-scale business scenarios to provide solid evidence about the competitiveness of the technology in three natural environments (renewable generation, industry, and private household).

- The United Kingdom-based company Faradion Ltd is one of the leading sodium-ion battery manufacturers worldwide. The company is one of the beneficiaries of the United Kingdom government's USD 338.42 million Faraday battery challenge and is gearing up to supply sodium-ion batteries with an annual capacity of more than 1 GWh by 2024-25, worth more than approximately USD 100 million per year.

- Hence, the ongoing research work, increasing investments, and increasing demand for electric vehicles are expected to create ample opportunities for the players involved in the European region in the near future.

Sodium Ion Battery Industry Overview

The sodium-ion battery market is semi-consolidated. The key players in the market (not in particular order) include Faradion Limited, Contemporary Amperex Technology Co. Limited, NGK Insulators Ltd, TIAMAT SAS, HiNa Battery Technology Co. Ltd, Altris AB, and Natron Energy Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Demand for Cleaner Energy

- 4.5.1.2 Increasing Adoption of Sodium-Ion Batteries for Energy Storage Systems

- 4.5.2 Restraints

- 4.5.2.1 Availability of Technical Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Stationary Energy Storage

- 5.1.2 Transportation

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of the Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Faradion Limited

- 6.3.2 AMTE Power PLC

- 6.3.3 NGK Insulators Ltd

- 6.3.4 HiNa Battery Technology Co. Ltd.

- 6.3.5 TIAMAT SAS

- 6.3.6 Contemporary Amperex Technology Co. Limited

- 6.3.7 Altris AB

- 6.3.8 Natron Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Renewable Energy Targets Across the Regions